Answered step by step

Verified Expert Solution

Question

1 Approved Answer

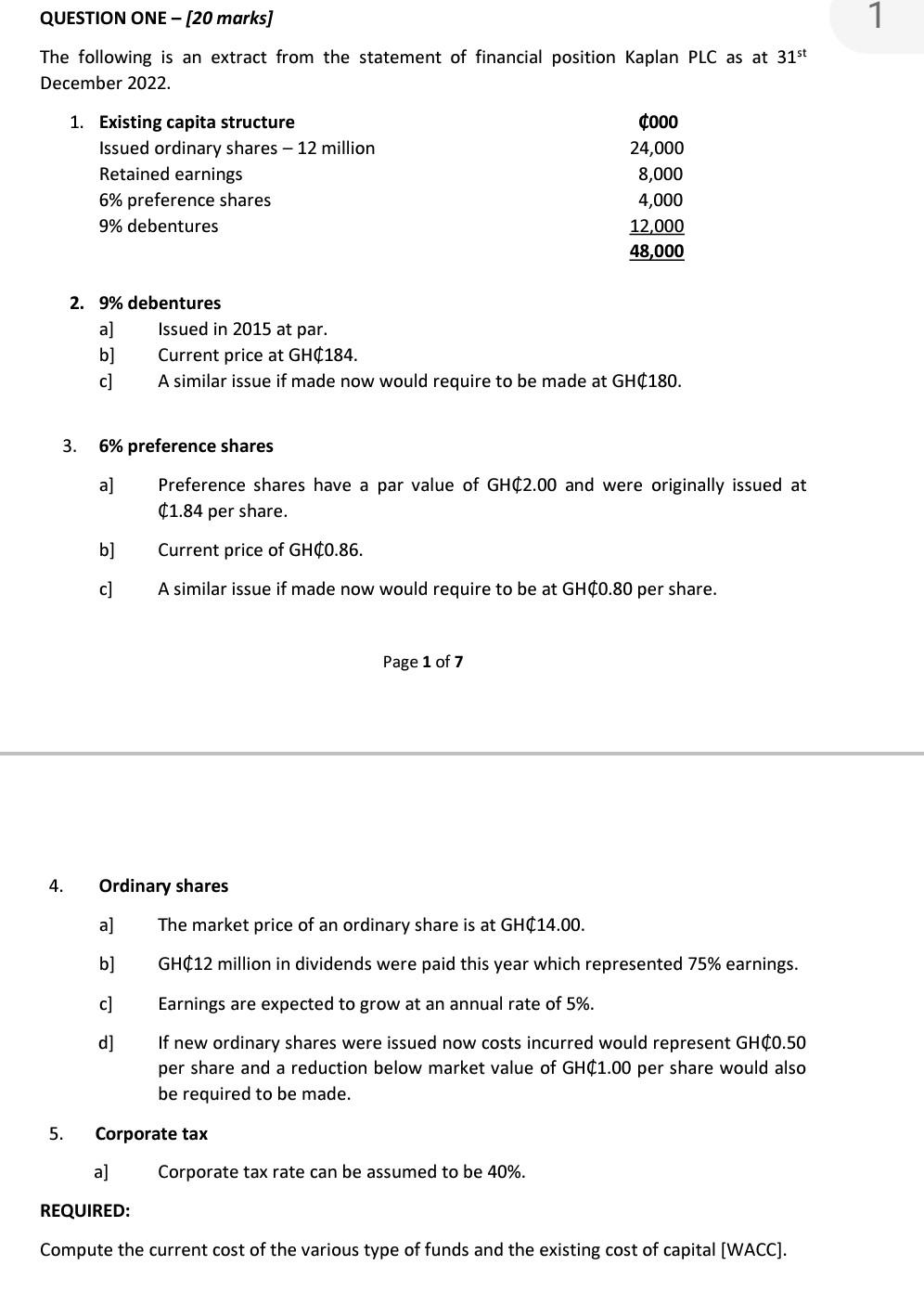

course title: Corporate Finance/Corporate Finance and Accounting QUESTION ONE - [20 marks] The following is an extract from the statement of financial position Kaplan PLC

course title: Corporate Finance/Corporate Finance and Accounting

QUESTION ONE - [20 marks] The following is an extract from the statement of financial position Kaplan PLC as at 31st December 2022. 2. 9% debentures a] Issued in 2015 at par. b] Current price at GH184. c] A similar issue if made now would require to be made at GH$180. 3. 6% preference shares a] Preference shares have a par value of GH$2.00 and were originally issued at $1.84 per share. b] Current price of GH0.86. c] A similar issue if made now would require to be at GH0.80 per share. Page 1 of 7 4. Ordinary shares a] The market price of an ordinary share is at GH14.00. b] GH12 million in dividends were paid this year which represented 75% earnings. c] Earnings are expected to grow at an annual rate of 5\%. d] If new ordinary shares were issued now costs incurred would represent GH0.50 per share and a reduction below market value of GH1.00 per share would also be required to be made. 5. Corporate tax a] Corporate tax rate can be assumed to be 40%. REQUIRED: Compute the current cost of the various type of funds and the existing cost of capital [WACC]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started