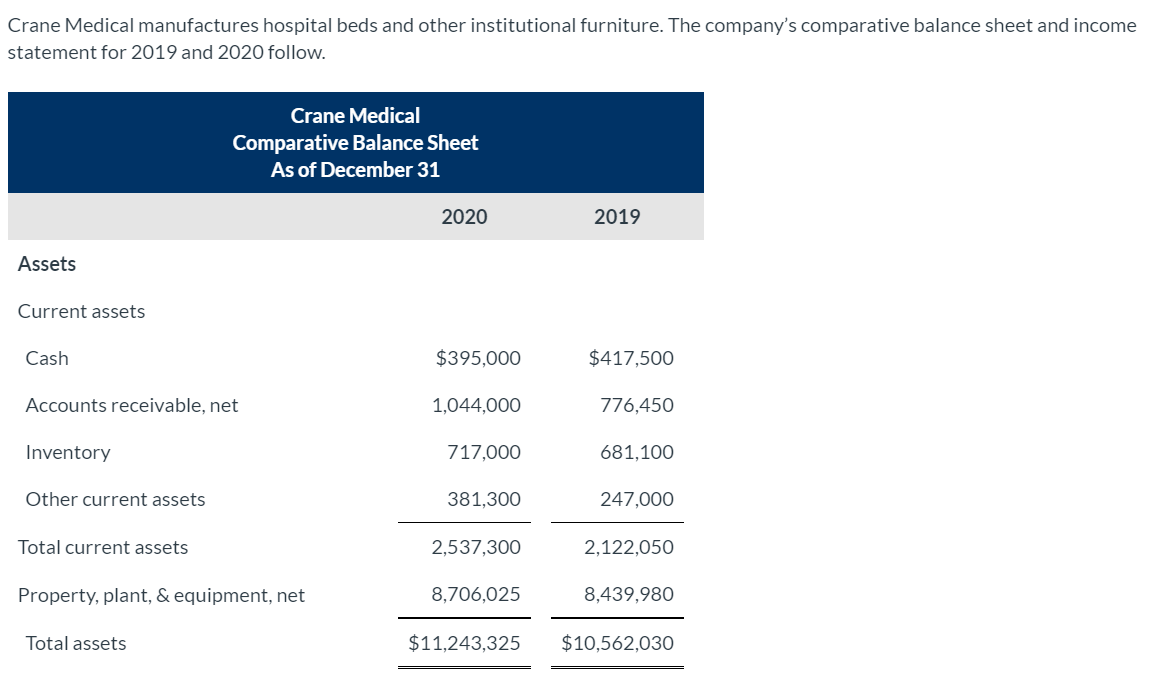

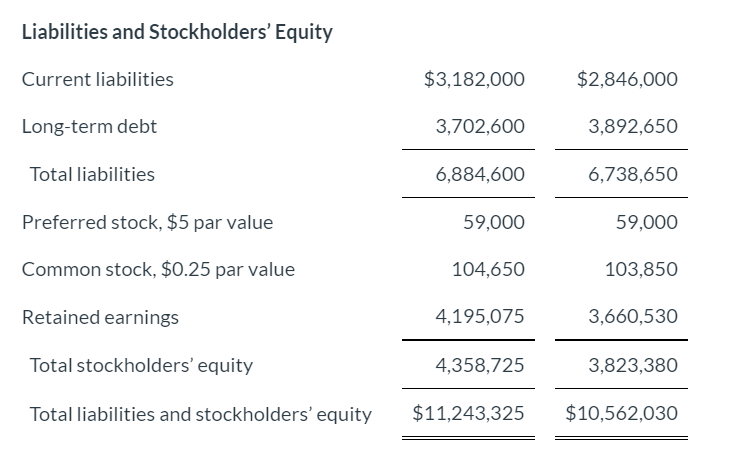

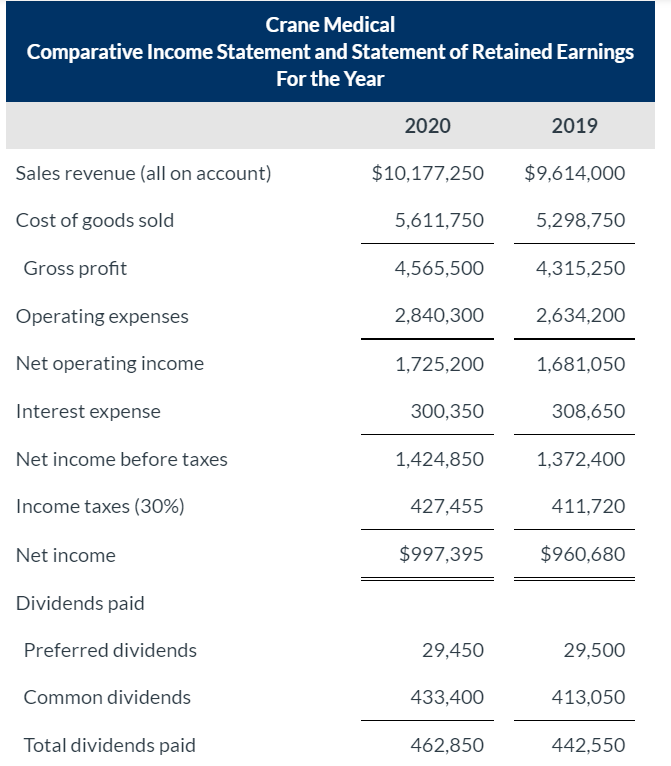

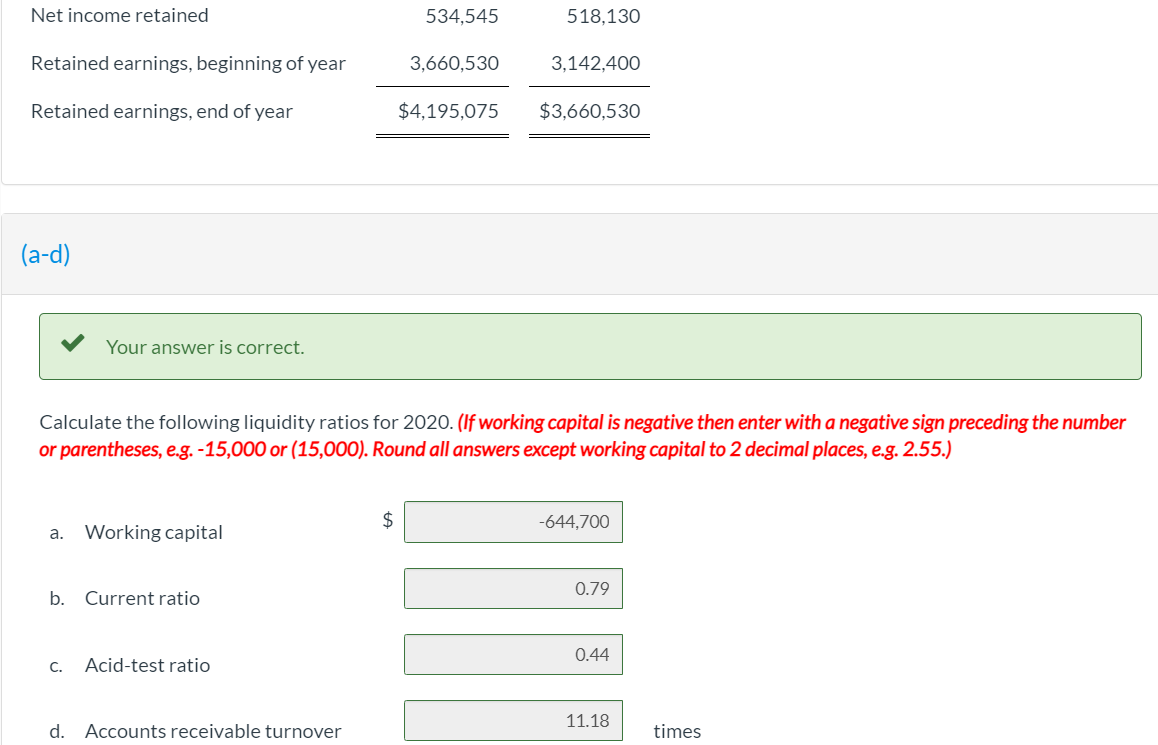

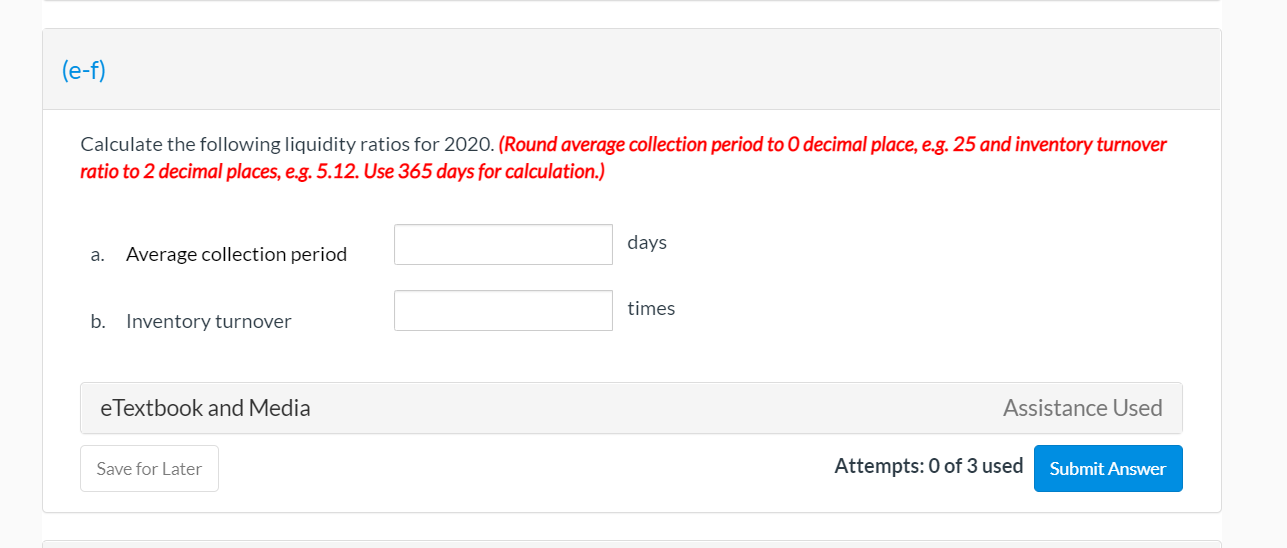

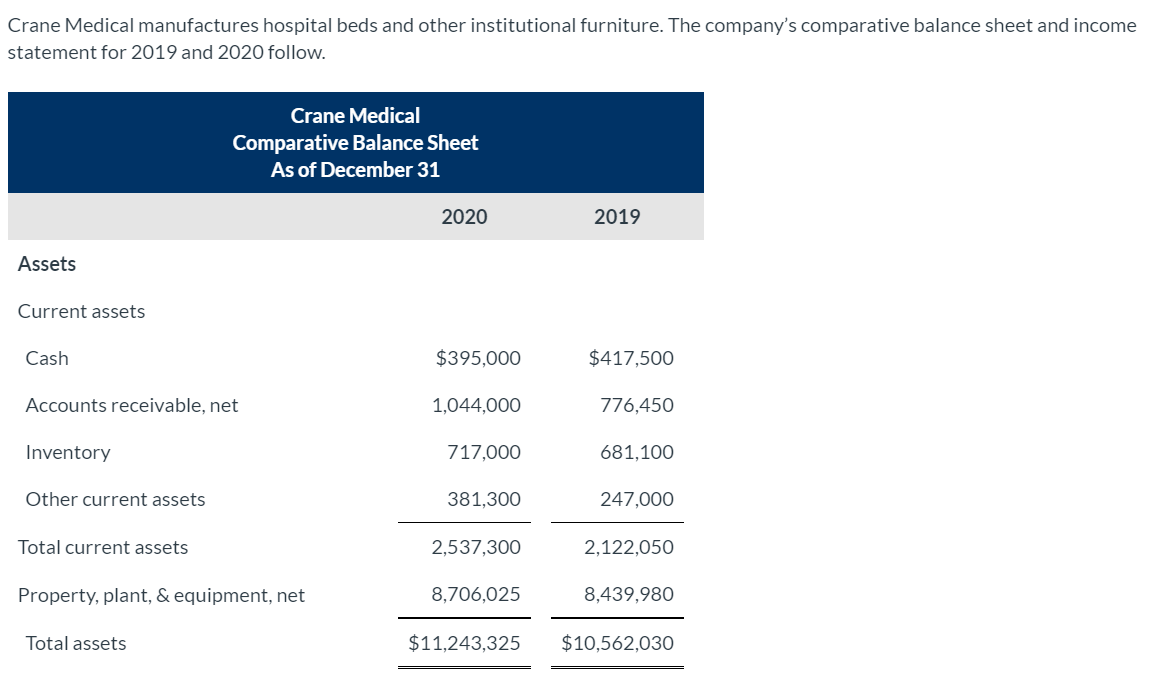

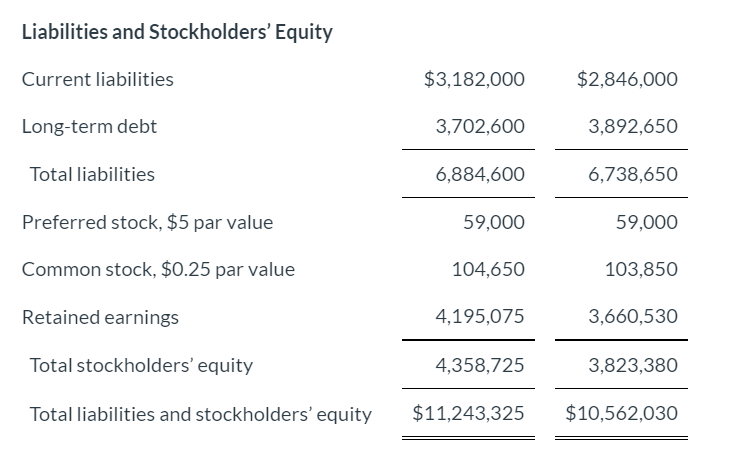

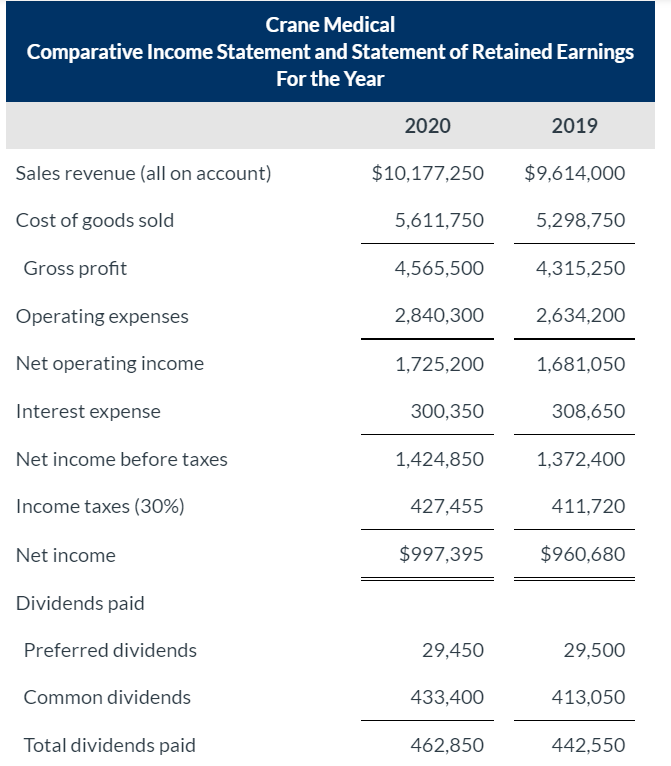

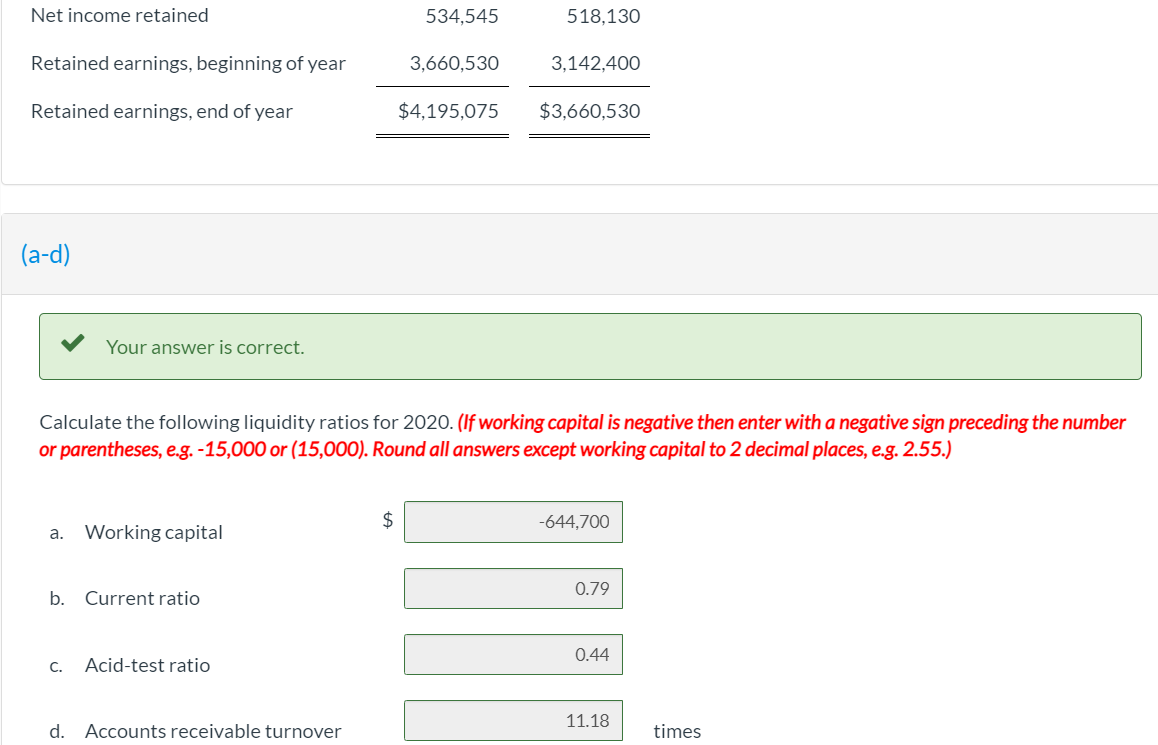

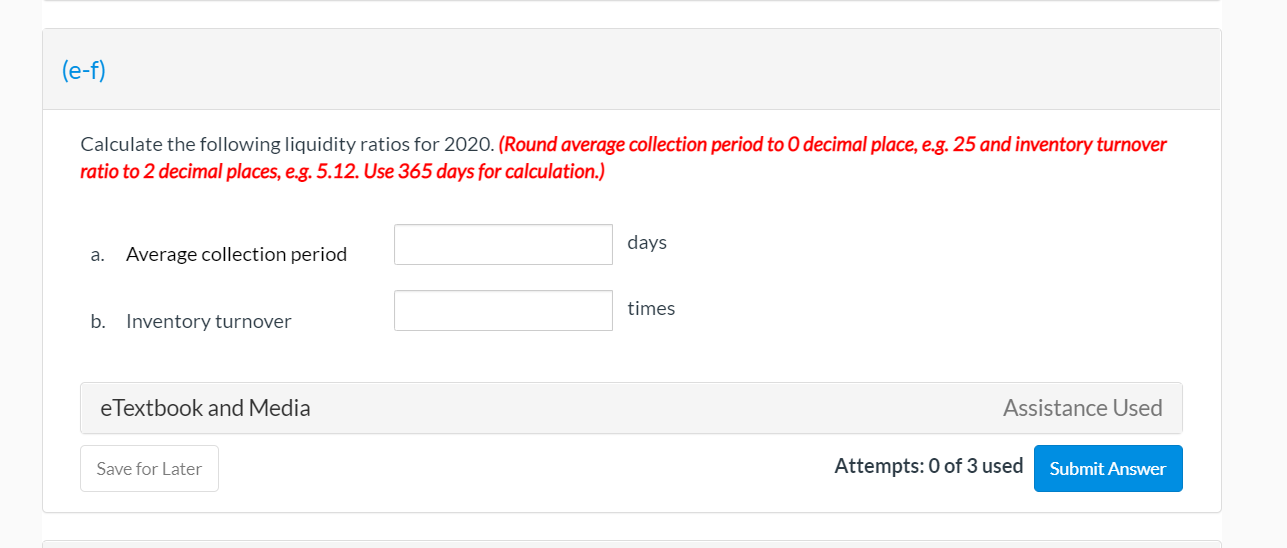

Crane Medical manufactures hospital beds and other institutional furniture. The company's comparative balance sheet and income statement for 2019 and 2020 follow. Crane Medical Comparative Balance Sheet As of December 31 2020 2019 Assets Current assets Cash $395,000 $417,500 Accounts receivable, net 1,044,000 776,450 Inventory 717,000 681,100 Other current assets 381,300 247,000 Total current assets 2,537,300 2,122,050 Property, plant, & equipment, net 8,706,025 8,439,980 Total assets $11,243,325 $10,562,030 Liabilities and Stockholders' Equity Current liabilities $3,182,000 $2,846,000 Long-term debt 3,702,600 3,892,650 Total liabilities 6,884,600 6,738,650 Preferred stock, $5 par value 59,000 59,000 Common stock, $0.25 par value 104,650 103,850 Retained earnings 4,195,075 3,660,530 Total stockholders' equity 4,358,725 3,823,380 Total liabilities and stockholders' equity $11,243,325 $10,562,030 Crane Medical Comparative Income Statement and Statement of Retained Earnings For the Year 2020 2019 Sales revenue (all on account) $10.177,250 $9,614,000 Cost of goods sold 5,611,750 5.298,750 Gross profit 4,565,500 4,315,250 Operating expenses 2,840,300 2,634,200 Net operating income 1,725,200 1,681,050 Interest expense 300,350 308,650 Net income before taxes 1,424,850 1,372,400 Income taxes (30%) 427,455 411,720 Net income $997,395 $960,680 Dividends paid Preferred dividends 29,450 29,500 Common dividends 433,400 413,050 Total dividends paid 462,850 442,550 Net income retained 534,545 518.130 Retained earnings, beginning of year 3,660,530 3,142,400 Retained earnings, end of year $4,195,075 $3.660.530 (a-d) Your answer is correct. Calculate the following liquidity ratios for 2020. (If working capital is negative then enter with a negative sign preceding the number or parentheses, e.g. -15,000 or (15,000). Round all answers except working capital to 2 decimal places, e.g. 2.55.) $ -644,700 a. Working capital 0.79 b. Current ratio 0.44 C. Acid-test ratio 11.18 d. Accounts receivable turnover times (e-f) Calculate the following liquidity ratios for 2020. (Round average collection period to 0 decimal place, e.g. 25 and inventory turnover ratio to 2 decimal places, e.g. 5.12. Use 365 days for calculation.) days a. Average collection period times b. Inventory turnover e Textbook and Media Assistance Used Save for Later Attempts: 0 of 3 used Submit