Answered step by step

Verified Expert Solution

Question

1 Approved Answer

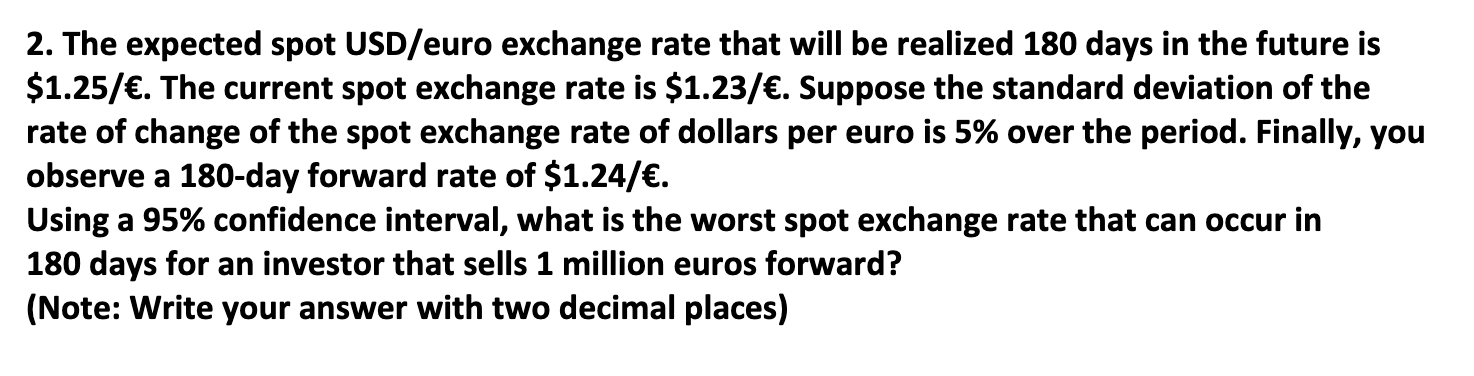

Could you explain why the answer is the one stated below? 2. The expected spot USD/euro exchange rate that will be realized 180 days in

Could you explain why the answer is the one stated below?

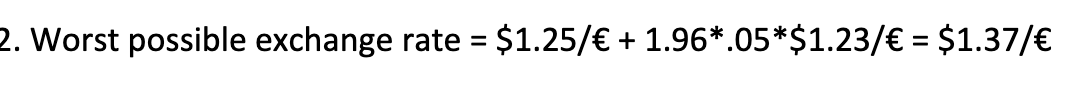

2. The expected spot USD/euro exchange rate that will be realized 180 days in the future is $1.25/. The current spot exchange rate is $1.23/. Suppose the standard deviation of the rate of change of the spot exchange rate of dollars per euro is 5% over the period. Finally, you observe a 180-day forward rate of $1.24/. Using a 95% confidence interval, what is the worst spot exchange rate that can occur in 180 days for an investor that sells 1 million euros forward? (Note: Write your answer with two decimal places) 2. Worst possible exchange rate = $1.25/ + 1.96*.05*$1.23/ = $1.37/Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started