Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could you please help me solve this master budget. erences Mailings ates) Review View my Mac In December 2019, 250,000 kg of material was purchased

Could you please help me solve this master budget.

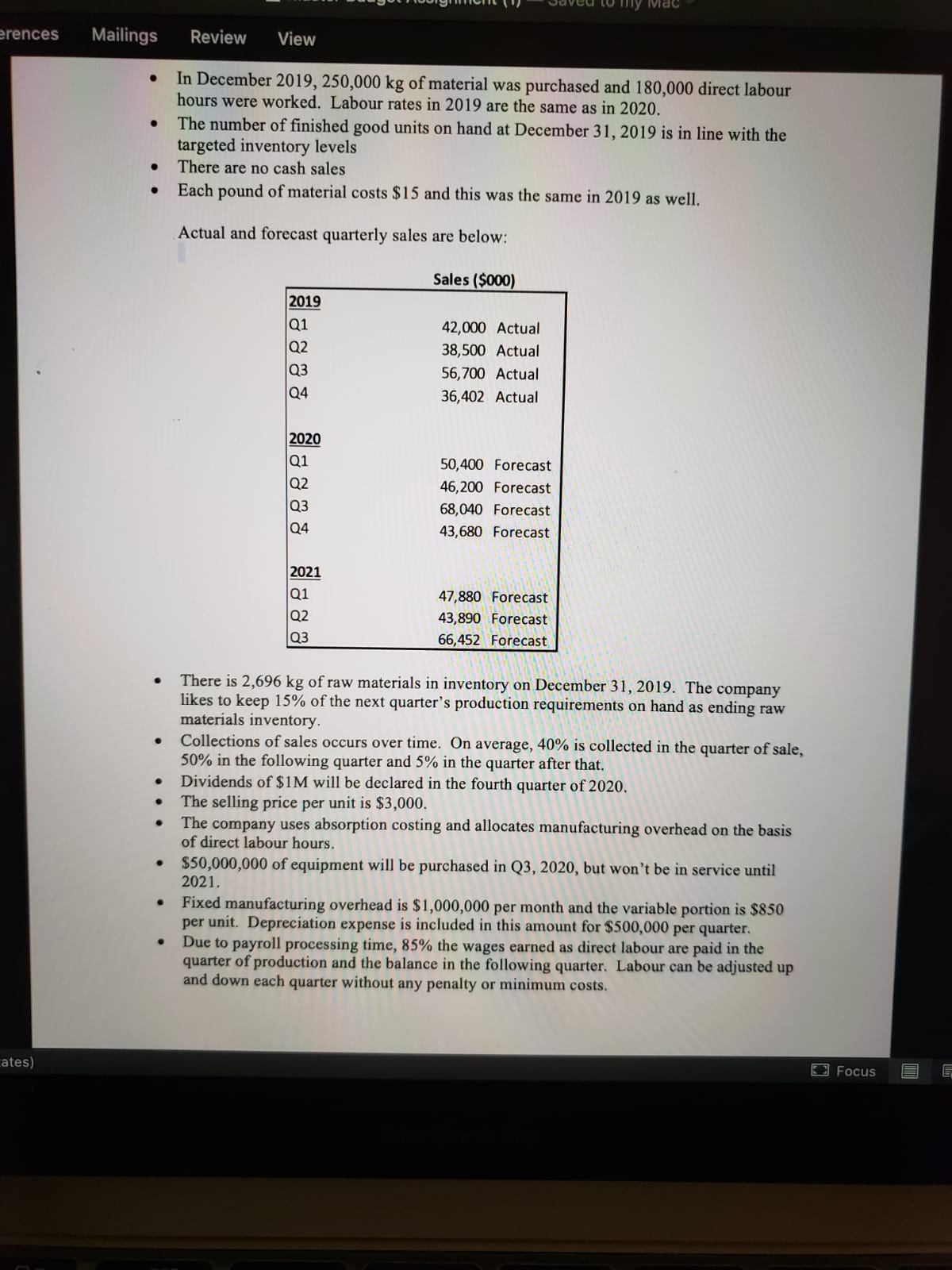

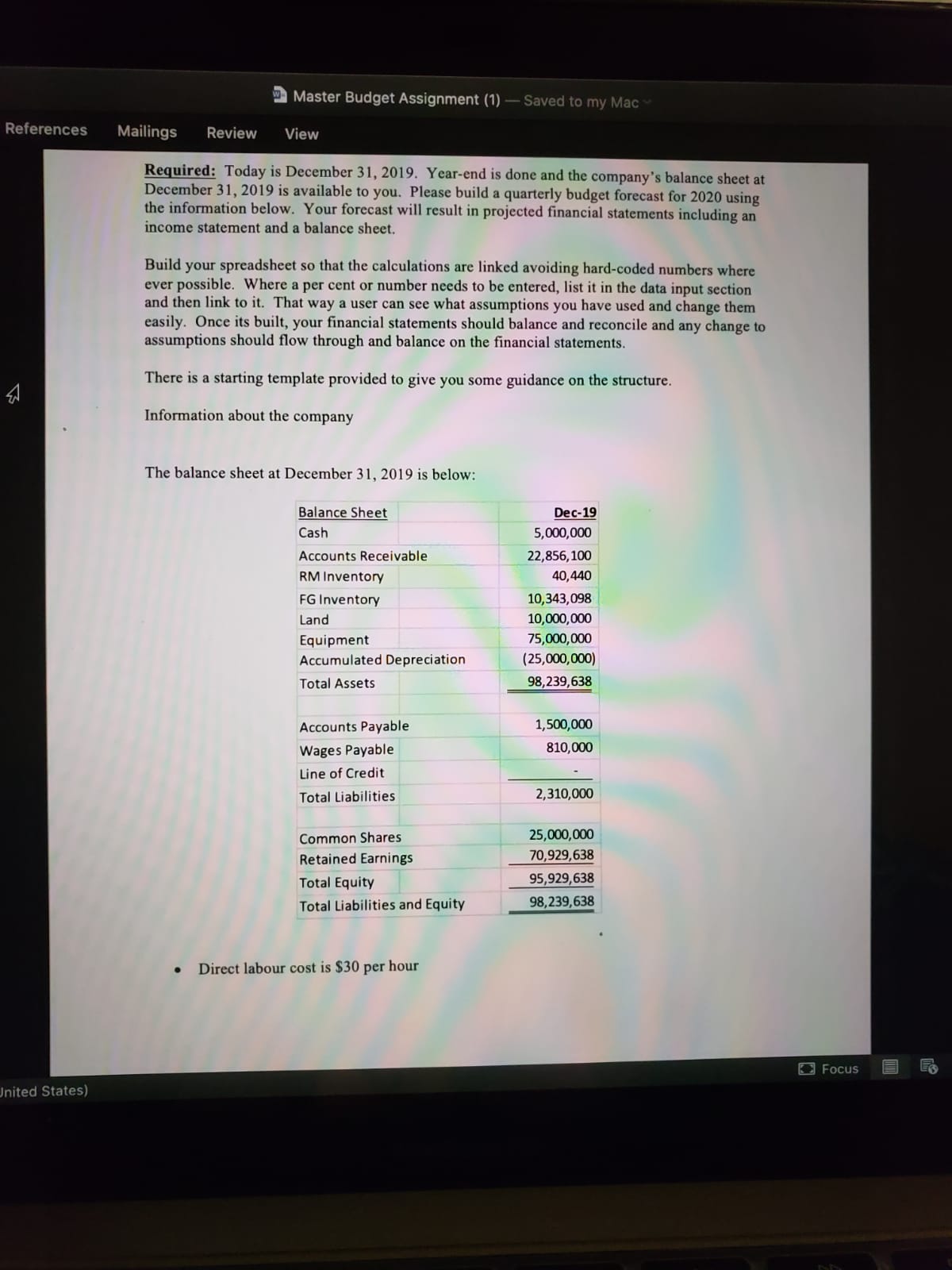

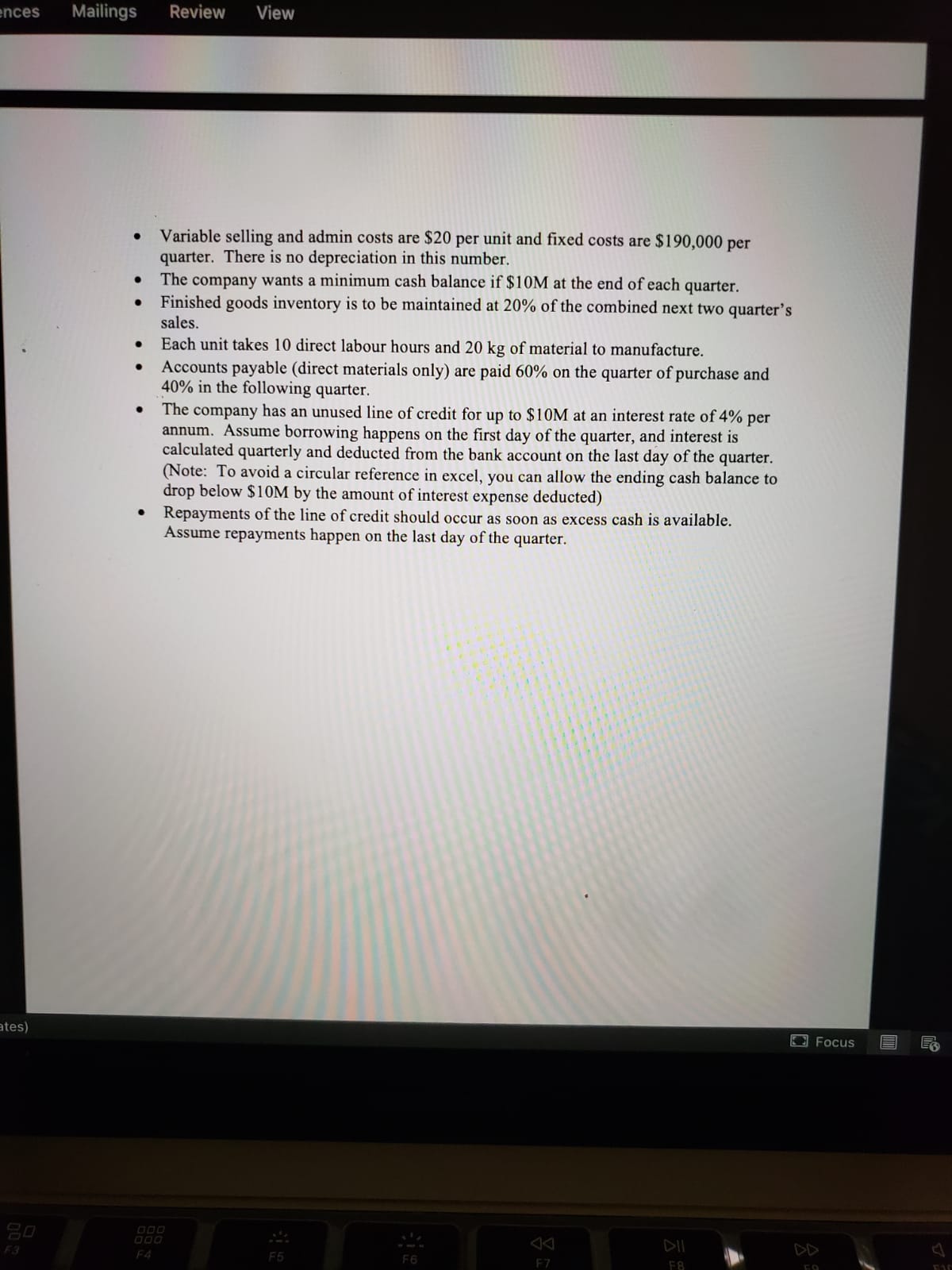

erences Mailings ates) Review View my Mac In December 2019, 250,000 kg of material was purchased and 180,000 direct labour hours were worked. Labour rates in 2019 are the same as in 2020. The number of finished good units on hand at December 31, 2019 is in line with the targeted inventory levels There are no cash sales Each pound of material costs $15 and this was the same in 2019 as well. Actual and forecast quarterly sales are below: Q1 Q2 Q3 Q4 2019 Q1 Q2 Q3 Q4 5 s Sales ($000) 42,000 Actual 38,500 Actual 56,700 Actual 36,402 Actual 2020 50,400 Forecast 46,200 Forecast 68,040 Forecast 43,680 Forecast 2021 Q1 47,880 Forecast Q2 43,890 Forecast Q3 66,452 Forecast There is 2,696 kg of raw materials in inventory on December 31, 2019. The company likes to keep 15% of the next quarter's production requirements on hand as ending raw materials inventory. Collections of sales occurs over time. On average, 40% is collected in the quarter of sale, 50% in the following quarter and 5% in the quarter after that. Dividends of $1M will be declared in the fourth quarter of 2020. The selling price per unit is $3,000. The company uses absorption costing and allocates manufacturing overhead on the basis of direct labour hours. $50,000,000 of equipment will be purchased in Q3, 2020, but won't be in service until 2021. Fixed manufacturing overhead is $1,000,000 per month and the variable portion is $850 per unit. Depreciation expense is included in this amount for $500,000 per quarter. Due to payroll processing time, 85% the wages earned as direct labour are paid in the quarter of production and the balance in the following quarter. Labour can be adjusted up and down each quarter without any penalty or minimum costs. Focus E

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started