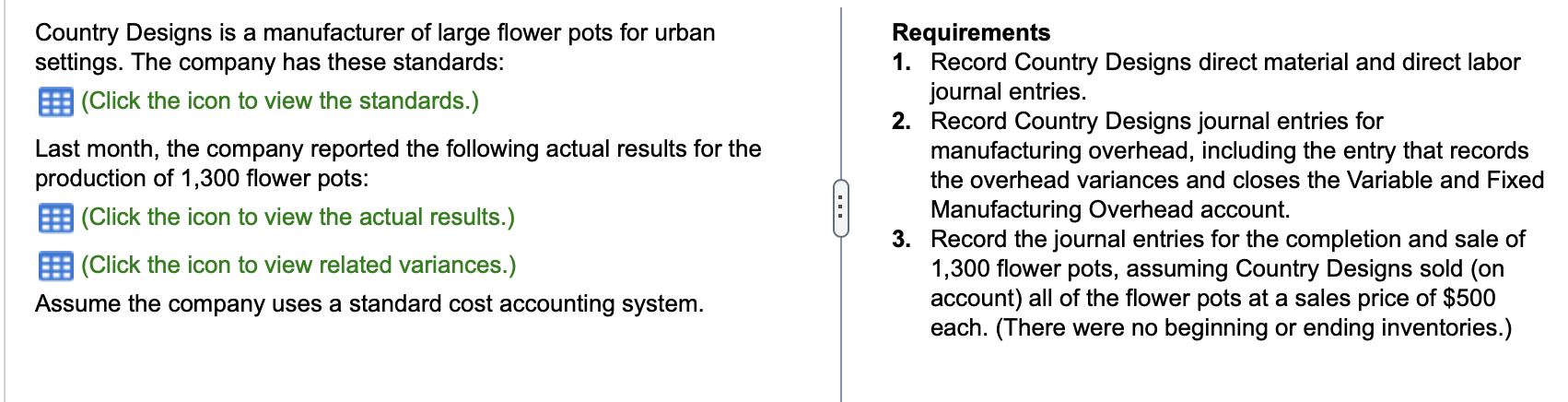

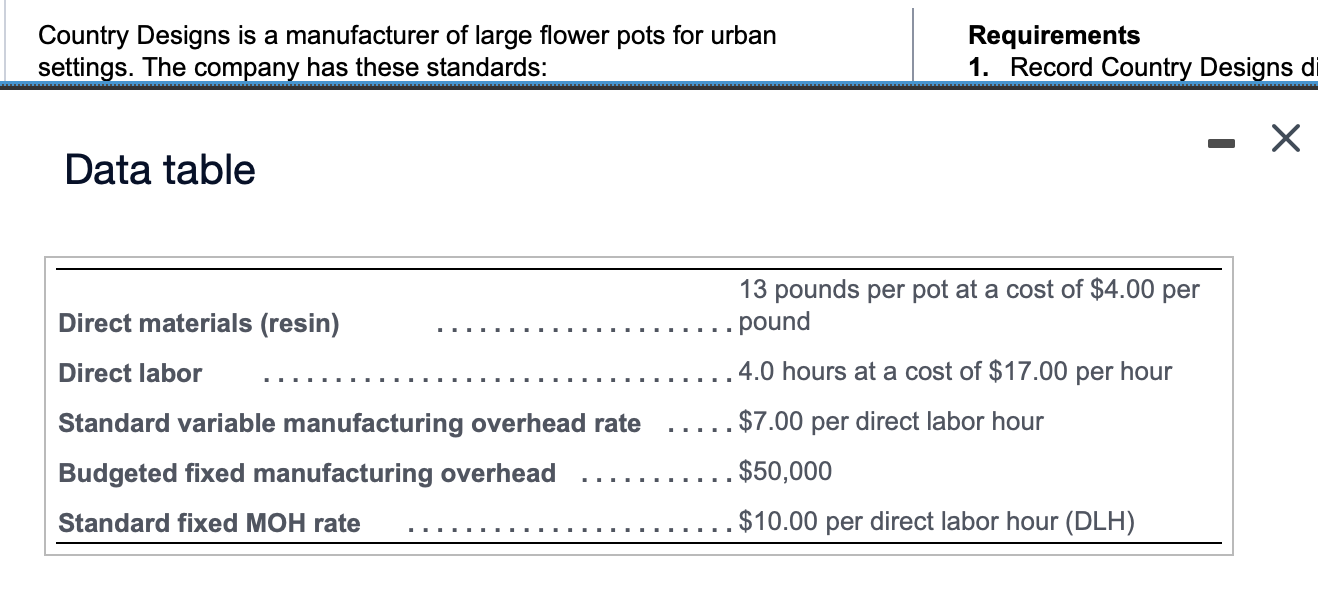

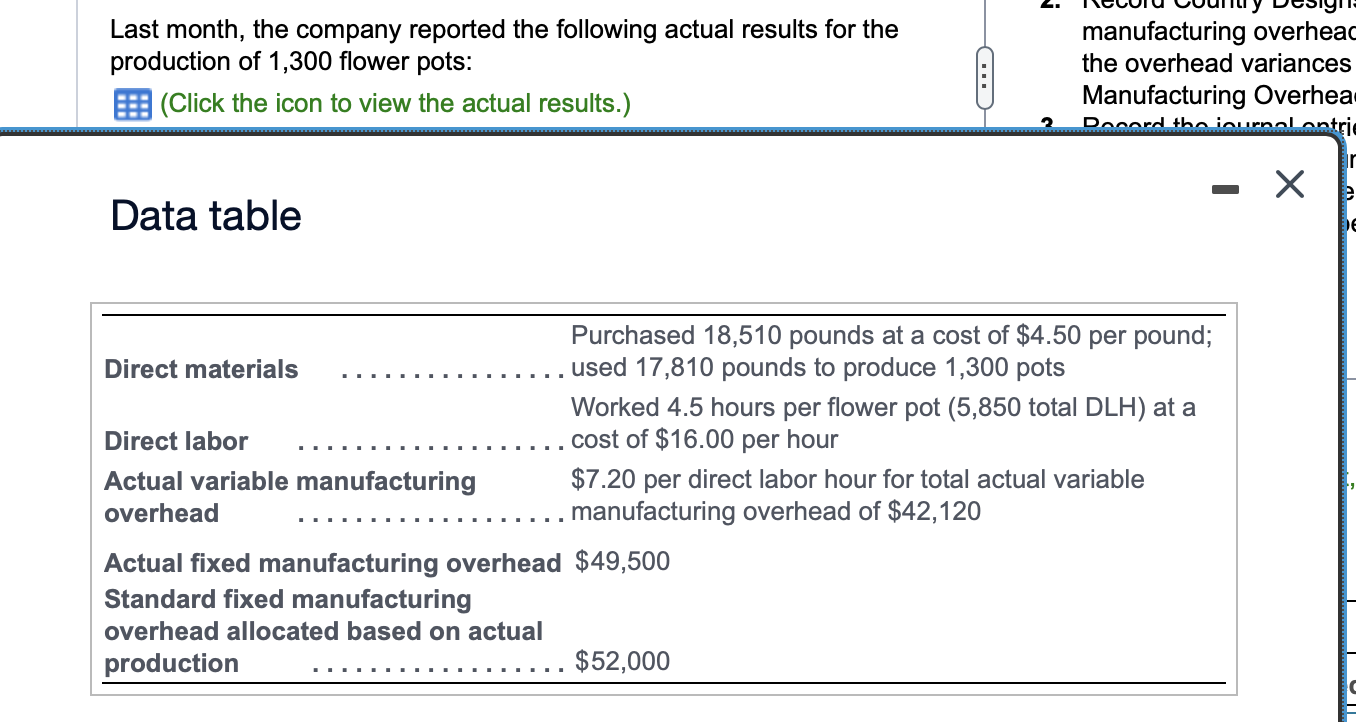

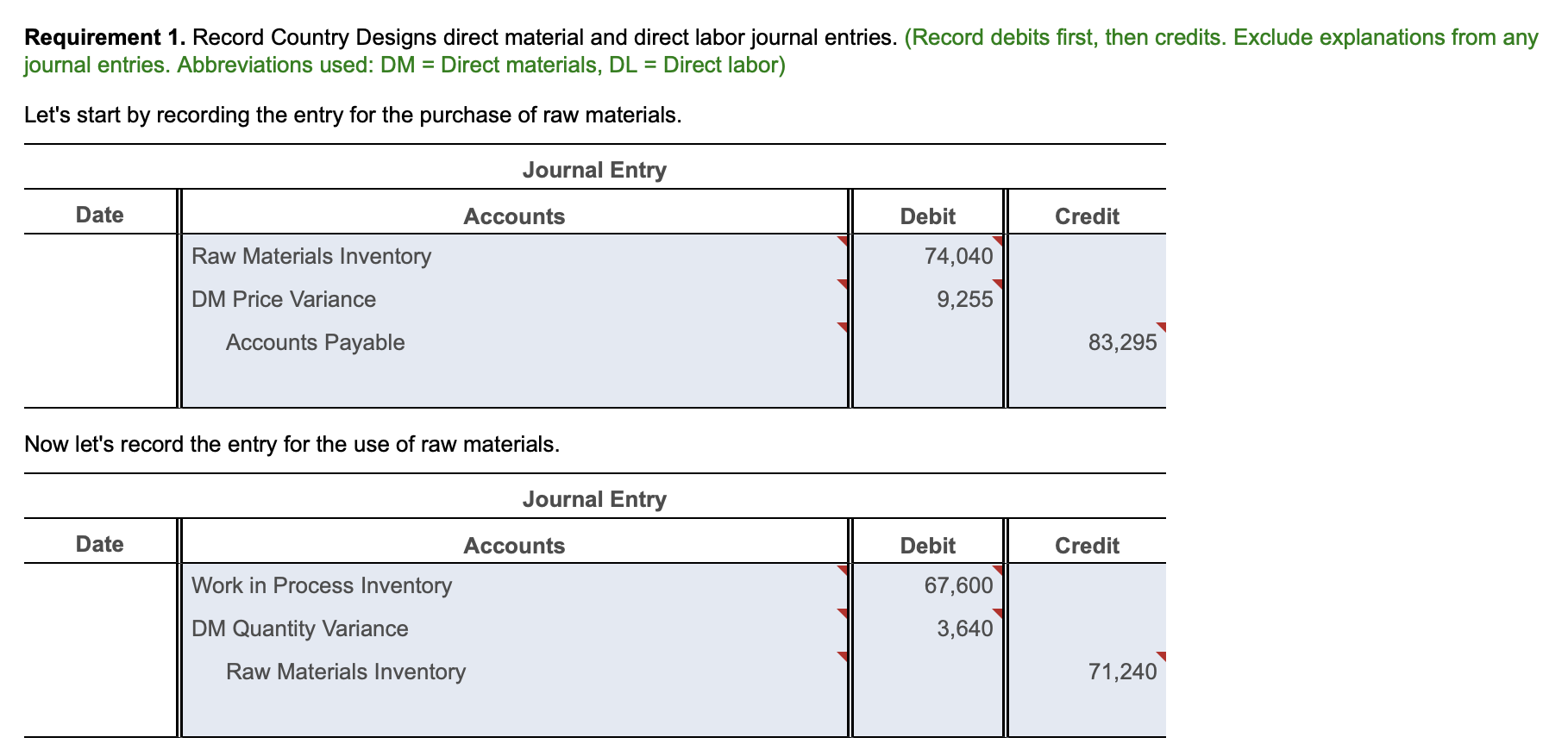

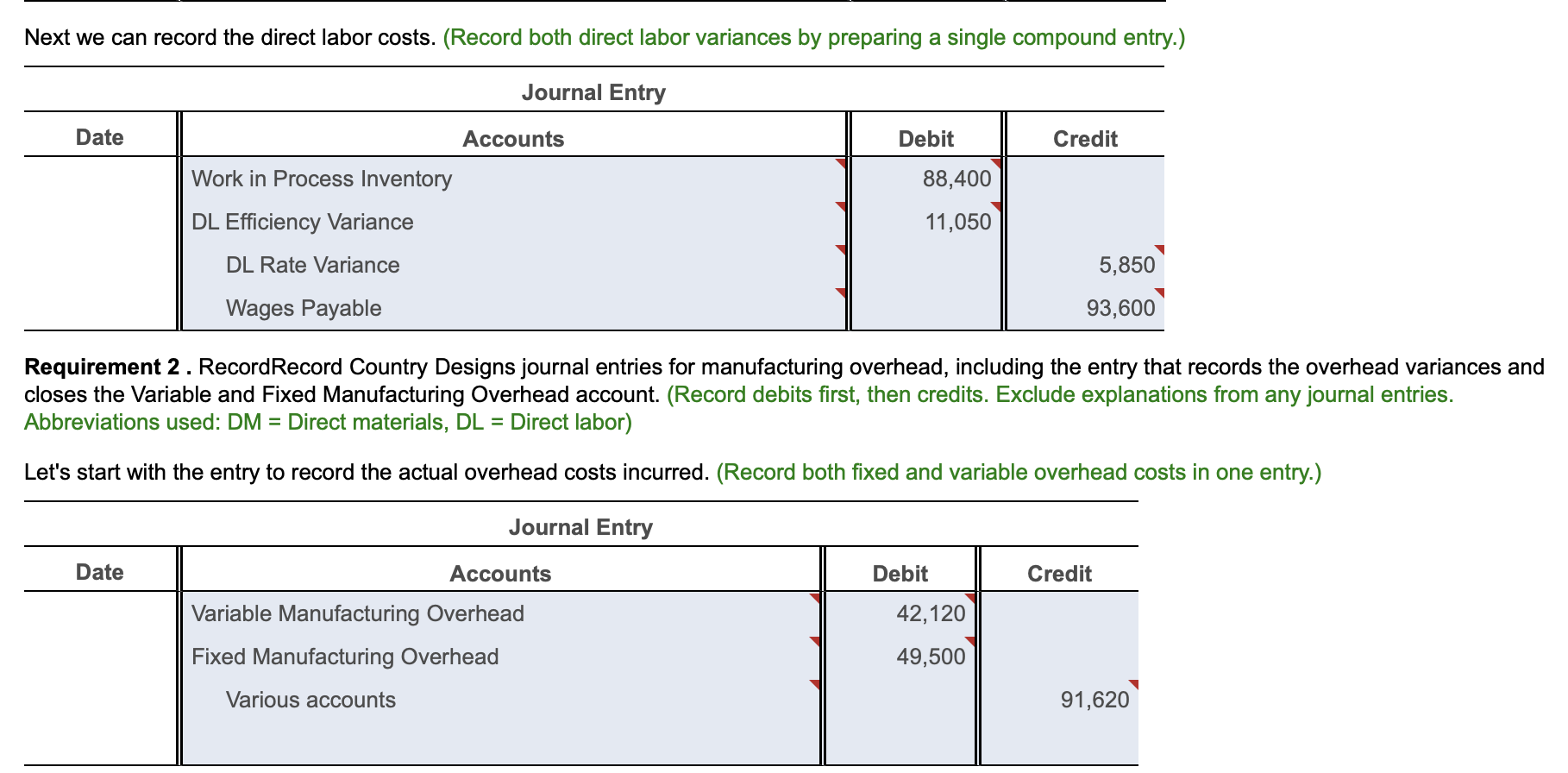

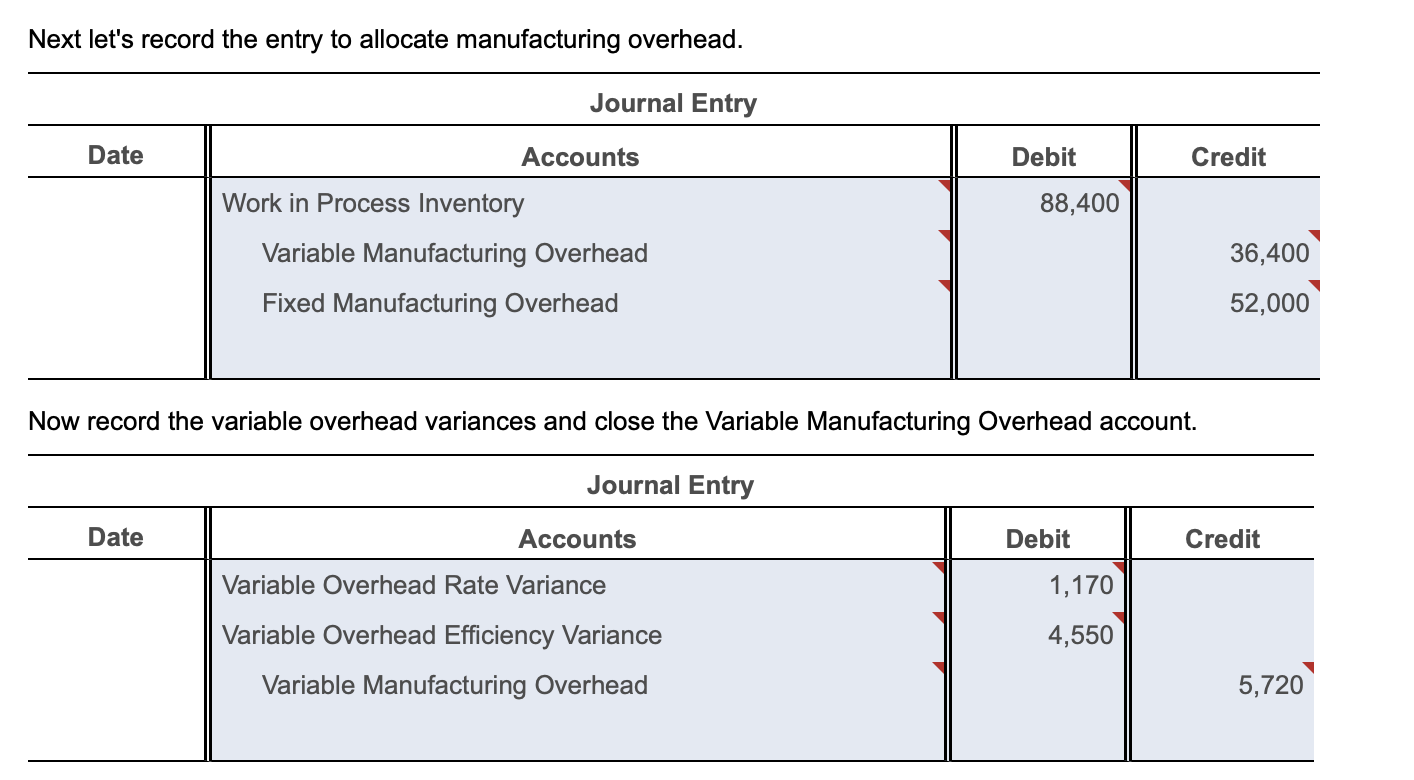

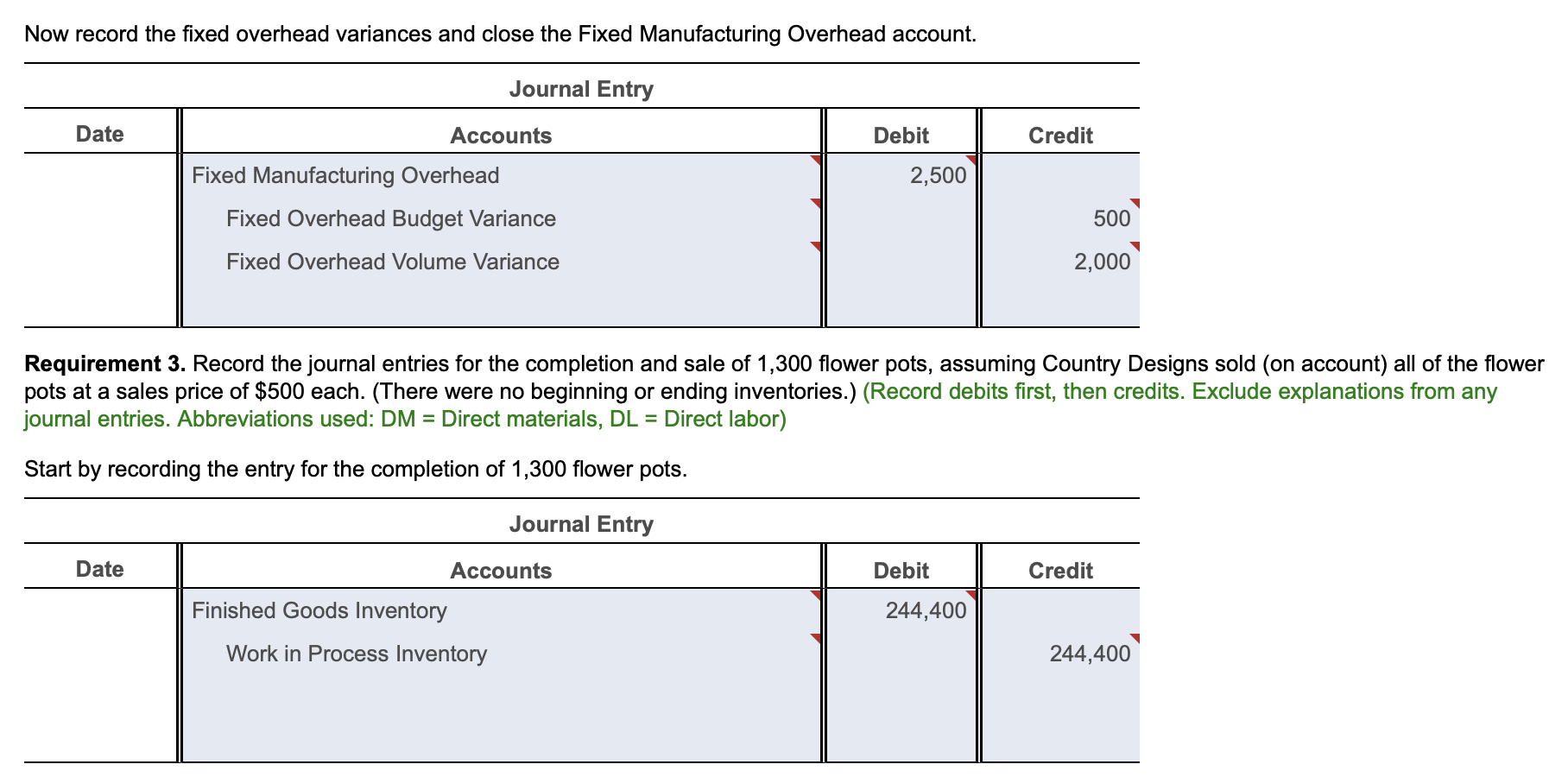

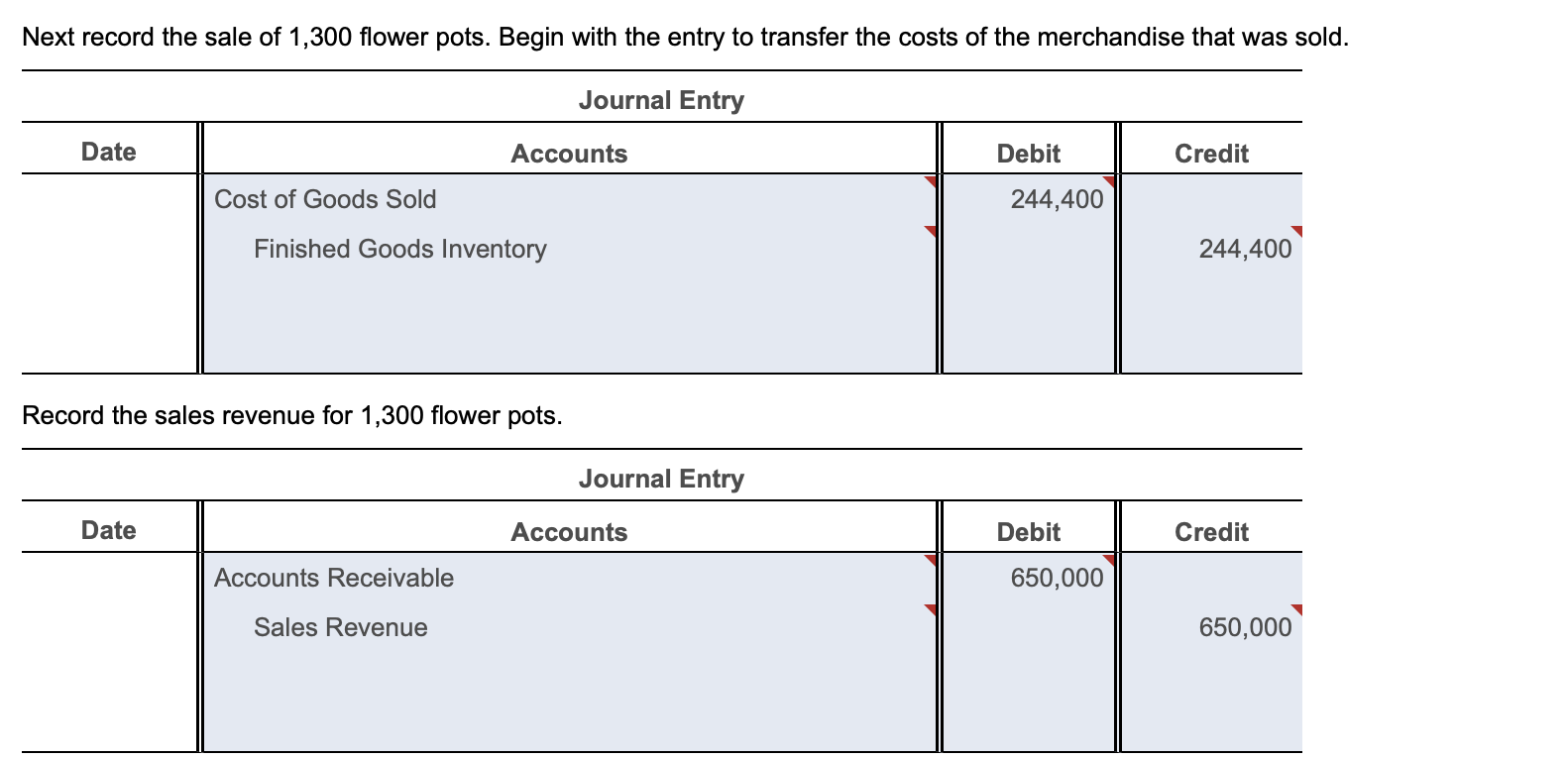

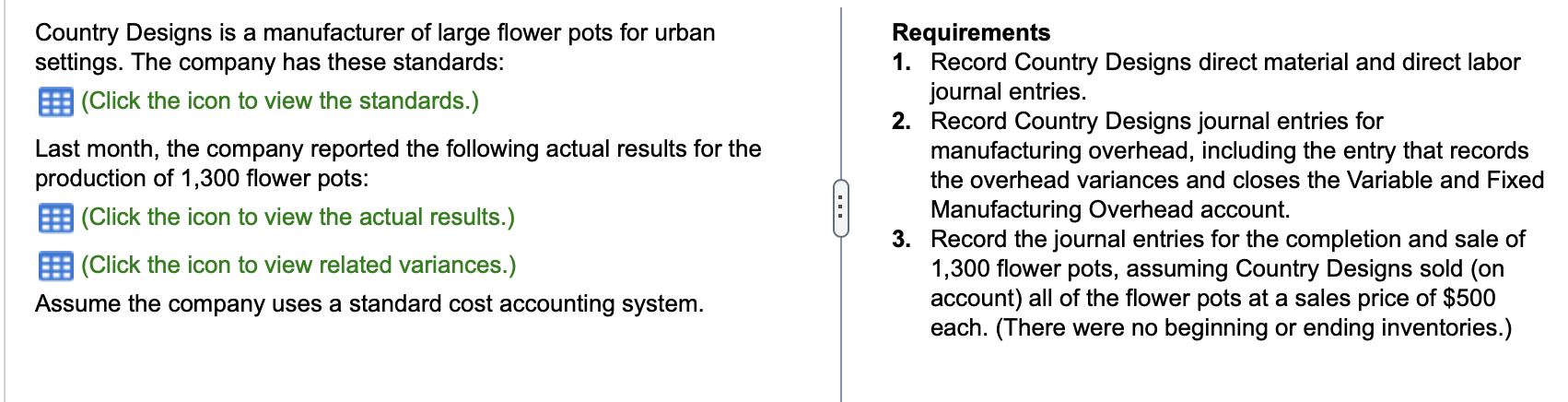

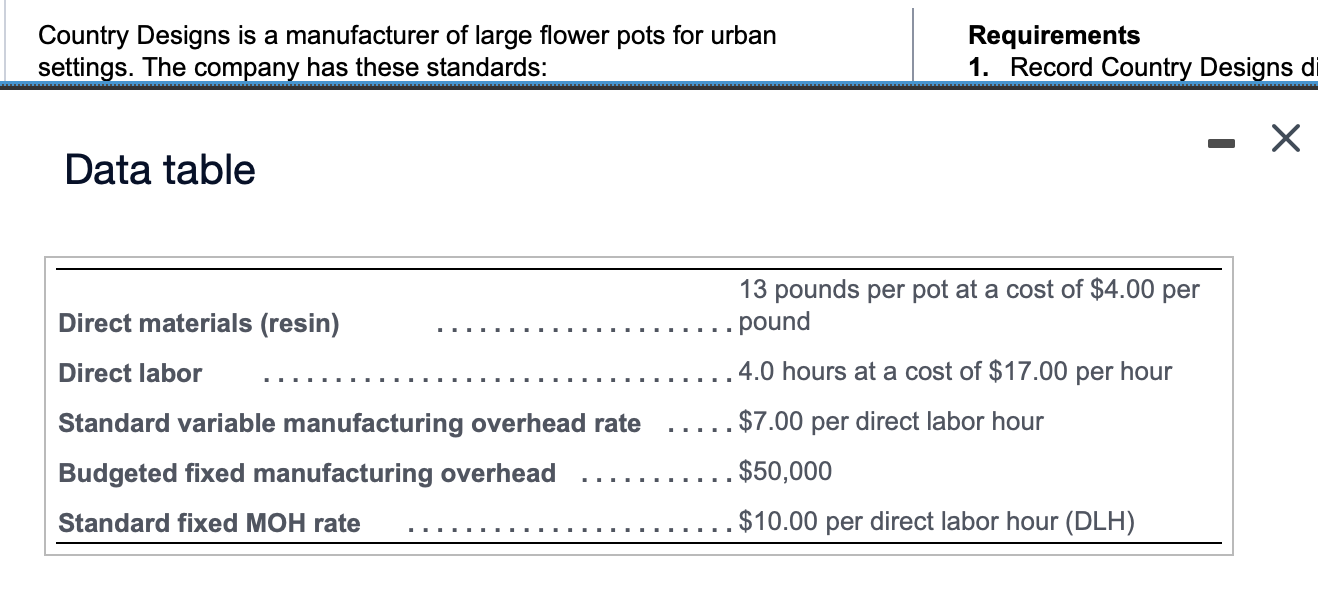

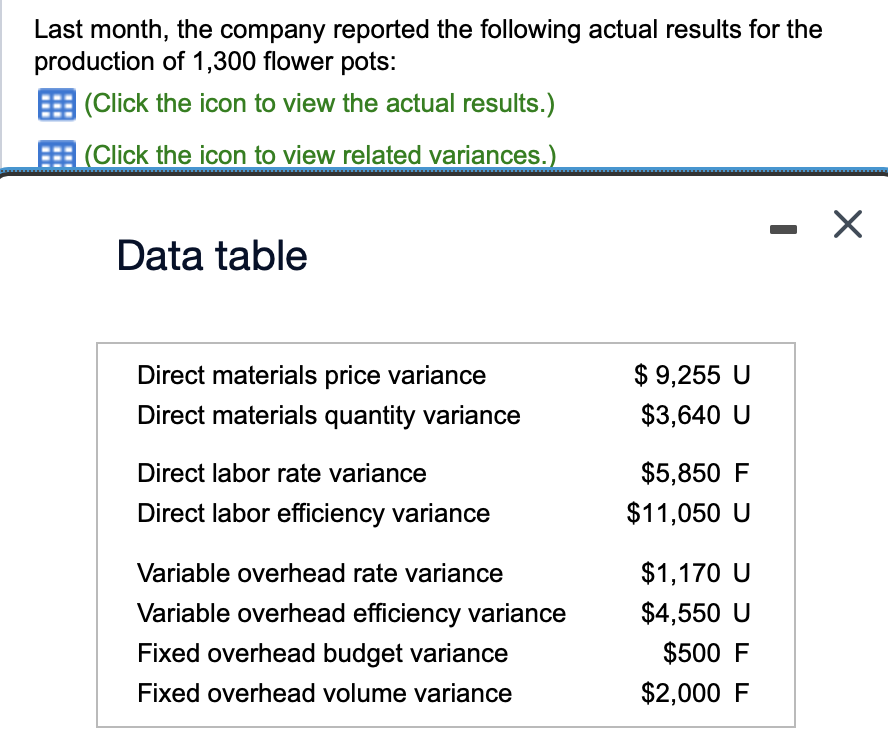

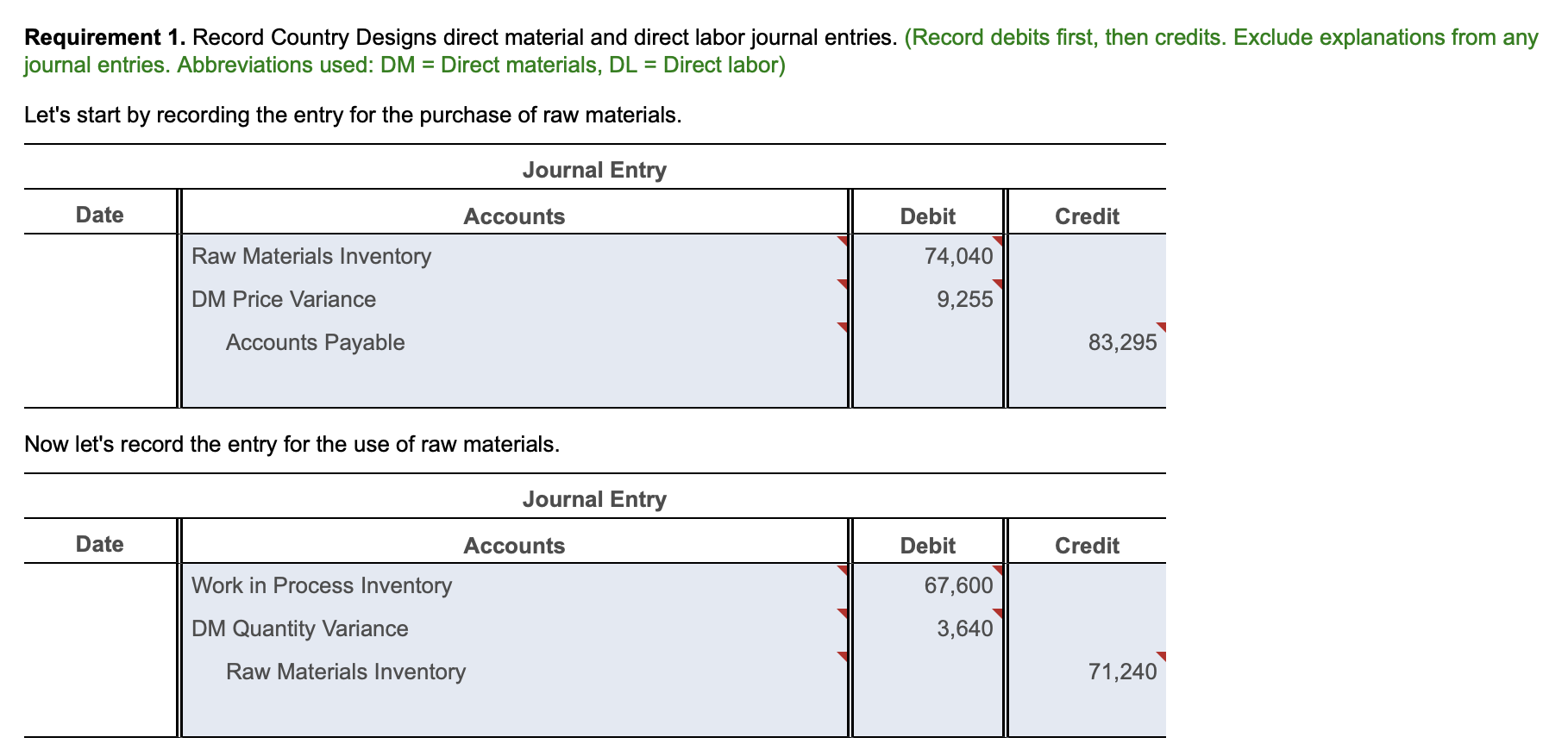

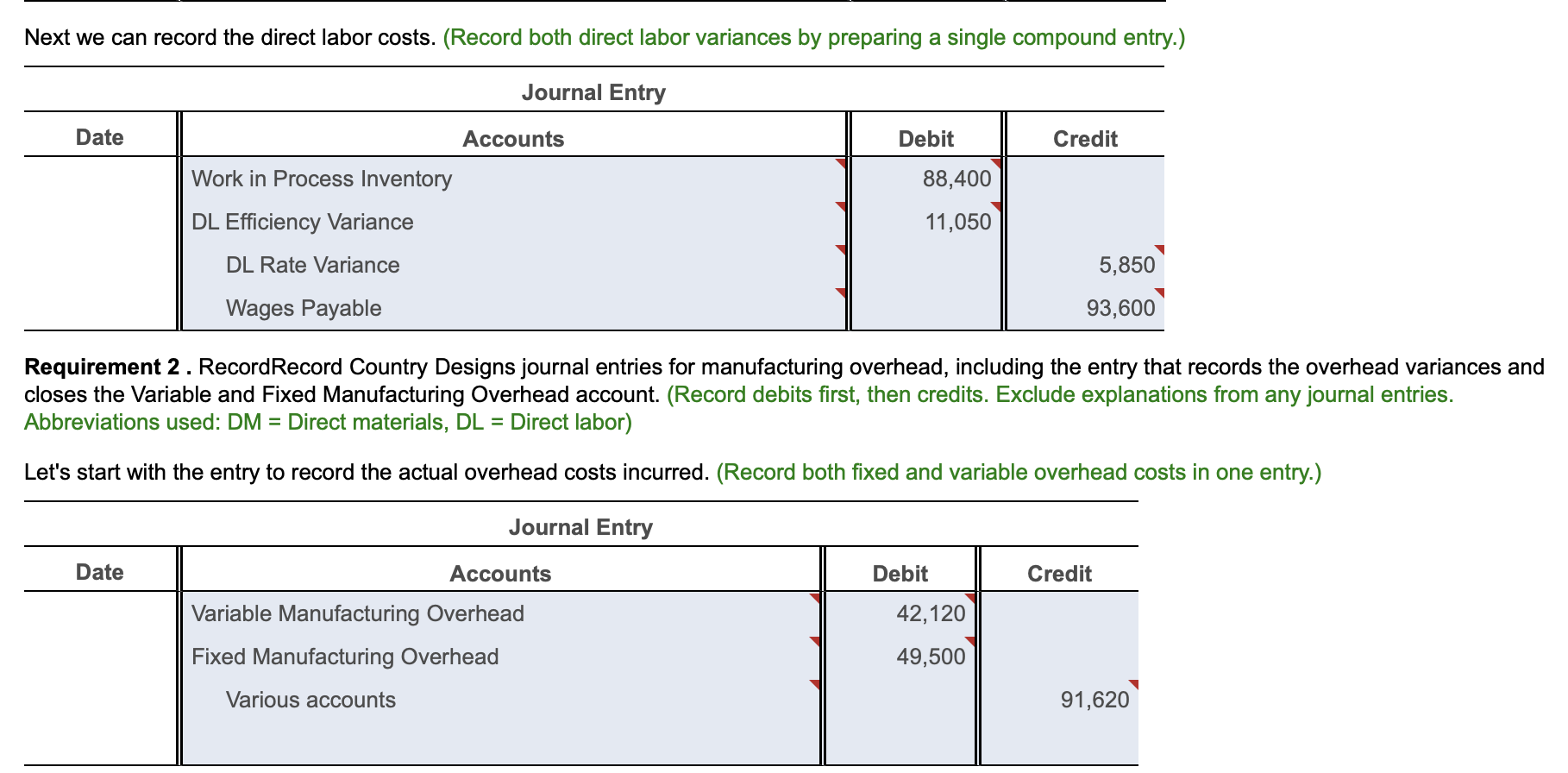

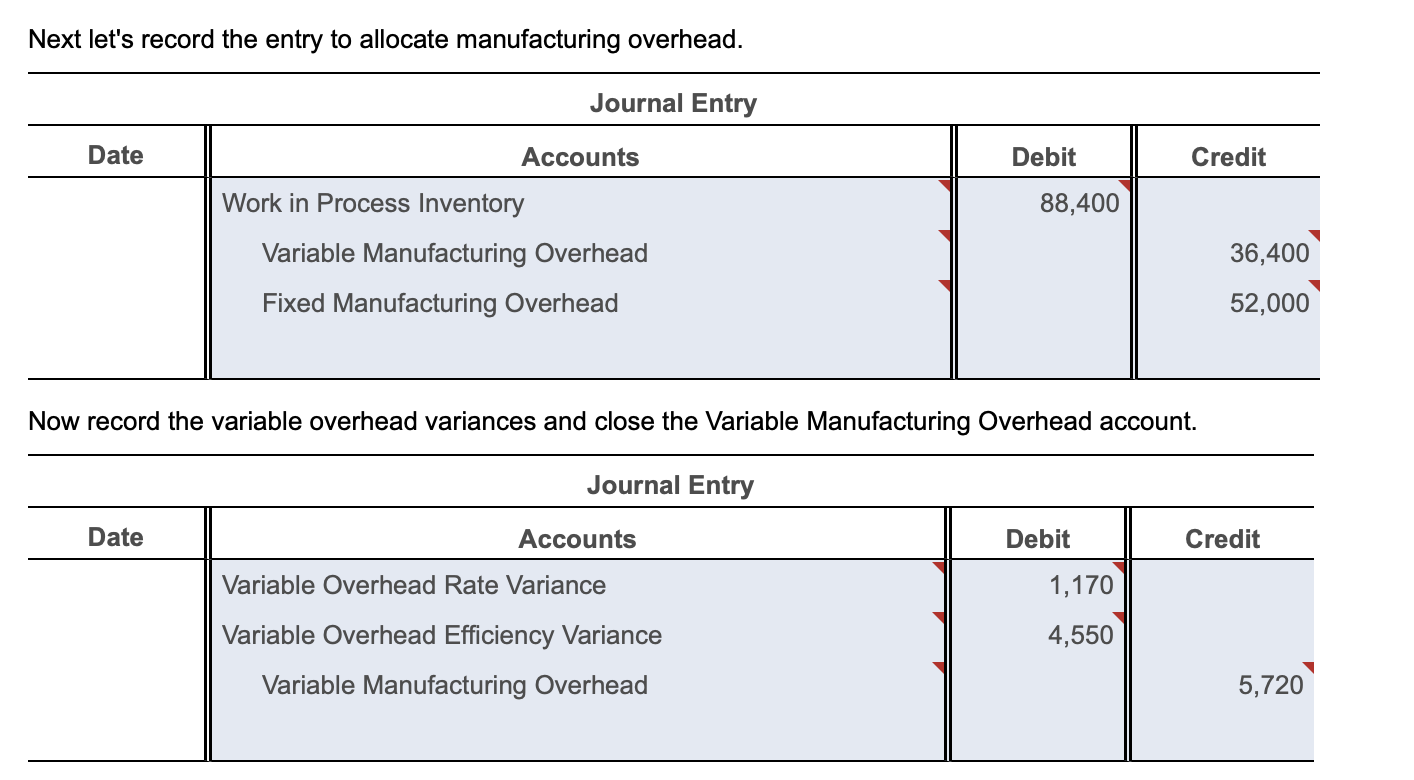

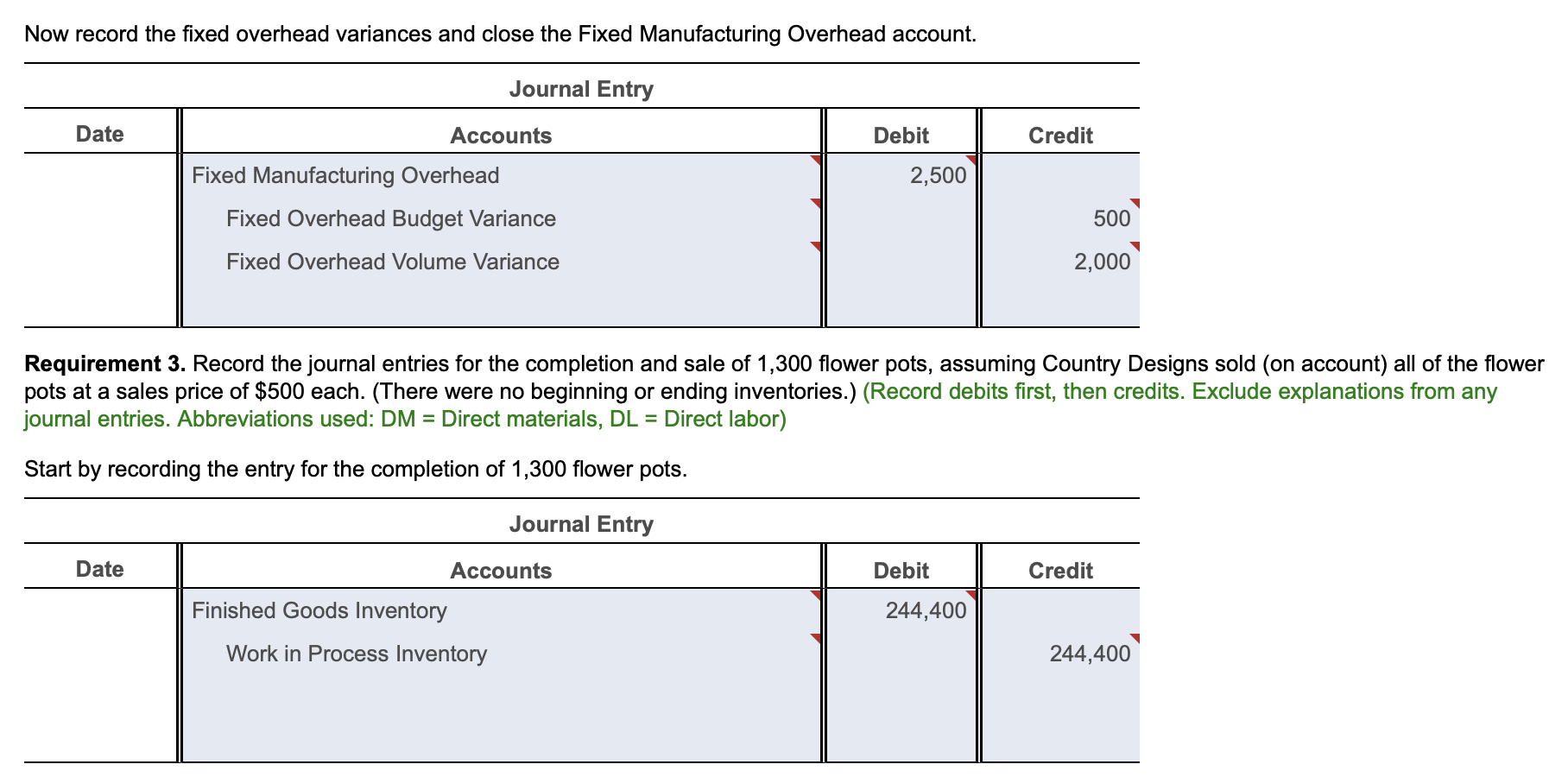

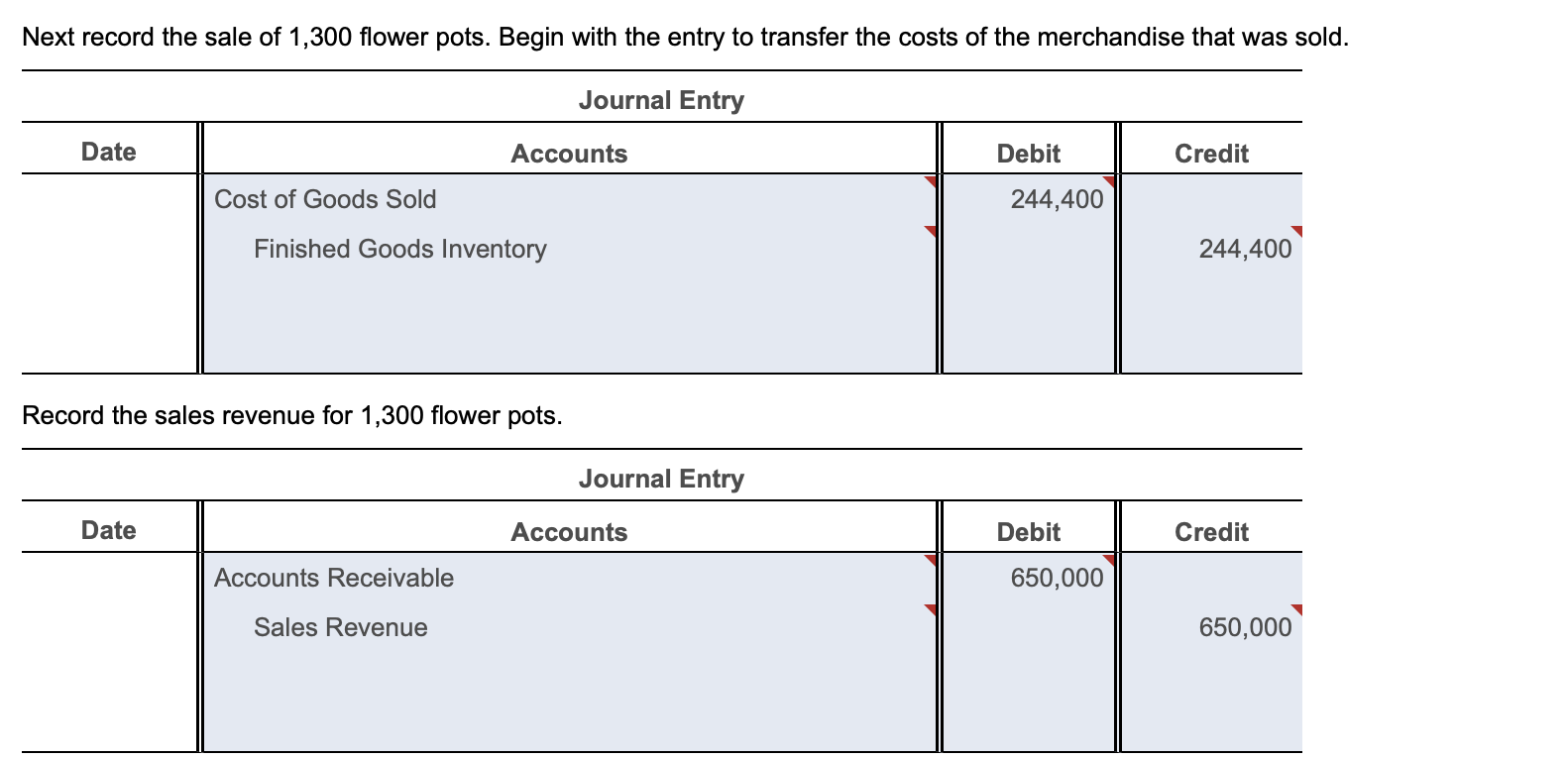

Country Designs is a manufacturer of large flower pots for urban Requirements settings. The company has these standards: 1. Record Country Designs direct material and direct labor (Click the icon to view the standards.) journal entries. 2. Record Country Designs journal entries for Last month, the company reported the following actual results for the manufacturing overhead, including the entry that records production of 1,300 flower pots: the overhead variances and closes the Variable and Fixed (Click the icon to view the actual results.) Manufacturing Overhead account. (Click the icon to view related variances.) 3. Record the journal entries for the completion and sale of 1,300 flower pots, assuming Country Designs sold (on Assume the company uses a standard cost accounting system. account) all of the flower pots at a sales price of $500 each. (There were no beginning or ending inventories.) Data table Last month, the company reported the following actual results for the production of 1,300 flower pots: (Click the icon to view the actual results.) manufacturing overheac the overhead variances Manufacturing Overhea Data table Last month, the company reported the following actual results for the production of 1,300 flower pots: (Click the icon to view the actual results.) (Click the icon to view related variances.) Data table Requirement 1. Record Country Designs direct material and direct labor journal entries. (Record debits first, then credits. Exclude explanations from any journal entries. Abbreviations used: DM = Direct materials, DL= Direct labor) Let's start by recording the entry for the purchase of raw materials. Next we can record the direct labor costs. (Record both direct labor variances by preparing a single compound entry.) Requirement 2 . RecordRecord Country Designs journal entries for manufacturing overhead, including the entry that records the overhead variances and closes the Variable and Fixed Manufacturing Overhead account. (Record debits first, then credits. Exclude explanations from any journal entries. Abbreviations used: DM = Direct materials, DL= Direct labor) Let's start with the entry to record the actual overhead costs incurred. (Record both fixed and variable overhead costs in one entry.) Next let's record the entry to allocate manufacturing overhead. Now record the fixed overhead variances and close the Fixed Manufacturing Overhead account. Requirement 3. Record the journal entries for the completion and sale of 1,300 flower pots, assuming Country Designs sold (on account) all of the flower pots at a sales price of $500 each. (There were no beginning or ending inventories.) (Record debits first, then credits. Exclude explanations from any journal entries. Abbreviations used: DM = Direct materials, DL = Direct labor) Next record the sale of 1,300 flower pots. Begin with the entry to transfer the costs of the merchandise that was sold. Journal Entry \begin{tabular}{c||c||c||c} \hline \multicolumn{1}{c||}{ Date } & Accounts & Debit & Credit \\ \hline & Cost of Goods Sold & 244,400 & \\ & Finished Goods Inventory & & \\ & & & \\ \hline \end{tabular} Record the sales revenue for 1,300 flower pots. Journal Entry \begin{tabular}{c||c||c||c} \hline \multicolumn{1}{c||}{ Date } & \multicolumn{1}{c||||c}{ Accounts } & Debit & Credit \\ \hline & Accounts Receivable & 650,000 & \\ & Sales Revenue & & \\ & & & \\ \hline \end{tabular} Country Designs is a manufacturer of large flower pots for urban Requirements settings. The company has these standards: 1. Record Country Designs direct material and direct labor (Click the icon to view the standards.) journal entries. 2. Record Country Designs journal entries for Last month, the company reported the following actual results for the manufacturing overhead, including the entry that records production of 1,300 flower pots: the overhead variances and closes the Variable and Fixed (Click the icon to view the actual results.) Manufacturing Overhead account. (Click the icon to view related variances.) 3. Record the journal entries for the completion and sale of 1,300 flower pots, assuming Country Designs sold (on Assume the company uses a standard cost accounting system. account) all of the flower pots at a sales price of $500 each. (There were no beginning or ending inventories.) Data table Last month, the company reported the following actual results for the production of 1,300 flower pots: (Click the icon to view the actual results.) manufacturing overheac the overhead variances Manufacturing Overhea Data table Last month, the company reported the following actual results for the production of 1,300 flower pots: (Click the icon to view the actual results.) (Click the icon to view related variances.) Data table Requirement 1. Record Country Designs direct material and direct labor journal entries. (Record debits first, then credits. Exclude explanations from any journal entries. Abbreviations used: DM = Direct materials, DL= Direct labor) Let's start by recording the entry for the purchase of raw materials. Next we can record the direct labor costs. (Record both direct labor variances by preparing a single compound entry.) Requirement 2 . RecordRecord Country Designs journal entries for manufacturing overhead, including the entry that records the overhead variances and closes the Variable and Fixed Manufacturing Overhead account. (Record debits first, then credits. Exclude explanations from any journal entries. Abbreviations used: DM = Direct materials, DL= Direct labor) Let's start with the entry to record the actual overhead costs incurred. (Record both fixed and variable overhead costs in one entry.) Next let's record the entry to allocate manufacturing overhead. Now record the fixed overhead variances and close the Fixed Manufacturing Overhead account. Requirement 3. Record the journal entries for the completion and sale of 1,300 flower pots, assuming Country Designs sold (on account) all of the flower pots at a sales price of $500 each. (There were no beginning or ending inventories.) (Record debits first, then credits. Exclude explanations from any journal entries. Abbreviations used: DM = Direct materials, DL = Direct labor) Next record the sale of 1,300 flower pots. Begin with the entry to transfer the costs of the merchandise that was sold. Journal Entry \begin{tabular}{c||c||c||c} \hline \multicolumn{1}{c||}{ Date } & Accounts & Debit & Credit \\ \hline & Cost of Goods Sold & 244,400 & \\ & Finished Goods Inventory & & \\ & & & \\ \hline \end{tabular} Record the sales revenue for 1,300 flower pots. Journal Entry \begin{tabular}{c||c||c||c} \hline \multicolumn{1}{c||}{ Date } & \multicolumn{1}{c||||c}{ Accounts } & Debit & Credit \\ \hline & Accounts Receivable & 650,000 & \\ & Sales Revenue & & \\ & & & \\ \hline \end{tabular}