could you please answer bdc

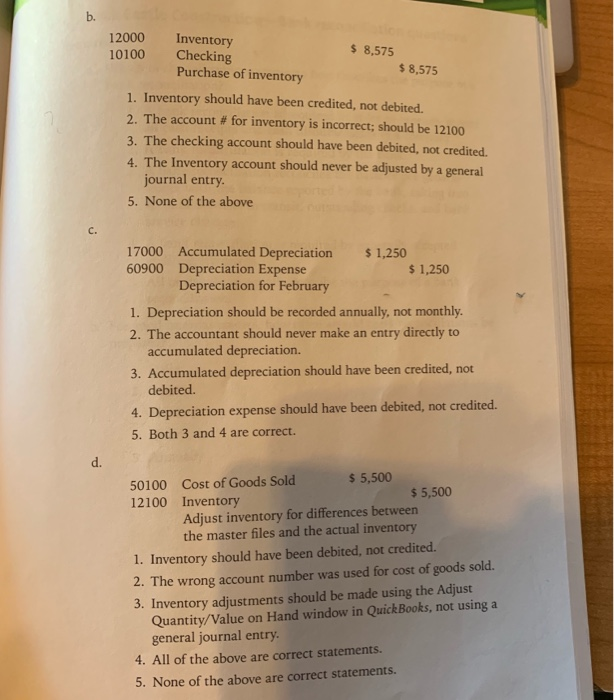

b. 12000 Inventory Checking Purchase of imventory $ 8,575 $ 8,575 10100 1. Inventory should have been credited, not debited. 2. The account # for inventory is incorrect; should be 12100 3. The checking account should have been debited, not credited. 4. The Inventory account should never be adjusted by a general journal entry 5. None of the above 17000 Accumulated Depreciation 60900 Depreciation Expense Depreciation for February $1,250 $1,250 1. Depreciation should be recorded annually, not monthly. 2. The accountant should never make an entry directly to accumulated depreciation. 3. Accumulated depreciation should have been credited, not debited. 4. Depreciation expense should have been debited, not credited. 5. Both 3 and 4 are correct. d. 50100 Cost of Goods Sold 12100 Inventory $ 5,500 $ 5,500 Adjust inventory for differences between the master files and the actual inventory 1. Inventory should have been debited, not credited. 2. The wrong account number was used for cost of goods sold. 3. Inventory adjustments should be made using the Adjust Quantity/Value on Hand window in QuickBooks, not using a general journal entry 4. All of the above are correct statements. 5. None of the above are correct statements b. 12000 Inventory Checking Purchase of imventory $ 8,575 $ 8,575 10100 1. Inventory should have been credited, not debited. 2. The account # for inventory is incorrect; should be 12100 3. The checking account should have been debited, not credited. 4. The Inventory account should never be adjusted by a general journal entry 5. None of the above 17000 Accumulated Depreciation 60900 Depreciation Expense Depreciation for February $1,250 $1,250 1. Depreciation should be recorded annually, not monthly. 2. The accountant should never make an entry directly to accumulated depreciation. 3. Accumulated depreciation should have been credited, not debited. 4. Depreciation expense should have been debited, not credited. 5. Both 3 and 4 are correct. d. 50100 Cost of Goods Sold 12100 Inventory $ 5,500 $ 5,500 Adjust inventory for differences between the master files and the actual inventory 1. Inventory should have been debited, not credited. 2. The wrong account number was used for cost of goods sold. 3. Inventory adjustments should be made using the Adjust Quantity/Value on Hand window in QuickBooks, not using a general journal entry 4. All of the above are correct statements. 5. None of the above are correct statements