Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Create an Adjusting Entry along with an adjusted trial balance for the ledger and trial balance provided above. Optional to create an income statement for

Create an Adjusting Entry along with an adjusted trial balance for the ledger and trial balance provided above. Optional to create an income statement for understanding as well. Thank you.

Do not just provide the answer, provide how you got there and show your work.

Thank you!

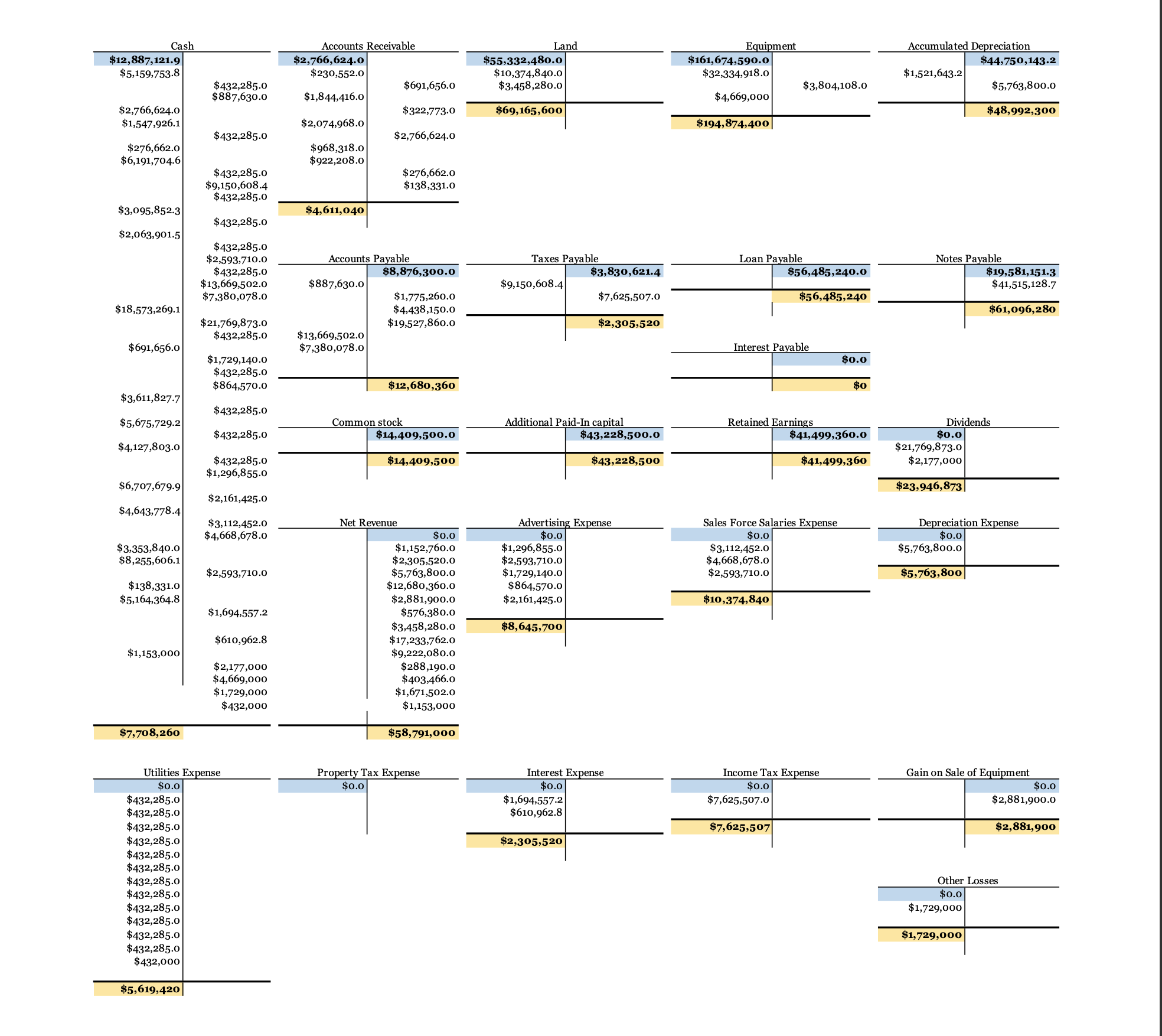

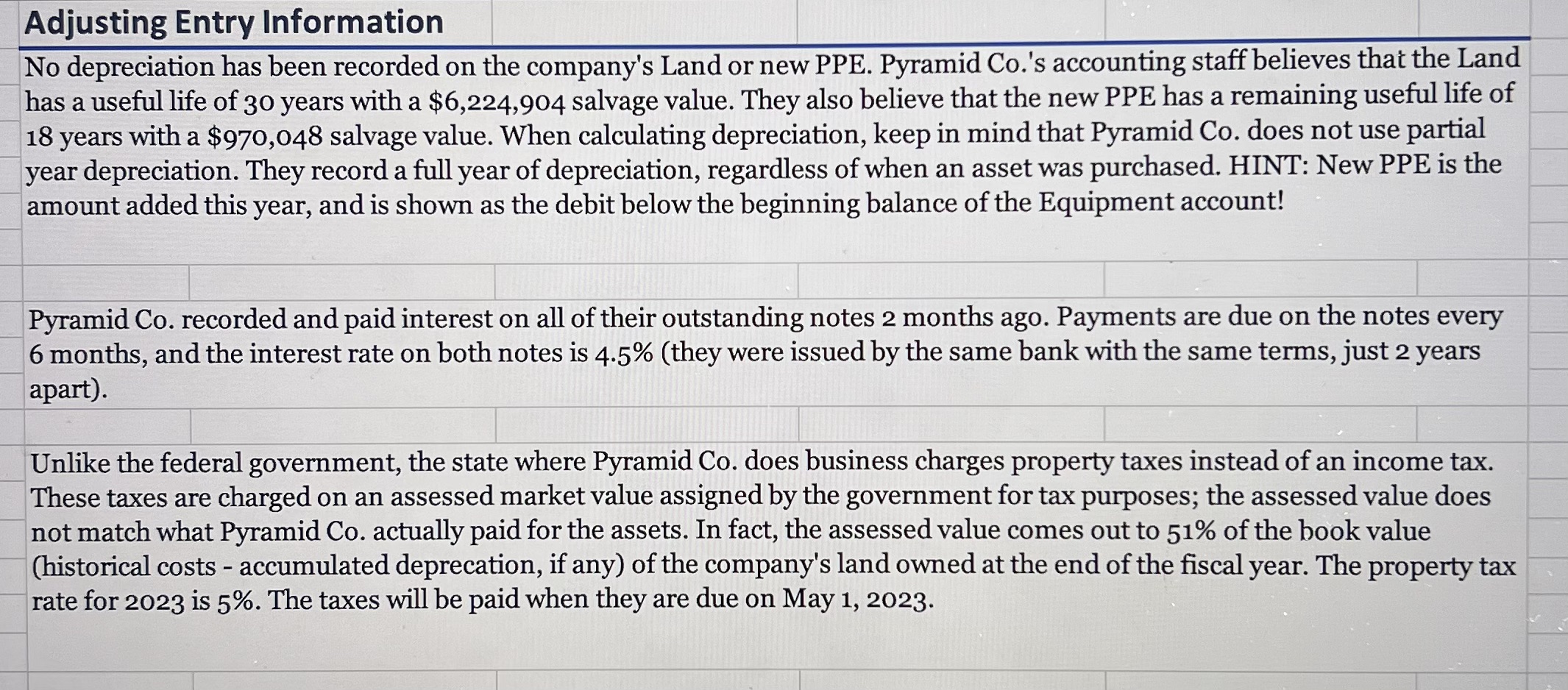

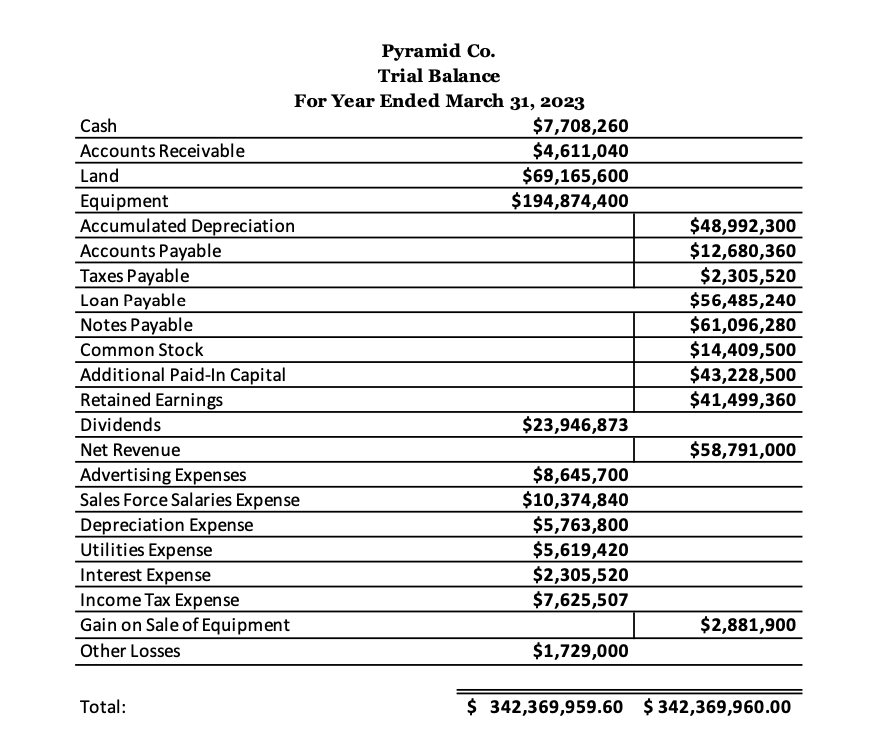

No depreciation has been recorded on the company's Land or new PPE. Pyramid Co.'s accounting staff believes that the Land has a useful life of 30 years with a $6,224,904 salvage value. They also believe that the new PPE has a remaining useful life of 18 years with a $970,048 salvage value. When calculating depreciation, keep in mind that Pyramid Co. does not use partial year depreciation. They record a full year of depreciation, regardless of when an asset was purchased. HINT: New PPE is the amount added this year, and is shown as the debit below the beginning balance of the Equipment account! Pyramid Co. recorded and paid interest on all of their outstanding notes 2 months ago. Payments are due on the notes every 6 months, and the interest rate on both notes is 4.5% (they were issued by the same bank with the same terms, just 2 years apart). Unlike the federal government, the state where Pyramid Co. does business charges property taxes instead of an income tax. These taxes are charged on an assessed market value assigned by the government for tax purposes; the assessed value does not match what Pyramid Co. actually paid for the assets. In fact, the assessed value comes out to 51% of the book value (historical costs - accumulated deprecation, if any) of the company's land owned at the end of the fiscal year. The property tax rate for 2023 is 5%. The taxes will be paid when they are due on May 1, 2023. Pyramid Co. Trial Balance For Year Ended March 31, 2023 \begin{tabular}{lr} Cash & $7,708,260 \\ \hline Accounts Receivable & $4,611,040 \\ \hline Land & $69,165,600 \\ \hline Equipment & $194,874,400 \end{tabular} \begin{tabular}{l|r} \hline Accumulated Depreciation & $48,992,300 \\ \hline Accounts Payable & $12,680,360 \\ \hline Taxes Payable & $2,305,520 \\ \hline Loan Payable & $56,485,240 \\ \hline Notes Payable & $61,096,280 \\ \hline Common Stock & $14,409,500 \\ \hline Additional Paid-In Capital & $43,228,500 \\ \hline Retained Earnings & $41,499,360 \\ \hline \end{tabular} No depreciation has been recorded on the company's Land or new PPE. Pyramid Co.'s accounting staff believes that the Land has a useful life of 30 years with a $6,224,904 salvage value. They also believe that the new PPE has a remaining useful life of 18 years with a $970,048 salvage value. When calculating depreciation, keep in mind that Pyramid Co. does not use partial year depreciation. They record a full year of depreciation, regardless of when an asset was purchased. HINT: New PPE is the amount added this year, and is shown as the debit below the beginning balance of the Equipment account! Pyramid Co. recorded and paid interest on all of their outstanding notes 2 months ago. Payments are due on the notes every 6 months, and the interest rate on both notes is 4.5% (they were issued by the same bank with the same terms, just 2 years apart). Unlike the federal government, the state where Pyramid Co. does business charges property taxes instead of an income tax. These taxes are charged on an assessed market value assigned by the government for tax purposes; the assessed value does not match what Pyramid Co. actually paid for the assets. In fact, the assessed value comes out to 51% of the book value (historical costs - accumulated deprecation, if any) of the company's land owned at the end of the fiscal year. The property tax rate for 2023 is 5%. The taxes will be paid when they are due on May 1, 2023. Pyramid Co. Trial Balance For Year Ended March 31, 2023 \begin{tabular}{lr} Cash & $7,708,260 \\ \hline Accounts Receivable & $4,611,040 \\ \hline Land & $69,165,600 \\ \hline Equipment & $194,874,400 \end{tabular} \begin{tabular}{l|r} \hline Accumulated Depreciation & $48,992,300 \\ \hline Accounts Payable & $12,680,360 \\ \hline Taxes Payable & $2,305,520 \\ \hline Loan Payable & $56,485,240 \\ \hline Notes Payable & $61,096,280 \\ \hline Common Stock & $14,409,500 \\ \hline Additional Paid-In Capital & $43,228,500 \\ \hline Retained Earnings & $41,499,360 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started