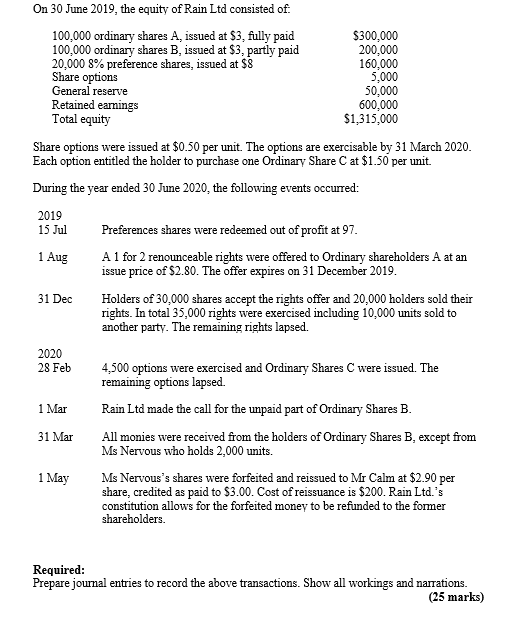

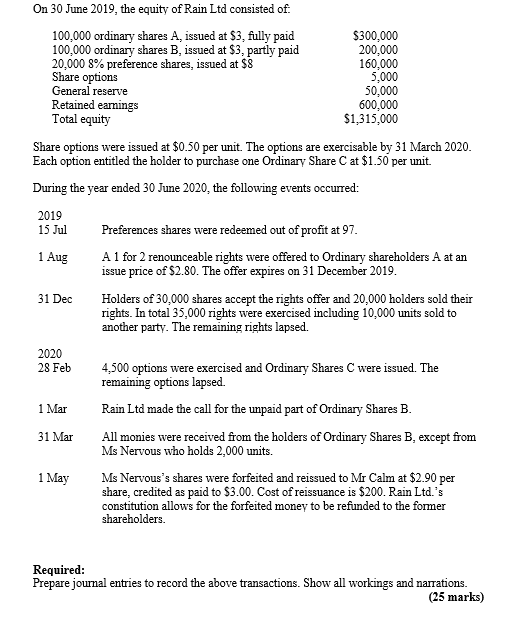

On 30 June 2019, the equity of Rain Ltd consisted of. 100.000 ordinary shares A issued at $3, fully paid $300,000 100,000 ordinary shares B, issued at $3, partly paid 200,000 20,000 8% preference shares, issued at $8 160,000 Share options 5,000 General reserve 50,000 Retained earnings 600,000 Total equity $1,315,000 Share options were issued at $0.50 per unit. The options are exercisable by 31 March 2020. Each option entitled the holder to purchase one Ordinary Share Cat $1.50 per unit. During the year ended 30 June 2020. the following events occurred: 2019 15 Jul 1 Aug Preferences shares were redeemed out of profit at 97. A 1 for 2 renounceable rights were offered to Ordinary shareholders A at an issue price of $2.80. The offer expires on 31 December 2019. Holders of 30,000 shares accept the rights offer and 20,000 holders sold their rights. In total 35,000 rights were exercised including 10,000 units sold to another party. The remaining rights lapsed. 31 Dec 2020 28 Feb 1 Mar 31 Mar 4.500 options were exercised and Ordinary Shares were issued. The remaining options lapsed. Rain Ltd made the call for the unpaid part of Ordinary Shares B. All monies were received from the holders of Ordinary Shares B, except from Ms Nervous who holds 2,000 units. Ms Nervous's shares were forfeited and reissued to Mr Calm at $2.90 per share, credited as paid to $3.00. Cost of reissuance is $200. Rain Ltd.'s constitution allows for the forfeited money to be refunded to the former shareholders. 1 May Required: Prepare journal entries to record the above transactions. Show all workings and narrations. (25 marks) On 30 June 2019, the equity of Rain Ltd consisted of. 100.000 ordinary shares A issued at $3, fully paid $300,000 100,000 ordinary shares B, issued at $3, partly paid 200,000 20,000 8% preference shares, issued at $8 160,000 Share options 5,000 General reserve 50,000 Retained earnings 600,000 Total equity $1,315,000 Share options were issued at $0.50 per unit. The options are exercisable by 31 March 2020. Each option entitled the holder to purchase one Ordinary Share Cat $1.50 per unit. During the year ended 30 June 2020. the following events occurred: 2019 15 Jul 1 Aug Preferences shares were redeemed out of profit at 97. A 1 for 2 renounceable rights were offered to Ordinary shareholders A at an issue price of $2.80. The offer expires on 31 December 2019. Holders of 30,000 shares accept the rights offer and 20,000 holders sold their rights. In total 35,000 rights were exercised including 10,000 units sold to another party. The remaining rights lapsed. 31 Dec 2020 28 Feb 1 Mar 31 Mar 4.500 options were exercised and Ordinary Shares were issued. The remaining options lapsed. Rain Ltd made the call for the unpaid part of Ordinary Shares B. All monies were received from the holders of Ordinary Shares B, except from Ms Nervous who holds 2,000 units. Ms Nervous's shares were forfeited and reissued to Mr Calm at $2.90 per share, credited as paid to $3.00. Cost of reissuance is $200. Rain Ltd.'s constitution allows for the forfeited money to be refunded to the former shareholders. 1 May Required: Prepare journal entries to record the above transactions. Show all workings and narrations. (25 marks)