Answered step by step

Verified Expert Solution

Question

1 Approved Answer

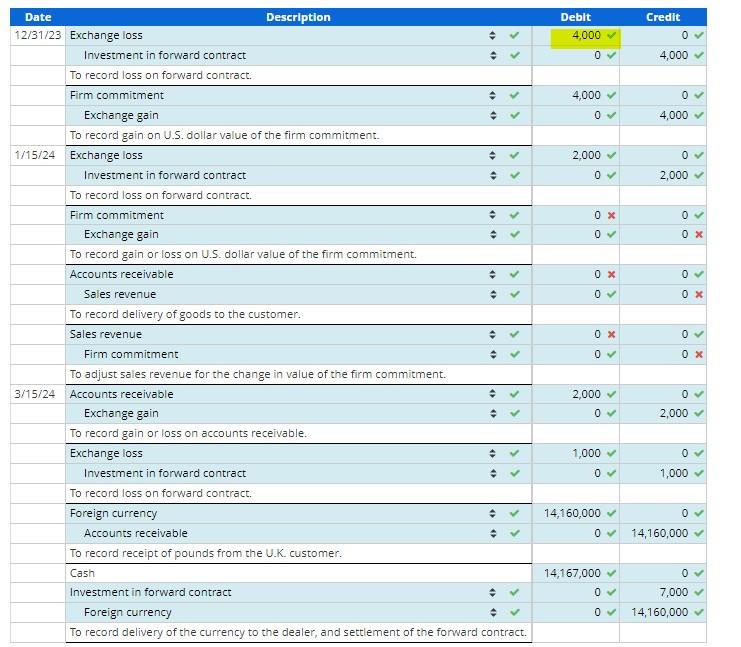

Could you please help by explaining why the highlighted is 4,000 as well as the ones I got wrong Hedged Sale Commitment and Exposed Asset

Could you please help by explaining why the highlighted is 4,000 as well as the ones I got wrong

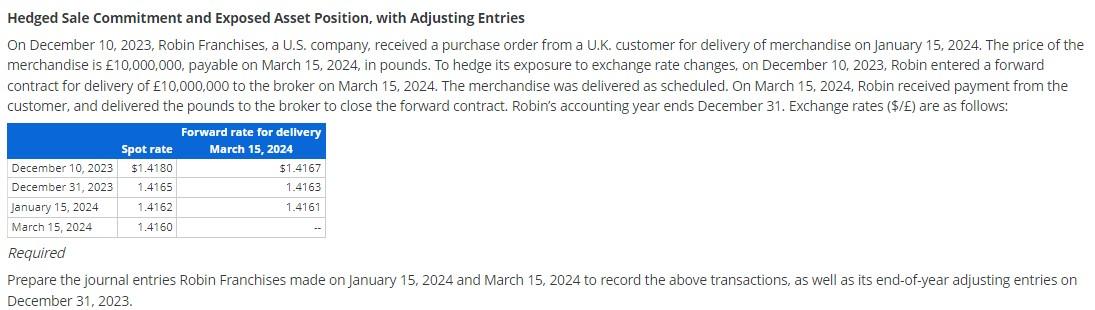

Hedged Sale Commitment and Exposed Asset Position, with Adjusting Entries On December 10, 2023, Robin Franchises, a U.S. company, received a purchase order from a U.K. customer for delivery of merchandise on January 15 , 2024. The price of the merchandise is 10,000,000, payable on March 15,2024 , in pounds. To hedge its exposure to exchange rate changes, on December 10 , 2023, Robin entered a forward contract for delivery of 10,000,000 to the broker on March 15, 2024. The merchandise was delivered as scheduled. On March 15, 2024, Robin received payment from the customer, and delivered the pounds to the broker to close the forward contract. Robin's accounting year ends December 31 . Exchange rates (\$/E) are as follows: Required Prepare the journal entries Robin Franchises made on January 15, 2024 and March 15, 2024 to record the above transactions, as well as its end-of-year adjusting entries on December 31,2023. Hedged Sale Commitment and Exposed Asset Position, with Adjusting Entries On December 10, 2023, Robin Franchises, a U.S. company, received a purchase order from a U.K. customer for delivery of merchandise on January 15 , 2024. The price of the merchandise is 10,000,000, payable on March 15,2024 , in pounds. To hedge its exposure to exchange rate changes, on December 10 , 2023, Robin entered a forward contract for delivery of 10,000,000 to the broker on March 15, 2024. The merchandise was delivered as scheduled. On March 15, 2024, Robin received payment from the customer, and delivered the pounds to the broker to close the forward contract. Robin's accounting year ends December 31 . Exchange rates (\$/E) are as follows: Required Prepare the journal entries Robin Franchises made on January 15, 2024 and March 15, 2024 to record the above transactions, as well as its end-of-year adjusting entries on December 31,2023Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started