Create a Proforma Income Statement it must be a Contribution margin income statement for Bobcat Beverage Company using the information provided please share any formulas that were used:

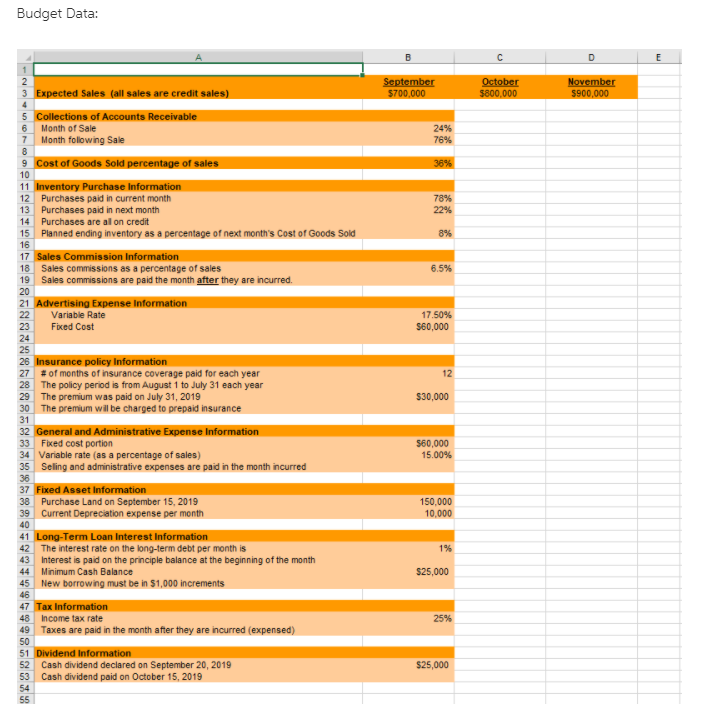

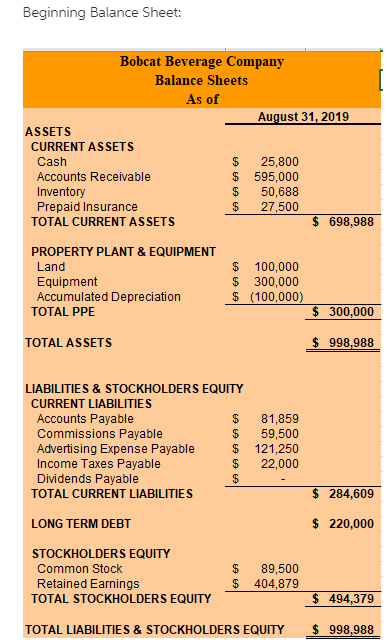

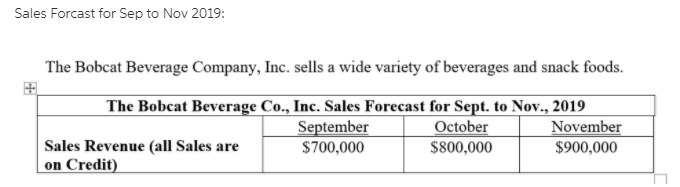

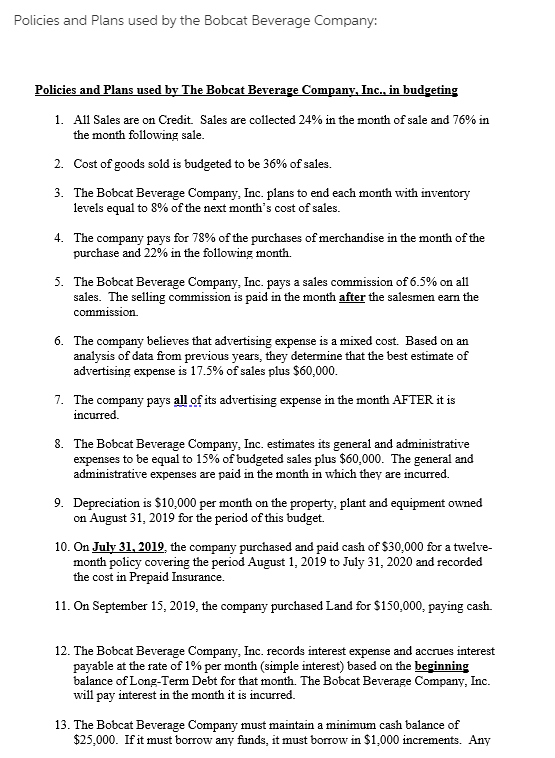

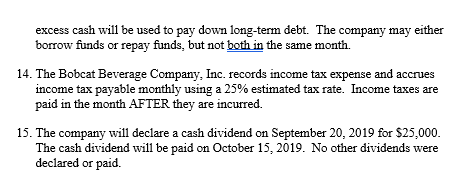

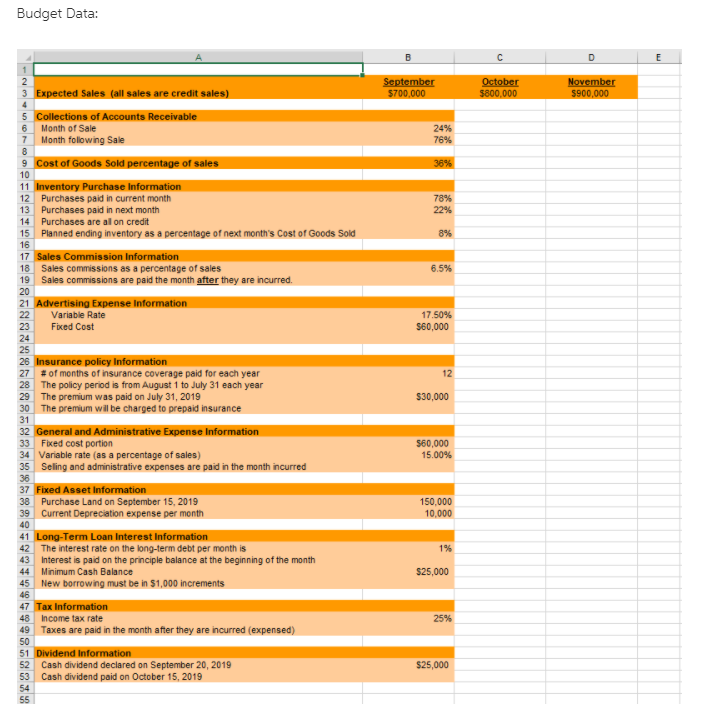

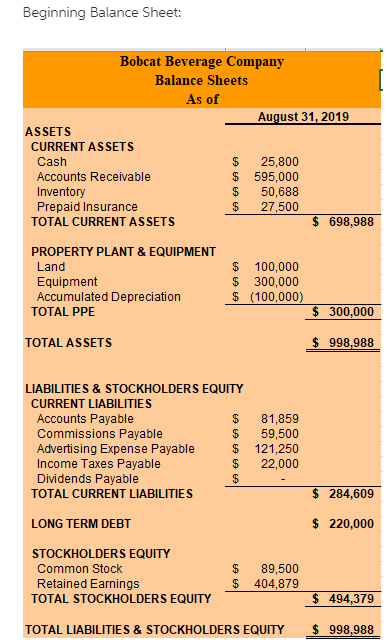

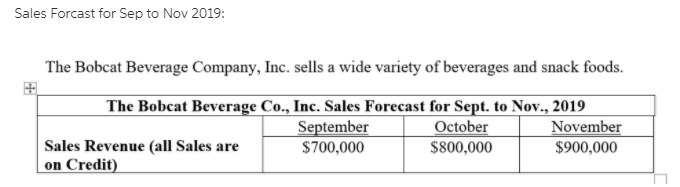

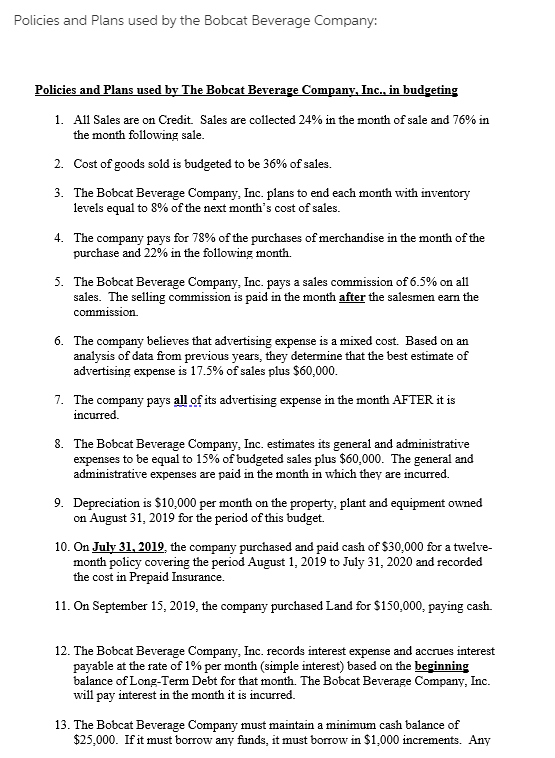

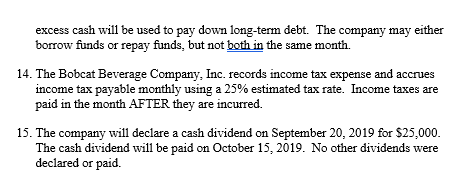

Budget Data: September $700,000 October 5800,000 November $900,000 4 24% 76% 36% 10 78% 22% 13 14 8% 6.5% 19 20 17.50% 560,000 12 3 Expected Sales (all sales are credit sales) 5 Collections of Accounts Receivable 6 Month of Sale 7 Month following Sale 8 9 Cost of Goods Sold percentage of sales 11 Inventory Purchase Information 12 Purchases paid in current month Purchases paid in next month Purchases are al on credit 15 Planned ending inventory as a percentage of next month's Cost of Goods Sold 16 17 Sales Commission Information 18 Sales commissions as a percentage of sales Sales commissions are paid the month after they are incurred. 21 Advertising Expense Information 22 Variable Rate 23 Fixed Cost 24 25 26 Insurance policy Information 27 # of months of insurance coverage paid for each year 28 The policy period is from August 1 to July 31 each year 29 The premium was paid on July 31, 2019 30 The premium will be charged to prepaid insurance 31 32 General and Administrative Expense Information 33 Fixed cost portion 34 Variable rate (as a percentage of sales) 35 Seling and administrative expenses are paid in the month incurred 36 37 Fixed Asset Information 38 Purchase Land on September 15, 2019 39 Current Depreciation expense per month 40 41 Long-Term Loan Interest Information 42 The interest rate on the long-term debt per month is 43 Interest is paid on the principle balance at the beginning of the month 44 Minimum Cash Balance 45 New borrowing must be in 1,000 increments 46 47 Tax Information 48 Income tax rate 49 Taxes are paid in the month after they are incurred (expensed) 50 51 Dividend Information 52 Cash dividend declared on September 20, 2019 53 Cash dividend paid on October 15, 2019 54 55 $30,000 $60,000 15.00% 150,000 10,000 1% $25,000 25% $25,000 Beginning Balance Sheet: Bobcat Beverage Company Balance Sheets As of August 31, 2019 ASSETS CURRENT ASSETS Cash $ 25,800 Accounts Receivable $ 595,000 Inventory $ 50,688 Prepaid Insurance $ 27,500 TOTAL CURRENT ASSETS $ 698,988 0000 PROPERTY PLANT & EQUIPMENT Land Equipment Accumulated Depreciation TOTAL PPE $ 100,000 $ 300,000 $ (100,000) $ 300,000 TOTAL ASSETS $ 998,988 LIABILITIES & STOCKHOLDERS EQUITY CURRENT LIABILITIES Accounts Payable Commissions Payable Advertising Expense Payable Income Taxes Payable Dividends Payable $ TOTAL CURRENT LIABILITIES 0000 81,859 59,500 121,250 22,000 $ 284,609 LONG TERM DEBT $ 220,000 STOCKHOLDERS EQUITY Common Stock Retained Earnings TOTAL STOCKHOLDERS EQUITY $ $ 89,500 404,879 $ 494,379 TOTAL LIABILITIES & STOCKHOLDERS EQUITY $ 998,988 Sales Forcast for Sep to Nov 2019: The Bobcat Beverage Company, Inc. sells a wide variety of beverages and snack foods. The Bobcat Beverage Co., Inc. Sales Forecast for Sept. to Nov., 2019 September October November Sales Revenue (all Sales are $700,000 $800,000 $900,000 on Credit) Policies and Plans used by the Bobcat Beverage Company: Policies and Plans used by The Bobcat Beverage Company, Inc., in budgeting 1. All Sales are on Credit Sales are collected 24% in the month of sale and 76% in the month following sale. 2. Cost of goods sold is budgeted to be 36% of sales. 3. The Bobcat Beverage Company, Inc. plans to end each month with inventory levels equal to 8% of the next month's cost of sales. 4. The company pays for 78% of the purchases of merchandise in the month of the purchase and 22% in the following month. 5. The Bobcat Beverage Company, Inc. pays a sales commission of 6.5% on all sales. The selling commission is paid in the month after the salesmen earn the commission 6. The company believes that advertising expense is a mixed cost. Based on an analysis of data from previous years, they determine that the best estimate of advertising expense is 17.5% of sales plus $60,000. 7. The company pays all of its advertising expense in the month AFTER it is incurred. 8. The Bobcat Beverage Company, Inc. estimates its general and administrative expenses to be equal to 15% of budgeted sales plus $60,000. The general and administrative expenses are paid in the month in which they are incurred. 9. Depreciation is $10,000 per month on the property, plant and equipment owned on August 31, 2019 for the period of this budget. 10. On July 31, 2019, the company purchased and paid cash of $30,000 for a twelve- month policy covering the period August 1, 2019 to July 31, 2020 and recorded the cost in Prepaid Insurance. 11. On September 15, 2019, the company purchased Land for $150,000, paying cash. 12. The Bobcat Beverage Company, Inc. records interest expense and accrues interest payable at the rate of 1% per month (simple interest) based on the beginning balance of Long-Term Debt for that month. The Bobcat Beverage Company, Inc. will pay interest in the month it is incurred. 13. The Bobcat Beverage Company must maintain a minimum cash balance of $25,000. If it must borrow any funds, it must borrow in $1,000 increments. Any excess cash will be used to pay down long-term debt. The company may either borrow funds or repay funds, but not both in the same month. 14. The Bobcat Beverage Company, Inc. records income tax expense and accrues income tax payable monthly using a 25% estimated tax rate. Income taxes are paid in the month AFTER they are incurred. 15. The company will declare a cash dividend on September 20, 2019 for $25,000. The cash dividend will be paid on October 15, 2019. No other dividends were declared or paid. Budget Data: September $700,000 October 5800,000 November $900,000 4 24% 76% 36% 10 78% 22% 13 14 8% 6.5% 19 20 17.50% 560,000 12 3 Expected Sales (all sales are credit sales) 5 Collections of Accounts Receivable 6 Month of Sale 7 Month following Sale 8 9 Cost of Goods Sold percentage of sales 11 Inventory Purchase Information 12 Purchases paid in current month Purchases paid in next month Purchases are al on credit 15 Planned ending inventory as a percentage of next month's Cost of Goods Sold 16 17 Sales Commission Information 18 Sales commissions as a percentage of sales Sales commissions are paid the month after they are incurred. 21 Advertising Expense Information 22 Variable Rate 23 Fixed Cost 24 25 26 Insurance policy Information 27 # of months of insurance coverage paid for each year 28 The policy period is from August 1 to July 31 each year 29 The premium was paid on July 31, 2019 30 The premium will be charged to prepaid insurance 31 32 General and Administrative Expense Information 33 Fixed cost portion 34 Variable rate (as a percentage of sales) 35 Seling and administrative expenses are paid in the month incurred 36 37 Fixed Asset Information 38 Purchase Land on September 15, 2019 39 Current Depreciation expense per month 40 41 Long-Term Loan Interest Information 42 The interest rate on the long-term debt per month is 43 Interest is paid on the principle balance at the beginning of the month 44 Minimum Cash Balance 45 New borrowing must be in 1,000 increments 46 47 Tax Information 48 Income tax rate 49 Taxes are paid in the month after they are incurred (expensed) 50 51 Dividend Information 52 Cash dividend declared on September 20, 2019 53 Cash dividend paid on October 15, 2019 54 55 $30,000 $60,000 15.00% 150,000 10,000 1% $25,000 25% $25,000 Beginning Balance Sheet: Bobcat Beverage Company Balance Sheets As of August 31, 2019 ASSETS CURRENT ASSETS Cash $ 25,800 Accounts Receivable $ 595,000 Inventory $ 50,688 Prepaid Insurance $ 27,500 TOTAL CURRENT ASSETS $ 698,988 0000 PROPERTY PLANT & EQUIPMENT Land Equipment Accumulated Depreciation TOTAL PPE $ 100,000 $ 300,000 $ (100,000) $ 300,000 TOTAL ASSETS $ 998,988 LIABILITIES & STOCKHOLDERS EQUITY CURRENT LIABILITIES Accounts Payable Commissions Payable Advertising Expense Payable Income Taxes Payable Dividends Payable $ TOTAL CURRENT LIABILITIES 0000 81,859 59,500 121,250 22,000 $ 284,609 LONG TERM DEBT $ 220,000 STOCKHOLDERS EQUITY Common Stock Retained Earnings TOTAL STOCKHOLDERS EQUITY $ $ 89,500 404,879 $ 494,379 TOTAL LIABILITIES & STOCKHOLDERS EQUITY $ 998,988 Sales Forcast for Sep to Nov 2019: The Bobcat Beverage Company, Inc. sells a wide variety of beverages and snack foods. The Bobcat Beverage Co., Inc. Sales Forecast for Sept. to Nov., 2019 September October November Sales Revenue (all Sales are $700,000 $800,000 $900,000 on Credit) Policies and Plans used by the Bobcat Beverage Company: Policies and Plans used by The Bobcat Beverage Company, Inc., in budgeting 1. All Sales are on Credit Sales are collected 24% in the month of sale and 76% in the month following sale. 2. Cost of goods sold is budgeted to be 36% of sales. 3. The Bobcat Beverage Company, Inc. plans to end each month with inventory levels equal to 8% of the next month's cost of sales. 4. The company pays for 78% of the purchases of merchandise in the month of the purchase and 22% in the following month. 5. The Bobcat Beverage Company, Inc. pays a sales commission of 6.5% on all sales. The selling commission is paid in the month after the salesmen earn the commission 6. The company believes that advertising expense is a mixed cost. Based on an analysis of data from previous years, they determine that the best estimate of advertising expense is 17.5% of sales plus $60,000. 7. The company pays all of its advertising expense in the month AFTER it is incurred. 8. The Bobcat Beverage Company, Inc. estimates its general and administrative expenses to be equal to 15% of budgeted sales plus $60,000. The general and administrative expenses are paid in the month in which they are incurred. 9. Depreciation is $10,000 per month on the property, plant and equipment owned on August 31, 2019 for the period of this budget. 10. On July 31, 2019, the company purchased and paid cash of $30,000 for a twelve- month policy covering the period August 1, 2019 to July 31, 2020 and recorded the cost in Prepaid Insurance. 11. On September 15, 2019, the company purchased Land for $150,000, paying cash. 12. The Bobcat Beverage Company, Inc. records interest expense and accrues interest payable at the rate of 1% per month (simple interest) based on the beginning balance of Long-Term Debt for that month. The Bobcat Beverage Company, Inc. will pay interest in the month it is incurred. 13. The Bobcat Beverage Company must maintain a minimum cash balance of $25,000. If it must borrow any funds, it must borrow in $1,000 increments. Any excess cash will be used to pay down long-term debt. The company may either borrow funds or repay funds, but not both in the same month. 14. The Bobcat Beverage Company, Inc. records income tax expense and accrues income tax payable monthly using a 25% estimated tax rate. Income taxes are paid in the month AFTER they are incurred. 15. The company will declare a cash dividend on September 20, 2019 for $25,000. The cash dividend will be paid on October 15, 2019. No other dividends were declared or paid