Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Couses the periodic method and has the following account balances: rchase Returns, $17,000; Beginning Inventory, $4,000; Purchases, 12- $19 3,000; Freight-In, $11,000; and Accounts Payable,

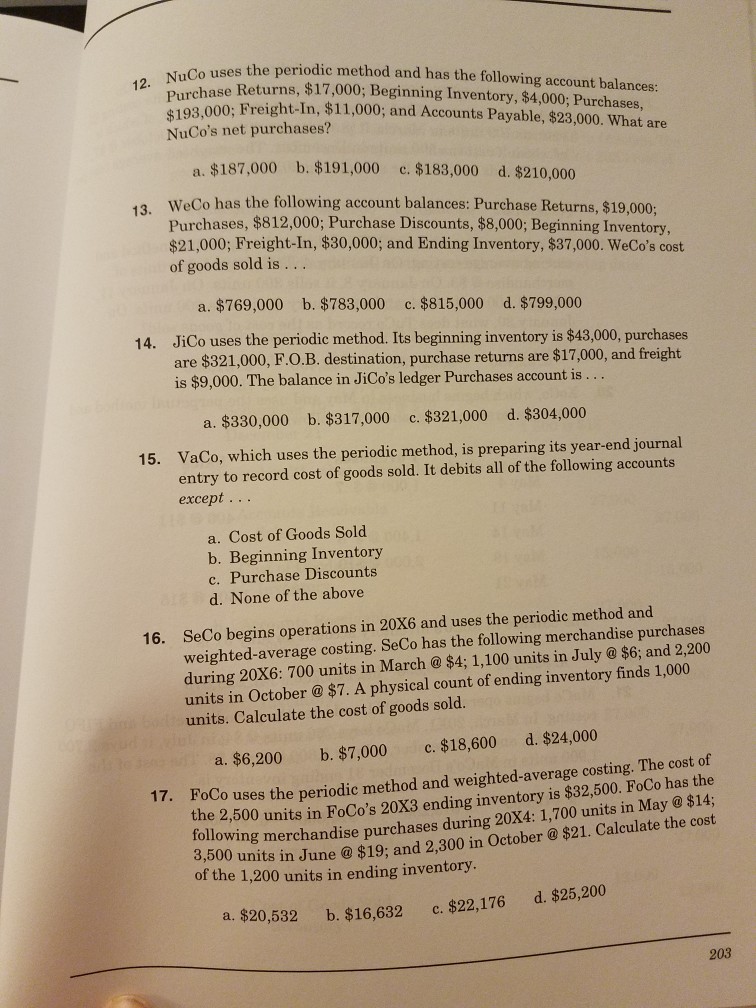

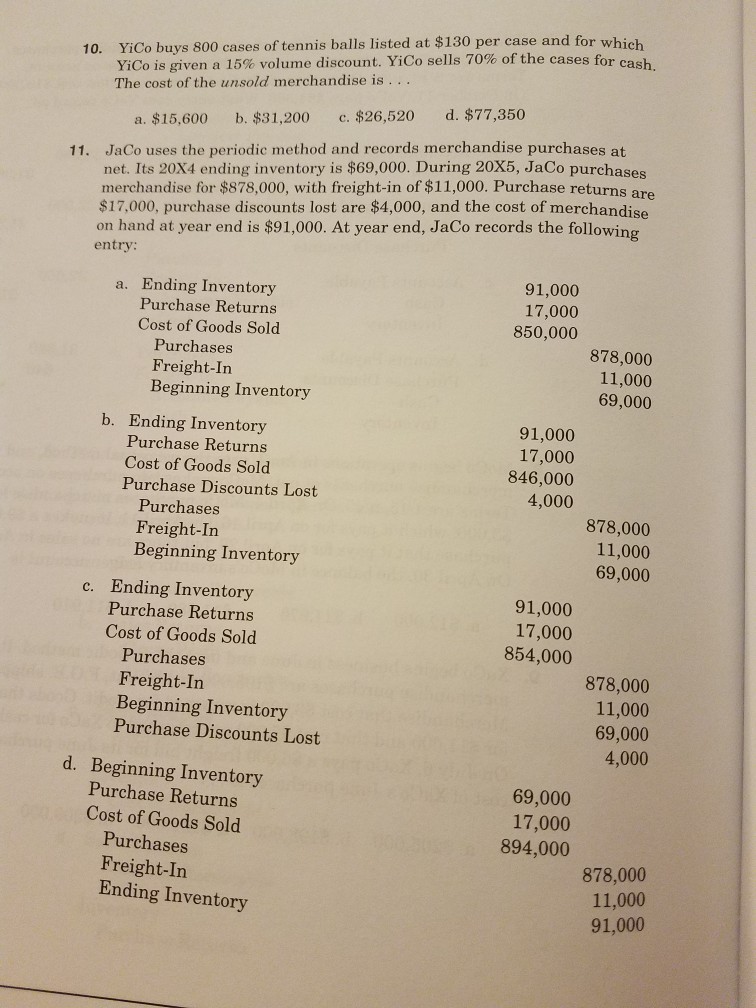

Couses the periodic method and has the following account balances: rchase Returns, $17,000; Beginning Inventory, $4,000; Purchases, 12- $19 3,000; Freight-In, $11,000; and Accounts Payable, $23,000. What are NuCo's net purchases? a. $187,000 b. $191,000 c. $183,000 d. $210,000 13. WeCo has the following account balances: Purchase Returns, $19,000; Purchases, $812,000; Purchase Discounts, $8,000; Beginning Inventory $21,000; Freight-In, $30,000; and Ending Inventory, $37,000. WeCo's cost of goods sold is a. $769,000 b. $783,000 c. $815,000 d. $799,000 14. JiCo uses the periodic method. Its beginning inventory is $43,000, purchases are $321,000, F.O.B. destination, purchase returns are $17,000, and freight is $9,000. The balance in JiCo's ledger Purchases account is a. $330,000 b. $317,000 c. $321,000 d. $304,000 VaCo, which uses the periodic method, is preparing its year-end journal entry to record cost of goods sold. It debits all of the following accounts except... 15. a. Cost of Goods Sold b. Beginning Inventory c. Purchase Discounts d. None of the above SeCo begins operations in 20X6 and uses the periodic method and weighted-average costing. SeCo has the following merchandise purchases during 20X6: 700 units in March @$4; 1,100 units in July @$6; and 2,200 units in October $7. A physical count of ending inventory finds 1,000 units. Calculate the cost of goods sold. 16. d. $24,000 c. $18,600 oCo uses the periodic method and weighted-average costing. The cost of owing merchandise purchases during 20X4: 1,700 units in May$14; a. $6,200 b. $7,000 17. F the 2,500 uni 3,500 of the 1,200 units in ending inventory ts in FoCo's 20X3 ending inventory is $32,500. FoCo has the $21. Calculate the cost units in June@ $19, and 2,300 in October d. $25,200 a. $20,532 b. $16,632 c. $22,176 203

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started