Question

Could you please help me write the explanation about the below-mentioned Question:- Emmy is curious as to how you determined the number of years she

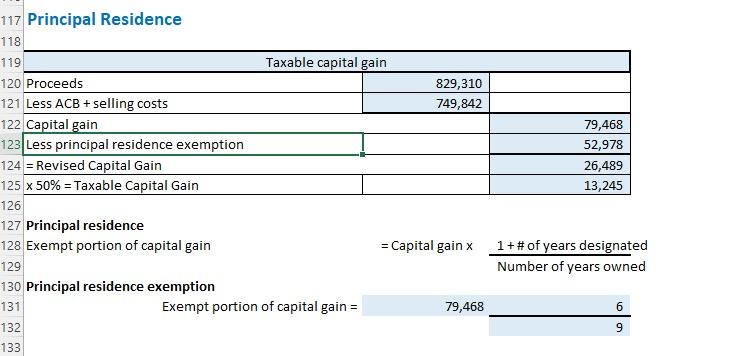

Could you please help me write the explanation about the below-mentioned Question:- Emmy is curious as to how you determined the number of years she designated her Toronto home, and why the capital gain isn't fully exempt like her condo was.

Information is given Below:

She was requested to relocate by her employer and agreed thinking moving to a smaller center may be better to raise a child. For this reason she agreed to relocated from Toronto to Sarnia. She owned the home she sold in Toronto for nine years. She would like to utilize the principal residence exemption for this transaction. During this 9 years she owned a condo for four years and used the principal residence to fully exempt the gain. Costs associated with the move, and sale of her residence are contained in note 4.

Thanks!

Principal Residence Principal ResidenceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started