Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could you answer to the all questions as possible as? I mean a,b,c,d,e,f parts Part C a) A fimm produce $124 million of net income

Could you answer to the all questions as possible as? I mean a,b,c,d,e,f parts

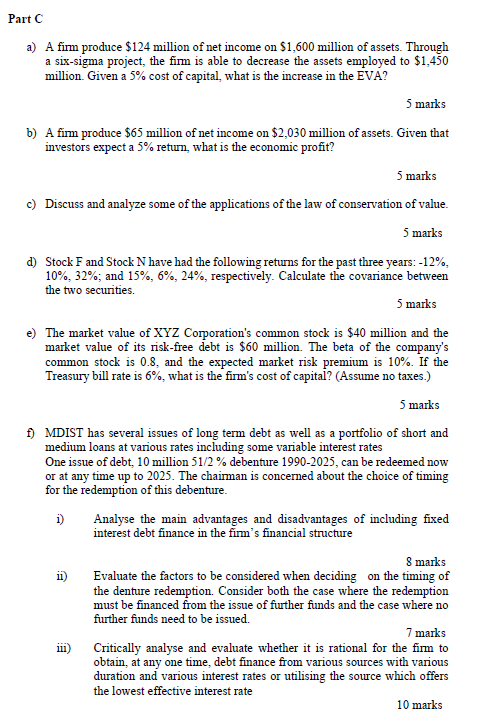

Part C a) A fimm produce $124 million of net income on $1,600 million of assets. Through a six-sigma project, the firm is able to decrease the assets employed to $1,450 million. Given a 5% cost of capital, what is the increase in the EVA? 5 marks b) A fim produce $65 million of net income on $2,030 million of assets. Given that investors expect a 5% return, what is the economic profit? 5 marks c) Discuss and analyze some of the applications of the law of conservation of value. 5 marks d) Stock F and Stock N have had the following returns for the past three years: -12%, 10%, 32%, and 15%, 6%, 24%, respectively. Calculate the covariance between the two securities. 5 marks e) The market value of XYZ Corporation's common stock is $40 million and the market value of its risk-free debt is $60 million. The beta of the company's common stock is 0.8, and the expected market risk premium is 10%. If the Treasury bill rate is 6%, what is the firm's cost of capital? (Assume no taxes.) 5 marks 1) MDIST has several issues of long term debt as well as a portfolio of short and medium loans at various rates including some variable interest rates One issue of debt, 10 million 51/2 % debenture 1990-2025, can be redeemed now or at any time up to 2025. The chaimman is concerned about the choice of timing for the redemption of this debenture. 1) Analyse the main advantages and disadvantages of including fixed interest debt finance in the firm's financial structure 8 marks ) Evaluate the factors to be considered when deciding on the timing of the denture redemption. Consider both the case where the redemption must be financed from the issue of further funds and the case where no further funds need to be issued. 7 marks 111) Critically analyse and evaluate whether it is rational for the firm to obtain, at any one time, debt finance from various sources with various duration and various interest rates or utilising the source which offers the lowest effective interest rate 10 marksStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started