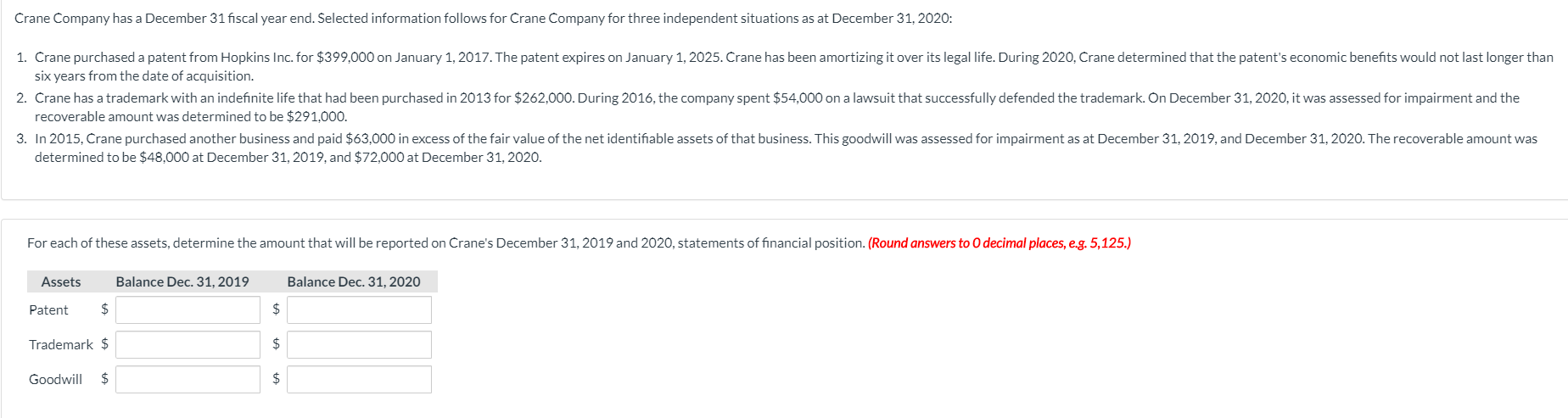

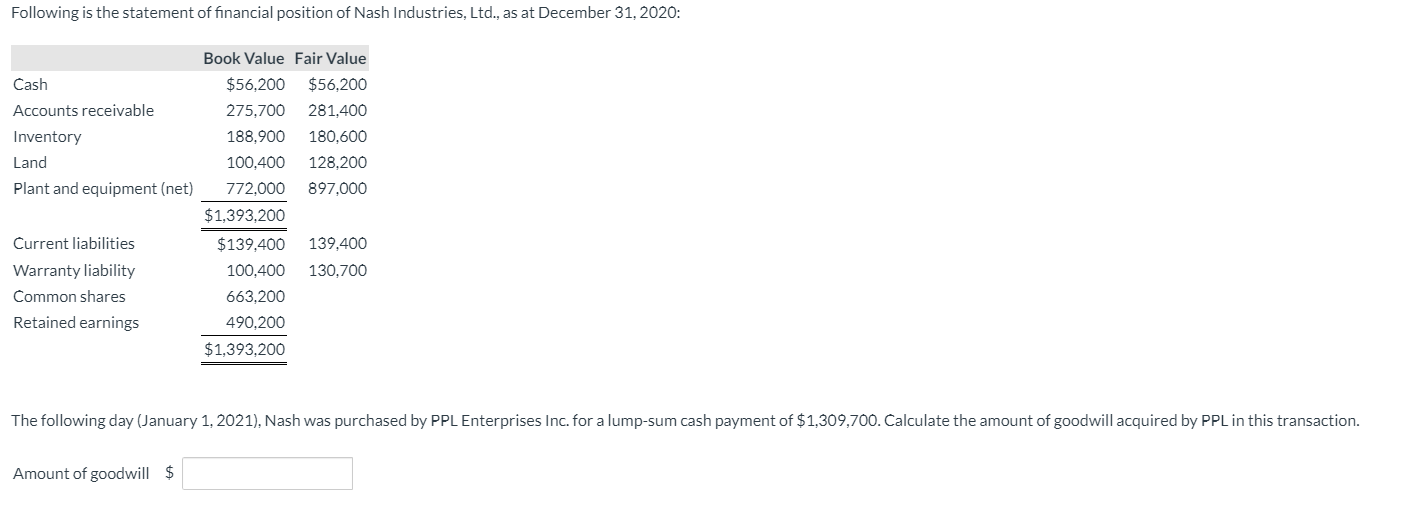

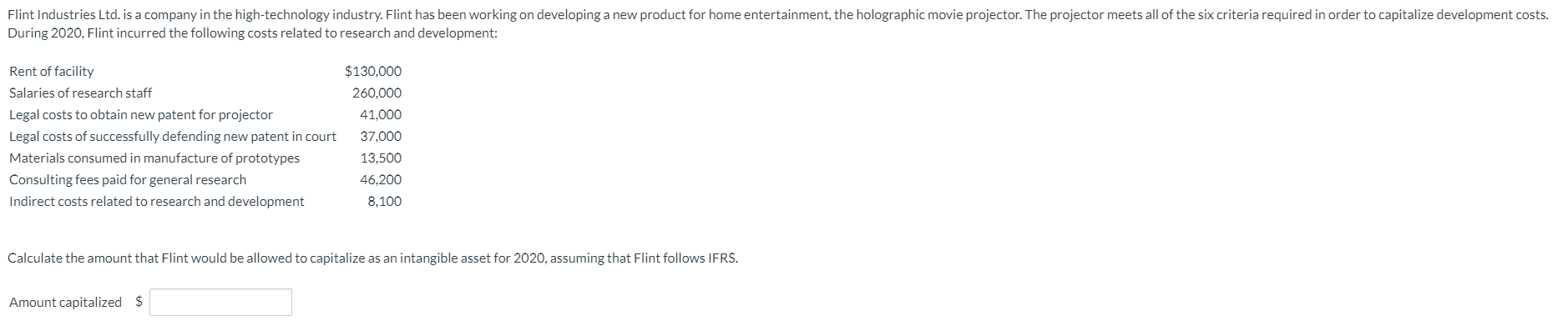

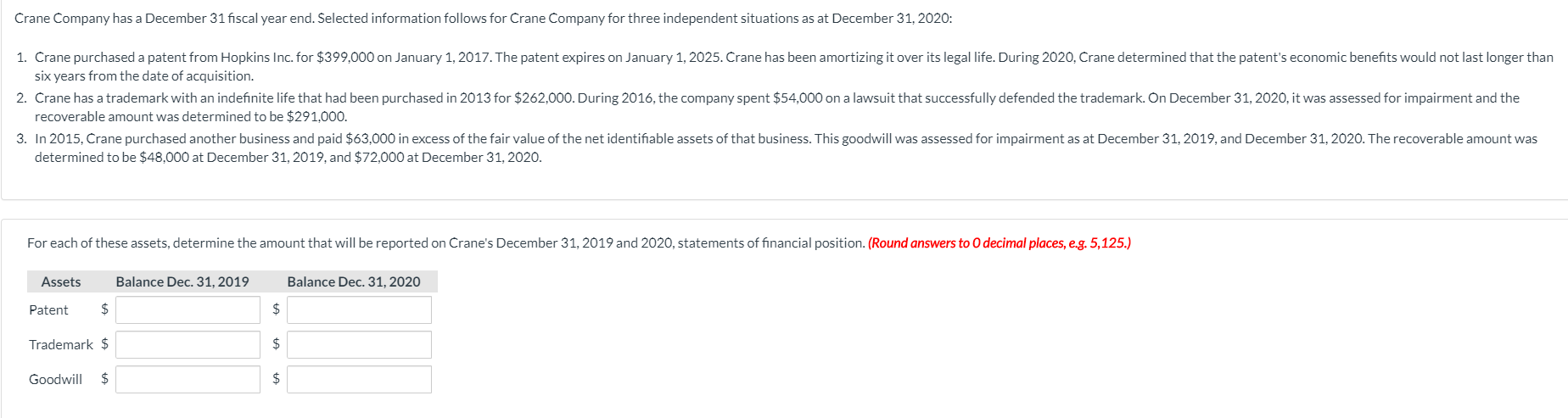

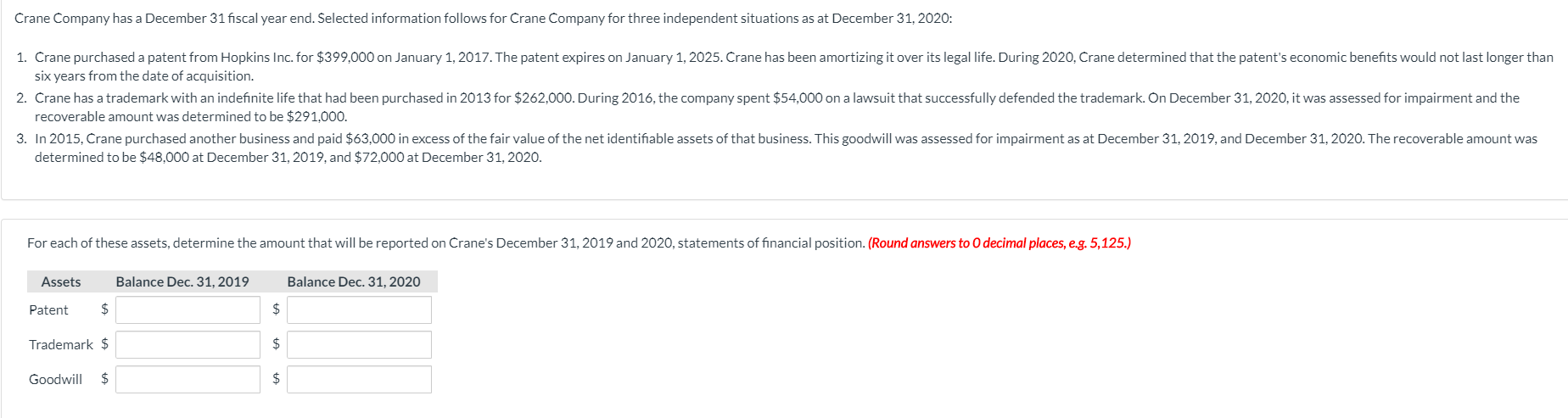

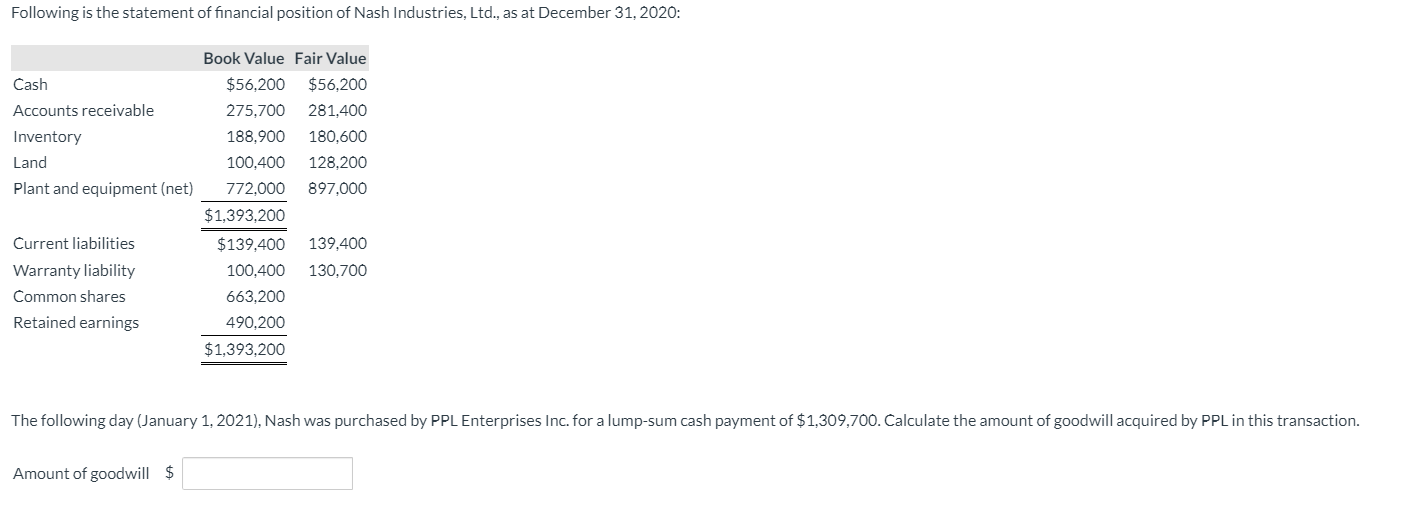

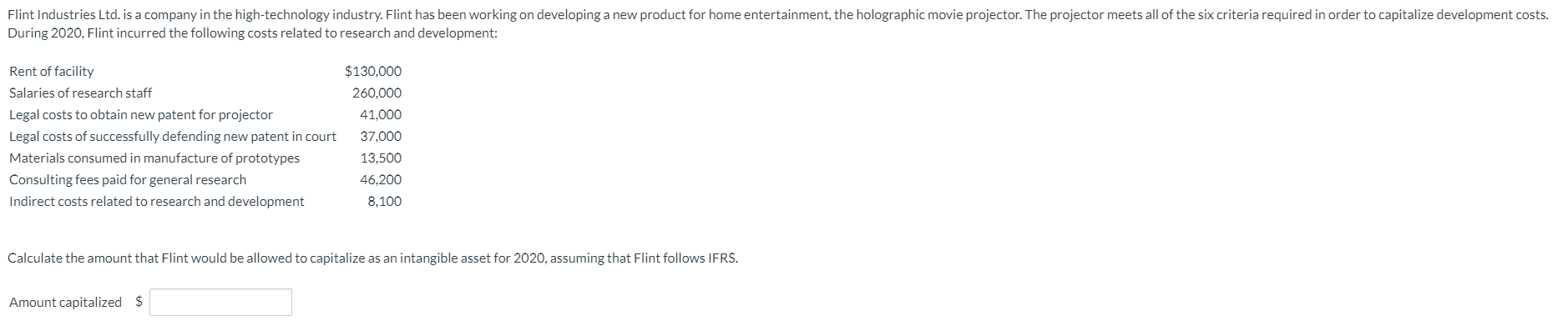

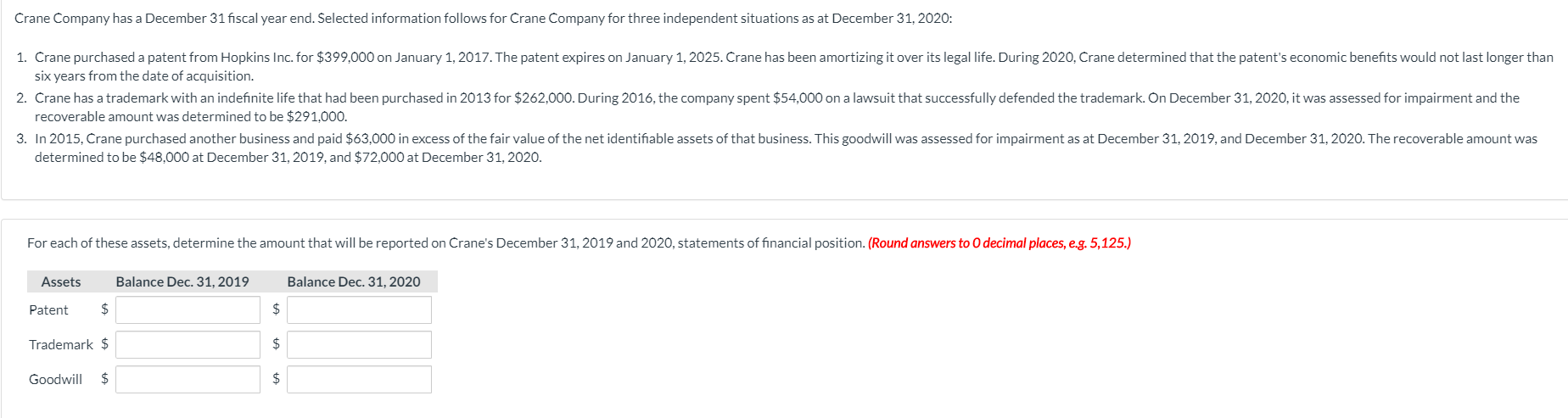

Crane Company has a December 31 fiscal year end. Selected information follows for Crane Company for three independent situations as at December 31, 2020: 1. Crane purchased a patent from Hopkins Inc. for $399,000 on January 1, 2017. The patent expires on January 1, 2025. Crane has been amortizing it over its legal life. During 2020, Crane determined that the patent's economic benefits would not last longer than six years from the date of acquisition. 2. Crane has a trademark with an indefinite life that had been purchased in 2013 for $262.000. During 2016, the company spent $54,000 on a lawsuit that successfully defended the trademark. On December 31, 2020, it was assessed for impairment and the recoverable amount was determined to be $291.000. 3. In 2015, Crane purchased another business and paid $63,000 in excess of the fair value of the net identifiable assets of that business. This goodwill was assessed for impairment as at December 31, 2019, and December 31, 2020. The recoverable amount was determined to be $48,000 at December 31, 2019, and $72,000 at December 31, 2020. For each of these assets, determine the amount that will be reported on Crane's December 31, 2019 and 2020, statements of financial position. (Round answers to decimal places, e.g. 5,125.) Assets Balance Dec. 31, 2019 Balance Dec. 31, 2020 Patent $ $ Trademark $ $ Goodwill $ $ Following is the statement of financial position of Nash Industries, Ltd., as at December 31, 2020: Book Value Fair Value Cash $56,200 $56,200 Accounts receivable 275,700 281,400 Inventory 188,900 180,600 Land 100,400 128.200 Plant and equipment (net) 772.000 897,000 $1,393,200 Current liabilities $139.400 139,400 Warranty liability 100,400 130.700 Common shares 663.200 Retained earnings 490.200 $1,393,200 The following day (January 1, 2021), Nash was purchased by PPL Enterprises Inc. for a lump-sum cash payment of $1,309,700. Calculate the amount of goodwill acquired by PPL in this transaction. Amount of goodwill $ Flint Industries Ltd. is a company in the high-technology industry. Flint has been working on developing a new product for home entertainment, the holographic movie projector. The projector meets all of the six criteria required in order to capitalize development costs. During 2020, Flint incurred the following costs related to research and development: Rent of facility Salaries of research staff Legal costs to obtain new patent for projector Legal costs of successfully defending new patent in court Materials consumed in manufacture of prototypes Consulting fees paid for general research Indirect costs related to research and development $130.000 260.000 41,000 37,000 13.500 46,200 8.100 Calculate the amount that Flint would be allowed to capitalize as an intangible asset for 2020, assuming that Flint follows IFRS. Amount capitalized $ Crane Company has a December 31 fiscal year end. Selected information follows for Crane Company for three independent situations as at December 31, 2020: 1. Crane purchased a patent from Hopkins Inc. for $399,000 on January 1, 2017. The patent expires on January 1, 2025. Crane has been amortizing it over its legal life. During 2020, Crane determined that the patent's economic benefits would not last longer than six years from the date of acquisition. 2. Crane has a trademark with an indefinite life that had been purchased in 2013 for $262.000. During 2016, the company spent $54,000 on a lawsuit that successfully defended the trademark. On December 31, 2020, it was assessed for impairment and the recoverable amount was determined to be $291.000. 3. In 2015, Crane purchased another business and paid $63,000 in excess of the fair value of the net identifiable assets of that business. This goodwill was assessed for impairment as at December 31, 2019, and December 31, 2020. The recoverable amount was determined to be $48,000 at December 31, 2019, and $72,000 at December 31, 2020. For each of these assets, determine the amount that will be reported on Crane's December 31, 2019 and 2020, statements of financial position. (Round answers to decimal places, e.g. 5,125.) Assets Balance Dec. 31, 2019 Balance Dec. 31, 2020 Patent $ $ Trademark $ $ Goodwill $ $