Could someone help me with my practical project discussion?

Here is the question I have to discuss in my discussion:

-What approach will you take to complete this phase?

-What questions do you have about this phase?

Here is the project outline:

Frustrated by not being able to find a pair of red cowboy boots in her size, an Alberta woman, who works as a bookkeeper, and her out-of-work husband decide to open their own business. Although the store manages to earn a small profit, early sales returns dampen the couple's enthusiasm. Now they need to plan for the year ahead. You are given a balance sheet and income statement for 2006.

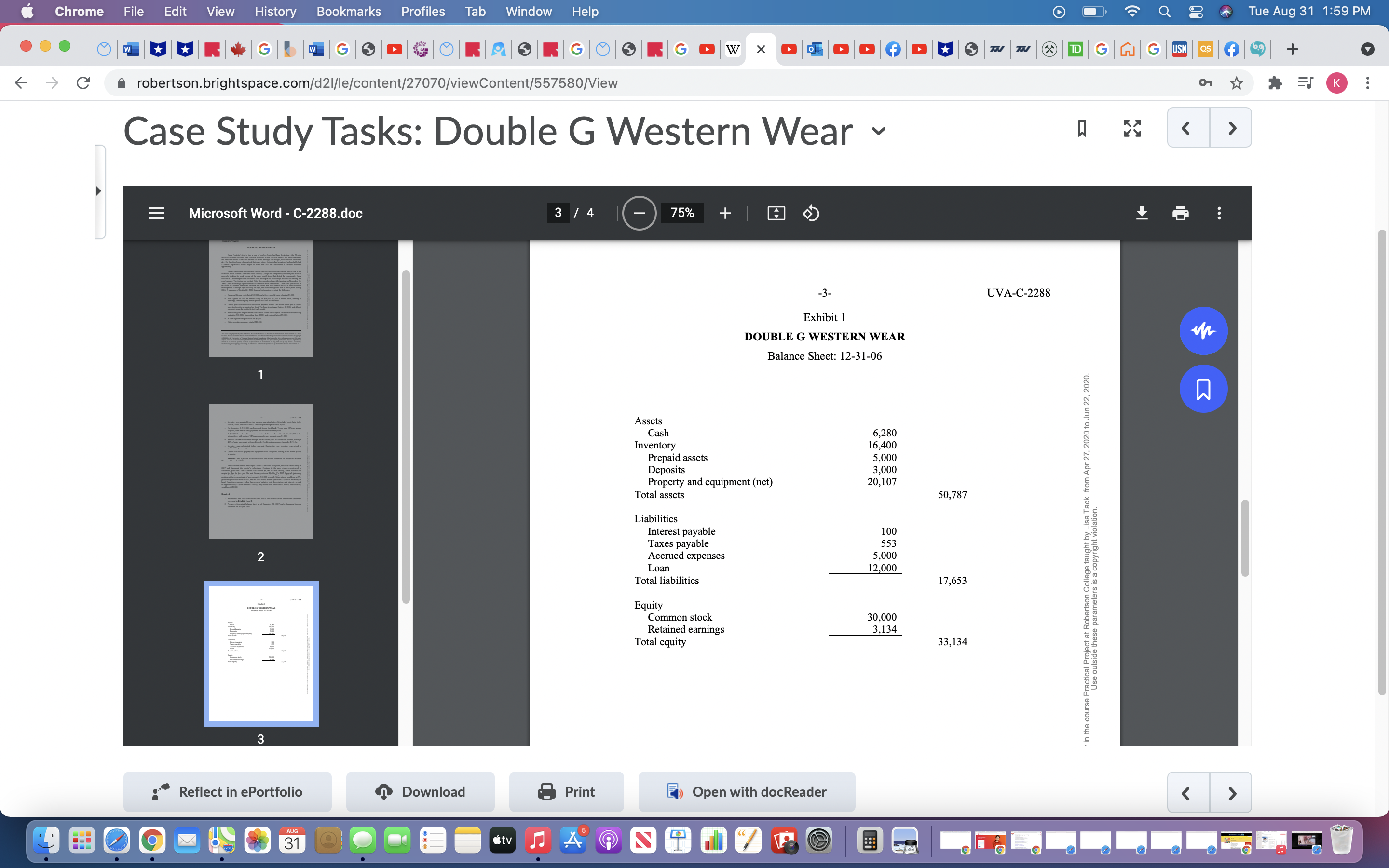

Here is the balance sheet and income statement:

rome File Edit View History Book ks Proles Tab Window Help TueAg3'l '59PM O G '0. 6|. Ulll it 6 9 C' i robertson.brightspace.com/d2Illelcontent/27070/viewContent/557580/View . Case Study Tasks: Double G Western Wear v D x Microsoft Word - 0-2288.doc DOUBLE G WESTERN WEAR Germ Franklin's trip to buy a pair of cowboy boots had been frustratingthe 30-mi1e drive had yielded no boots, The selection available in her size was sparse, but, more important she had been unable to nd her desired red boots. Strange, she thought, how life took a turn that day' On the drive home, she realized that many others living in her hometown had probably had a similar experience. Gena began to think that she had discovered a fantastic business opportunity. Gerta Franklin and her husband, George, had recently been married and were living in the heart of Central Florida's farm and horse country. George was temporarily between jobs and was currently looking for work on one of the many small farms that dotted the countryside. Gena worked as a bookkeeper for a successful land developer but had always dreamed of running her own business. The timing was perfect Aer three months of careful planning, on November 16, 2006, Gena and George opened Double G Western Wear for business Their store specialized in all forms of westa-n equestrian clothing and shoes and was located just off a main business thoroughfare Although open for only 45 days, the store managed to earn a small prot during 2006. A summary of Double GS 1006 nancial information revealed the following: Llsa Tack from Apr27. 2020 to Jun 22. 2020. o Germ and George contributed $25,000 and a ve-year-old truck valued at $5,000. - Both agreed to take an annual salary of $36,000 ($3,000 a month each, starting at opening), reinvesting any annual prots back into the business. Leased space downtown was secured at $5,000 a month, One month's rent plus a $3,000 security deposit was required up front The lease term began October 1, 2006, and all rent payments were due on the rst of each month. Remodeling and improvements were made to the leased space. These included shelving materials ($10,000), four ceiling fans ($800), and contract labor ($3,000) A cash register was purchased for $2,000 use outside these Parameters is z wayngh volztmn Other operating expenses totaled $28,000. Authanzed tor use only m the mmse Pmctmal Pmpect zt Rwerbon College augm 3" Reect in ePortfoIio '4) Download MUSiC Print E) Open with docReader ( ) Chrome File Edit View History Bookmarks Profiles Tab Window Help Q Tue Aug 31 1:59 PM ... OW * *GG GG W X D D H S T V X D G N G USN QS f 6 + C robertson.brightspace.com/d21/le/content/27070/viewContent/557580/View OT K ... Case Study Tasks: Double G Western Wear Microsoft Word - C-2288.doc 2 / 4 75% + PARPEN -2- UVA-C-2288 Inventory was acquired from two western-wear distributors. It included boots, hats, belts, scarves, vests, and knickknacks. The total purchase price was $30,000 On November 1, $12,000 was borrowed from a local bank. Terms were 10% per annum required, with interest-only payments due for the first three years. . A $15,000 line of credit was also established. Terms allowed for the first $1,000 to be interest-free, with a rate of 12% per annum for any amounts over $1,000. . Sales of $82,000 were made through the end of the year. No credit was offered, although 40% of sales were made with credit cards. Credit-card processors charged a 2.5% fee. Inventory was replenished before year-end. During the year, inventory was priced to by Lisa Tack from Apr 27, 2020 to Jun 22, 2020 yield a 70% gross margin. . Useful lives for all property and equipment were five years, starting in the month placed in service. Exhibits 1 and 2 present the balance sheet and income statement for Double G Western Wear as of the end of 2006 2 The Christmas season had helped Double G earn the 2006 profit, but sales returns early in 2007 had dampened the couple's enthusiasm. Contrary to the zero returns experienced in December, post-New Year's returns had totaled $5, 100. In mid-January, Gerta realized she needed to plan for the year. She and George projected Double G's 2007 financial statements under what they believed were very conservative assumptions. They assumed that sales would continue at their present rate of approximately $52,000 a month. Sales returns would run at 3%, gross margins would hold at 70%, and the store would end the year with $35,000 of inventory on hand. Operating expenses-other than owners' salaries, rent, depreciation, and interest-would be approximately $19,000 a month. Finally, they would need a new truck, which, after trade-in, Use outside would cost $20,000. irse Pr Reflect in ePortfolio Download Print Open with docReader Course Hero 9 M AUG 31Chrome File Edit View History Bookmarks Profiles Tab Window Help Q Tue Aug 31 1:59 PM ... OW * *GG GG W X Of THE TV X D G N G USN QS f 6 + C robertson.brightspace.com/d21/le/content/27070/viewContent/557580/View OT K ... Case Study Tasks: Double G Western Wear Microsoft Word - C-2288.doc 3 / 4 75% + UVA-C-2288 Exhibit 1 DOUBLE G WESTERN WEAR Balance Sheet: 12-31-06 Assets Cash 6,280 Inventory 16,400 Prepaid assets 5,00 it by Lisa Tack from Apr 27, 2020 to Jun 22, 2020 Deposits 3,000 Property and equipment (net) 20,107 Total assets 50, 787 Liabilities Interest payable 100 Taxes payable 553 2 Accrued expenses S,000 Loan 12,000 Total liabilities 17,653 Use outside these parameters is a copyright violation. Equity Common stock 30,000 Retained earnings 3,134 Total equity 33,134 in the course Practical Project at Robertson College taught by 3 Reflect in ePortfolio Download Print Open with docReader 9 AUG 31