Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could someone help? 4. Consider two bonds, A and B. Bond A is a 5-year 2% annual-coupon bond, and Bond B is a 3-year 4%

Could someone help?

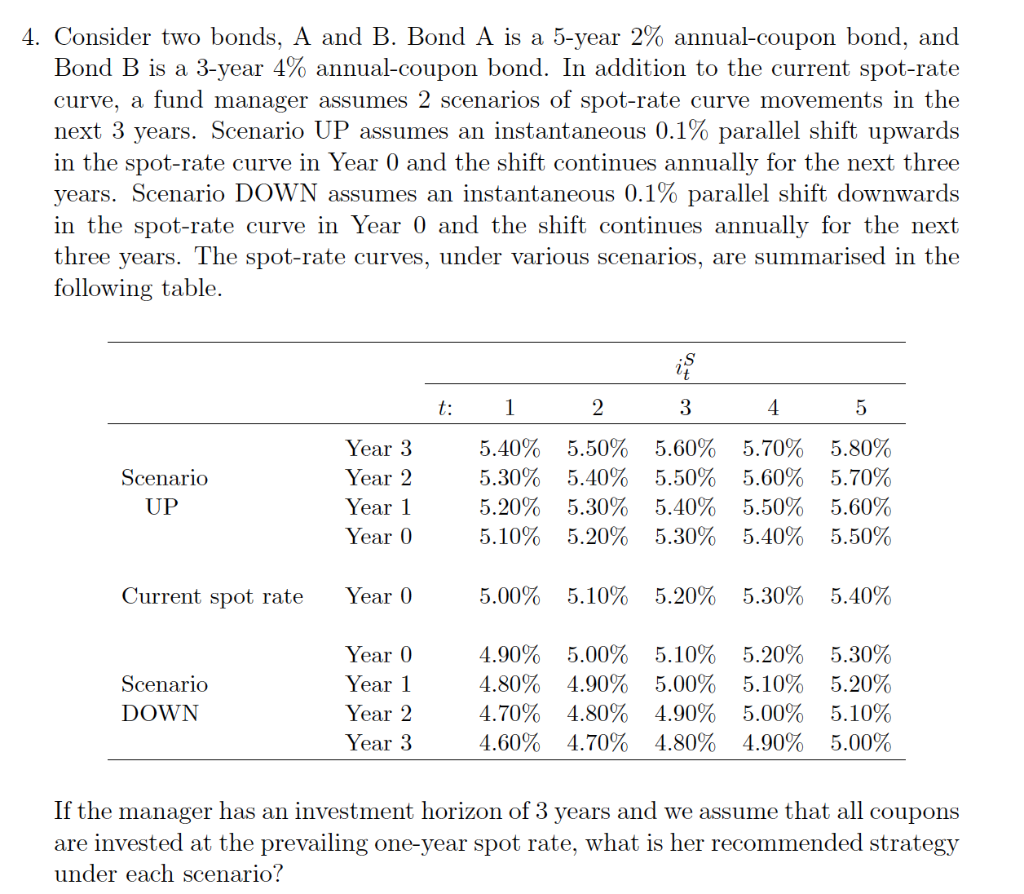

4. Consider two bonds, A and B. Bond A is a 5-year 2% annual-coupon bond, and Bond B is a 3-year 4% annual-coupon bond. In addition to the current spot-rate curve, a fund manager assumes 2 scenarios of spot-rate curve movements in the next 3 years. Scenario UP assumes an instantaneous 0.1% parallel shift upwards in the spot-rate curve in Year 0 and the shift continues annually for the next three years. Scenario DOWN assumes an instantaneous 0.1% parallel shift downwards in the spot-rate curve in Year 0 and the shift continues annually for the next three years. The spot-rate curves, under various scenarios, are summarised in the following table. t: Scenario UP Year 3 Year 2 Year 1 Year 0 1 5.40% 5.30% 5.20% 5.10% 2 5.50% 5.40% 5.30% 5.20% 3 5.60% 5.50% 5.40% 5.30% 4 5.70% 5.60% 5.50% 5.40% 5 5.80% 5.70% 5.60% 5.50% Current spot rate Year 0 5.00% 5.10% 5.20% 5.30% 5.40% Scenario DOWN Year 0 Year 1 Year 2 Year 3 4.90% 4.80% 4.70% 4.60% 5.00% 4.90% 4.80% 4.70% 5.10% 5.00% 4.90% 4.80% 5.20% 5.10% 5.00% 4.90% 5.30% 5.20% 5.10% 5.00% If the manager has an investment horizon of 3 years and we assume that all coupons are invested at the prevailing one-year spot rate, what is her recommended strategy under each scenario? 4. Consider two bonds, A and B. Bond A is a 5-year 2% annual-coupon bond, and Bond B is a 3-year 4% annual-coupon bond. In addition to the current spot-rate curve, a fund manager assumes 2 scenarios of spot-rate curve movements in the next 3 years. Scenario UP assumes an instantaneous 0.1% parallel shift upwards in the spot-rate curve in Year 0 and the shift continues annually for the next three years. Scenario DOWN assumes an instantaneous 0.1% parallel shift downwards in the spot-rate curve in Year 0 and the shift continues annually for the next three years. The spot-rate curves, under various scenarios, are summarised in the following table. t: Scenario UP Year 3 Year 2 Year 1 Year 0 1 5.40% 5.30% 5.20% 5.10% 2 5.50% 5.40% 5.30% 5.20% 3 5.60% 5.50% 5.40% 5.30% 4 5.70% 5.60% 5.50% 5.40% 5 5.80% 5.70% 5.60% 5.50% Current spot rate Year 0 5.00% 5.10% 5.20% 5.30% 5.40% Scenario DOWN Year 0 Year 1 Year 2 Year 3 4.90% 4.80% 4.70% 4.60% 5.00% 4.90% 4.80% 4.70% 5.10% 5.00% 4.90% 4.80% 5.20% 5.10% 5.00% 4.90% 5.30% 5.20% 5.10% 5.00% If the manager has an investment horizon of 3 years and we assume that all coupons are invested at the prevailing one-year spot rate, what is her recommended strategy under each scenarioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started