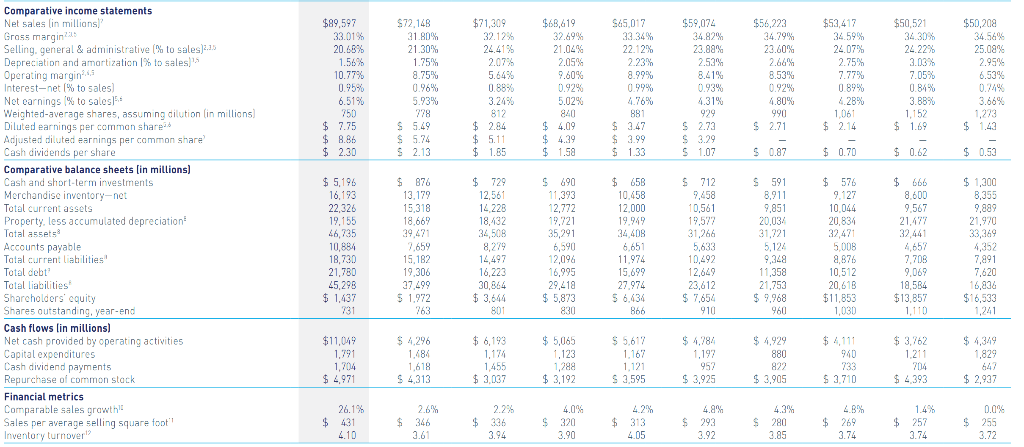

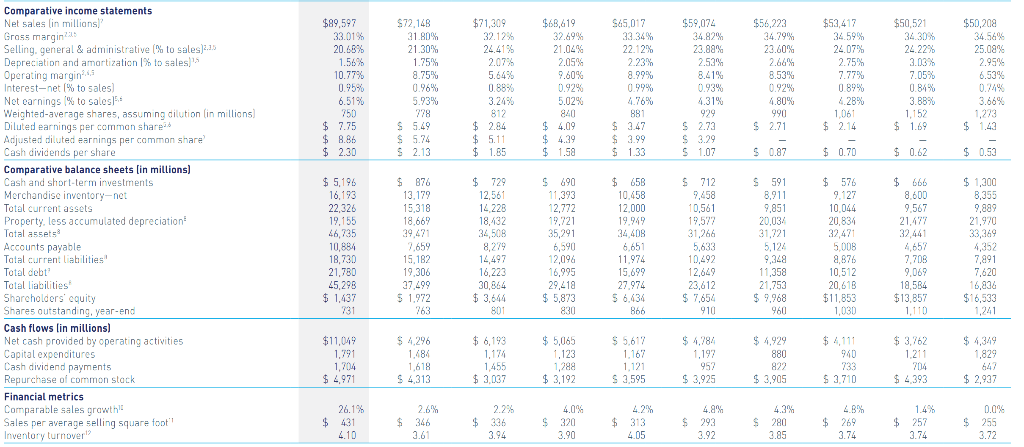

Create a Forecasted Income Statement

$89,597 33.01% 20.68% 1.56% 10.77% 0.95% 6.51% % 750 $ 7.75 $ 8.86 $ 2.30 $72,148 31.80% 21.30% 1.75% 8.75% 0.96% 5.93% 778 S 5.49 S 5.74 $71,309 32.12% 24.41% 2.07% 5.6456 0.88% 3.2490 812 $ 2.84 $ 5.11 $ 1.85 $63.619 32.69% 21.04% 2.05% 9.60% 0.92% 5.02% 840 $4.09 $ 4.39 $ 1.58 S45,017 33 34% 22.12% 2.23% 8.99% 0.99% 4.76% 881 $ 3.47 $ 3.99 $ 1.33 $59,074 34.82% 23.89% 2.53% 8.41% 0.93% 4.31% 929 S 2.73 S 3.29 $ 1.07 $56,223 34.79% 23.60% 2.66% 8.53% 0.92% 4.80% 990 $ 2.71 - S 0.87 $53, 417 34.59% 24.07% 2.75% 7.77% 0899 2.28% 1,061 $ 2.14 - $50,521 34 30 24.22% 3.03% 7.05% 0.84% 3.88% 1,152 $ 1.69 $50,208 34.56% 25.08% 2.95% 6.53% 0.744 3.66% 1,273 $ 1.43 - $ 2.13 $ 0.70 $ 0.62 $ 0.53 Comparative income statements Net sales in millions! Gross marginal Selling, general & administrative to sales) 2.23 Depreciation and amortization to sales) Operating margin: Interest-net (% to sales) Net earnings % to sales Weighted average shares, assuming dilution in millions Diluted earnings per comman shared Adjusted diluted earnings per common share Cash dividends per share Comparative balance sheets (in millions) Cash and short-term investments Merchandise inventory-net Total current assets Property, less accumulated depreciation Total assets Accounts payable Tatal current liabilities Total debt Total liabilities Shareholders' cquity Shares outstanding year-end Cash flows lin millions) Net cash provided by operating activities Capital expenditures Cash dividend payments Repurchase of common stack Financial metrics Comparable sales growth Sales per average selling square foot Inventory turnover $ 5,198 16,193 22,326 19.155 46,735 10,884 18,730 21,780 45,298 $ 1,437 731 $ 876 13.179 15,318 18,667 39,471 2.659 15.182 19.306 37.499 5 1.972 763 $ 729 12,561 14.228 18,432 34,508 8,279 14,497 16,223 30,864 $ 3,644 801 $ 490 11,393 12,772 19,721 35,291 6,590 12,096 16,995 29,418 $ 5,873 830 $ 658 10.458 12.000 19.949 34.4DB 6,651 11.974 15,699 27.974 5 6,434 866 $ 712 9,458 10,561 19,577 31,266 5,633 10,492 12,649 23,612 $ 7,654 910 S 591 8,911 9,851 20.034 31,721 5,122 9,348 11,358 21,753 $ 9.968 960 $ 576 9.127 10.044 20,834 32.471 500B 8,876 10,512 20,618 $11,853 1,030 $ 666 8.600 9.567 21,477 32,441 4,657 7,705 9,069 18,584 $13,857 1,110 $ 1,300 8,355 9,889 21,970 33,369 4,352 7,891 7,620 16,834 $16,533 1,241 $11,049 1,791 1,704 $ 4,971 $ 4,296 1.484 1,618 $ 4,313 $ 6,193 1.174 1,455 $ 3,037 $ 5,065 1,123 1,288 $ 3,192 S 5617 1.167 1.121 S 3,595 $ 4,784 1.197 957 $ 3,925 $ 4,929 880 822 $ 3,905 940 733 $ 3.710 $ 3,762 1.211 7114 $ 4393 $ 4,349 1,829 647 $ 2,937 26.1% $ 431 4.10 2.6% $ 346 3.61 2.2% $ 336 3.94 4.0% S 320 3.90 4.2% $ 313 4.05 4.9% $ 293 3.92 4.3% S280 3.85 4.3% $ 269 3.74 1.4% $ 257 3.74 0.0% $ 255 3.72