Answered step by step

Verified Expert Solution

Question

1 Approved Answer

could I see an example of the line item operating AND cash budget reports? if more informarion is beeded let me know, but im not

could I see an example of the line item operating AND cash budget reports?

could I see an example of the line item operating AND cash budget reports?

if more informarion is beeded let me know, but im not sure what format to put the information into.

OMG...

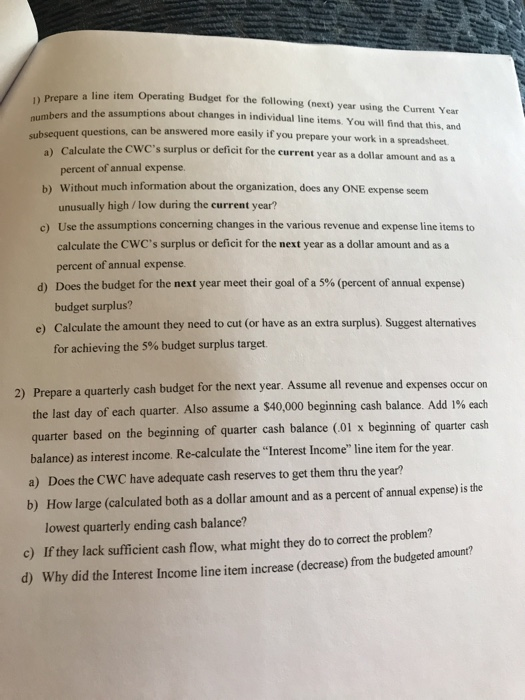

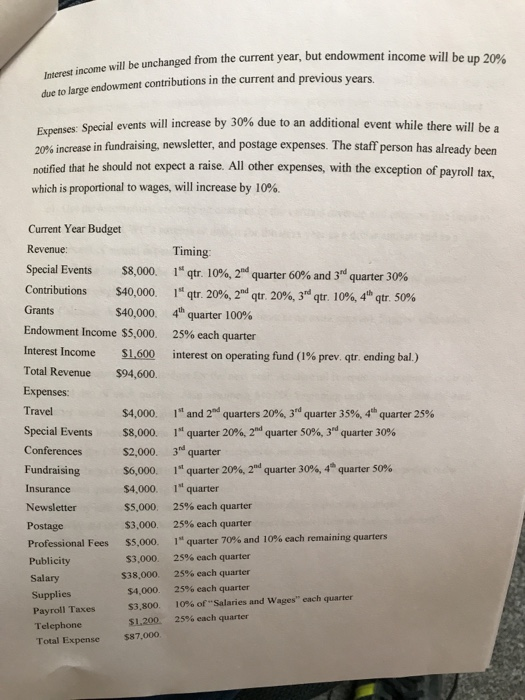

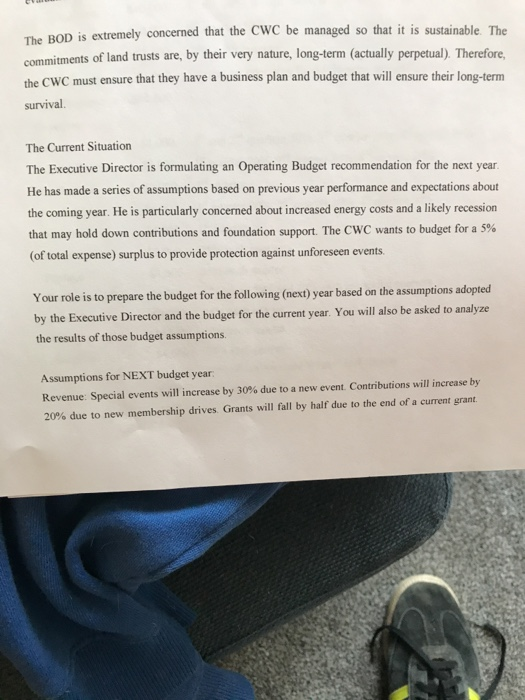

n Prepare a line item Operating Budget for the following (next) year using the Current Year numbers and the assumptions about chan subsequent quest ges in individual line items. You will find that this, and ions, can be answered more easily if you prepare your work in a spreadsheet the CWC's surplus or deficit for the current year as a dollar amount and as a a) Calculate percent of annual expense. b) Without much information about the organization, does any ONE expense seem unusually high/low during the current year? Use the assumptions concerning changes in the various revenue and expense line items to calculate the CWC's surplus or deficit for the next year as a dollar amount and as a percent of annual expense Does the budget for the next year meet their goal of a 5% (percent of annual expense) budget surplus? c) d) e) Calculate the amount they need to cut (or have as an extra surplus). Suggest alternatives for achieving the 5% budget surplus target. penses occur on 2) Prepare a quarterly cash budget for the next year. Assume all revenue and ex the last day of each quarter. Also assume a $40,000 beginning cash balance. Add i% each quarter based on the beginning of quarter cash balance (01 x beginning of quarter cash balance) as interest income. Re-calculate the "Interest Income" line item for the year. a) Does the CWC have adequate cash reserves to get them thru the year? b) How large (calculated both as a dollar amount and as a percent of annual expense) is the lowest quarterly ending cash balance? c) If they lack sufficient cash flow, what might they do to correct the problem? d) Why did the Interest Income line item increase (decrease) from the budgeted amount? n Prepare a line item Operating Budget for the following (next) year using the Current Year numbers and the assumptions about chan subsequent quest ges in individual line items. You will find that this, and ions, can be answered more easily if you prepare your work in a spreadsheet the CWC's surplus or deficit for the current year as a dollar amount and as a a) Calculate percent of annual expense. b) Without much information about the organization, does any ONE expense seem unusually high/low during the current year? Use the assumptions concerning changes in the various revenue and expense line items to calculate the CWC's surplus or deficit for the next year as a dollar amount and as a percent of annual expense Does the budget for the next year meet their goal of a 5% (percent of annual expense) budget surplus? c) d) e) Calculate the amount they need to cut (or have as an extra surplus). Suggest alternatives for achieving the 5% budget surplus target. penses occur on 2) Prepare a quarterly cash budget for the next year. Assume all revenue and ex the last day of each quarter. Also assume a $40,000 beginning cash balance. Add i% each quarter based on the beginning of quarter cash balance (01 x beginning of quarter cash balance) as interest income. Re-calculate the "Interest Income" line item for the year. a) Does the CWC have adequate cash reserves to get them thru the year? b) How large (calculated both as a dollar amount and as a percent of annual expense) is the lowest quarterly ending cash balance? c) If they lack sufficient cash flow, what might they do to correct the problem? d) Why did the Interest Income line item increase (decrease) from the budgeted amount please and thank you!!

sorry

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started