Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could use some help with the answers that are left blank. Need more help with Part B. Please show work. Thank you!(: PROBLEM 2-COST CONCEPTS

Could use some help with the answers that are left blank. Need more help with Part B. Please show work. Thank you!(:

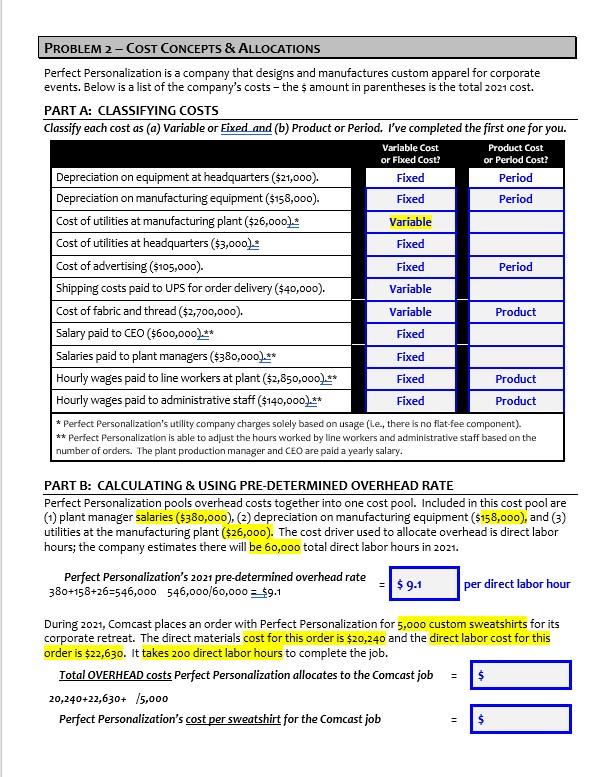

PROBLEM 2-COST CONCEPTS & ALLOCATIONS Perfect Personalization is a company that designs and manufactures custom apparel for corporate events. Below is a list of the company's costs - the $ amount in parentheses is the total 2021 cost. PART A: CLASSIFYING COSTS Classify each cost as (a) Variable or Eixed and (b) Product or Period. I've completed the first one for you. Variable Cost Product Cost or Fixed Cost? or Perlod Cost? Depreciation on equipment at headquarters ($21,000). Fixed Period Depreciation on manufacturing equipment ($158,000). Fixed Period Cost of utilities at manufacturing plant ($26,000.). Variable Cost of utilities at headquarters ($3,000). Fixed cost of advertising ($105,000). Fixed Period Shipping costs paid to UPS for order delivery ($40,000). Variable Cost of fabric and thread ($2,700,000). Variable Product Salary paid to CEO ($600,000)** Fixed Salaries paid to plant managers ($380,000).** Fixed Hourly wages paid to line workers at plant ($2,850,000). ** Fixed Product Hourly wages paid to administrative staff ($140,000)** Fixed Product * Perfect Personalization's utility company charges solely based on usage (ie, there is no flat-fee component). ** Perfect Personalization is able to adjust the hours worked by line workers and administrative staff based on the number of orders. The plant production manager and CEO are paid a yearly salary. PART B: CALCULATING & USING PRE-DETERMINED OVERHEAD RATE Perfect Personalization pools overhead costs together into one cost pool. Included in this cost pool are (1) plant manager salaries ($380,000), (2) depreciation on manufacturing equipment (5158,000), and (3) utilities at the manufacturing plant ($26,000). The cost driver used to allocate overhead is direct labor hours; the company estimates there will be 60,000 total direct labor hours in 2021. Perfect Personalization's 2021 pre-determined overhead rate 380+158+26=546,000 546,000/60,000 = $9.1 $ 9.1 per direct labor hour During 2021, Comcast places an order with Perfect Personalization for 5,000 custom sweatshirts for its corporate retreat. The direct materials cost for this order is $20,240 and the direct labor cost for this order is $22,630. It takes 200 direct labor hours to complete the job. Total OVERHEAD costs Perfect Personalization allocates to the Comcast job $ 20,240+22,630+ 15,000 Perfect Personalization's cost per sweatshirt for the Comcast job 11Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started