Answered step by step

Verified Expert Solution

Question

1 Approved Answer

could you please solve 1 & 2. Thank you! Alright, alright, alright. Extra-Credit. To be added to Exam 3 score, 1/2 the difference between an

could you please solve 1 & 2. Thank you!

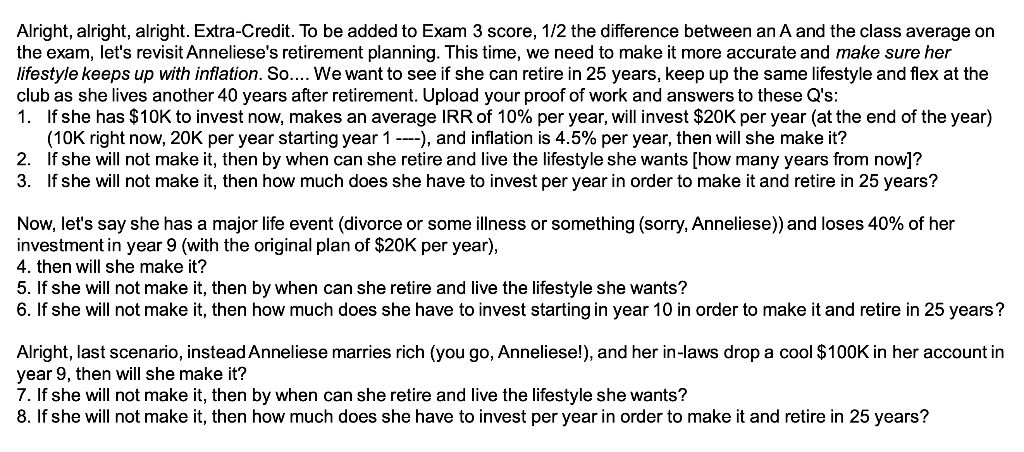

Alright, alright, alright. Extra-Credit. To be added to Exam 3 score, 1/2 the difference between an A and the class average on the exam, let's revisit Anneliese's retirement planning. This time, we need to make it more accurate and make sure her lifestyle keeps up with inflation. So.... We want to see if she can retire in 25 years, keep up the same lifestyle and flex at the club as she lives another 40 years after retirement. Upload your proof of work and answers to these Q's: 1. If she has $10K to invest now, makes an average IRR of 10% per year, will invest $20K per year (at the end of the year) (10K right now, 20K per year starting year 1 ----), and inflation is 4.5% per year, then will she make it? 2. If she will not make it, then by when can she retire and live the lifestyle she wants [how many years from now]? 3. If she will not make it, then how much does she have to invest per year in order to make it and retire in 25 years? Now, let's say she has a major life event (divorce or some illness or something (sorry, Anneliese)) and loses 40% of her investment in year 9 (with the original plan of $20K per year), 4. then will she make it? 5. If she will not make it, then by when can she retire and live the lifestyle she wants? 6. If she will not make it, then how much does she have to invest starting in year 10 in order to make it and retire in 25 years? Alright, last scenario, instead Anneliese marries rich (you go, Anneliese!), and her in-laws drop a cool $100K in her account in year 9, then will she make it? 7. If she will not make it, then by when can she retire and live the lifestyle she wants? 8. If she will not make it, then how much does she have to invest per year in order to make it and retire in 25 years? Alright, alright, alright. Extra-Credit. To be added to Exam 3 score, 1/2 the difference between an A and the class average on the exam, let's revisit Anneliese's retirement planning. This time, we need to make it more accurate and make sure her lifestyle keeps up with inflation. So.... We want to see if she can retire in 25 years, keep up the same lifestyle and flex at the club as she lives another 40 years after retirement. Upload your proof of work and answers to these Q's: 1. If she has $10K to invest now, makes an average IRR of 10% per year, will invest $20K per year (at the end of the year) (10K right now, 20K per year starting year 1 ----), and inflation is 4.5% per year, then will she make it? 2. If she will not make it, then by when can she retire and live the lifestyle she wants [how many years from now]? 3. If she will not make it, then how much does she have to invest per year in order to make it and retire in 25 years? Now, let's say she has a major life event (divorce or some illness or something (sorry, Anneliese)) and loses 40% of her investment in year 9 (with the original plan of $20K per year), 4. then will she make it? 5. If she will not make it, then by when can she retire and live the lifestyle she wants? 6. If she will not make it, then how much does she have to invest starting in year 10 in order to make it and retire in 25 years? Alright, last scenario, instead Anneliese marries rich (you go, Anneliese!), and her in-laws drop a cool $100K in her account in year 9, then will she make it? 7. If she will not make it, then by when can she retire and live the lifestyle she wants? 8. If she will not make it, then how much does she have to invest per year in order to make it and retire in 25 yearsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started