Could i get some help with this question

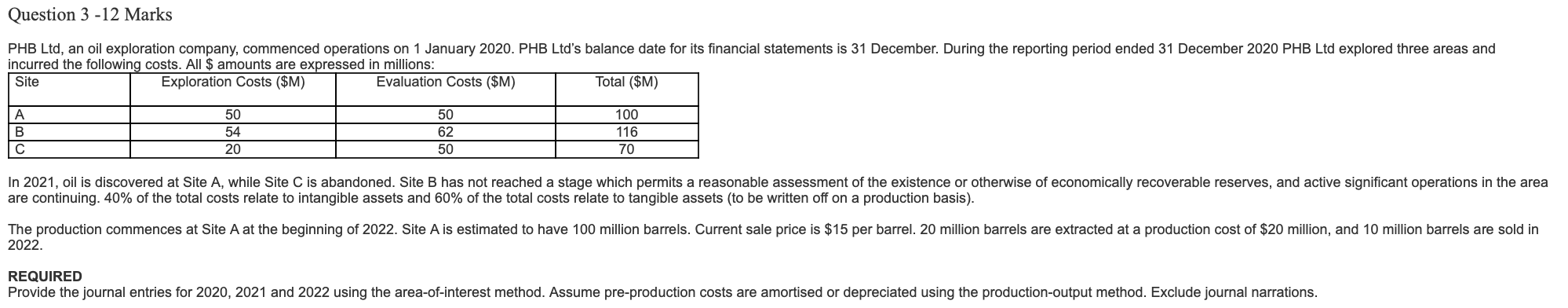

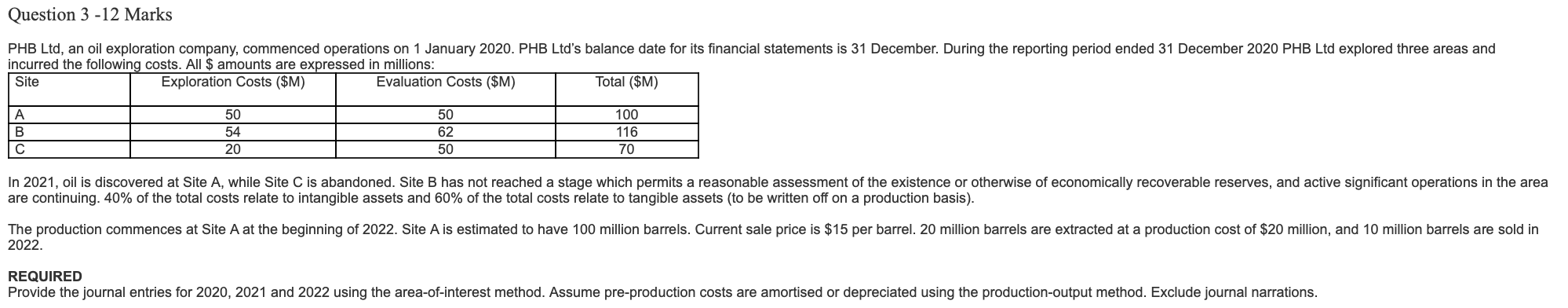

Question 3 -12 Marks PHB Ltd, an oil exploration company, commenced operations on 1 January 2020. PHB Ltd's balance date for its financial statements is 31 December. During the reporting period ended 31 December 2020 PHB Ltd explored three areas and incurred the following costs. All $ amounts are expressed in millions: Site Exploration Costs ($M) Evaluation Costs ($M) Total ($M) | B 50 54 20 50 62 50 100 116 70 In 2021, oil is discovered at Site A, while Site C is abandoned. Site B has not reached a stage which permits a reasonable assessment of the existence or otherwise of economically recoverable reserves, and active significant operations in the area are continuing. 40% of the total costs relate to intangible assets and 60% of the total costs relate to tangible assets (to be written off on a production basis). The production commences at Site A at the beginning of 2022. Site A is estimated to have 100 million barrels. Current sale price is $15 per barrel. 20 million barrels are extracted at a production cost of $20 million, and 10 million barrels are sold in 2022. REQUIRED Provide the journal entries for 2020, 2021 and 2022 using the area-of-interest method. Assume pre-production costs are amortised or depreciated using the production-output method. Exclude journal narrations. Question 3 -12 Marks PHB Ltd, an oil exploration company, commenced operations on 1 January 2020. PHB Ltd's balance date for its financial statements is 31 December. During the reporting period ended 31 December 2020 PHB Ltd explored three areas and incurred the following costs. All $ amounts are expressed in millions: Site Exploration Costs ($M) Evaluation Costs ($M) Total ($M) | B 50 54 20 50 62 50 100 116 70 In 2021, oil is discovered at Site A, while Site C is abandoned. Site B has not reached a stage which permits a reasonable assessment of the existence or otherwise of economically recoverable reserves, and active significant operations in the area are continuing. 40% of the total costs relate to intangible assets and 60% of the total costs relate to tangible assets (to be written off on a production basis). The production commences at Site A at the beginning of 2022. Site A is estimated to have 100 million barrels. Current sale price is $15 per barrel. 20 million barrels are extracted at a production cost of $20 million, and 10 million barrels are sold in 2022. REQUIRED Provide the journal entries for 2020, 2021 and 2022 using the area-of-interest method. Assume pre-production costs are amortised or depreciated using the production-output method. Exclude journal narrations