Answered step by step

Verified Expert Solution

Question

1 Approved Answer

could you help me with requirements 5, 6, 7 and 8?? no need to make a full excell sheet! you can just write it out

could you help me with requirements 5, 6, 7 and 8??

no need to make a full excell sheet! you can just write it out and attatch a picture

this is the first part of transactions

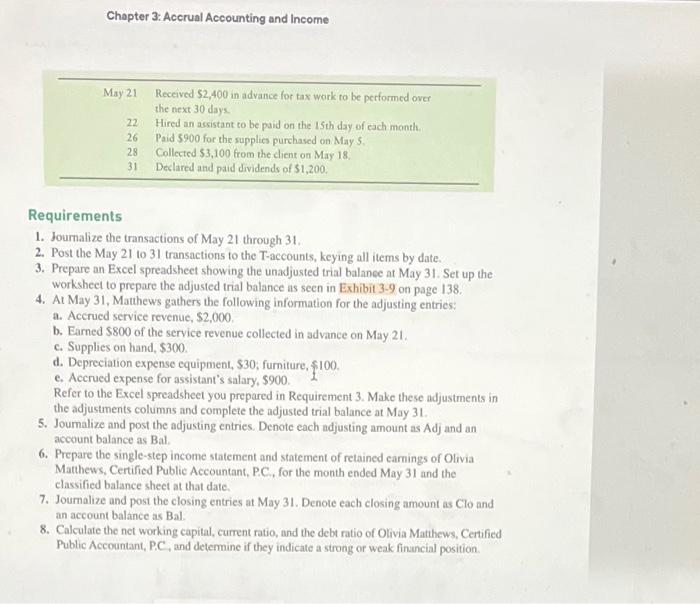

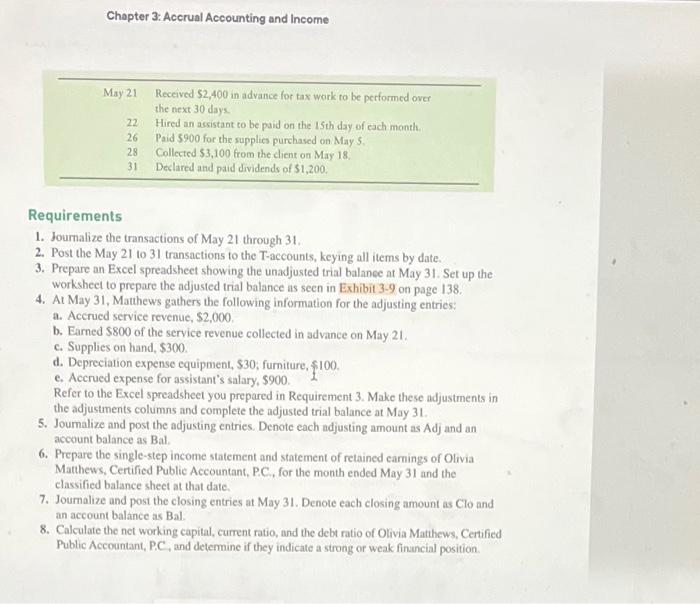

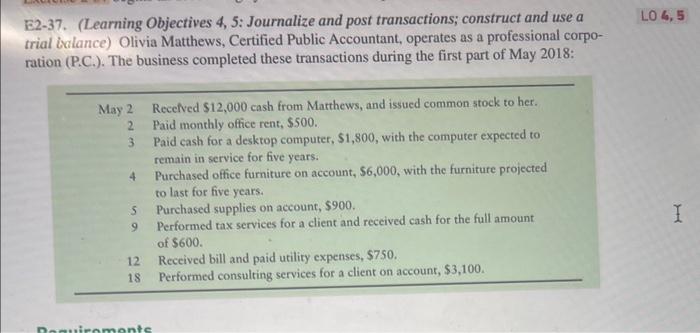

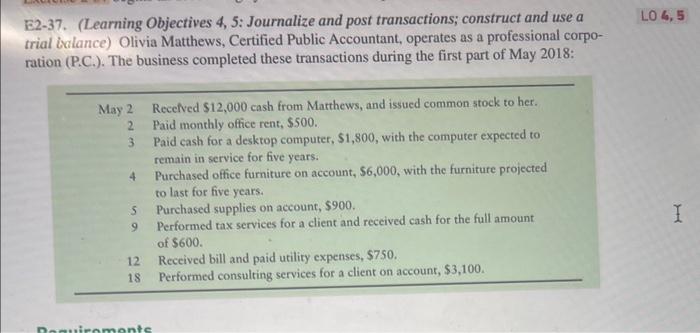

Chapter 3: Accrual Accounting and Income Requirements 1. Journalize the transactions of May 21 through 31 . 2. Post the May 21 to 31 transactions to the T-accounts, keying all items by date. 3. Prepare an Excel spreadsheet showing the unadjusted trial balanee at May 31. Set up the worksheet to prepare the adjusted trial balance as seen in Exhibit 39 on page 138. 4. At May 31, Mathews gathers the following information for the adjusting entries: a. Accrued service revenue, $2,000. b. Earned $800 of the service revenue collected in advance on May 21 . c. Supplies on hand, $300. d. Depreciation expense equipment, $30; furniture, $100. e. Accrued expense for assistant's salary, $900. Refer to the Excel spreadsheet you prepared in Requirement 3. Make these adjustments in the adjustments columss and complete the adjusted trial balance at May 31. 5. Joumalize and post the adjusting entries. Denote each adjusting amount as Adj and an account balance as Bal. 6. Prepare the single-step income statement and statement of retained earnings of Olivia Matthews, Certified Public Accountant, PC., for the month ended May 31 and the classified balance sheet at that date. 7. Joumalize and post the closing entries at May 31. Denote each closing amount as Clo and an account balance as Bal. 8. Calculate the net working capital, current ratio, and the debt ratio of Olivia Mathews, Certified Public Accountant, P.C and determine if they indicate a strong or weak finuncial position. E2-37. (Learning Objectives 4, 5: Journalize and post transactions; construct and use a trial balance) Olivia Matthews, Certified Public Accountant, operates as a professional corporation (P.C.). The business completed these transactions during the first part of May 2018

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started