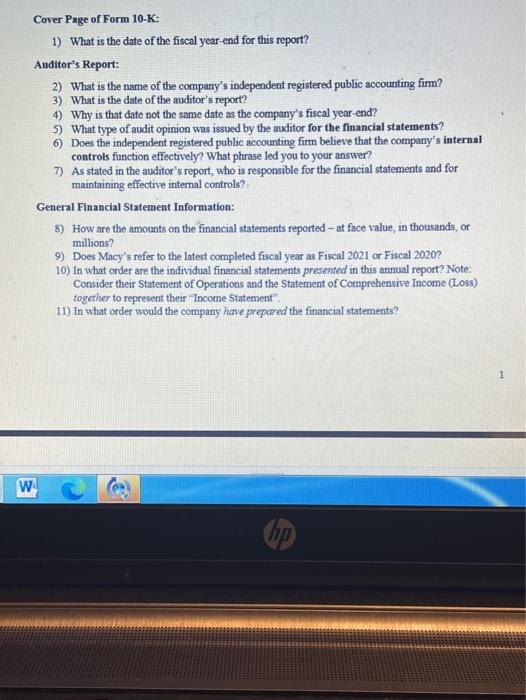

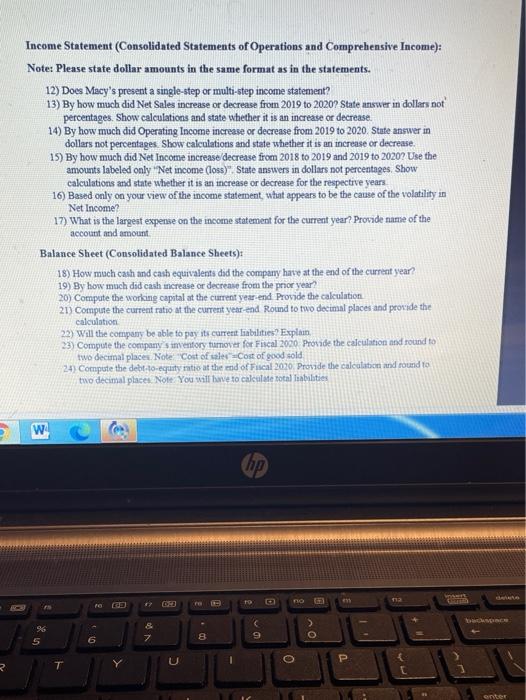

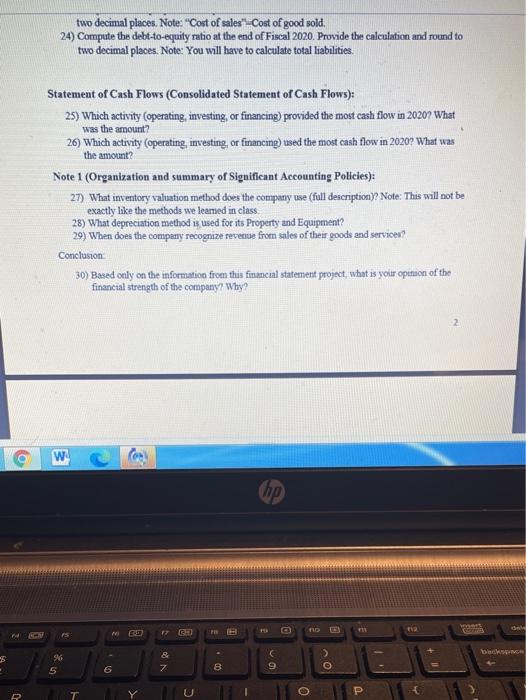

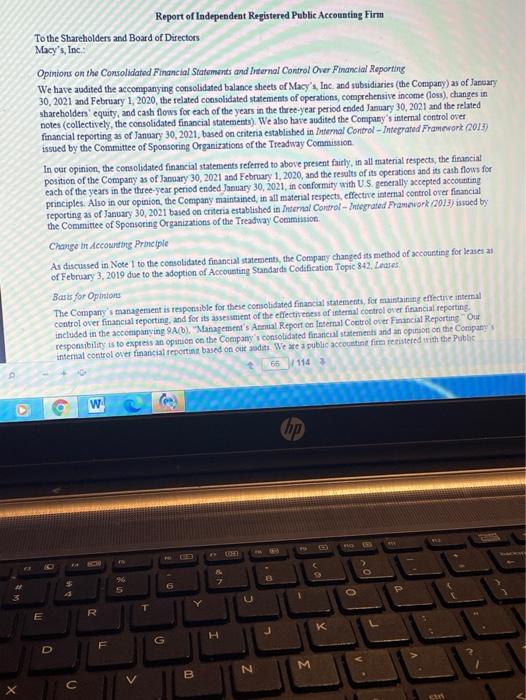

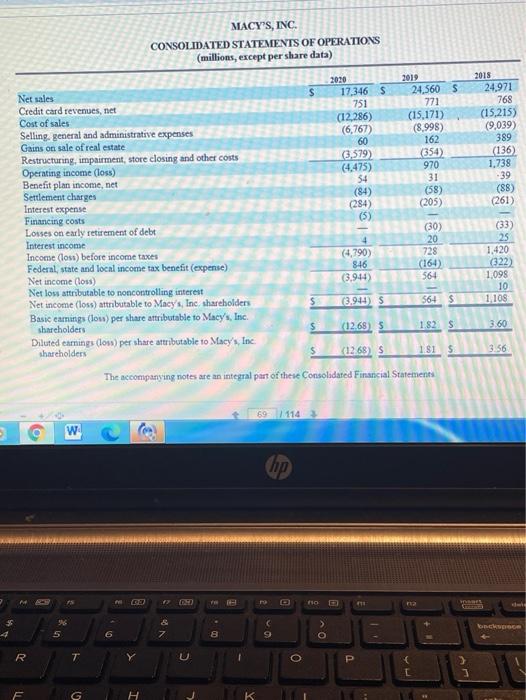

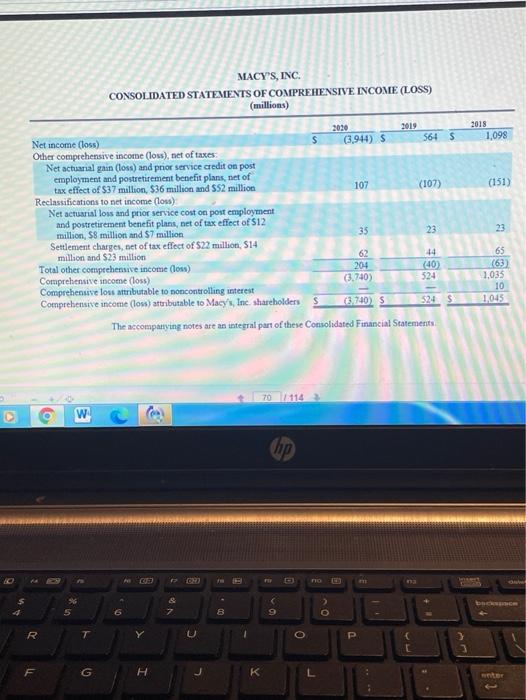

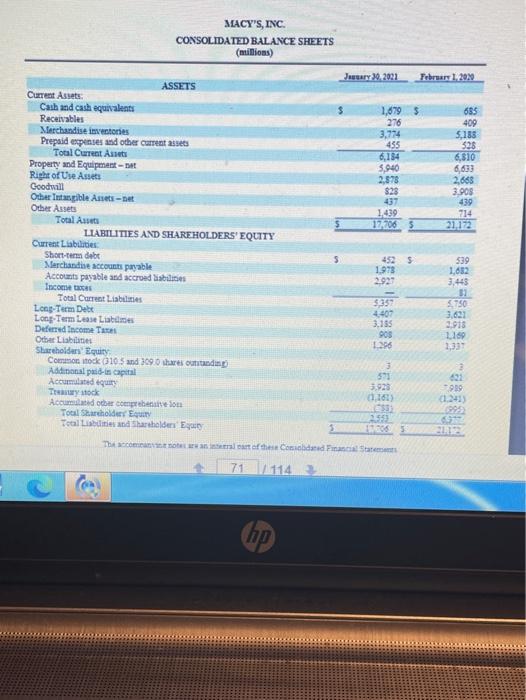

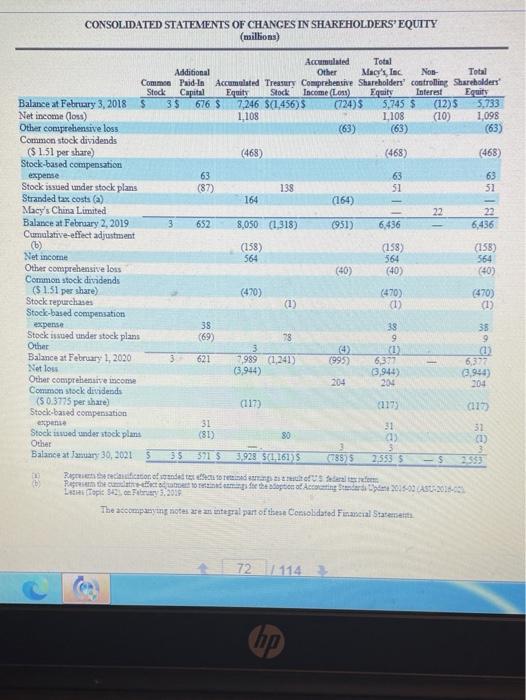

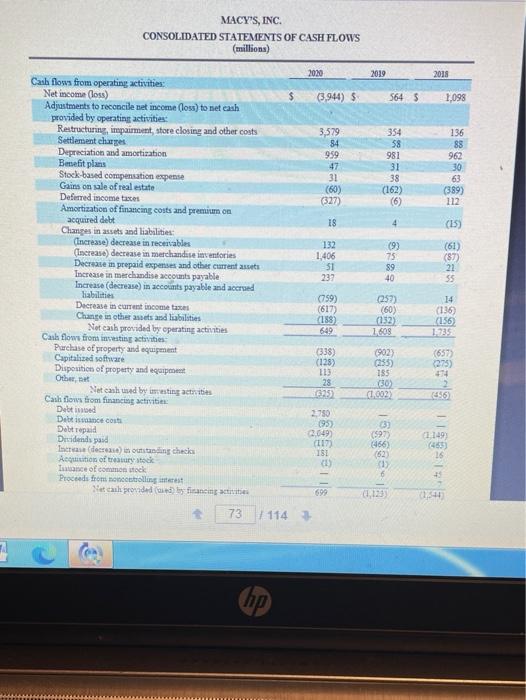

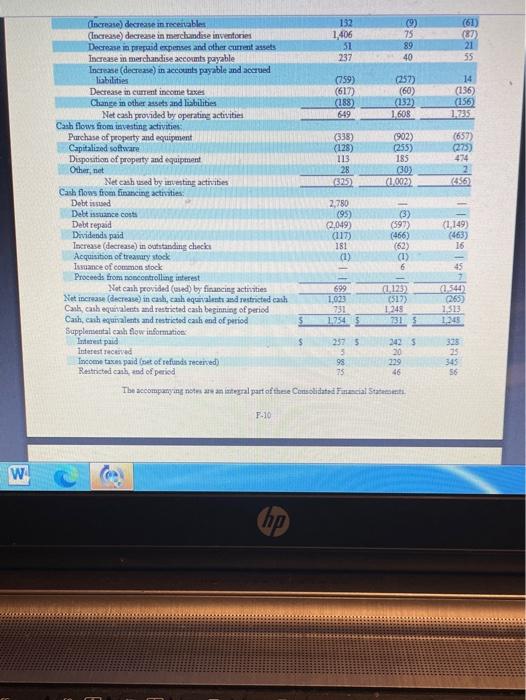

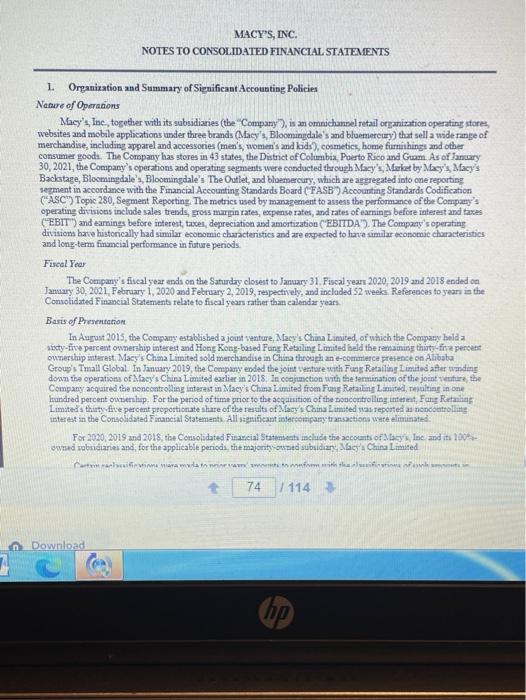

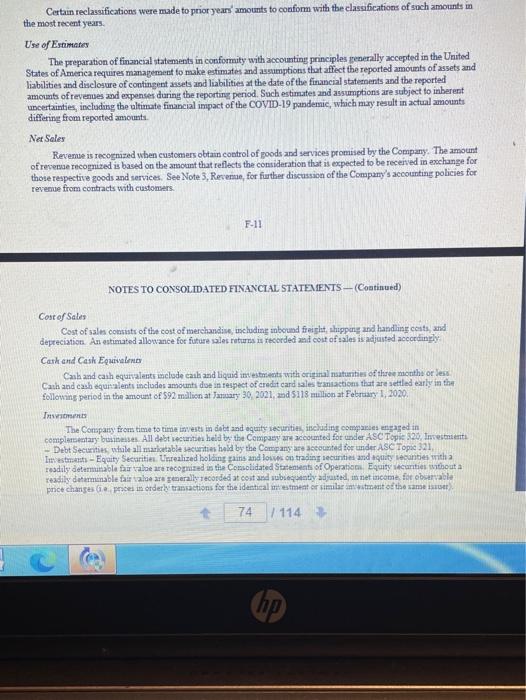

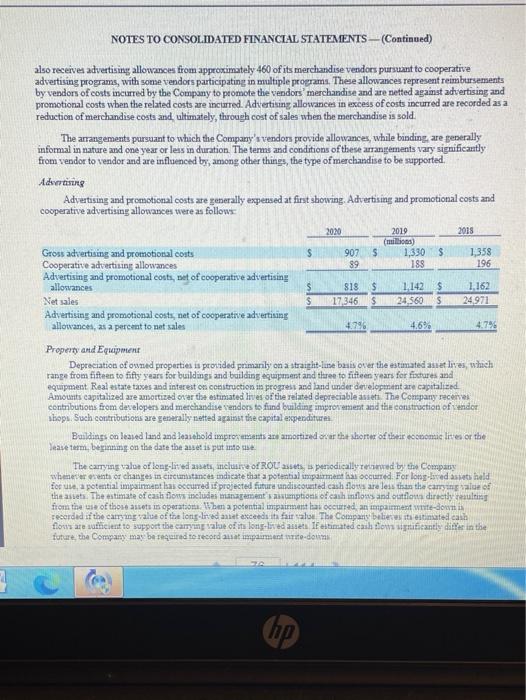

Cover Page of Form 10-K: 1) What is the date of the fiscal year-end for this report? Auditor's Report: 2) What is the name of the company's independent registered public accounting firm? 3) What is the date of the auditor's report? 4) Why is that date not the same date as the company's fiscal year-end? 3) What type of audit opinion was issued by the auditor for the financial statements? 6) Does the independent registered public accounting firm believe that the company's internal controls function effectively? What phrase led you to your answer? 7) As stated in the auditor's report , who is responsible for the financial statements and for maintaining effective internal controls? General Financial Statement Information: 8) How are the amounts on the financial statements reported at face value in thousands, or millions? 9) Does Macy's refer to the latest completed fiscal year as Fiscal 2021 or Fiscal 2020? 10) In what order are the individual financial statements presented in this annual report? Note: Consider their Statement of Operations and the Statement of Comprehensive Income (Loss) together to represent their "Income Statement" 11) In what order would the company have prepared the financial statements? w Income Statement (Consolidated Statements of Operations and Comprehensive Income): Note: Please state dollar amounts in the same format as in the statements. 12) Does Macy's present a single-step or multi-step income statement? 13) By how much did Net Sales increase or decrease from 2019 to 2020? State answer in dollars not percentages. Show calculations and state whether it is an increase or decrease. 14) By how much did Operating Income increase or decrease from 2019 to 2020. State answer in dollars not percentages Show calculations and state whether it is an increase or decrease 15) By how much did Net Income increase decrease from 2018 to 2019 and 2019 to 2020? Use the amounts labeled only "Net income (loss)". State answers in dollars not percentages. Show calculations and state whether it is an increase or decrease for the respective years 16) Based only on your view of the income statement, what appears to be the cause of the volatility in Net Income? 17) What is the largest expense on the income statement for the current year? Provide name of the account and amount Balance Sheet (Consolidated Balance Sheets): 18) How much cash and cash equivalents did the company have at the end of the current year? 19) By how much did cash increase or decrease from the prior year? 20) Compute the working capital at the current year-end provide the calculation 21) Compute the current ratio at the current year-end Round to two decimal places and provide the calculation 22) Will the company be able to pay its current liabilities? Explain 23) Compute the company's inventory tumover for Fiscal 2020 Provide the calculation and round to two decimal places Note Cost of Cost of good sold 24) Compute the debt-to-equity ratio at the end of Fiscal 2020 Provide the calculation and round to two decimal places. Note You will have to calculate total abilities W hp Ta DE C 9 OV 7 8 O P R T enter two decimal places. Note: "Cost of sales" Cost of good sold, 24) Compute the debt-to-equity ratio at the end of Fiscal 2020. Provide the calculation and round to two decimal places. Note: You will have to calculate total liabilities, Statement of Cash Flows (Consolidated Statement of Cash Flows): 25) Which activity (operating, investing, or financing) provided the most cash flow in 20207 What was the amount? 26) Which activity (operating, investing, or financing) used the most cash flow in 2020? What was the amount? Note 1 (Organization and summary of Significant Accounting Policies): 27) What inventory valuation method does the company use (full descriptiony? Note: This will not be exactly like the methods we leamed in class 28) What depreciation method is used for its Property and Equipment? 29) When does the company recognize revenue from sales of their goods and service? Conclusion: 30) Based only on the information from this financial statement project, what is your opinion of the financial strength of the company? Why? w CH 0 TIR ES & 7 C 9 > O 8 5 6 T Report of Independent Registered Public Accounting Firm To the Shareholders and Board of Directors Macy's, Inc Opinions on the Consolidated Financial Statements and internal Control Over Financial Reporting We have audited the accompanying consolidated balance sheets of Macy's, Inc and subsidiaries (the Company) as of January 30, 2021 and February 1, 2020, the related consolidated statements of operations, comprehensive income (loss), changes in shareholders' equity, and cash flows for each of the years in the three-year period ended January 30, 2021 and the related notes (collectively, the consolidated financial statements) We also have audited the Company's internal control over financial reporting as of January 30, 2021, based on criteria established in Internal Control - Integrated Framcork (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of the Company as of January 30, 2021 and February 1, 2020, and the results of its operations and its cash flows for each of the years in the three-year period ended January 30, 2021, in conformity with U.S. generally accepted accounting principles. Also in our opinion, the Company maintained in all material respects, effective internal control over financial reporting as of January 30, 2021 based on criteria established in Internal Control - Integrated Pramovork 2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission Change in Accounting Protetple As discussed in Note to the consolidated financial statements, the Company changed its method of accounting for leases 23 of February 3, 2019 due to the adoption of Accounting Standards Codification Topic 842. Leases Basis for Opinios The Company's management is responsible for these consolidated financial statements, for maintaining effective internal control over financial reporting, and for its assessment of the effectiveness of internal control over financial reporting included in the accompanying 9A(b). "Management's Annual Report on Internal Control over Financial Reporting Out responsibility is to express an opinion on the Company's consolidated financial statements and an opinion on the Company internal control over financial reporting based on our suditi We are a public accountint firm renistered with the Public 66114 w hop D AO 6 un 1 O R E K J L G H M N B c X EM responsibility is to express an opinion on the Company's consolidated financial statements and an opinion on the Company's internal control over financial reporting based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud, and whether effective internal control over financial reporting was maintained in all material respects Our audits of the consolidated financial statements included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. Our audit of internal control over financial reporting included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of interal control based on the assessed risk. Our audits also included performing such other procedures as we considered necessary in the circumstances. We believe that our audits provide a reascuable basis for our opinions. Debution and Limitations of Internal Control Over Financial Reporting A company's internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles A company's internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the company (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and 3 56114 w hp no 9 ch . > 0 96 9 7 B 5 P R T G H TI D expenditures of the company are being made only in accordance with authorizations of management and directors of the company, and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company's assets that could have a material effect on the financial statements Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate Critical Audit Matters The critical audit matters communicated below are matters arising from the current period audit of the consolidated financial statements that were communicated or required to be communicated to the audit committee and that (1) relate to accounts or disclosures that are material to the consolidated financial statements and (2) involved our especially challenging, subjective or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the consolidated financial statements, taken as a whole, and we are not, by communicating the critical audit matters below, providing separate opinions on the critical dit matters or on the accounts or disclosures to which they relate Assessment of the liability for unrecognized far benefit As discussed in Note 9 to the consolidated financial statements, the Company has recorded gross unrecognized tax benefits, including interest and penalties, of $173 million as of January 30, 2021. The Company recognizes tax positions when it is more likely than not that the tax position will be sustained on examination based on the technical merits of the position Uncertain tax positions meeting the recognition threshold are then measured at the largest amount of benefit that is more likely than not to be realised upon ultimate settlement We identified the assessment of the liability for unrecognized tax benefits as a critical audit matter. Complex auditor judgment was required in evaluating the Company's interpretation of tax law and its estimate of the ultimate resolution of the tax positions The following are the primary procedures we performed to address this critical nudut matter. We evaluated the design and tested the operating effectiveness of certain internal control related to the Company's unrecognized tax benefits process, including a control related to the interpretation of tax in and the estimate of the ultimate resolution of the tax positions. Since tax law a complex and often subject to interpretation, we involved tax professionals with specialized sila and knowledge. They sted us evaluating the estimate of the ultimate resolution of the tax positions taken by the Company and the impact on unrecognized tax benefits by senting tax examination activity and evaluating the tax positions based on tax law regulations, and other suthoritative rodance with respect to statute expirations and reserve 67114 w D 0 hp P G H IN 8 N M V + CATE Assessment of the carrying value of certain property and equipment As discussed in Note I to the consolidated financial statements, the Company evaluates the carrying value of property and equipment whenever events or changes in circumstances indicate that a potential impairment has occurred. As of January 30, 2021, net property and equipment was $5,940 million. When a potential impairment has occurred, an impairment write-down is recorded if the carrying value of the long-lived asset exceeds its fair value. As discussed in Note 4 to the consolidated financial statements, the Company recognized $200 million of impairments primarily related to long-lived tangible and right of use assets in the year ended January 30, 2021. We identified the assessment of the carrying value of certain property and equipment as a critical audit matter Subjective and challenging auditor judgment was required to assess the fair value estimates made related to certain properties, specifically identifying comparable sales transactions and market rent assumptions, as well as assessing adjustments to the comparable market data based on the specific characteristics of the property. The following are the primary procedures we performed to address this critical audit matter. We evaluated the design and tested the operating effectiveness of certain internal controls related to the Company's impairment assessment process for property and equipment, including controls related to fair value estimates made related to the underlying properties. We involved valuation professionals with specialized skills and knowledge who assisted in: Developing independent fair value estimates for certain properties by selecting comparable sales transactions and market rent assumptions based on publicly available market data for comparable assets, and making certain adjustments considering the location, quality of the property and real estate market conditions Comparing the independent fair value estimates for certain properties to the Company's fair value estimates that were ultimately used to identify and record, if applicable, impairment . F-4 67 114 W hp GD no 12 e > DICE Assessment of the carrying value of goodwill in the Macy's reporting unit As discussed in Notes 4 and 6 to the consolidated financial statements, during 2020 the Company recognized $2,982 million of goodwill impairment for the Macy's reporting unit. The goodwill impairment resulted from a sustained decline in the Company's market capitalization and changes in the Company's long-term projections driven largely by the impacts of the COVID-19 pandemic. The Company reviews goodwill for impaument annually and whenever events or changes in circumstances indicate that the carrying value of a reporting unit likely exceeds its fair value. This involves estimating the fair value of reporting units using a market approach or a combination of a market approach and income approach, as appropriate We identified the assessment of the carrying value of goodwill in the Macy's reporting unit as a critical audit matter Specialized skills and knowledge were required to evaluate the company-specific risk premsam applied in discounting management's financial projections Subjective and challenging auditor judgment was required to evaluate comparable masket-based information, including assessing the control premium implied by a comparison of management's discounted financial projections to the Company's market capitalization. The following are the primary procedures we performed to address this critical audit matter. We evaluated the design and tested the operating effectrveness of certain internal controls related to the assessment of the carrying value of goodwill in the Macy's reporting unit, including a control related to management's review of the company specific risk premium. We involved valuation professionals with specialized skills and knowledge who assisted in evaluating the company specific risk premium by Considering how management's financial projections compared to publicly-available forecasts of comparable companies Evaluating the implaed control premium calculated as part of a market capitalization reconciliation relative to a range of control premiums on observed transactions in the industry KPMG LLP 68114 O W. hp DO Oy R T > 3 E G A MACY'S, INC CONSOLIDATED STATEMENTS OF OPERATIONS (millions, except per share data) s 2020 2019 17,346 $ 24,560 5 751771 (12.286) (15.171) (6,767) (8.998) 60 162 3.579) (354) (4.475) 970 54 31 (84) (58) (284) (205) (5) (30) 4 20 (4,790) 728 846 (164) (3.944) 564 2018 24,971 768 (15,215) (9,039) 389 (136) 1,738 -39 (88) (261) Net sales Credit card revenues, net Cost of sales Selling general and administrative expenses Gains on sale of real estate Restructuring, impairment, store closing and other costs Operating income (Loss) Benefit plan income, net Settlement charges Interest expense Financing costs Losses on early retirement of debt Interest income Income (los) before income taxes Federal, state and local income tax benefit (expense) Net income (los) Net lost attributable to noncontrolling interest Net income (loss) attributable to Macy's, Inc shareholders Basic earnings (lonper share attributable to Macy's, Inc. shareholders Diluted earnings (los) per share attributable to Macy's, Inc. shareholders (33) 25 1,420 (322) 1.098 10 1.108 $ (3.941) S 564 $ $ (12.68) 5 1.82 $ 3.60 (1268) S 181 $ 3.56 The accompanying notes are an integral part of these Consolidated Financial Statements 69 1114 B w hop GD 10 2 IN 8 9 O R I 3 1 F G H K MACY'S, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (millions) 2019 2030 (3.944) 5 564 5 2018 1,098 107 (107) (151) Net income (loss $ Other comprehensive income (loss), net of taxes Net actuarial gain (loss) and prior service credit on post employment and postretirement benefit plans, net of tax effect of $37 million, 536 million and SS2 million Reclassifications to net income (los) Net actuarial loss and prior service cost on post employment and postretirement benefit plans, net of tax effect of S12 million, 58 million and $7 million Settlement charges, net of tax effect of S22 million, S14 million and $23 million Total other comprehensive income (los) Comprehensive income (loss) Comprehenuse lou attributable to noncontrolling interest Comprehensive income (low) attributable to Macy's, Inc. shareholders S 35 23 23 62 204 (3.740) 14 (40) 524 65 (63) 1.035 10 1.045 (3.740) $ 524 $ The accompanying notes are an integral part of these Consolidated Financial Statements 70114 GO W hop no 03 R U o G H J WE MACY'S, INC. CONSOLIDATED BALANCE SHEETS (millions) JRSARY.2021 Februar 2012 ASSETS Current Assets Cash and cash equivalents 1,679 5 685 Receivables 276 409 Merchandise investors 3,774 5,133 Prepaid expenses and other current assets 435 526 Total Current Asti 6,134 6,810 Property and Equipment 5,940 6,633 Right of Use Assets 2,578 2,668 Goodwill $28 3.908 Other Intangible Anti- 437 439 Other Assets 1439 714 Total Auto 1967065 21.172 LIABILITIES AND SHAREHOLDERS' EQUITY Current Liabilities Short-term debt S 4525 539 Merchandise accounts payable 1973 1,682 Accounts payable and accrued abilities 2927 Income 3,443 Total Current Liabilities 5,357 3.750 Long-Term Debt 4407 LongTerm Les Liables 3.153 1918 Ded Income Tax OS LIS Other Liabile 26 1,337 Shareholders' Equity Common stock 103 and 3090 suretding 3 Additional pus capital 2 593 Accumulateur Trstock --999 01.16 Accumulated other compresion 01.241 ES Total Sold 1999 259 Total Liabid Shareholders Egy 3 6063 The como of the Considered Financial Statem 717 114 hp CONSOLIDATED STATEMENTS OF CHANCES IN SHAREHOLDERS' EQUITY (millions) Non Capital 164 Accumulated Total Additional Other Macy's, Inc Total Comme Paid In Accumulated Treasury Comprehensive Shareholders' controlling Shareholders Stock Equity Stock Income (Los) Equity Interest Equity Balance at February 3, 2018 S 3$ 676 $ 7,246 $(1.456) (724) 5.745 $ (12) 5,733 Net income (los) 1,108 1. 108 (10) 1,098 Other comprehensive loss (63) (63) (63) Common stock dividends ($ 1.51 per share) (468) (468) (468) Stock-based compensation expense 63 63 63 Stock issued under stock plans (87) 138 51 52 Stranded tax costs (a) (164) Macy's China Limited 22 22 Balance at February 2, 2019 3 652 8,050 (1,318) (951) 6,436 6,436 Cumulative effect adjustment 6) (158) (158) (158) Net income 564 564 Other comprehensive loss (40) (40) (40) Common stock dividends ($ 1.51 per share) (470) (470) (470) Stock repurchases (1) (1) (1) Stock-based compensation expense 38 39 38 Stock issued under stock plans (69) 78 9 9 Other (1) Balance at February 1, 2020 621 1989 (1.241) (995) 6377 6,377 Net loss (3,944) (3,944) 3.944) Other comprehensive income 204 204 200 Common stock dividends (50.3775 per share (117) 1173 (117) Stock-based compensation expense 31 31 31 Stock oed under stock plans (81) 80 (D Other Balance at January 30, 2021 35 3715 3.923 4,1615 189) 5 2.5535 s 2533 564 35 Fans gemela sem a) Race of orders om Pin the conditie 10 tin minte bestion of Accounting and ASU 2016-05 The accompanying notes are an integral part of these Consolidated Financial Statement 72 7114 hp MACY'S, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (millions) 2020 2019 2018 (3.944) 5 564 5 1,098 136 3,579 84 959 47 31 (60) (327) 354 58 981 31 38 (162) (6) 88 962 30 63 (389) 112 18 (15) 132 1,406 SI 232 (9) 75 89 40 (61) (87) 21 55 Cash flows from operating activities Net income (loss) Adjustments to reconcile net income (loss) to net cash provided by operating activities: Restructuring, impairment store closing and other costs Settlement charges Depreciation and amortization Benefit plans Stock-based compensation expense Gains on sale of real estate Defumed income tace Amortization of financing costs and premium on acquired debt Changes in assets and liabilities: Increase) decrease in receivables (Increase) decrease in merchandise informes Decrease in prepaid expenses and other current assets Increase in merchandise accounts payable Increase (decrease in accounts payable and accred habilities Decrease in current income taxes Change in other assets and liabilities Net cash provided by operating activities Cash flow from investing activities Purchase of property and equipment Capitalized software Disposition of property and equipment Others Net caused by testing activities Cashflows from fangari Deltid Det some cost Det paid Desidends paid Istras (dec) in outstanding checki Acquisition of treasury stock Tutance of common stock Proceeds from no controlling Het cash ponded by financing (759) (617) (188) 649 (257) (60) (132) 1.809 14 (136) (256 1735 (338) (128) 113 28 1625 (902) (235) 185 (30) (1.002) (657 (275) +++ 356 2.750 (95) 2049 (117 181 1149 33 (597 (466) (62) 1 6 16 699 73 114 hp 132 1,406 51 237 (9) 75 89 40 (61) (87) 21 55 (759) (617) (188) 649 (257) (60) (152) 1608 14 (136) (156 1235 (657 (338) (128) 113 28 (325) (902) (255) 185 (30) 0.002) (275) 474 2 (456 Increase) decrease in recentables (Increase) decrease in merchandise inventories Decrease in pred expenses and other current sets Increase in merchandise accommts payable Increase (decrease in accounts payable and accrued liabilities Decrease in current income taxes Change in other assets and liabilibes Net cash provided by operating activities Cash flows from investing activities Purchase of property and equipment Capitalized software Disposition of property and equipment Othernet Net cash used by iting activities Cash flows from financing activities Debt issued Debt issuance costs Deltrepand Dividends paid Increase (decrease) in odstanding checki Acquisition of treasury stock Issuance of common stock Proceeds from noncontrolling interest Nat can provided(uud) by financing activities Net increase (decrease in cash, cash equivalent and restricted cash Canh, cash equivalents and restricted cash beginning of period Cash, cash equivalents and restricted cash end of period Supplemental cash flow information Interest paid Interest received Income taxes paid foet of refunds recured Restricted cash and of period 2.780 (95) 02.049) (117) 181 (1) (3) (597) (466) (1,149 (463) 16 (62) (1) 6 45 699 1,023 731 1.7545 125) (517) 1 249 7315 0540 265) 1313 1243 5 $ 2575 3 98 75 3425 20 229 46 328 25 345 56 The accompany notes are an integral part of these Consolidated Financial Statement F-10 W hp Certain teclassifications were made to prior years' amounts to conform with the classifications of soch amounts in the most recent years. Use of Estimate The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Such estimates and assumptions are subject to inherent uncertainties, including the ultimate financial impact of the COVID-19 pandemic, which may result in actual amounts differing from reported amounts Net Sales Reveme is recognized when customers obtain control of goods and services promised by the Company. The amount of revenge recognized is based on the amount that reflects the consideration that is expected to be received in exchange for those respective goods and services. See Note 3, Reverite, for further discussion of the Company's accounting policies for revenue from contracts with customers F-11 NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) Cost of Sales Cost of sales comists of the cost of merchandise, including anbound freight, shipping and handling costs, and depreciation. An estimated allowance for future sales returns is recorded and cost of sales is adjusted accordingly Cask and Cask Ev Cash and cashequrvalets clade cash and liquid investments with original natures of three months or less Cath and cash gunalents includes amounts doe in respect of credit card sales transactions that are settled early in the following period in the amount of 592 millionat January 30, 2021, and 5118 million at February 1, 2020, The Company from time to time invest in debt and equits securities including companies engaged in complementary business All debt securitas held by the Company are accounted for under ASC Topic 320, Insetet -Debt Securities we all marotable securities held by the Company are accounted for under ASC Topic 321 Investments - Equity Securitie Unrealized holding rains and lows on trading securities and equity enties with a readily determinable far vale are recognized as the Consolidated Statements of Operation Equity cute tout a readily determinable at als are generally recorded at cost and sequently adjusted, in net income for observable price changes price in orderly transactions for the identical intestment or similar testant of the same 74 11 114 hp) Recavables Receivables were $276 million at January 30, 2021, compared to $409 million at February 1, 2020. The Company and Citibank, the owner of most of the Company's credit assets, are party to a long-term marketing and servicing alliance pursuant to the terms of the Program Agreement. Income earned under the Program Agreement is treated as credit card revenues, net on the Consolidated Statements of Operations. Under the Program Agreement Citibank offers proprietary and non-proprietary credit cards to the Company's customers, Merchandise Inventories Merchandise inventories are valued at lower of cost or market using the last in first-out ("LIFO) retail inventory method. Under the retail inventory method, inventory is segregated into departments of merchandise having similar characteristics, and is stated at its current retail selling value Inventory retail values are converted to a cost basis by applying specific average cost factors for each merchandise department Cost factors represent the average cost-to-retail ratio for each merchandise department based on beginning inventory and the annual purchase activity, At January 30, 2021, and February 1, 2020, merchandise inventories valued at LIFO, including adjustments as necessary to record inventory at the lower of cost or market, approximated the cost of such inventories using the first in first-out ("FIFO retail inventory method. The application of the LIFO retail inventory method did not result in the recognition of any LIFO charges or credits affecting cost of sales for 2020, 2019 or 2018. The retail inventory method inherently requires management judgments and estimates, such as the amount and timing of permanent markdowns to clear unproductive or slow-moving inventory, which may impact the ending inventory valuation as well as gross marins Permanent markdown designated for clearance activity are recorded when the utility of the inventory has diminished. Factors considered in the determination of permanent markdowns include current and anticipated demand, customer preferences, age of the merchandise and fashion trends. When a decision is made to permanently markdown merchandise, the resulting grous margin reduction is recognised in the period the markdown is recorded Physical inventories are generally taken within each merchandise department ammually, and inventory records are adjusted accordingly, resulting in the recording of actual shriage Physical inventores are taken at all store locations for substantially all merchandise categories approximately three weeks before the end of the year. Shrinkage is estimated as a percentage of sales at interim periods and for this approximate three-week period, based on historical shimlage rates While it is not possible to quantify the impact from each cause of shrinkage, the Company has loss prevention programs and policies that are intended to minimize shrinkage including theme of radio frequmy identification cycle counts and interim totories to keep the Company's merchandise files accurate Vendor. Allowance The Company recentes certain allowances as rambursement for markdowns take me to support the pro margineamed in connection with the sales of merchandise. These allowances are recognised when medThe Company F-12 NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Costined) hp NOTES TO CONSOLIDATED FINANCIAL STATEMENTS--(Continued) also receives advertising allowances from approximately 460 of its merchandise vendors pursuant to cooperative advertising programs, with some vendors participating in multiple programs. These allowances represent reimbursements by vendors of costs incurred by the Company to promote the vendors merchandise and are netted against advertising and promotional costs when the related costs are incurred. Advertising allowances in excess of costs incurred are recorded as a reduction of merchandise costs and ultimately, through cost of sales when the merchandise is sold. The arrangements pursuant to which the Company's vendors provide allowances, while binding are generally informal in nature and one year or less in duration The terms and conditions of these arrangements vary significantly from vendor to vendor and are influenced by, among other things, the type of merchandise to be supported Advertising Advertising and promotional costs are generally expensed at first showing. Advertising and promotional costs and cooperative advertising allowances were as follows: 2020 2019 2015 (ms) Gross advertising and promotional costs $ 907 S 1,330 $ 1,358 Cooperative advertising allowances 89 188 196 Advertising and promotional costs, net of cooperative advertising allowances $ 819 $ 1.1425 1.162 Net sales $ 17,346 $ 24,560 5 24971 Advertising and promotional costs, net of cooperative advertising allowances, as a percent to net sales 4.796 4.6% 4.7% Property and Equipment Depreciation of owned properties is provided primarily on a straight line basis over the estimated annat lives, which range from fifteen to fifty years for buildings and building equipment and three to fifteen years for fiscares and equipment Real estate taxes and interest on construction in progress and land under development are capitalized Amounts capitalized are amortized over the estimated lives of the related depreciable assets. The Company receives contributions from developers and merchandise vendors to find building improvement and the construction of vendor shops. Such contributions are generally netted against the capital expenditures Buildings on leased land and leasehold improvements are amortized order the shorter of the economic lites or the Jease term, beginning on the date the asset is put into se The carrying value of long-lied assets, melusive of ROU'asses penodically red by the Company wheeteresents or changes in circumstances indicate that a potential impairment has occurred. For long-wed assets held for use, a potential impairment has occurred if projected future discounted cash flows are less in the carrying sale of the assets. The estimate of cash flows includes management assumption of cash flous and outta directly faulting from the use of those assets in operationam a potential impatients occurred an impairment write-down Fecorded if the carrying value of the long red annet exceeds it fair salou The Company babeste estimated cash fons are set to support the camme value of its long-lived asset IF estimated cash flow gantly date in the future the Company may be required to record ausamment down hp If the Company commits to a plan to dispose of a long-lived asset before the end of its previously estimated usefal life, estimated cash flows are revised accordingly, and the Company may be required to record an asset impairment write down. Additionally, related Liabilities arise such as severance, contractual obligations and other accruals associated with store closings from decisions to dispose of assets. The Company estimates these liabilities based on the facts and circumstances in existence for each restructuring decision. The amounts the Company will ultimately realize or disburse could differ from the amounts assumed in arriving at the asset impairment and restructuring charge recorded The Company classifies certain long-lived assets as held for disposal by sale and ceases depreciation when the particular criteria for such classification are met, including the probable sale within one year. For long-lived assets to be disposed of by sale, an impairment charge is recorded if the carrying amount of the asset exceeds its fair value less costs to sell. Such valuation include estimations of fair values and incremental direct costs to transact a sale E-13 NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (Continued) Lease Operating lease liabilities are recognized at the lease commencement date based on the present value of the ficed lease payments using the Company's incremental borrowing rates for its population of leaser Related operating ROU assets are recognized based on the initial present value of the fixed lease payments, reduced by contributions from landlords, plus any prepaid rent and direct costs from executing the leases. ROU assets are tested for impairment in the same mener as long-lied assets. Certains of the Company's real estate leases have terms that extend for a significant number of years and provide for rental rates that increase or decrease over time. Lease terms include the poecancellable portion of the underlying leases along with any reasonably certain lease periods associated with available renewal periods termination options and purchase options Lease agreements with lease and non-lease components are combined as a Single lease component for all classes of underlying assets. Leases with an initial term of 12 months or less are not recorded on the balance sheet, the Company recomie Jease expense for these leaves on a straight line basis over the lease tam. Variable Jease payments are recognized as lease experts as they are merred ASU 2016-02 Luases Topic 542), as amended, was adopted by the Company on February 3, 2019. utilizing modified retrospective approach that allowed for transition in the period of adoption The Company adopted tisa package of practical expedients available at transition that retained the lease clasification and initial direct costs feels that cisted prior to adoption of the standard Contracts entered into prior to adoption were not essed for lemnes or embedded lases. Upon adoption the Company used hindsight in determining lease term and impairment For lease and mon-lase components, the Company has elected to account for both as 2 mg ese component Porto February 3, 2019. leases were accounted for under ASC Sobtopie Sto. La Goodwill and Other Intangibles The came value of soods and other intables et definities and at least way to HD Goodwill and Other Intangible The carrying value of goodwill and other intangible assets with indefinite lives are reviewed at least annually for possible impairment in accordance with ASC Subtopic 350-20, Goodwill. Goodwill and other intangible assets with indefinite lives have been ained to reporting units for purposes of impairment testing. The reporting units are the Company's retail operating division Goodwill and other intangible amets with indefinite lives are tested for impairment annually at the end of the fiscal month of May The Company evaluates qualitative factors to determine if it is more likely than not that the fair value of a reporting unit or other intampible assets with indefinite lives is less than its carrying value and whether it is necessary to perform the quantitative impairment test. If required, the Company performs a quantitative impairment test which involves a comparison of each reporting at's or other intangible assets with indefinite lives fair values to its carrying value Estimating the fair values of the reporting units or other intangible assets with indefinite lives involves the use of significant assumptions, estimates and judgments with respect to a variety of factors, including sales, pro margin and SG&A expense rates, capital expenditures, cash flows and the selection and use of an appropriate discount rate and market values and multiples of eamings and revenues of susilar public companies. The projected sales gross margin and SG&A expense rate assumptions and capital expenditures are based on the Company's annual business plan or other forecasted results, Discount rates reflect market-based estimates of the risks associated with the projected cash flows of the reporting unit or indefinite lived intangible asset The estimates of fair value of reporting units or other intangible assets with indefinite lives are based on the best information available as of the date of the essent If the carrying value of a reporting unit exceeds its fair value, an impaiment loss will be recognized in an amount equal to such exces limited to the total amount of goodwill allocated to the reporting unit. If the carrying value of an individual indefinite-lived intangible asset teeds its fair valor, such individual indefinite-Ineditangle set in wintten down by an amount equal to such eccess Capitalized Soforere The Company capitalizes purchased and internally deeloped software and amortize such costs to ease on straight-line basis encally over four to five years. Capitalized software is meluded in other nation the Consolidated Balance Sheets Gif Cards The Company only offers of non-ping cards to custom At the entender und no te econized, rather the Company records and liability to the ability as led and F-14 NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Tma retoroet andard fema The Counteams it card reakage in tratabasertiste peio de tot total data updated dalysed to datumesc redempties patiem. The Commode V hp NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) reverse is recognized equal to the amount redeemed for merchandise. The Company records revenue from redeemed gift cards (breakage) in net sales on a pro-rata basis over the time period gift cards are actually redeemed. At least three years of historical data updated amually, is used to determine actual redemption patterns. The Company records breakage income within net sales on the Consolidated Statements of Operations, Loyalty Program The Company mainams customer loyalty programs in which customers cam points based on their purchases. Under the Macy's Star Rewards loyalty program, points are earned based on customers spending on Macy's private label and co-branded credit cards as well as non-proprietary cards Under the Macy's brand the Company previously participated in a coalition program ("Plentz") whereby customers could eam points based on spending levels with bonus opportunities through various targeted offers and promotions at Macy's and other partners. The Company's participation in Plasti ended on May 3, 2018 The Company's Bloomingdale's Loyallist and bluemercury BloRewards programs pronde tender neutral points based programs to their customers. The Company recognizes the estimated net amount of the rewards that will be named and redeemed as a reduction to net sales at the time of the initial transaction and as tender when the points are subsequently redeemed by a customer Self-Trace Reserves The Company, through its insurance subsidiary, is self-insured for workers compensation and general liability claims up to certain maximum liability amounts. Although the amounts accrued are actuarially determined based on analysis of historical trends of losses, settlements, litigation costs and other factors, the amounts the Company will ultimately disbane could differ from such accrued amounts Post Employment and Postrem Obligations The Company, through its actuaries, utilizes assumptions when estimating the abilities for pension and other employee benefit plans. These assumption, where applicable, include the discount rates used to determine the actual present value of projected benefit obligations, the rate of increase in future compensation levels mortality rates, the long- term rate of return on assets and the growth in health care costs. The Company measures posteployment and postretirement assets and obligations using the month-end that as closest to the Company's fiscal year-endorem period quarter-end if a plan is determined to qualify for a remesurement. The benefit expense is generally recogated the Consolidated Financial Statements on an accrual bassover the teragereaming life of participants, and the accrued besefits are reported in other sets, accounts payable and accrued liabilities and other liabilities on the Cocidated Balance Sheets, as appropriate Income Texen , Income taxes are accounted for under the asset and ability method Deferred income tax ans and liabilities are recemized for the future tax consequences attributable to difference between the financial statement carrying amount of istig assets and liabilities and their respective tax bases, and set operating lous and tax credit came forwards Dede income tatuat and abilities are measured ang enacted taxes ecpected to apply to table mome is the years in which these temporary differences are expected to be recovered or settled Theft on deference and abilities of a change in tax rates is record in the Consolidated Statements of Operation in the period that include the mactant date Detened income tax assets are reduced by a valuation allowance when it is more than that some portion of the defected income tax assets will not be alised Stock Band Com hp income tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which these temporary differences are expected to be recovered or settled. The effect on deferred income tax assets and liabilities of a change in tax rates is recognized in the Consolidated Statements of Operations in the period that includes the enactment date. Deferred income tax assets are reduced by a valuation allowance when it is more likely than not that some portion of the deferred income tax assets will not be realized Stock Band Compensation The Company records stock-based compensation expense according to the provisions of ASC Topic 718, Compensation - Stock Compensation ASC Topic 718 requires all share-based payments to employees, including erants of employer stock options, to be recognized in the financial statements based on their fair values. Under the provisions of ASC Topic 718, the Company determines the appropriate far value model to be used for valuing share based payments and the amortization method for compensation cost Comprehensive Income (Loss) Total comprehensive income (los) represents the change in equity during a period from sources other than transactions with shareholders and as such, includes et income (los). For the Company, the only other components of total comprehensive income (los) for 2020, 2019 and 2018 relate to post employment and postreurement plan items Settlement charges incurred are included as a separate component of income before income taces in the Consolidated F-15 NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued) Statements of Operations Amortization reclassifications out of accumulated other comprobados are included in the computations of the periodic benefit cost (income and are included in benefit plan income Bet on the Consolidated Statements of Operation Recent Accounting Pronouncement In June 2016, the FASB ASU 2016-13, Financal Instruments - Credit Lowes Topic 326-Messurement of Credit Lossis on Facial Instruments, with amands tie financial instrument impairment model to use an expected Jous methodology in place a incurred loss methodology. The new puidance applies to financial asset med mortized cont base, including recervables that result from rene tramactions and hold to maturity debt cute This guidance is effective for fiscal years and interim periods whose fiscal yean, ganga December 15 2019 andaly adoption as permitted for real an being December 15, 2018 The Compans adopted the undance is the first quarter of fiscal 2020. The adoption of the domaterial impact on the Compascomodated financial statements and related disco In August 2015 the FASB ed ASU 2018. Easelect Tesic 820 Dido Changes to the Dace Requirements for Farecha.the bemor modifying and dang certain datele trecere forta nem periode with the saint after December 15, 2009. adoption The Cape he w hp E qUISCHE UTILICE Company's consolidated financial statements and related disclosures In August 2018, the FASB isted ASU 2018-13, Fair Value Measurement Topic 820). Disclosure Framework- Changes to the Disclosure Requirements for Fair Value Measurement, which amends the fair value disclosure requirements by removing, modifying and adding certain disclosures. This guidance is effective for fiscal years, and interim periods within those years, beginning after December 15, 2019, with early adoption permitted. The Company adopted this guidance in the first quarter of fiscal 2020. The adoption of this guidance did not have a material impact on the Company's consolidated financial statements and related disclosures In August 2018, the FASB issued ASU 2018-15, Intangibles - Goodwill and Other - Intemal-Use Software (Subtopic 350-40). Customer's Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement That Is a Service Contract. This ASU clarifies the accounting treatment for fees paid by a customer in a cloud computing arrangement (hosting arrangement) by providing guidance for determining when the arrangement includes a software license. This guidance is effective for public business entities for fiscal years, and interim periods within those years, beginning after December 15, 2019, with early adoption permitted. The amendments may be applied either retrospectively or prospectively to all implementation costs incurred after the date of adoption. The Company adopted this guidance on a prospective basis in the first quarter of fiscal 2020. The adoption of this guidance did not have a material impact on the Company's consolidated financial statements and related disclosures In March 2020, the SEC issued a final rule, Financial Disclosures About Guarantors and Issues of Guaranteed Securities and Affiliates Whose Securities Collateralize a Registrant's Securities, that simplifies the disclosure requirements related to registered securities under Rule 3-10 of Reralation SX The rule replaces the requirement to provide condensed consolidating financial information with a requirement to present summarized financial information of the issues and guaranton. It also requires qualitative disclosures with respect to information about granton, the terms and conditions of guarantees and the factors that may affect payment. These disclosures may be provided outside the footnotes to the Company's consolidated financial statements. In applying this rule, the Company has elected to provide these disclosures in Item 7. Management's Discussion & Analysis of Financial Conditions and Results of Operation 2. Impact of COVID-19 In March 2020, the World Health Organisation declared the outbreak of COUTD-19 as a global pandemnac, which continues to spread throughout the United States. The COVID-19 pandemic had a negatne impact on the Company's 2020 operations and financial results, and the full financial impact of the pandera cannot be reasonably estimated at this time due to uncertainty as to the recity and duration of the pandemic. The following summarizes the actions taken and impacts from the COVID-19 pandemic during 2020 The Company temporarily closed all stores on March 18, 2020, which included all Stacy's Bloomingdale's blocury Macy Balata Blomdales the Outlet and Market by Macy's stores Stores began Teopening on Mar 4 2020 and substantially all of the Company stores are open by the end of the second . quarter of 2020 In an effort to increase liquidity, the Company folly drew on its $1,500 million credit facility amounced the sospension of quarterly cash didends beung in the second quarter of 2020 and took additional steps to reduce discretionary pandog The Company's Board of Directors also rescinderitation of any F-16 Cover Page of Form 10-K: 1) What is the date of the fiscal year-end for this report? Auditor's Report: 2) What is the name of the company's independent registered public accounting firm? 3) What is the date of the auditor's report? 4) Why is that date not the same date as the company's fiscal year-end? 3) What type of audit opinion was issued by the auditor for the financial statements? 6) Does the independent registered public accounting firm believe that the company's internal controls function effectively? What phrase led you to your answer? 7) As stated in the auditor's report , who is responsible for the financial statements and for maintaining effective internal controls? General Financial Statement Information: 8) How are the amounts on the financial statements reported at face value in thousands, or millions? 9) Does Macy's refer to the latest completed fiscal year as Fiscal 2021 or Fiscal 2020? 10) In what order are the individual financial statements presented in this annual report? Note: Consider their Statement of Operations and the Statement of Comprehensive Income (Loss) together to represent their "Income Statement" 11) In what order would the company have prepared the financial statements? w Income Statement (Consolidated Statements of Operations and Comprehensive Income): Note: Please state dollar amounts in the same format as in the statements. 12) Does Macy's present a single-step or multi-step income statement? 13) By how much did Net Sales increase or decrease from 2019 to 2020? State answer in dollars not percentages. Show calculations and state whether it is an increase or decrease. 14) By how much did Operating Income increase or decrease from 2019 to 2020. State answer in dollars not percentages Show calculations and state whether it is an increase or decrease 15) By how much did Net Income increase decrease from 2018 to 2019 and 2019 to 2020? Use the amounts labeled only "Net income (loss)". State answers in dollars not percentages. Show calculations and state whether it is an increase or decrease for the respective years 16) Based only on your view of the income statement, what appears to be the cause of the volatility in Net Income? 17) What is the largest expense on the income statement for the current year? Provide name of the account and amount Balance Sheet (Consolidated Balance Sheets): 18) How much cash and cash equivalents did the company have at the end of the current year? 19) By how much did cash increase or decrease from the prior year? 20) Compute the working capital at the current year-end provide the calculation 21) Compute the current ratio at the current year-end Round to two decimal places and provide the calculation 22) Will the company be able to pay its current liabilities? Explain 23) Compute the company's inventory tumover for Fiscal 2020 Provide the calculation and round to two decimal places Note Cost of Cost of good sold 24) Compute the debt-to-equity ratio at the end of Fiscal 2020 Provide the calculation and round to two decimal places. Note You will have to calculate total abilities W hp Ta DE C 9 OV 7 8 O P R T enter two decimal places. Note: "Cost of sales" Cost of good sold, 24) Compute the debt-to-equity ratio at the end of Fiscal 2020. Provide the calculation and round to two decimal places. Note: You will have to calculate total liabilities, Statement of Cash Flows (Consolidated Statement of Cash Flows): 25) Which activity (operating, investing, or financing) provided the most cash flow in 20207 What was the amount? 26) Which activity (operating, investing, or financing) used the most cash flow in 2020? What was the amount? Note 1 (Organization and summary of Significant Accounting Policies): 27) What inventory valuation method does the company use (full descriptiony? Note: This will not be exactly like the methods we leamed in class 28) What depreciation method is used for its Property and Equipment? 29) When does the company recognize revenue from sales of their goods and service? Conclusion: 30) Based only on the information from this financial statement project, what is your opinion of the financial strength of the company? Why? w CH 0 TIR ES & 7 C 9 > O 8 5 6 T Report of Independent Registered Public Accounting Firm To the Shareholders and Board of Directors Macy's, Inc Opinions on the Consolidated Financial Statements and internal Control Over Financial Reporting We have audited the accompanying consolidated balance sheets of Macy's, Inc and subsidiaries (the Company) as of January 30, 2021 and February 1, 2020, the related consolidated statements of operations, comprehensive income (loss), changes in shareholders' equity, and cash flows for each of the years in the three-year period ended January 30, 2021 and the related notes (collectively, the consolidated financial statements) We also have audited the Company's internal control over financial reporting as of January 30, 2021, based on criteria established in Internal Control - Integrated Framcork (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of the Company as of January 30, 2021 and February 1, 2020, and the results of its operations and its cash flows for each of the years in the three-year period ended January 30, 2021, in conformity with U.S. generally accepted accounting principles. Also in our opinion, the Company maintained in all material respects, effective internal control over financial reporting as of January 30, 2021 based on criteria established in Internal Control - Integrated Pramovork 2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission Change in Accounting Protetple As discussed in Note to the consolidated financial statements, the Company changed its method of accounting for leases 23 of February 3, 2019 due to the adoption of Accounting Standards Codification Topic 842. Leases Basis for Opinios The Company's management is responsible for these consolidated financial statements, for maintaining effective internal control over financial reporting, and for its assessment of the effectiveness of internal control over financial reporting included in the accompanying 9A(b). "Management's Annual Report on Internal Control over Financial Reporting Out responsibility is to express an opinion on the Company's consolidated financial statements and an opinion on the Company internal control over financial reporting based on our suditi We are a public accountint firm renistered with the Public 66114 w hop D AO 6 un 1 O R E K J L G H M N B c X EM responsibility is to express an opinion on the Company's consolidated financial statements and an opinion on the Company's internal control over financial reporting based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud, and whether effective internal control over financial reporting was maintained in all material respects Our audits of the consolidated financial statements included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. Our audit of internal control over financial reporting included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of interal control based on the assessed risk. Our audits also included performing such other procedures as we considered necessary in the circumstances. We believe that our audits provide a reascuable basis for our opinions. Debution and Limitations of Internal Control Over Financial Reporting A company's internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles A company's internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the company (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and 3 56114 w hp no 9 ch . > 0 96 9 7 B 5 P R T G H TI D expenditures of the company are being made only in accordance with authorizations of management and directors of the company, and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company's assets that could have a material effect on the financial statements Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate Critical Audit Matters The critical audit matters communicated below are matters arising from the current period audit of the consolidated financial statements that were communicated or required to be communicated to the audit committee and that (1) relate to accounts or disclosures that are material to the consolidated financial statements and (2) involved our especially challenging, s