Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could you please answer this question? I am in a hurry a little bit, so fast answer would be appreciated! Thank you! Question 7 (1

Could you please answer this question?

I am in a hurry a little bit, so fast answer would be appreciated!

Thank you!

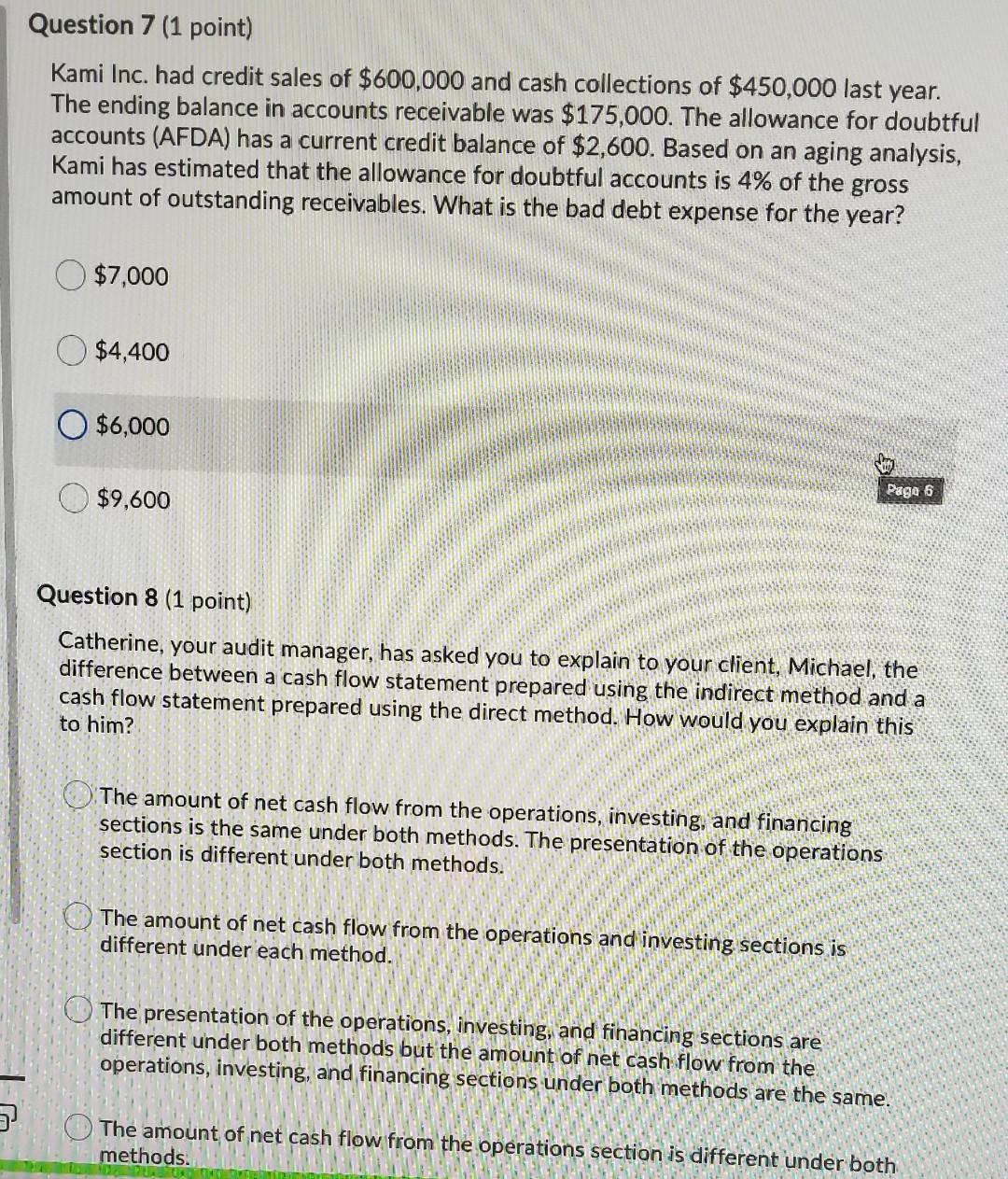

Question 7 (1 point) Kami Inc. had credit sales of $600,000 and cash collections of $450,000 last year. The ending balance in accounts receivable was $175,000. The allowance for doubtful accounts (AFDA) has a current credit balance of $2,600. Based on an aging analysis, Kami has estimated that the allowance for doubtful accounts is 4% of the gross amount of outstanding receivables. What is the bad debt expense for the year? $7,000 $4,400 O $6,000 Page 6 $9,600 Page 6 Question 8 (1 point) Catherine, your audit manager, has asked you to explain to your client, Michael, the difference between a cash flow statement prepared using the indirect method and a cash flow statement prepared using the direct method. How would you explain this to him? The amount of net cash flow from the operations, investing, and financing sections is the same under both methods. The presentation of the operations section is different under both methods. The amount of net cash flow from the operations and investing sections is different under each method. The presentation of the operations, investing, and financing sections are different under both methods but the amount of net cash flow from the operations, investing, and financing sections under both methods are the same. The amount of net cash flow from the operations section is different under both methods

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started