Could someone help me finish this? I'm kinda stuck :)

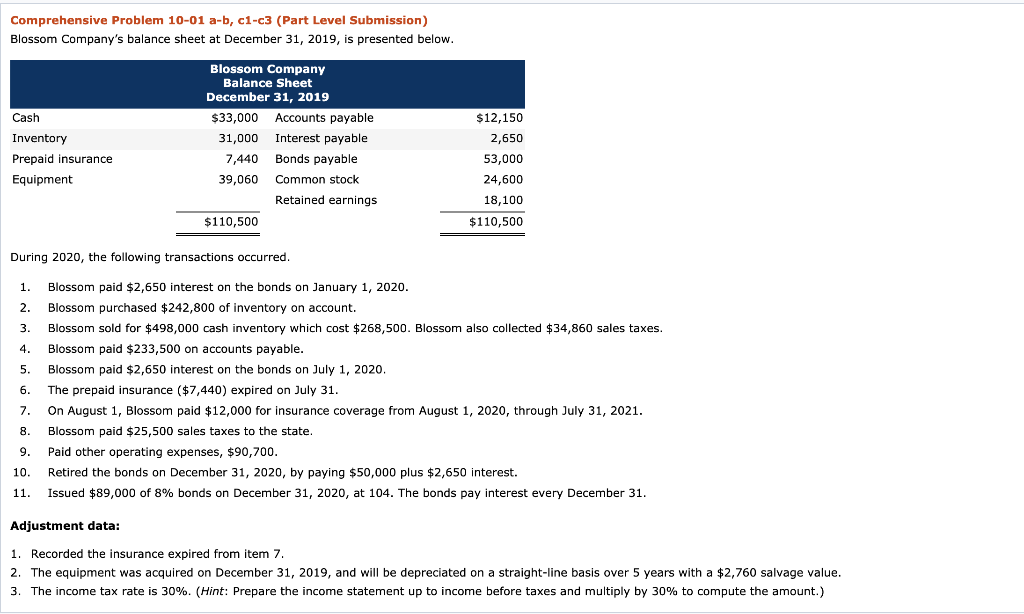

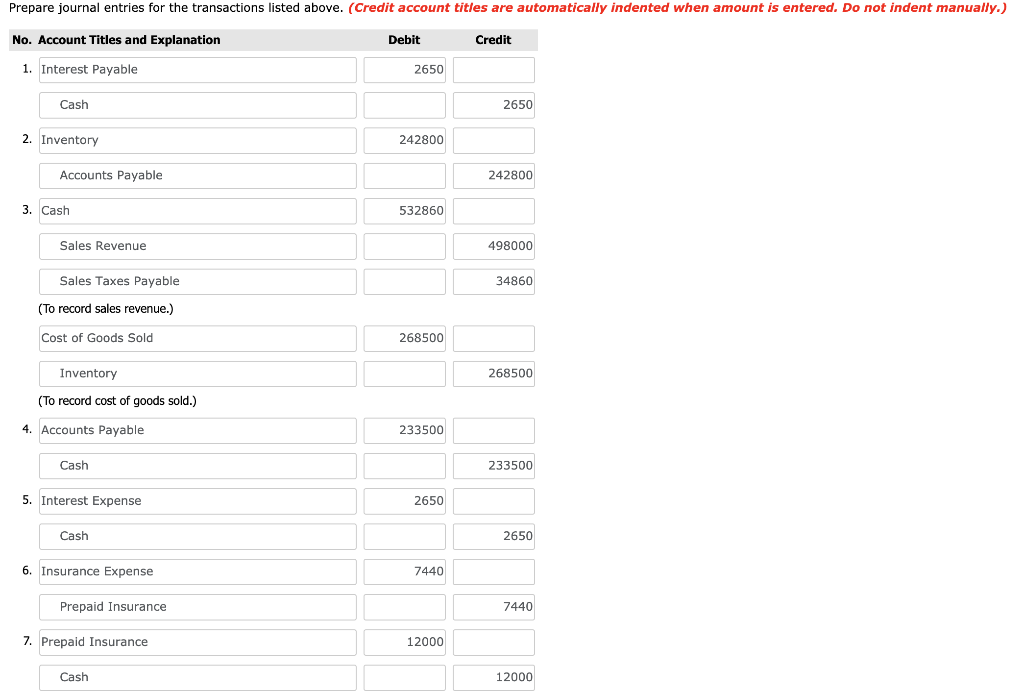

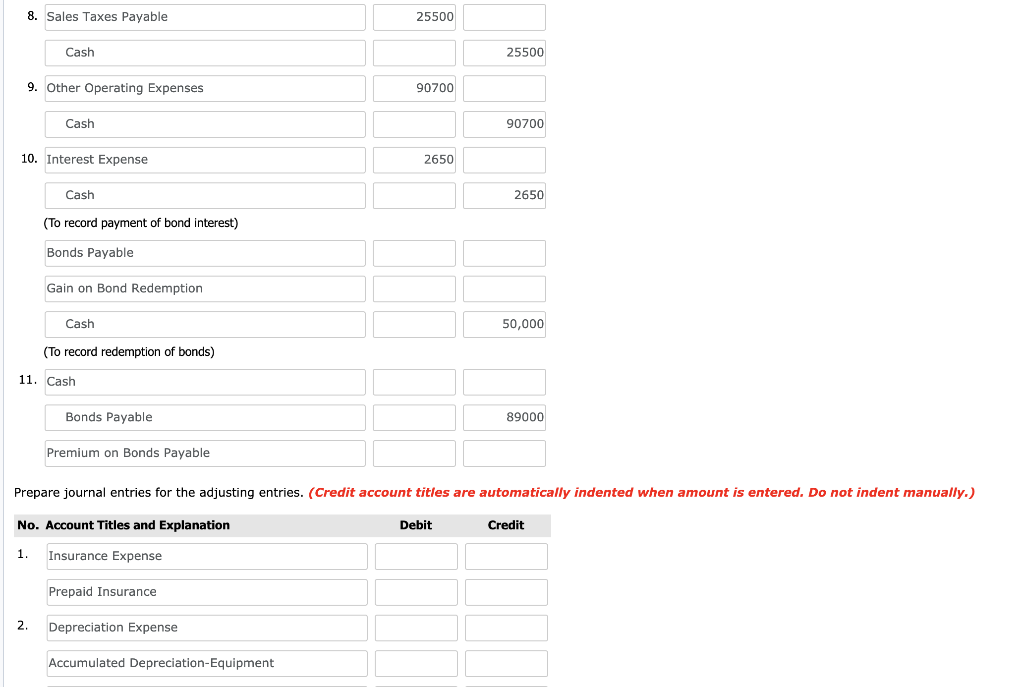

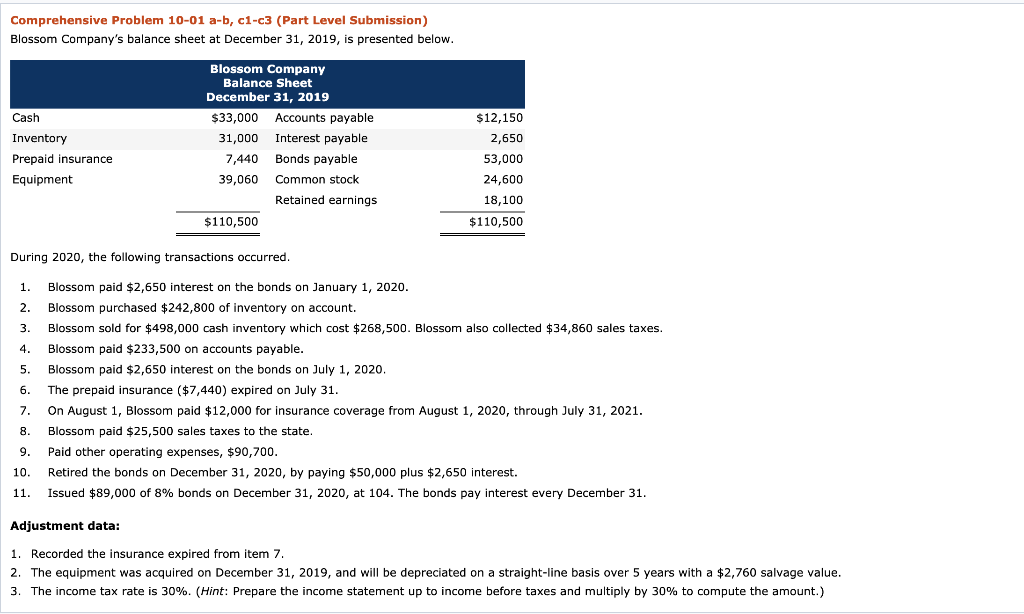

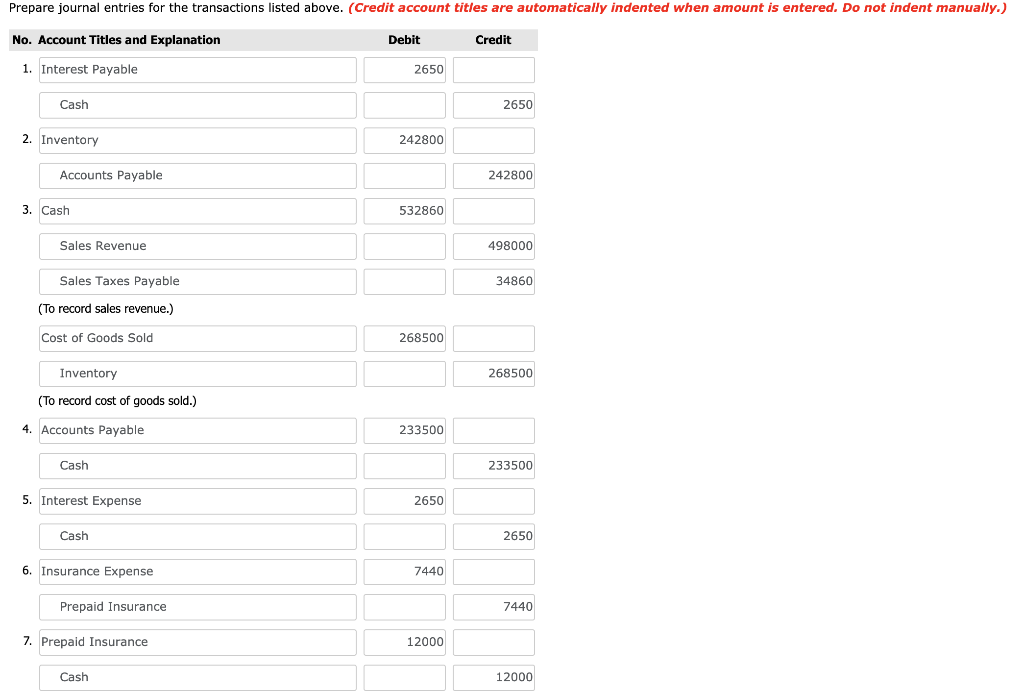

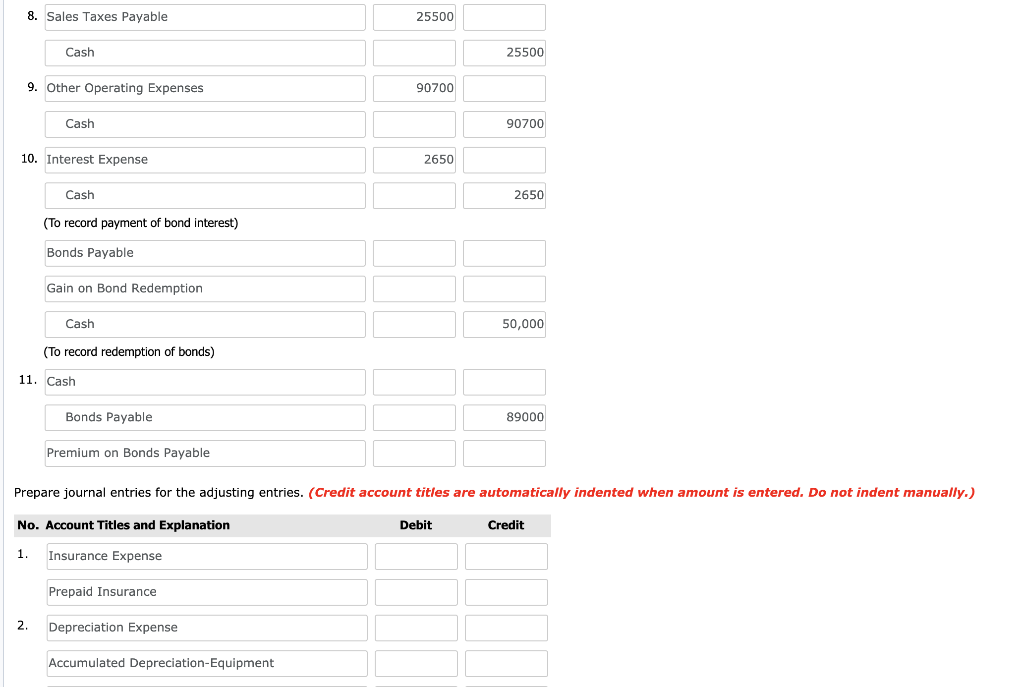

Comprehensive Problem 10-01 a-b, c1-c3 (Part Level Submission) Blossom Company's balance sheet at December 31, 2019, is presented below. Cash Inventory Prepaid insurance Equipment Blossom Company Balance Sheet December 31, 2019 $33,000 Accounts payable 31,000 Interest payable 7,440 Bonds payable 39,060 Common stock Retained earnings $110,500 $12,150 2,650 53,000 24,600 18,100 $110,500 During 2020, the following transactions occurred. 1. 2. 3. 4. 5. 6. Blossom paid $2,650 interest on the bonds on January 1, 2020. Blossom purchased $242,800 of inventory on account. Blossom sold for $498,000 cash inventory which cost $268,500. Blossom also collected $34,860 sales taxes. Blossom paid $233,500 on accounts payable. Blossom paid $2,650 interest on the bonds on July 1, 2020. The prepaid insurance ($7,440) expired on July 31. On August 1, Blossom paid $12,000 for insurance coverage from August 1, 2020, through July 31, 2021. Blossom paid $25,500 sales taxes to the state. Paid other operating expenses, $90,700. Retired the bonds on December 31, 2020, by paying $50,000 plus $2,650 interest. Issued $89,000 of 8% bonds on December 31, 2020, at 104. The bonds pay interest every December 31. 7. 8. 9. 10. 11. Adjustment data: 1. Recorded the insurance expired from item 7. 2. The equipment was acquired on December 31, 2019, and will be depreciated on a straight-line basis over 5 years with a $2,760 salvage value. 3. The income tax rate is 30%. (Hint: Prepare the income statement up to income before taxes and multiply by 30% to compute the amount.) Prepare journal entries for the transactions listed above. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) No. Account Titles and Explanation Debit Credit 1. Interest Payable 2650 Cash 2650 2. Inventory 242800 Accounts Payable 242800 3. Cash 532860 Sales Revenue 498000 Sales Taxes Payable 34860 (To record sales revenue.) Cost of Goods Sold 268500 Inventory 268500 (To record cost of goods sold.) 4. Accounts Payable 233500 Cash 233500 5. Interest Expense 2650 Cash 2650 6. Insurance Expense 7440 Prepaid Insurance 7440 7. Prepaid Insurance 12000 Cash 12000 8. Sales Taxes Payable 25500 Cash 25500 9. Other Operating Expenses 90700 Cash 90700 10. Interest Expense 2650 Cash 2650 (To record payment of bond interest) Bonds Payable Gain on Bond Redemption Cash 50,000 (To record redemption of bonds) 11. Cash Bonds Payable 89000 Premium on Bonds Payable Prepare journal entries for the adjusting entries. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) No. Account Titles and Explanation Debit Credit 1. Insurance Expense Prepaid Insurance 2. Depreciation Expense Accumulated Depreciation Equipment 3. Income Tax Expense Income Tax Payable