Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Could you please show the work to get the answers? These are practice problems for studying for my exam. International Portfolio Investments Rs = [(1

Could you please show the work to get the answers? These are practice problems for studying for my exam.

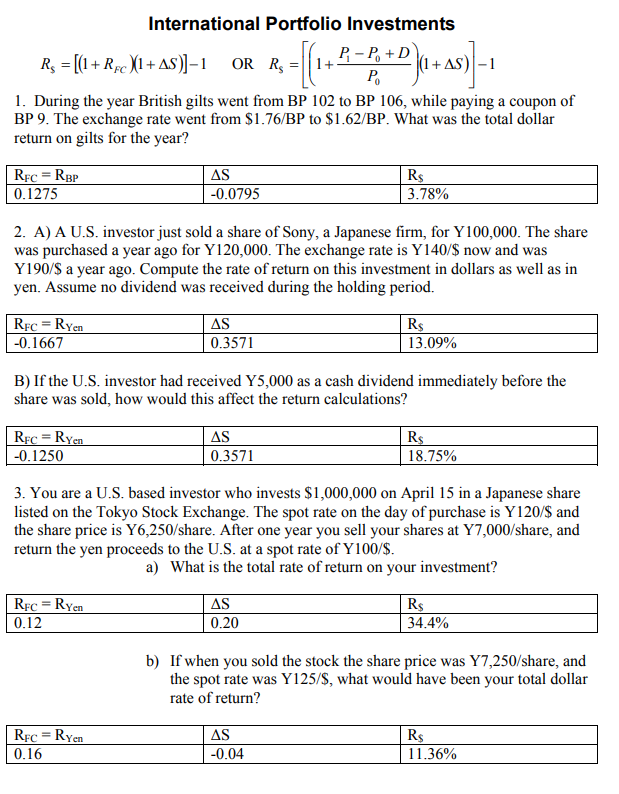

International Portfolio Investments Rs = [(1 + Rc X1+AS))1 OR Rg P-PD 1+ P. 1. During the year British gilts went from BP 102 to BP 106, while paying a coupon of BP 9. The exchange rate went from $1.76/BP to $1.62/BP. What was the total dollar return on gilts for the year? -=[[. ***)-1 as-- (1 Rrc = RBP 0.1275 AS -0.0795 Rs 3.78% 2. A) A U.S. investor just sold a share of Sony, a Japanese firm, for Y100,000. The share was purchased a year ago for Y120,000. The exchange rate is Y140/$ now and was Y190/$ a year ago. Compute the rate of return on this investment in dollars as well as in yen. Assume no dividend was received during the holding period. Rfc = Ryen -0.1667 AS 0.3571 Rs 13.09% B) If the U.S. investor had received Y5,000 as a cash dividend immediately before the share was sold, how would this affect the return calculations? Rc = Ryen -0.1250 AS 0.3571 Rs 18.75% 3. You are a U.S. based investor who invests $1,000,000 on April 15 in a Japanese share listed on the Tokyo Stock Exchange. The spot rate on the day of purchase is Y 120/$ and the share price is Y6,250/share. After one year you sell your shares at Y7,000/share, and return the yen proceeds to the U.S. at a spot rate of Y100/$. a) What is the total rate of return on your investment? Rs Rc = Ryen 0.12 AS 0.20 34.4% b) If when you sold the stock the share price was 97,250/share, and the spot rate was Y125/$, what would have been your total dollar rate of return? AS Rrc = Ryen 0.16 Rs 11.36% -0.04 International Portfolio Investments Rs = [(1 + Rc X1+AS))1 OR Rg P-PD 1+ P. 1. During the year British gilts went from BP 102 to BP 106, while paying a coupon of BP 9. The exchange rate went from $1.76/BP to $1.62/BP. What was the total dollar return on gilts for the year? -=[[. ***)-1 as-- (1 Rrc = RBP 0.1275 AS -0.0795 Rs 3.78% 2. A) A U.S. investor just sold a share of Sony, a Japanese firm, for Y100,000. The share was purchased a year ago for Y120,000. The exchange rate is Y140/$ now and was Y190/$ a year ago. Compute the rate of return on this investment in dollars as well as in yen. Assume no dividend was received during the holding period. Rfc = Ryen -0.1667 AS 0.3571 Rs 13.09% B) If the U.S. investor had received Y5,000 as a cash dividend immediately before the share was sold, how would this affect the return calculations? Rc = Ryen -0.1250 AS 0.3571 Rs 18.75% 3. You are a U.S. based investor who invests $1,000,000 on April 15 in a Japanese share listed on the Tokyo Stock Exchange. The spot rate on the day of purchase is Y 120/$ and the share price is Y6,250/share. After one year you sell your shares at Y7,000/share, and return the yen proceeds to the U.S. at a spot rate of Y100/$. a) What is the total rate of return on your investment? Rs Rc = Ryen 0.12 AS 0.20 34.4% b) If when you sold the stock the share price was 97,250/share, and the spot rate was Y125/$, what would have been your total dollar rate of return? AS Rrc = Ryen 0.16 Rs 11.36% -0.04

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started