Answered step by step

Verified Expert Solution

Question

1 Approved Answer

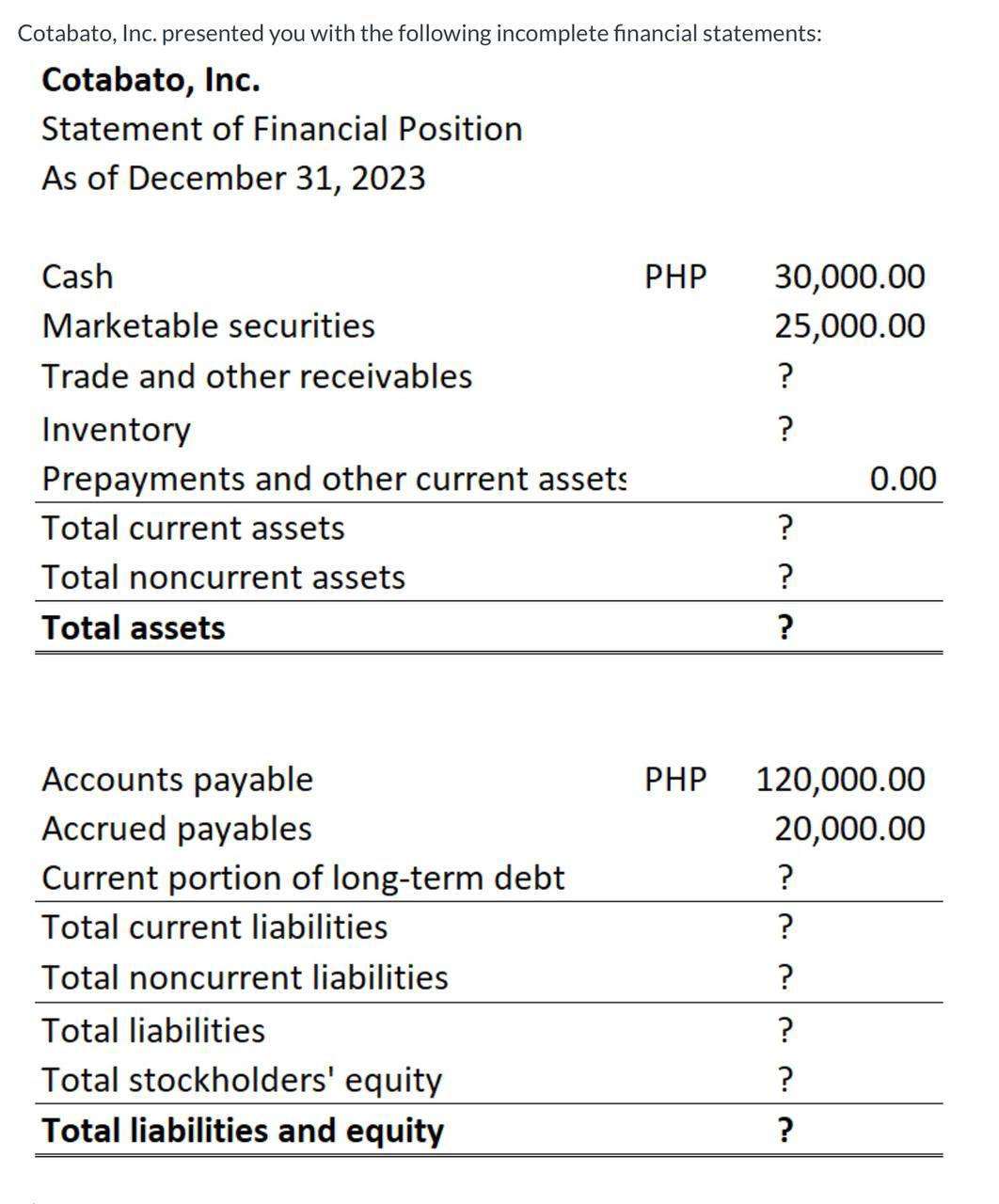

Cotabato, Inc. presented you with the following incomplete financial statements: Cotabato, Inc. Statement of Financial Position As of December 31, 2023 Cash PHP 30,000.00

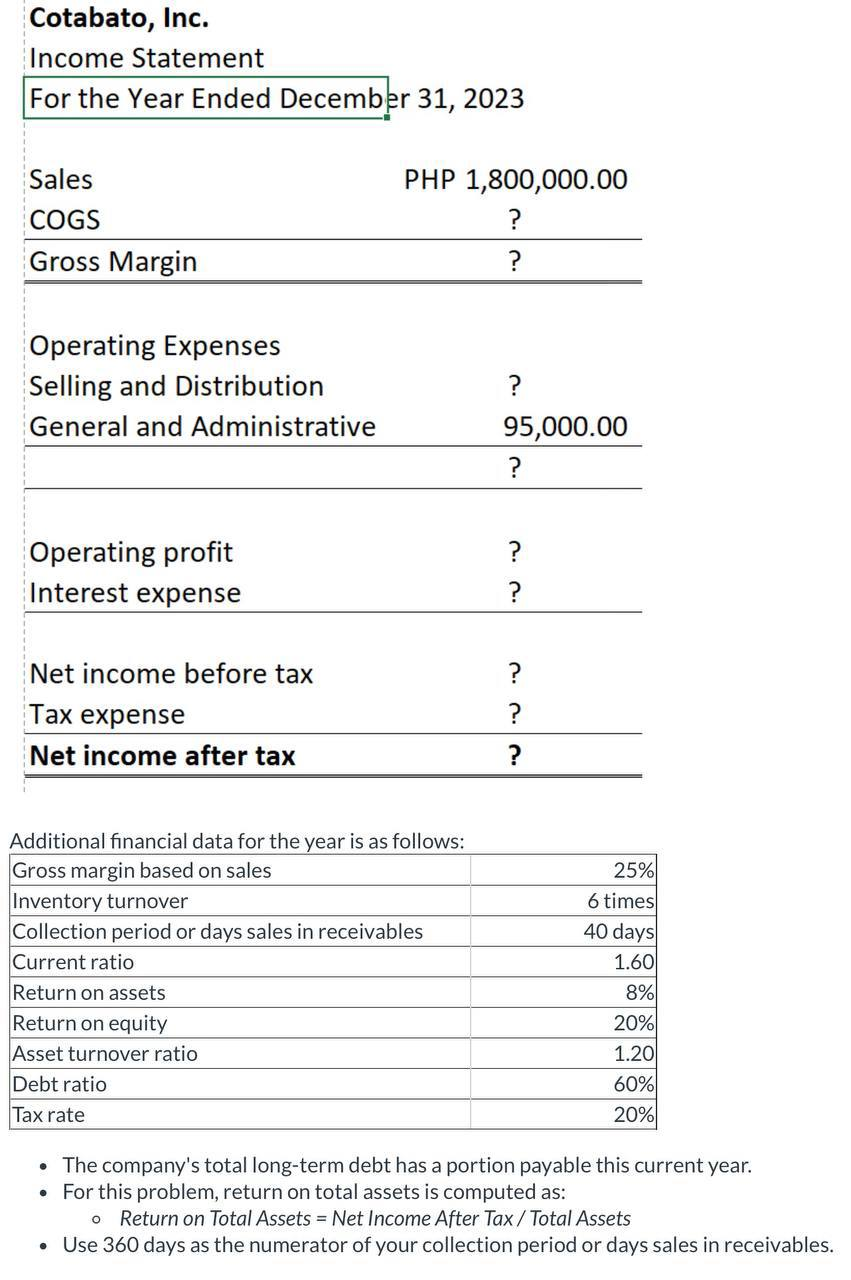

Cotabato, Inc. presented you with the following incomplete financial statements: Cotabato, Inc. Statement of Financial Position As of December 31, 2023 Cash PHP 30,000.00 Marketable securities 25,000.00 Trade and other receivables ? Inventory ? Prepayments and other current assets 0.00 Total current assets ? Total noncurrent assets ? Total assets ? Accounts payable Accrued payables Current portion of long-term debt PHP 120,000.00 20,000.00 ? Total current liabilities Total noncurrent liabilities ? ? Total liabilities ? Total stockholders' equity ? C. Total liabilities and equity ? Cotabato, Inc. Income Statement For the Year Ended December 31, 2023 Sales COGS PHP 1,800,000.00 ? ? Gross Margin Operating Expenses Selling and Distribution ? General and Administrative 95,000.00 ? Operating profit ? Interest expense Net income before tax ? 22 Tax expense ? Net income after tax ? Additional financial data for the year is as follows: Gross margin based on sales Inventory turnover Collection period or days sales in receivables Current ratio Return on assets Return on equity Asset turnover ratio Debt ratio Tax rate 25% 6 times 40 days 1.60 8% 20% 1.20 60% 20% The company's total long-term debt has a portion payable this current year. For this problem, return on total assets is computed as: o Return on Total Assets = Net Income After Tax/ Total Assets Use 360 days as the numerator of your collection period or days sales in receivables.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started