Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Create a (Fortnightly) Income Statement Sheet for Jack and Maggie's using the information below: ----------------------------------------------------- A couple, Jack and Maggie have come to see you

Create a (Fortnightly) Income Statement Sheet for Jack and Maggie's using the information below:

-----------------------------------------------------

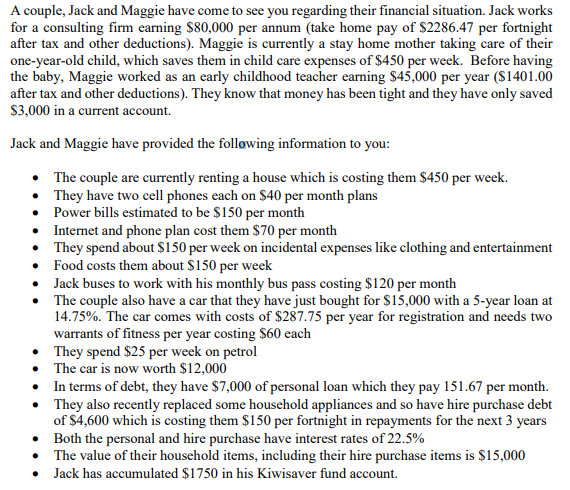

A couple, Jack and Maggie have come to see you regarding their financial situation. Jack works for a consulting firm earning $80,000 per annum (take home pay of $2286.47 per fortnight after tax and other deductions). Maggie is currently a stay home mother taking care of their one-year-old child, which saves them in child care expenses of $450 per week. Before having the baby, Maggie worked as an early childhood teacher earning $45,000 per year (S1401.00 after tax and other deductions). They know that money has been tight and they have only saved $3,000 in a current account. Jack and Maggie have provided the following information to you . The couple are currently renting a house which is costing them $450 per week. . They have two cell phones each on $40 per month plans Power bills estimated o be $150 per month Internet and phone plan cost them $70 per montlh They spend about S150 per week on incidental expenses like clothing and entertainment . Food costs them about $150 per week . Jack buses to work with his monthly bus pass costing $120 per montlh .The couple also have a car that they have just bought for $15,000 with a 5-year loan at es with costs of $287.75 per year for registration a per year costing $60 each nd needs two 14.75%. The car com warrants of fitness They spend $25 per week on petrol The car is now worth $12,000 . In terms of debt, they have $7,000 of personal loan which they pay 151.67 per month. They also recently replaced some household appliances and so have hire purchase debt of $4,600 which is costing them $150 per fortnight in repayments for the next 3 years Both the personal and hire purchase have interest rates of 22.5% The value of their household items, including their hire purchase items is $15,000 . . Jack has accumulated $1750 in his Kiwisaver fund account. A couple, Jack and Maggie have come to see you regarding their financial situation. Jack works for a consulting firm earning $80,000 per annum (take home pay of $2286.47 per fortnight after tax and other deductions). Maggie is currently a stay home mother taking care of their one-year-old child, which saves them in child care expenses of $450 per week. Before having the baby, Maggie worked as an early childhood teacher earning $45,000 per year (S1401.00 after tax and other deductions). They know that money has been tight and they have only saved $3,000 in a current account. Jack and Maggie have provided the following information to you . The couple are currently renting a house which is costing them $450 per week. . They have two cell phones each on $40 per month plans Power bills estimated o be $150 per month Internet and phone plan cost them $70 per montlh They spend about S150 per week on incidental expenses like clothing and entertainment . Food costs them about $150 per week . Jack buses to work with his monthly bus pass costing $120 per montlh .The couple also have a car that they have just bought for $15,000 with a 5-year loan at es with costs of $287.75 per year for registration a per year costing $60 each nd needs two 14.75%. The car com warrants of fitness They spend $25 per week on petrol The car is now worth $12,000 . In terms of debt, they have $7,000 of personal loan which they pay 151.67 per month. They also recently replaced some household appliances and so have hire purchase debt of $4,600 which is costing them $150 per fortnight in repayments for the next 3 years Both the personal and hire purchase have interest rates of 22.5% The value of their household items, including their hire purchase items is $15,000 . . Jack has accumulated $1750 in his Kiwisaver fund account

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started