Answered step by step

Verified Expert Solution

Question

1 Approved Answer

COVID 19, an accounting firm, provides consulting and tax planning services. For many years, the firm's total administrative cost (currently $270,000) has been allocated to

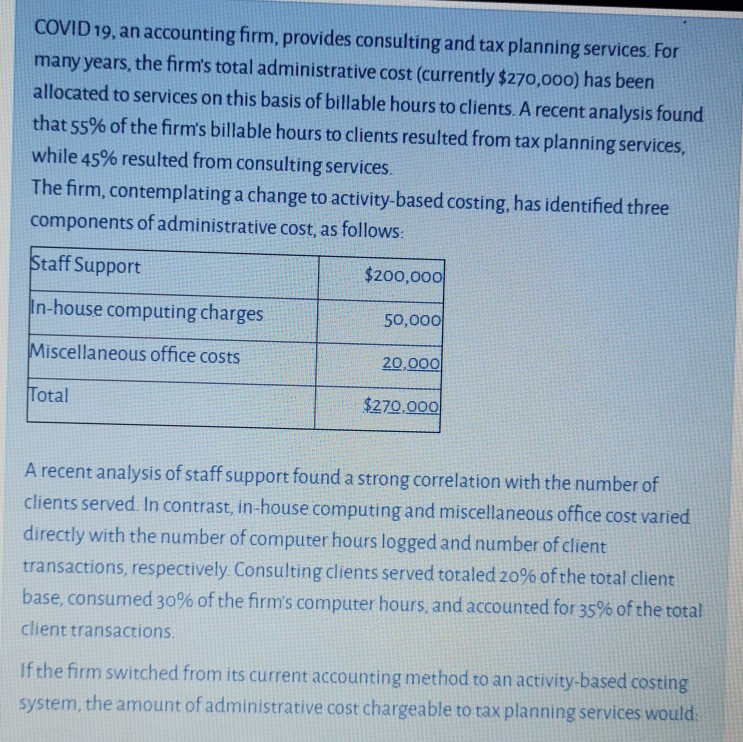

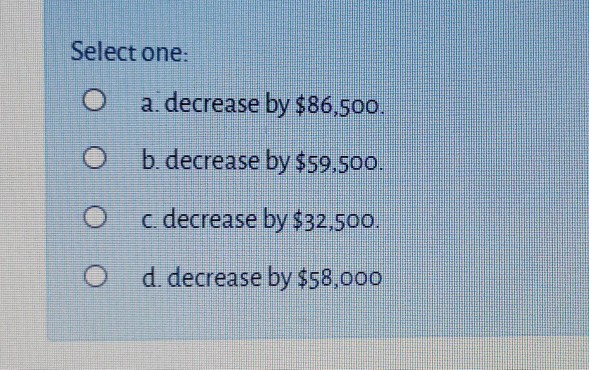

COVID 19, an accounting firm, provides consulting and tax planning services. For many years, the firm's total administrative cost (currently $270,000) has been allocated to services on this basis of billable hours to clients. A recent analysis found that 55% of the firm's billable hours to clients resulted from tax planning services, while 45% resulted from consulting services. The firm, contemplating a change to activity-based costing, has identified three components of administrative cost, as follows: Staff Support $200,000 In-house computing charges 50,000 Miscellaneous office costs 20,000 Total $270,000 A recent analysis of staff support found a strong correlation with the number of clients served. In contrast, in-house computing and miscellaneous office cost varied directly with the number of computer hours logged and number of client transactions, respectively. Consulting clients served totaled 20% of the total client base, consumed 30% of the firm's computer hours, and accounted for 35% of the total client transactions If the firm switched from its current accounting method to an activity-based costing system, the amount of administrative cost chargeable to tax planning services would: Select one: a. decrease by $86,500. b. decrease by $59.500. c. decrease by $32,500. d. decrease by $58,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started