Question

In order to accurately assess the capital structure of a firm, it is necessary to convert its balance sheet figures from historical book values

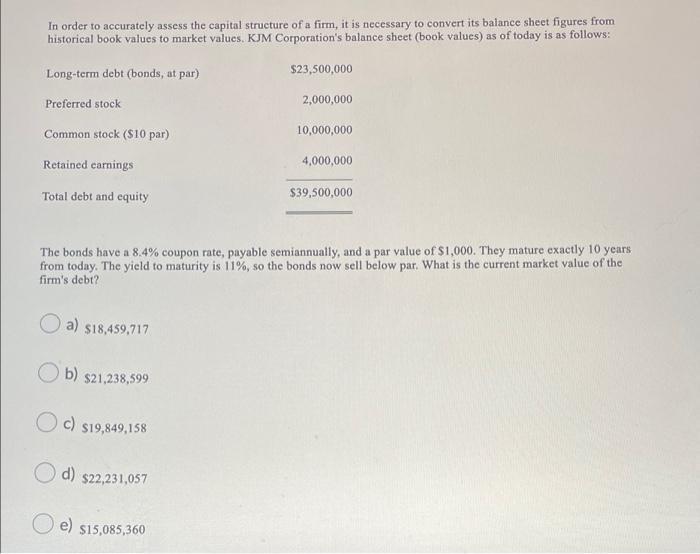

In order to accurately assess the capital structure of a firm, it is necessary to convert its balance sheet figures from historical book values to market values. KJM Corporation's balance sheet (book values) as of today is as follows: Long-term debt (bonds, at par) Preferred stock Common stock ($10 par) Retained earnings Total debt and equity a) $18,459,717 b) $21,238,599 c) $19,849,158 $23,500,000 d) $22,231,057 O e) $15,085,360 2,000,000 The bonds have a 8.4% coupon rate, payable semiannually, and a par value of $1,000. They mature exactly 10 years from today. The yield to maturity is 11%, so the bonds now sell below par. What is the current market value of the firm's debt? 10,000,000 4,000,000 $39,500,000

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Annual coupon rate of the bond is C 84 Compounded semiannual...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Business Law The Ethical Global and E-Commerce Environment

Authors: Jane Mallor, James Barnes, Thomas Bowers, Arlen Langvardt

15th edition

978-0073524986, 73524980, 978-0071317658

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App