Answered step by step

Verified Expert Solution

Question

1 Approved Answer

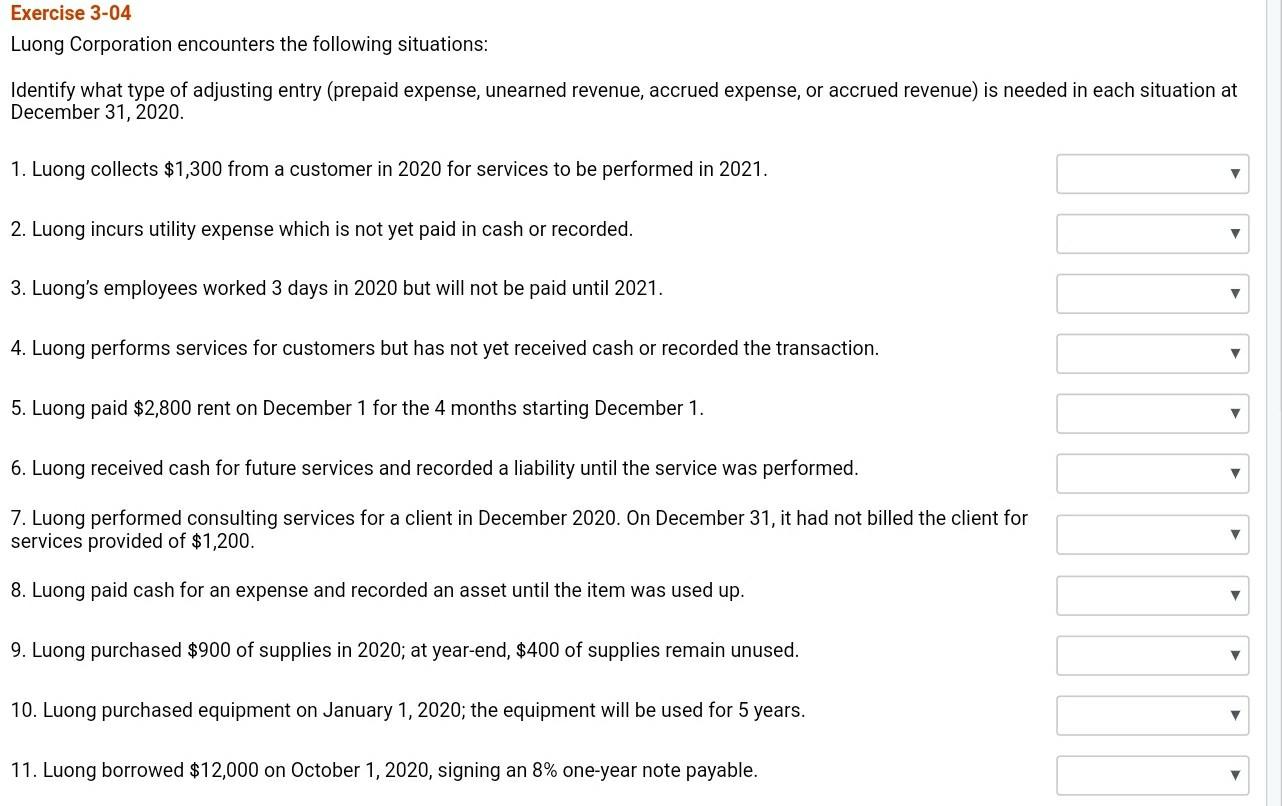

Excel format for answer, please Exercise 3-04 Luong Corporation encounters the following situations: Identify what type of adjusting entry (prepaid expense, unearned revenue, accrued expense,

Excel format for answer, please

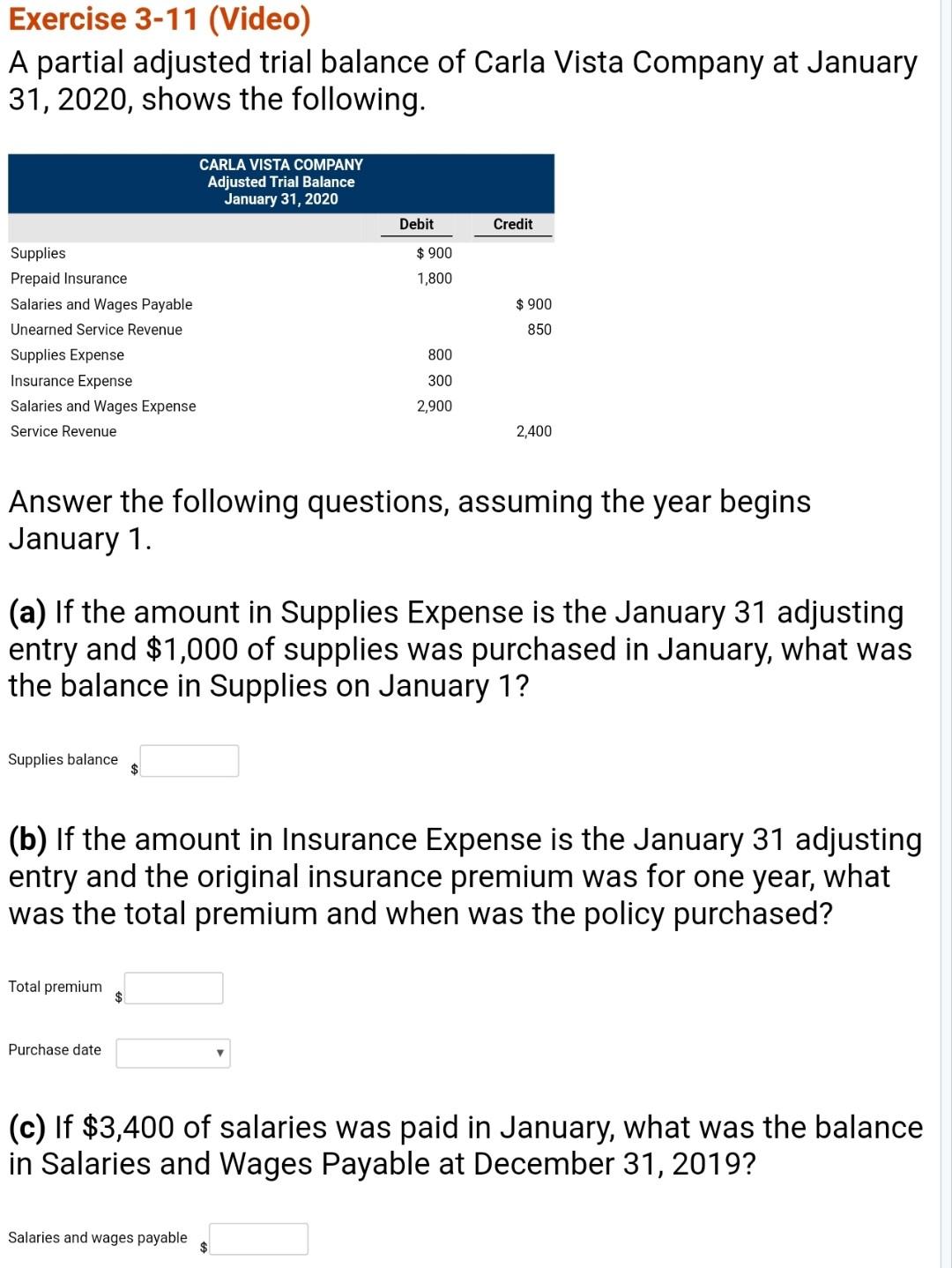

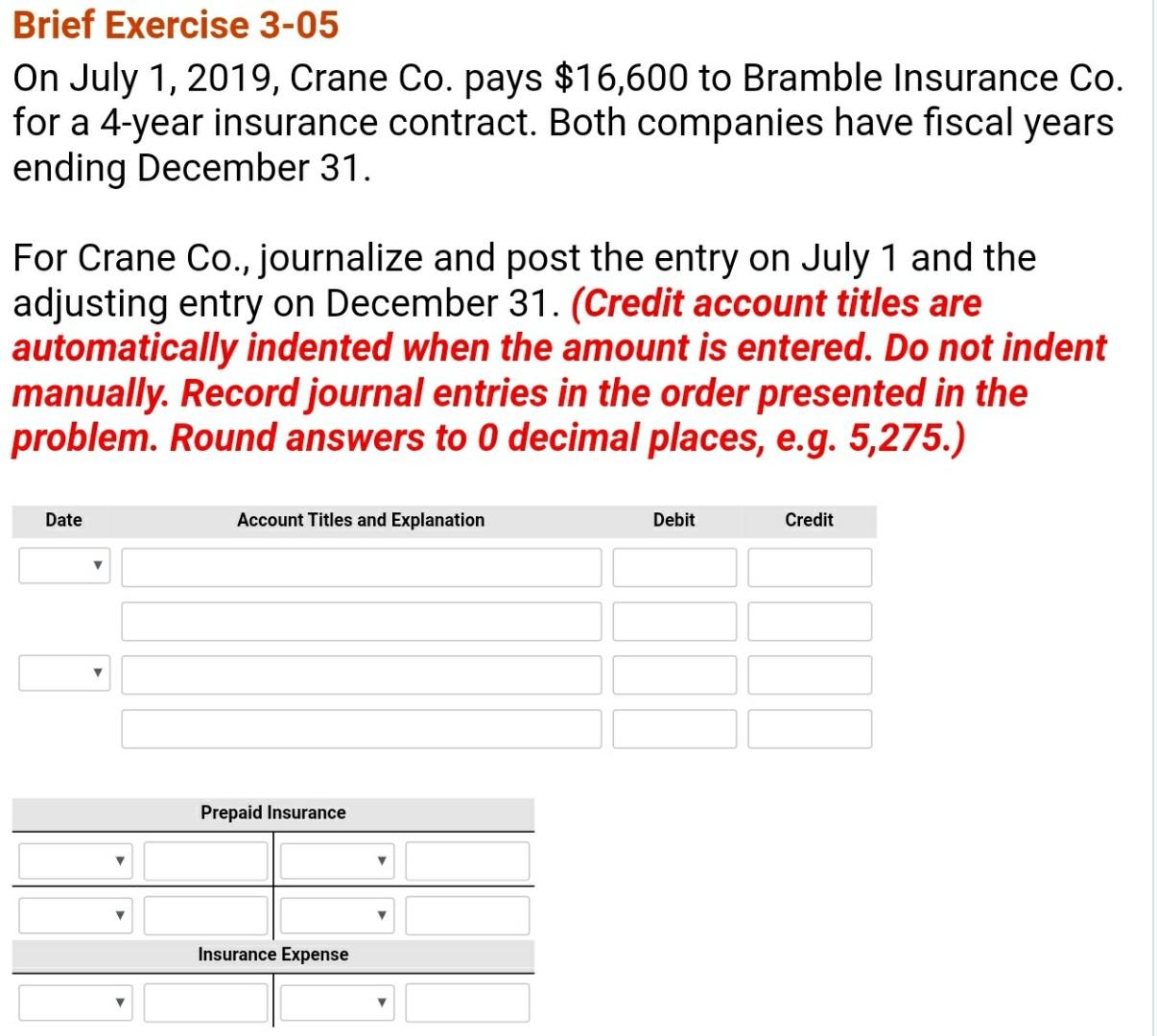

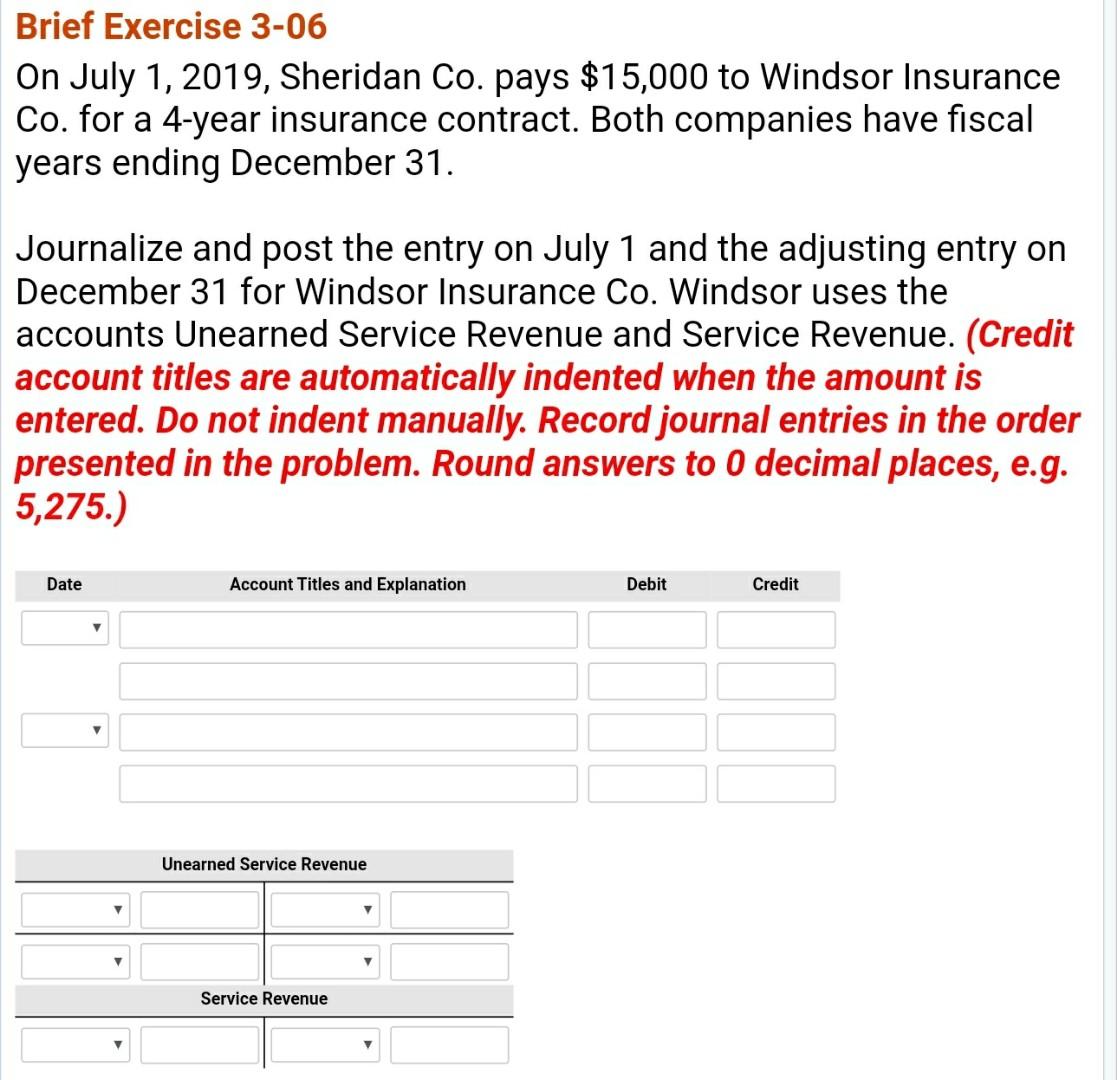

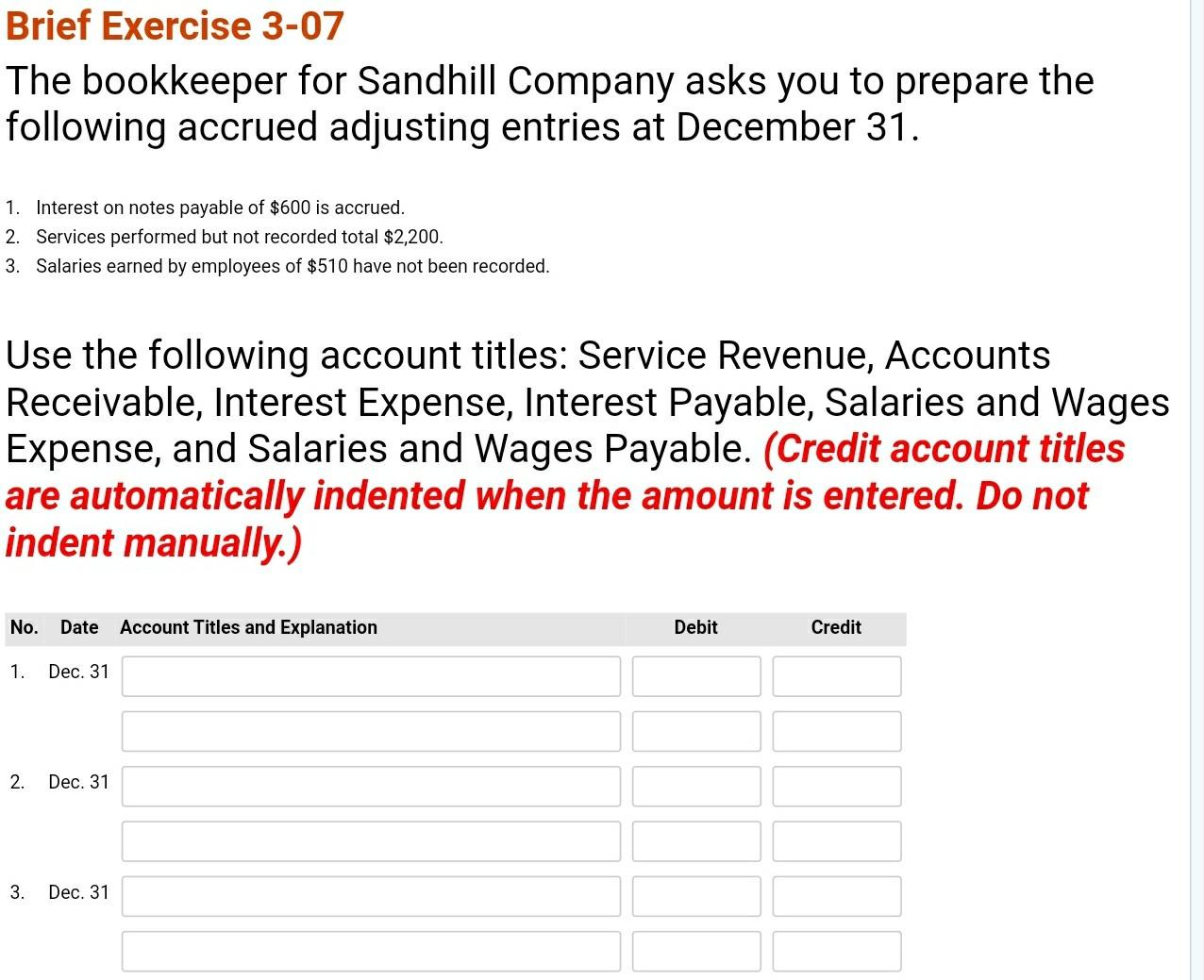

Exercise 3-04 Luong Corporation encounters the following situations: Identify what type of adjusting entry (prepaid expense, unearned revenue, accrued expense, or accrued revenue) is needed in each situation at December 31, 2020. 1. Luong collects $1,300 from a customer in 2020 for services to be performed in 2021. 2. Luong incurs utility expense which is not yet paid in cash or recorded. 3. Luong's employees worked 3 days in 2020 but will not be paid until 2021. 4. Luong performs services for customers but has not yet received cash or recorded the transaction. 5. Luong paid $2,800 rent on December 1 for the 4 months starting December 1. V 6. Luong received cash for future services and recorded a liability until the service was performed. 7. Luong performed consulting services for a client in December 2020. On December 31, it had not billed the client for services provided of $1,200. 8. Luong paid cash for an expense and recorded an asset until the item was used up. v 9. Luong purchased $900 of supplies in 2020; at year-end, $400 of supplies remain unused. 10. Luong purchased equipment on January 1, 2020; the equipment will be used for 5 years. 11. Luong borrowed $12,000 on October 1, 2020, signing an 8% one-year note payable. Exercise 3-11 (Video) A partial adjusted trial balance of Carla Vista Company at January 31, 2020, shows the following. CARLA VISTA COMPANY Adjusted Trial Balance January 31, 2020 Debit Credit $ 900 1,800 $ 900 850 Supplies Prepaid Insurance Salaries and Wages Payable Unearned Service Revenue Supplies Expense Insurance Expense Salaries and Wages Expense Service Revenue 800 300 2,900 2,400 Answer the following questions, assuming the year begins January 1. (a) If the amount in Supplies Expense is the January 31 adjusting entry and $1,000 of supplies was purchased in January, what was the balance in Supplies on January 1? Supplies balance (b) If the amount in Insurance Expense is the January 31 adjusting entry and the original insurance premium was for one year, what was the total premium and when was the policy purchased? Total premium Purchase date (c) If $3,400 of salaries was paid in January, what was the balance in Salaries and Wages Payable at December 31, 2019? Salaries and wages payable Brief Exercise 3-05 On July 1, 2019, Crane Co. pays $16,600 to Bramble Insurance Co. for a 4-year insurance contract. Both companies have fiscal years ending December 31. For Crane Co., journalize and post the entry on July 1 and the adjusting entry on December 31. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. Round answers to 0 decimal places, e.g. 5,275.) Date Account Titles and Explanation Debit Credit Prepaid Insurance Insurance Expense Brief Exercise 3-06 On July 1, 2019, Sheridan Co. pays $15,000 to Windsor Insurance Co. for a 4-year insurance contract. Both companies have fiscal years ending December 31. Journalize and post the entry on July 1 and the adjusting entry on December 31 for Windsor Insurance Co. Windsor uses the accounts Unearned Service Revenue and Service Revenue. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. Round answers to 0 decimal places, e.g. 5,275.) Date Account Titles and Explanation Debit Credit Unearned Service Revenue Service Revenue Brief Exercise 3-07 The bookkeeper for Sandhill Company asks you to prepare the following accrued adjusting entries at December 31. 1. Interest on notes payable of $600 is accrued. 2. Services performed but not recorded total $2,200. 3. Salaries earned by employees of $510 have not been recorded. Use the following account titles: Service Revenue, Accounts Receivable, Interest Expense, Interest Payable, Salaries and Wages Expense, and Salaries and Wages Payable. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) No. Date Account Titles and Explanation Debit Credit 1. Dec. 31 2. Dec. 31 3. Dec. 31Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started