Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Do part B PART A Madam DIY manufactures a range of tools, equipment and accessories used by plumbers. One of the company's most popular products

Do part B

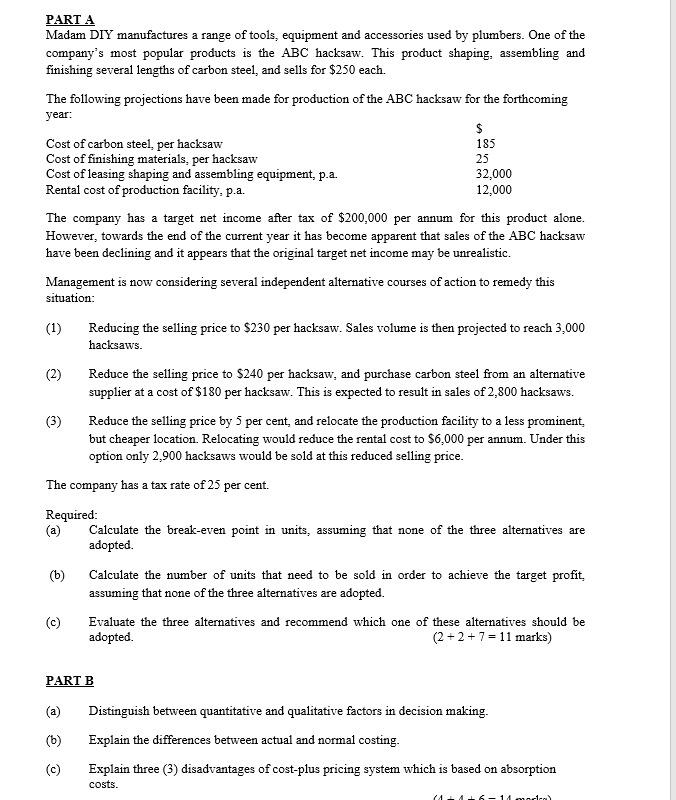

PART A Madam DIY manufactures a range of tools, equipment and accessories used by plumbers. One of the company's most popular products is the ABC hacksaw. This product shaping, assembling and finishing several lengths of carbon steel, and sells for $250 each. The following projections have been made for production of the ABC hacksaw for the forthcoming year: $ Cost of carbon steel, per hacksaw 185 Cost of finishing materials, per hacksaw 25 Cost of leasing shaping and assembling equipment, p.a. 32,000 Rental cost of production facility, p.a. 12,000 The company has a target net income after tax of $200,000 per annum for this product alone. However, towards the end of the current year it has become apparent that sales of the ABC hacksaw have been declining and it appears that the original target net income may be unrealistic. Management is now considering several independent alternative courses of action to remedy this situation: (1) Reducing the selling price to $230 per hacksaw. Sales volume is then projected to reach 3,000 hacksaws. (2) Reduce the selling price to $240 per hacksaw, and purchase carbon steel from an alternative supplier at a cost of $180 per hacksaw. This is expected to result in sales of 2,800 hacksaws. (3) Reduce the selling price by 5 per cent, and relocate the production facility to a less prominent. but cheaper location. Relocating would reduce the rental cost to $6,000 per annum. Under this option only 2,900 hacksaws would be sold at this reduced selling price. The company has a tax rate of 25 per cent. Required: (a) Calculate the break-even point in units, assuming that none of the three alternatives are adopted. (b) Calculate the number of units that need to be sold in order to achieve the target profit, assuming that none of the three alternatives are adopted. (c) Evaluate the three alternatives and recommend which one of these alternatives should be adopted. (2+2+ 7 = 11 marks) PART B (a) (6) Distinguish between quantitative and qualitative factors in decision making. Explain the differences between actual and normal costing. Explain three (3) disadvantages of cost-plus pricing system which is based on absorption costs. MA 14ocStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started