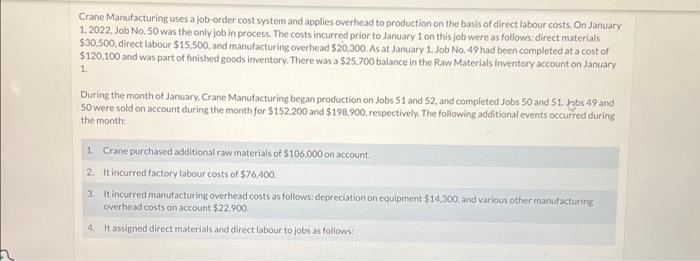

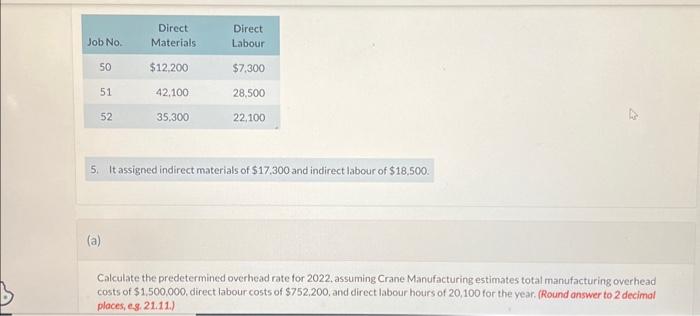

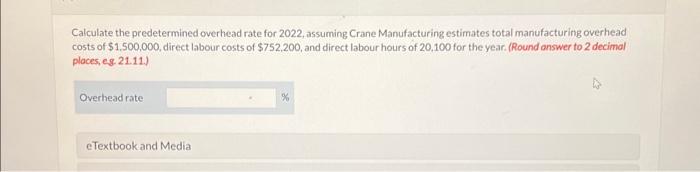

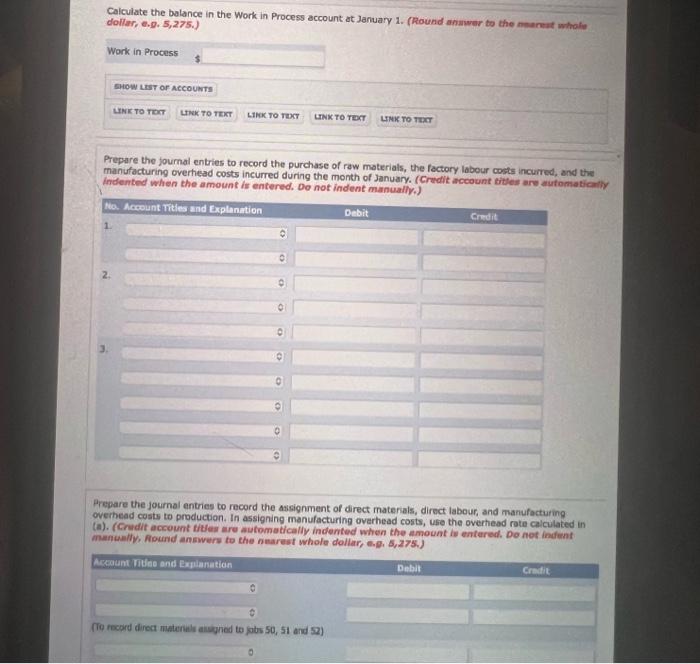

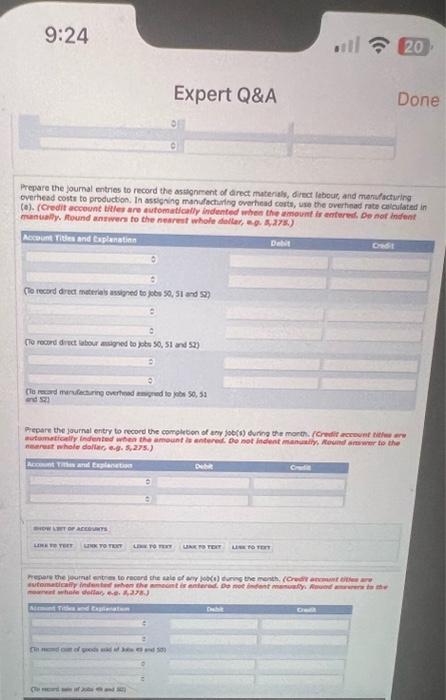

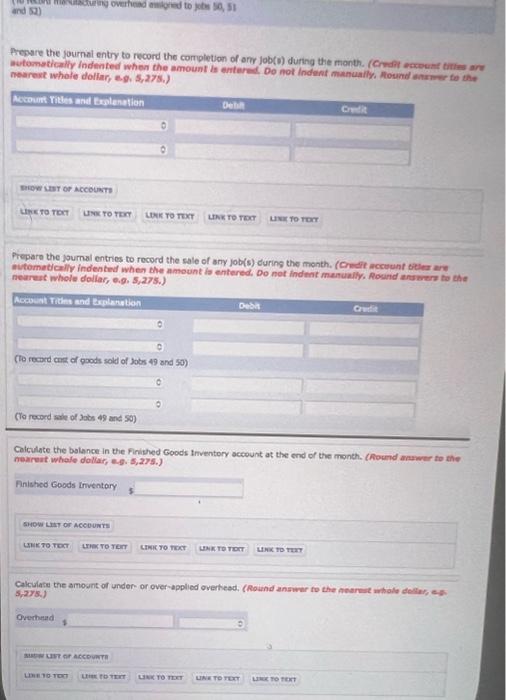

Crane Manufacturing uses a job-order cost system and applles overhead to production on the basis of direct labour costs. On January 1, 2022, Job No, 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows direct materials $30,500, direct labour $15,500, and manufacturing overhead $20,300. As at January 1 . Job No, 49 had been completed at a cost of $120,100 and was part of finished goods imentory. There was a $25,700 balance in the Raw Materials Inventory account on January 1. During the month of January. Crane Manufacturing began production on Jobs 51 and 52 , and completed Jobs 50 and 51 . Jabs 49 and 50 were sold on account during the month for $152,200 and $198,900, respectively. The following additional events occurred during the month: 5. It assigned indirect materials of $17,300 and indirect labour of $18,500. (a) Calculate the predetermined overhead rate for 2022, assuming Crane Manufacturing estimates total manufacturing overhead costs of $1.500,000, direct labour costs of $752,200, and direct labour hours of 20,100 for the year, (Round answer to 2 decimal places, eg. 21.11.) Calculate the predetermined overhead rate for 2022, assuming Crane Manufacturing estimates total manufacturing overhead costs of $1,500,000, direct labour costs of $752,200, and direct labour hours of 20,100 for the year. (Round answer to 2 decimal places,eg.21.11.) Calculate the bolance in the Work in Process account at January 1. (Round anmwer to the nament whofe dollar, 6.9,5,275. Prepare the fournal entries to record the purchase of raw materials, the factory labour costs incumed, and the manufacturing overhead costs incurred during the month of January. (Credit account bittes are autometicathy indented when the amount it entered, Do not indent manually.) Prepare the journal entries to record the assignment of direct materials, direct labour, and manufacturing overhead costs to production. In assigning manufacturing overhead costs, ufe the overhead rote calculated in (a). (Crudit account tites are autometically indented when the amount is entered. De net indent. manoulfy, fourd amswers to the nmarest shole dollar, e.g, 5,275. .) Prepare the journal entries to record the assignment of direct materibl direct lebout, and marsfacturing overhead costs to production, In assigning manufochaing ovarhead coits, uxe the overinad rate cuiculated in (e). (Credit account titler are automatteally indented whed the amoumt ir eptared be nof indent neerest whole dolitice e.s. 5,235 .) Prepsre the journal entry to record the comptetion of any job(v) during the month. ( C redit exceuar titias are automstically indented when the amount is entered Do not Indent manually, Alound anxar to the nearest whole dollar, eg. S,27s, Prepare the journal entries to record the sale of sny job(s) during the month. (Credit acceunt siller are nutometically indented when the amount is entered, Do not indent manualiy. Rocurd answers to bhe neurest whole dollar, 6.9,5,275. Calculate the balance in thie Finithed Goods tmentory sccount at the end of the month. (Aound anawer to the neareat whale dollar, a.g. 5,275 .) Finished coods inventery Cakulate the amount of under or over-applied overteed, (Round answar to the nearnst whole detle, e. (5,275