Question

Could somebody help me out with this? Maine Department Store is located near the Village Shopping Mall. At the end of the company's fiscal year

Could somebody help me out with this?

Could somebody help me out with this?

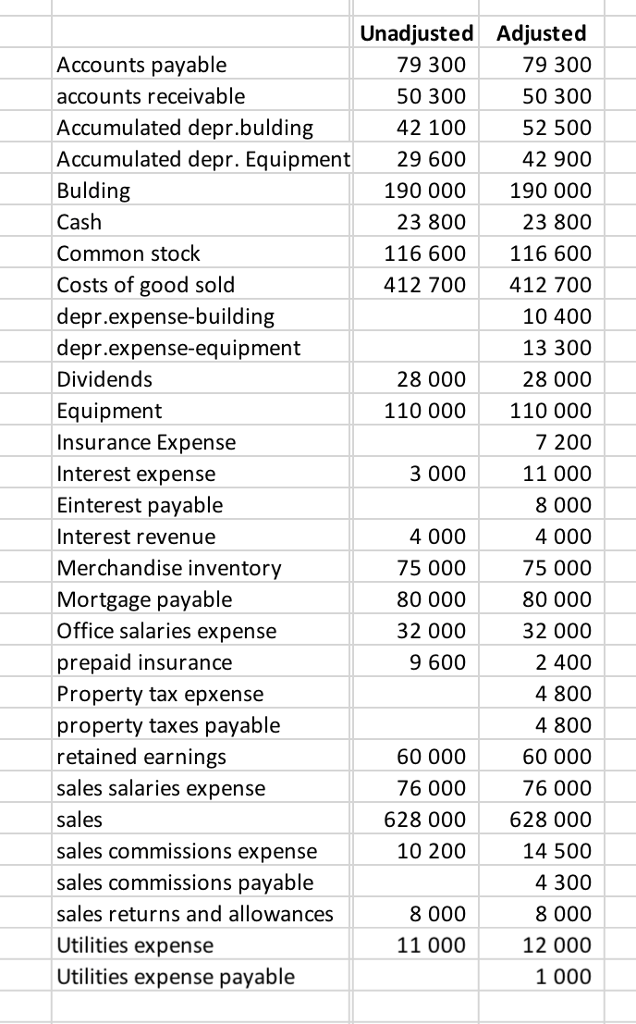

Maine Department Store is located near the Village Shopping Mall. At the end of the company's fiscal year on December 31, 2012, the following accounts appeared in two of its trial balances. Unadjusted Adjusted Unadjusted Adjusted Accounts Payable $79,300 $79,300 Interest Payable $8,000 Accounts Receivable 50,300 50,300 Interest Revenue $4,000 4,000 Accumulated Depr. - Building 42,100 52,500 Merchandise Inventory 75,000 75,000 Accumulated Depr. - Equipment 29,600 42,900 Mortgage Payable 80,000 80,000 Building 190,000 190,000 Office Salaries Expense 32,000 32,000 Cash 23,800 23,800 Prepaid Insurance 9,600 2,400 B. Maine, Capital 176,600 176,600 Property Tax Expense 4,800 Cost of Goods Sold 412,700 412,700 Property Taxes Payable 4,800 Depr. Expense - Building 10,400 Sales Salaries Expense 76,000 76,000 Depr. Expense- Equipment 13,300 Sales 628,000 628,000 B. Maine, Drawing 28,000 28,000 Sales Commissions Expense 10,200 14,500 Equipment 110,000 110,000 Sales Commissions Payable 4,300 Insurance Expense 7,200 Sales Returns and Allowances 8,000 8,000 Interest Expense 3,000 11,000 Utilities Expense 11,000 12,000 Utilities Expense Payable 1,000

Analysis reveals the following additional data.

1. Insurance Expense and utilities Expense are 60% selling and 40% administrative.

2. $20,000 of the mortgage Payable is due for payment next year.

3. Depreciation on the building and property Tax Expense are administrative Expenses; depreciation on the equipment is a selling Expense.

A. Journalize the adjusting entries that were made

B. Journalize the closing entries that are necessary

Accounts payable accounts receivable Accumulated depr.bulding Accumulated depr. Equipment Bulding Cash Common stock Costs of good sold depr.expense-building depr.expense-equipment Dividends Equipment Insurance Expense Interest expense Einterest payable Interest revenue Merchandise inventory Mortgage payable Office salaries expense prepaid insurance Property tax epxense property taxes payable retained earnings sales salaries expense sales sales commissions expense sales commissions payable sales returns and allowances Utilities expense Utilities expense payable Unadjusted Adjusted 79 300 50 300 52 500 42 900 190 000 190 000 23 800 116 600 116 600 412 700 412 700 10 400 13 300 28 000 110 000 110 000 7 200 11 000 8 000 4 000 75 000 80 000 32 000 2 400 4 800 4 800 60 000 76 000 628 000 628 000 14 500 4 300 8 000 12 000 1 000 79 300 50 300 42 100 29 600 23 800 28 000 3 000 4 000 75 000 80 000 32 000 9 600 60 000 76 000 10 200 8 000 11 000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started