Question

Coxon plc is a company listed on the London Stock Exchange. The following trial has been extracted from the firms accounting records at 31 December

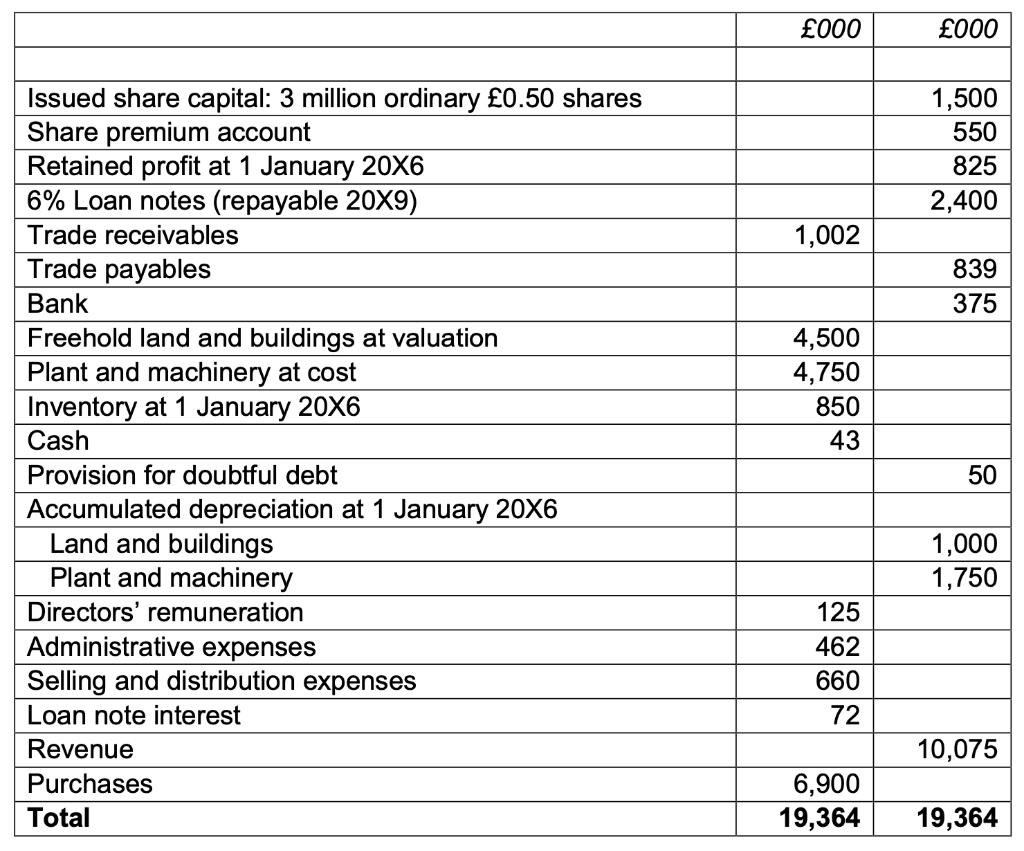

Coxon plc is a company listed on the London Stock Exchange. The following trial has been extracted from the firm’s accounting records at 31 December 20X6:

The following additional information was available at 31 December 20X6: i. Inventory at 31 December 20X6 was valued at £900,000.

Depreciation of land and buildings for 20X6 is to be provided at £100,000.

Depreciation on plant and machinery is to be provided at 20% on cost using the straight line method.

A debt of £2,000 will not be recovered and needs to be written off. The directors have determined that the year-end provision for doubtful debts should be £60,000.

All expenses are considered to be administrative expenses unless otherwise stated.

The following expenses, which had not been recorded in the company’s records, were unpaid at 31 December 20X6:

Administrative expenses £75,000

Selling and distribution £5,000

Insurance for the period 1 January 20X7 to 30 June 20X7 was paid in advance in December 20X6, and has been recorded in the accounting records as follows: Administrative expenses £10,000

Corporation tax based on the year’s profits is estimated to be £280,000.

The directors have announced that a dividend of 5p per ordinary share in respect of the year ended 31 December 20X6 will be paid in March 20X7.

The second instalment of the loan notes interest amounting to £72,000 will be paid in January 20X7.

Requirement:

a) Prepare an income statement for the year ended 31 December 20X6, and a

statement of financial position at that date for Coxon plc. (All calculations should be made to the nearest £000).

b) Identify and describe two accounting conventions and explain how they have been applied in the Income Statement and Statement of Financial Position for Coxon plc.

Issued share capital: 3 million ordinary 0.50 shares Share premium account Retained profit at 1 January 20X6 6% Loan notes (repayable 20X9) Trade receivables Trade payables Bank Freehold land and buildings at valuation Plant and machinery at cost Inventory at 1 January 20X6 Cash Provision for doubtful debt Accumulated depreciation at 1 January 20X6 Land and buildings Plant and machinery Directors' remuneration Administrative expenses Selling and distribution expenses Loan note interest Revenue Purchases Total 000 1,002 4,500 4,750 850 43 125 462 660 72 6,900 19,364 000 1,500 550 825 2,400 839 375 50 1,000 1,750 10,075 19,364

Step by Step Solution

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Income Statement To Opening inventory To Purchases To Gross profit To Depre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started