Create a balance sheet for the given problem.

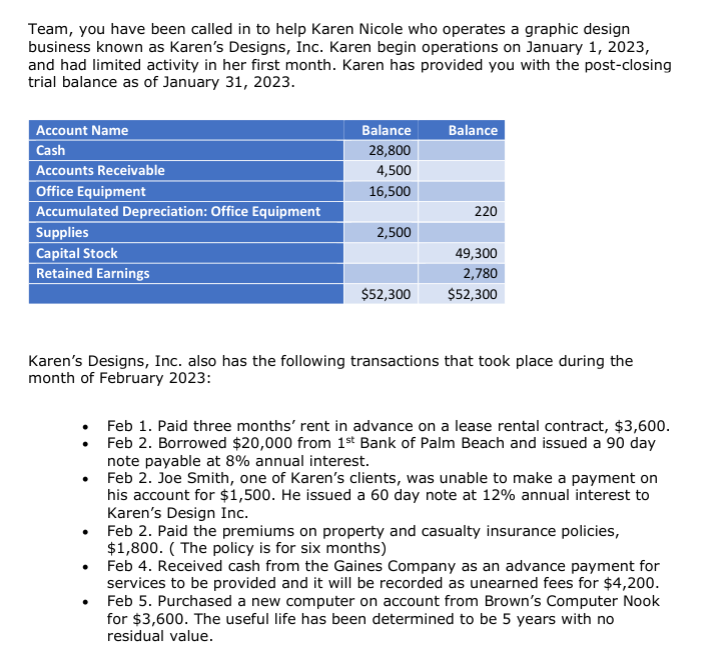

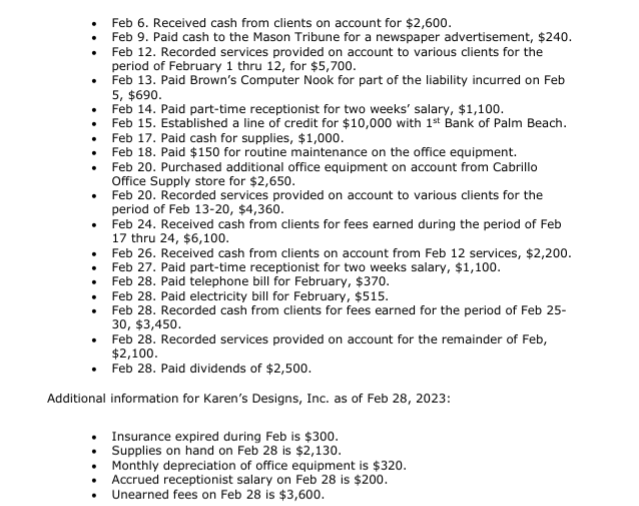

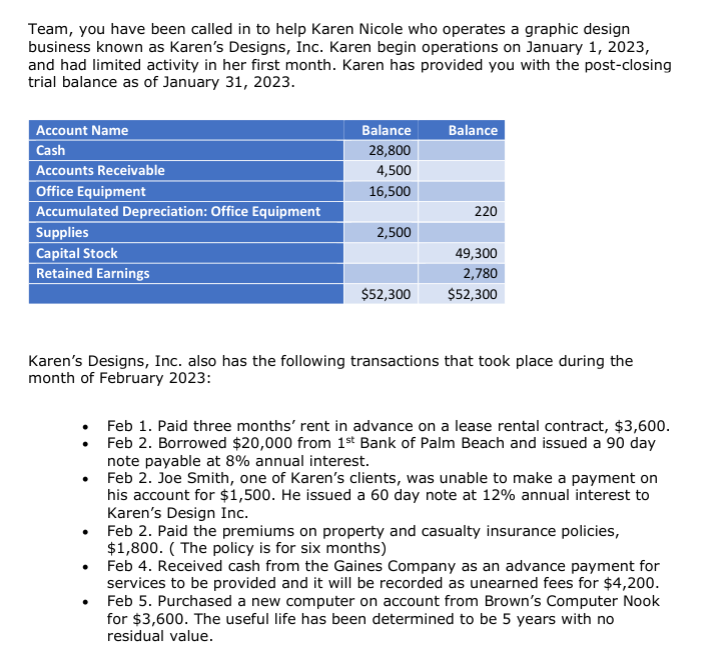

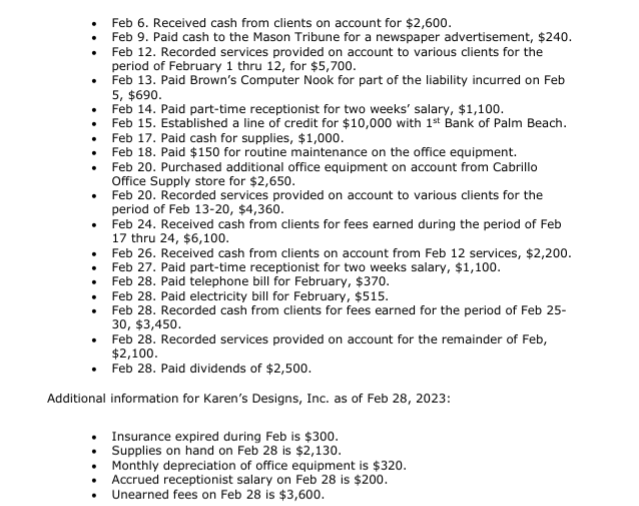

Team, you have been called in to help Karen Nicole who operates a graphic design business known as Karen's Designs, Inc. Karen begin operations on January 1, 2023, and had limited activity in her first month. Karen has provided you with the post-closing trial balance as of January 31,2023. Karen's Designs, Inc. also has the following transactions that took place during the month of February 2023: - Feb 1. Paid three months' rent in advance on a lease rental contract, $3,600. - Feb 2. Borrowed $20,000 from 1st Bank of Palm Beach and issued a 90 day note payable at 8% annual interest. - Feb 2. Joe Smith, one of Karen's clients, was unable to make a payment on his account for $1,500. He issued a 60 day note at 12% annual interest to Karen's Design Inc. - Feb 2. Paid the premiums on property and casualty insurance policies, $1,800. (The policy is for six months) - Feb 4. Received cash from the Gaines Company as an advance payment for services to be provided and it will be recorded as unearned fees for $4,200. - Feb 5. Purchased a new computer on account from Brown's Computer Nook for $3,600. The useful life has been determined to be 5 years with no residual value. - Feb 6. Received cash from clients on account for $2,600. - Feb 9. Paid cash to the Mason Tribune for a newspaper advertisement, $240. - Feb 12. Recorded services provided on account to various clients for the period of February 1 thru 12 , for $5,700. - Feb 13. Paid Brown's Computer Nook for part of the liability incurred on Feb 5,$690. - Feb 14. Paid part-time receptionist for two weeks' salary, $1,100. - Feb 15. Established a line of credit for $10,000 with 1st Bank of Palm Beach. - Feb 17. Paid cash for supplies, $1,000. - Feb 18. Paid $150 for routine maintenance on the office equipment. - Feb 20. Purchased additional office equipment on account from Cabrillo Office Supply store for $2,650. - Feb 20. Recorded services provided on account to various clients for the period of Feb 13-20, $4,360. - Feb 24. Received cash from clients for fees earned during the period of Feb 17 thru 24,$6,100. - Feb 26. Received cash from clients on account from Feb 12 services, $2,200. - Feb 27. Paid part-time receptionist for two weeks salary, $1,100. - Feb 28. Paid telephone bill for February, $370. - Feb 28. Paid electricity bill for February, $515. - Feb 28. Recorded cash from clients for fees earned for the period of Feb 2530,$3,450. - Feb 28. Recorded services provided on account for the remainder of Feb, $2,100. - Feb 28. Paid dividends of $2,500. Additional information for Karen's Designs, Inc. as of Feb 28, 2023: - Insurance expired during Feb is $300. - Supplies on hand on Feb 28 is $2,130. - Monthly depreciation of office equipment is $320. - Accrued receptionist salary on Feb 28 is $200. - Unearned fees on Feb 28 is $3.600