Answered step by step

Verified Expert Solution

Question

1 Approved Answer

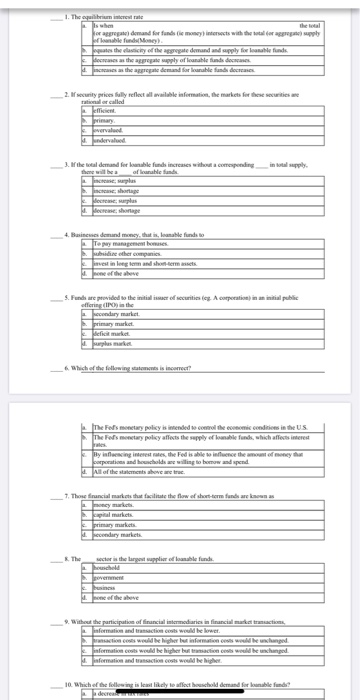

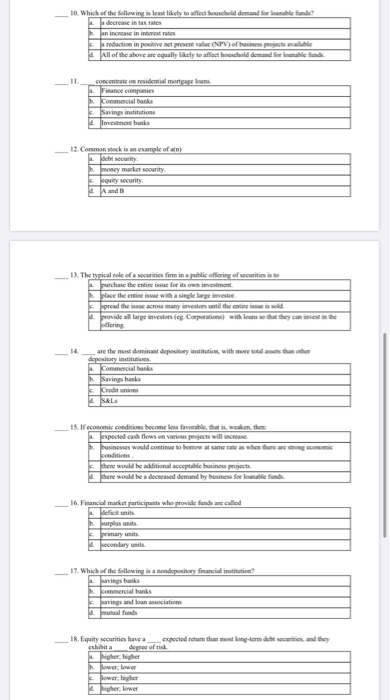

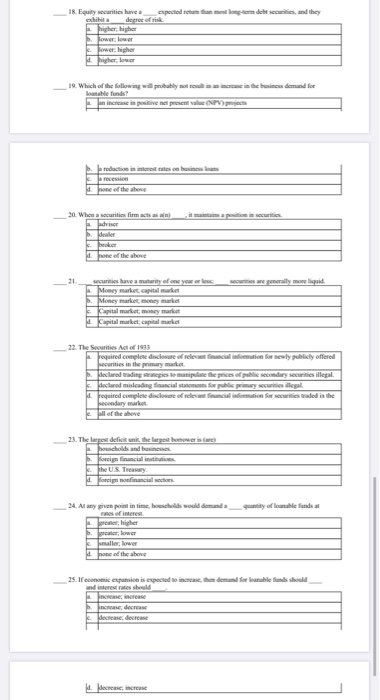

could you answer each question? the 1. The equilibrium interest rate We are demand for funds le money intersects with the ball to agreep Wanable

could you answer each question?

the 1. The equilibrium interest rate We are demand for funds le money intersects with the ball to agreep Wanable funds Money). quates the classicity of the aggregate demand and apply for the funds dress the aggregate supply of anable and dem ces as the agreed for alle fond de AMA 2. security prices fully reflect all available information, the markets for these securities we rational or called verval undervalul 3. If the total demand for ble funds incre who coming there will be of alle fonds resplus shortage fernales se shortage 4. Business demand may that is, loanable funds to Teymanposes wide the companies vel in logomador of the above HAH 5. Funds are provided to the initial of securities (eg. A corporati) in an initial public offering (IPO) in the darymarket primary deficit makes Als+ Make M 4. Which of the following statements is incorrect! The Fementary policy is intended to the comic conditions in the US The Fods mentary policy affects the supply of able funds, which affects interest By influencing interest rates the Fed is able to influence the amount of the Seperations and acholdere willing tobomow and spend All of the statements above me true 7. The financial markets that facilitate the flow of short-term funduarenas w spital markets primary markets secondary markets sector is the largest supplier of funds Scheld AME 9. Without the participation of financial intermediaries in financial market transactions information and transactions would be lower transaction costs would be ligher but information costs would be unchanged. information coobs would be higher bulmacices would be changed information and transactions wher 10. Which of the following is last likely to affect schold demand for ble fund decre 10. Which of the following is kast likely to affect heescheld demand for alle funde decrease in tax rates an increase in interest rates reduction in positive net present value (NPV) of business projects alle All of the above are equally likely to affect household demand for alle fonde concentrate on residential mortgage loans Finance companies Commercial banks Savingsinstitutions Imment banks 12. Common stock is an example of ain) Get security money market security Jequity security AndB 1. The typical role of a securities form in a public offering of securities is to purchase the entire fois os investment place the entire issue with a single large investee pread the issue across many investes until the entire is sold provide all large investors (eg. Corporates with loans they come in the offering 14 are the most dominant depository institution, with more than the depository institutions Commercial Banks Savings banks Credit union SALS 15. If economic conditions become less fable that is weaken, the expected cash flows en various projects will increase businesses would continue to bomow at same rate when the song conditions there would be additional table business projects here would be a decreased demand by business for alle funk 16. Financial market participants who provide funds are called deficits surplus units primary units secondary units 17. Which of the following is a nendepository financial institution? commercial Banks wavings and loan cities muual funds 18. Equity securities have a expected return the long-term wed they Exha dege of risk higher, higher Lower lower lower higher her, lower cxpected on the leptem de ses, and they 18. Equity securities have a demo her higher wer, Tower, higher agher, 19. Which of the following will probably are in the business demand for loane fund an increme in penitive et presente (PV) redactie mechi 4. see the one 20. When a securities firmas dealer 1. pe of the above care generally more liquid. securities have a maturity of your los Money market capital market Money market, men market Capital market market Capital market capital market 22. The Securities Act 1993 required complete disclosure of reficial formation for newly publicly offered oarities in the declared dig segies to manipulate the people day securities illegal declared misleading financial for discrimilegal 1. required complete disclosure ofrecemos securities made in the condarymas all of the above 23. The largest definite artis holds and be Sarcin financial institutions the US Treasury. foreign noinciale of funds 24. At any given point in time, boschilds would demanda fine prater, higher prower maller lower 4. one of the one 25. If comic expansion is expected to increase the demand for Bonable finds should and interest rates should dece Merdere keren the 1. The equilibrium interest rate We are demand for funds le money intersects with the ball to agreep Wanable funds Money). quates the classicity of the aggregate demand and apply for the funds dress the aggregate supply of anable and dem ces as the agreed for alle fond de AMA 2. security prices fully reflect all available information, the markets for these securities we rational or called verval undervalul 3. If the total demand for ble funds incre who coming there will be of alle fonds resplus shortage fernales se shortage 4. Business demand may that is, loanable funds to Teymanposes wide the companies vel in logomador of the above HAH 5. Funds are provided to the initial of securities (eg. A corporati) in an initial public offering (IPO) in the darymarket primary deficit makes Als+ Make M 4. Which of the following statements is incorrect! The Fementary policy is intended to the comic conditions in the US The Fods mentary policy affects the supply of able funds, which affects interest By influencing interest rates the Fed is able to influence the amount of the Seperations and acholdere willing tobomow and spend All of the statements above me true 7. The financial markets that facilitate the flow of short-term funduarenas w spital markets primary markets secondary markets sector is the largest supplier of funds Scheld AME 9. Without the participation of financial intermediaries in financial market transactions information and transactions would be lower transaction costs would be ligher but information costs would be unchanged. information coobs would be higher bulmacices would be changed information and transactions wher 10. Which of the following is last likely to affect schold demand for ble fund decre 10. Which of the following is kast likely to affect heescheld demand for alle funde decrease in tax rates an increase in interest rates reduction in positive net present value (NPV) of business projects alle All of the above are equally likely to affect household demand for alle fonde concentrate on residential mortgage loans Finance companies Commercial banks Savingsinstitutions Imment banks 12. Common stock is an example of ain) Get security money market security Jequity security AndB 1. The typical role of a securities form in a public offering of securities is to purchase the entire fois os investment place the entire issue with a single large investee pread the issue across many investes until the entire is sold provide all large investors (eg. Corporates with loans they come in the offering 14 are the most dominant depository institution, with more than the depository institutions Commercial Banks Savings banks Credit union SALS 15. If economic conditions become less fable that is weaken, the expected cash flows en various projects will increase businesses would continue to bomow at same rate when the song conditions there would be additional table business projects here would be a decreased demand by business for alle funk 16. Financial market participants who provide funds are called deficits surplus units primary units secondary units 17. Which of the following is a nendepository financial institution? commercial Banks wavings and loan cities muual funds 18. Equity securities have a expected return the long-term wed they Exha dege of risk higher, higher Lower lower lower higher her, lower cxpected on the leptem de ses, and they 18. Equity securities have a demo her higher wer, Tower, higher agher, 19. Which of the following will probably are in the business demand for loane fund an increme in penitive et presente (PV) redactie mechi 4. see the one 20. When a securities firmas dealer 1. pe of the above care generally more liquid. securities have a maturity of your los Money market capital market Money market, men market Capital market market Capital market capital market 22. The Securities Act 1993 required complete disclosure of reficial formation for newly publicly offered oarities in the declared dig segies to manipulate the people day securities illegal declared misleading financial for discrimilegal 1. required complete disclosure ofrecemos securities made in the condarymas all of the above 23. The largest definite artis holds and be Sarcin financial institutions the US Treasury. foreign noinciale of funds 24. At any given point in time, boschilds would demanda fine prater, higher prower maller lower 4. one of the one 25. If comic expansion is expected to increase the demand for Bonable finds should and interest rates should dece Merdere keren Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started