Could you write down the answer?

Could you write down the answer?

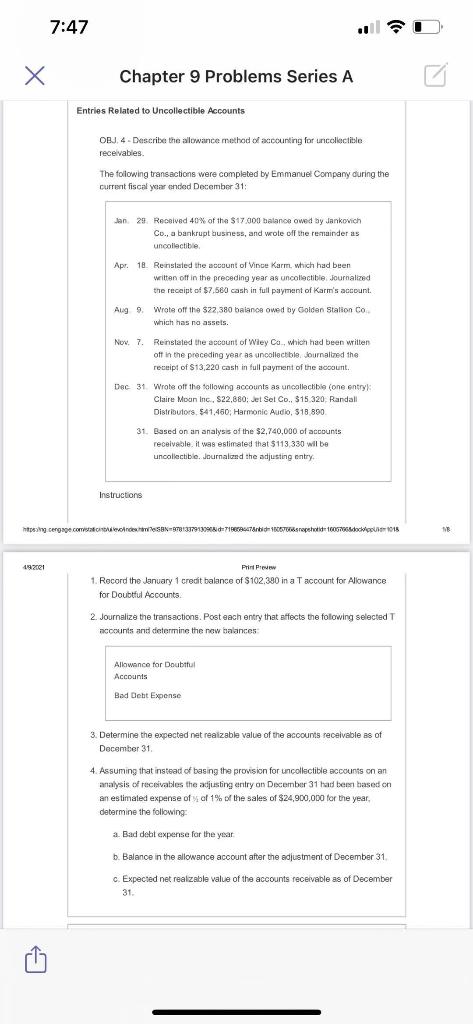

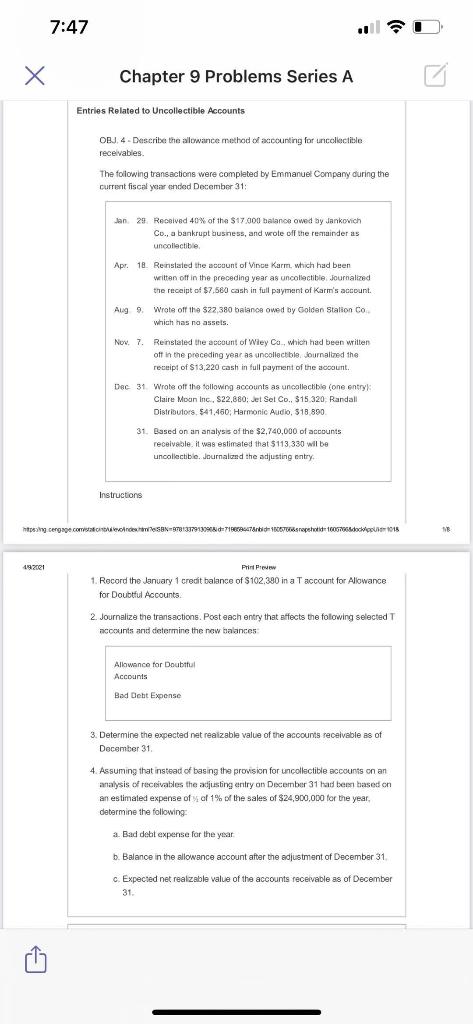

7:47 Chapter 9 Problems Series A Entries Related to Uncollectible Accounts . 4 OBJ. 4. Describe the allowance method of accounting for uncollectible receivables. The following transactions were completed by Emmanuel Company during the current fiscal year ended December 31: Jan. 29 Received 40% of the $17.000 balance owed by Jankovich Co., a bankrupt business, and wole off the remainder as uncollectible Apr. 18. Reinstated the account of Vince Karm, which had been written off in the preceding year as uncollectible Journalized the receipt of $7,580 cash in full payment of Karm's account Aug 9, Wrate off the $22,380 balance owed by Golden Stalion Co which has no assets. Nuv. 7. Reinstated the account of Wiley Co., which had been written off in the preceding year as uncollectible Journalized the receipt of $13,220 cash in full payment of the account. Dec 31 Wrote of the following accounts as uncollectible (one entry Claire Moon Inc., S22,880, Jet Set Co., 315 320Randall Distributors. 341.460, Harmonic Audio, 518 890 31. Based on an analysis of the $2,740,000 of accounts receivable, it was estimated that $113,330 wil be uncollectible. Journalund the adjusting entry Instructions htping cengage.com windshiesa1337919908797&nbiss repsotis.doc 1015 NB 41921 Print Pau 1. Record the January 1 credit balance of $102.390 in a T account for Allowance a for Doubtful Accounts 2. Journalize the transactions. Post each entry that affects the following selected accounts and determine the new balances Allowance for Doubtful Accounts Bad Debt Expense 3. Determine the expected net realizable value of the accounts receivable as of December 31 4. Assuming that instead of basing the provision for uncollectible accounts on an analysis of receivables the adjusting entry on December 31 had been based on an estimated expense of af 1% of the sales of $24,900,000 for the year. determine the following: a a. Bad dobl expense for the year b. Balance in the allowance account after the adjustment of December 31 c. Expected net realzable value of the accounts receivable as of December 31 7:47 Chapter 9 Problems Series A Entries Related to Uncollectible Accounts . 4 OBJ. 4. Describe the allowance method of accounting for uncollectible receivables. The following transactions were completed by Emmanuel Company during the current fiscal year ended December 31: Jan. 29 Received 40% of the $17.000 balance owed by Jankovich Co., a bankrupt business, and wole off the remainder as uncollectible Apr. 18. Reinstated the account of Vince Karm, which had been written off in the preceding year as uncollectible Journalized the receipt of $7,580 cash in full payment of Karm's account Aug 9, Wrate off the $22,380 balance owed by Golden Stalion Co which has no assets. Nuv. 7. Reinstated the account of Wiley Co., which had been written off in the preceding year as uncollectible Journalized the receipt of $13,220 cash in full payment of the account. Dec 31 Wrote of the following accounts as uncollectible (one entry Claire Moon Inc., S22,880, Jet Set Co., 315 320Randall Distributors. 341.460, Harmonic Audio, 518 890 31. Based on an analysis of the $2,740,000 of accounts receivable, it was estimated that $113,330 wil be uncollectible. Journalund the adjusting entry Instructions htping cengage.com windshiesa1337919908797&nbiss repsotis.doc 1015 NB 41921 Print Pau 1. Record the January 1 credit balance of $102.390 in a T account for Allowance a for Doubtful Accounts 2. Journalize the transactions. Post each entry that affects the following selected accounts and determine the new balances Allowance for Doubtful Accounts Bad Debt Expense 3. Determine the expected net realizable value of the accounts receivable as of December 31 4. Assuming that instead of basing the provision for uncollectible accounts on an analysis of receivables the adjusting entry on December 31 had been based on an estimated expense of af 1% of the sales of $24,900,000 for the year. determine the following: a a. Bad dobl expense for the year b. Balance in the allowance account after the adjustment of December 31 c. Expected net realzable value of the accounts receivable as of December 31

Could you write down the answer?

Could you write down the answer?