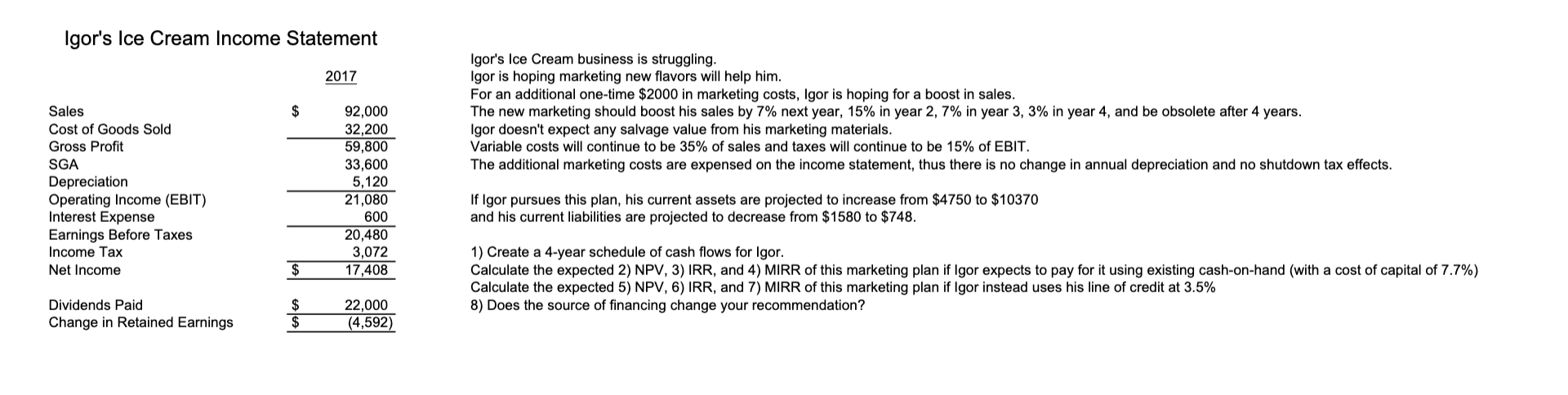

Question: - Create a 4 - year schedule of cash flows for Igor. - Calculate the expected NPV , IRR, and MIRR of this marketing plan

Create a year schedule of cash flows for Igor.

Calculate the expected NPV IRR, and MIRR of this marketing plan if Igor expects to pay for it using existing cashonhand with a cost of capital of

Calculate the expected NPV IRR, and MIRR of this marketing plan if Igor instead uses his line of credit at

Does the source of financing change your recommendation?

All the rest of the data to solve the exercise is on the picture.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock