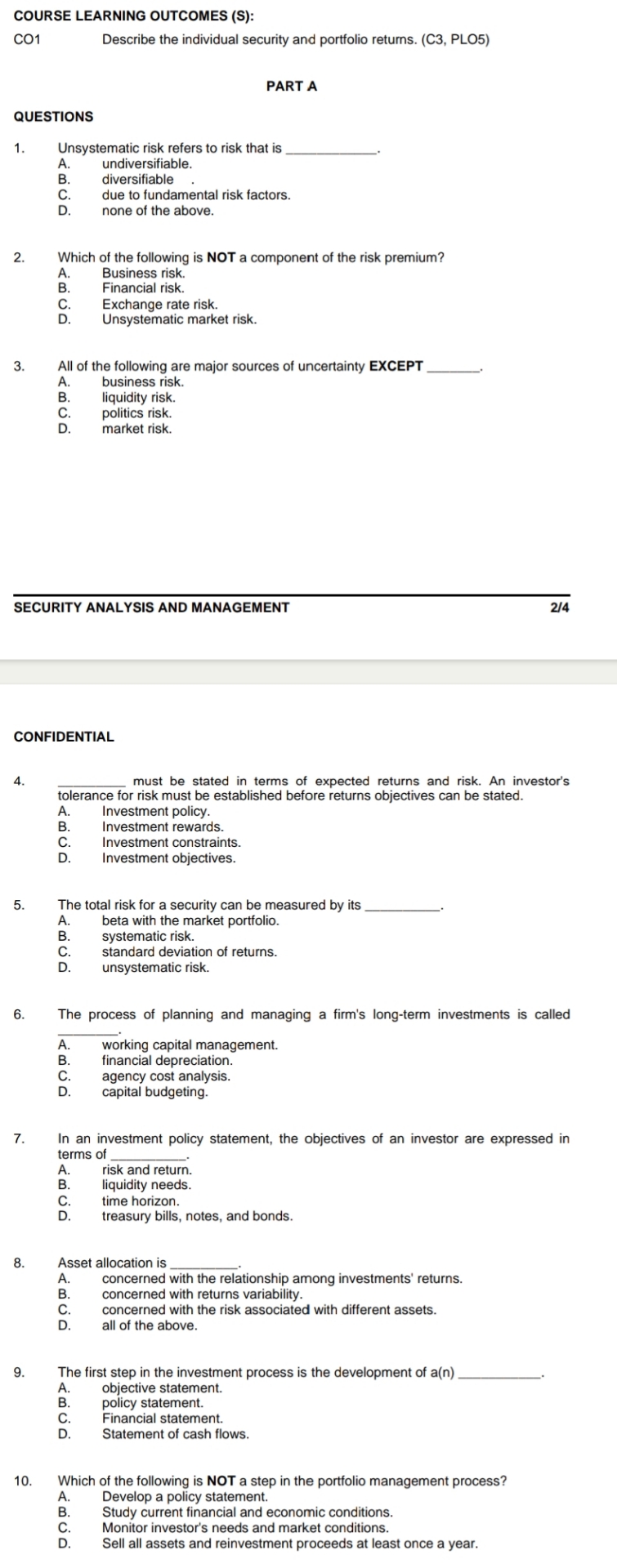

Question: COURSE LEARNING OUTCOMES ( S ) :CO 1 QUESTIONS 1 . 2 3 . 4 5 6 7 8 9 . A 1 0 Unsystematic

COURSE LEARNING OUTCOMES S:COQUESTIONSAUnsystematic risk refers to risk that isCDABCDWhich of the following is NOTa component of the risk premium?ABCDBAll of the following are major sources of uncertainty EXCEPTCSECURITY ANALYSIS AND MANAGEMENTCONFIDENTIALDABD.ABmust be stated in terms expected returns and risk. An investor'stolerance for risk must be established before returns objectives can be stated.AABCD.ADescribe the individual security and portfolio returns. C PLOBThe total risk for a security can be measured by itsCundiversifiable.diversifiableDdue to fundamental risk factors.none of the above.ABBusiness risk.CFinancial risk.DExchange rate risk.Unsystematic market risk.The process of planning and managing a firm's ongterm investments is calledABbusiness risk.Cliquidity risk.politics risk.Dmarket risk.D capital budgeting.In an investment policy statement, the objectives of an investor are expressed interms ofInvestment policy.Investment rewards.Investment constraints.Investment objectives.beta with the market portfolio.systematic risk.Asset allocation isstandard deviation of returns.unsystematic risk.working capital management.financial depreciation.PART Aagency cost analysis.risk and return.liquidity needs.time horizon.The first step in the investment process is the development of antreasury bills, notes, and bonds.concerned with the relationship among investments' returns.concerned with returns variability.concerned with the risk associated with different assets.all of the above.objective statement.policy statement.Which of the following is NOTa step in the portfolio management process?Develop a policy statement.Financial statement.Statement of cash flowsStudy current financial and economic conditions.Monitor investor's needs and market conditions.Sell all assets and reinvestment proceeds at least once a year.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock