Answered step by step

Verified Expert Solution

Question

1 Approved Answer

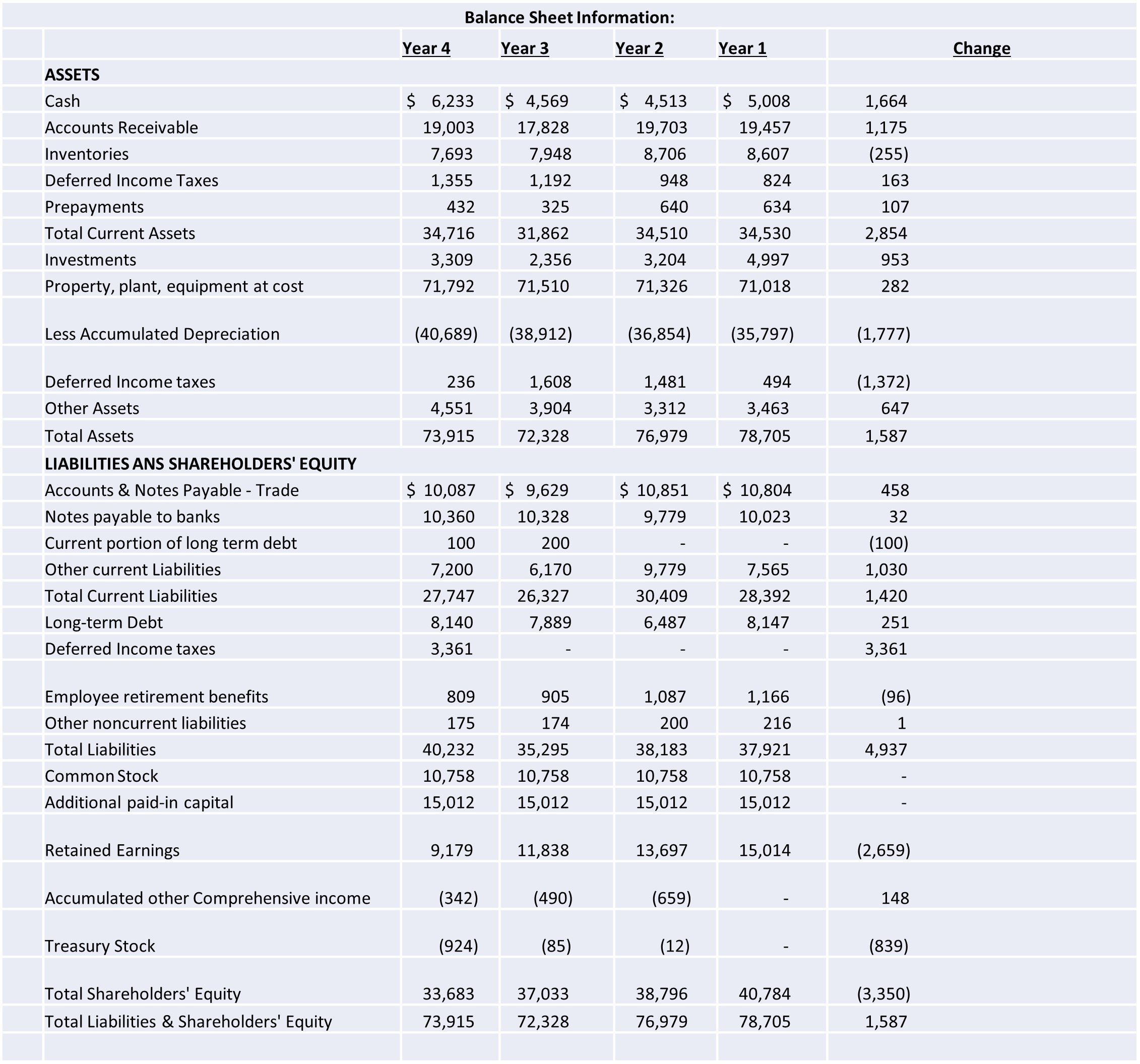

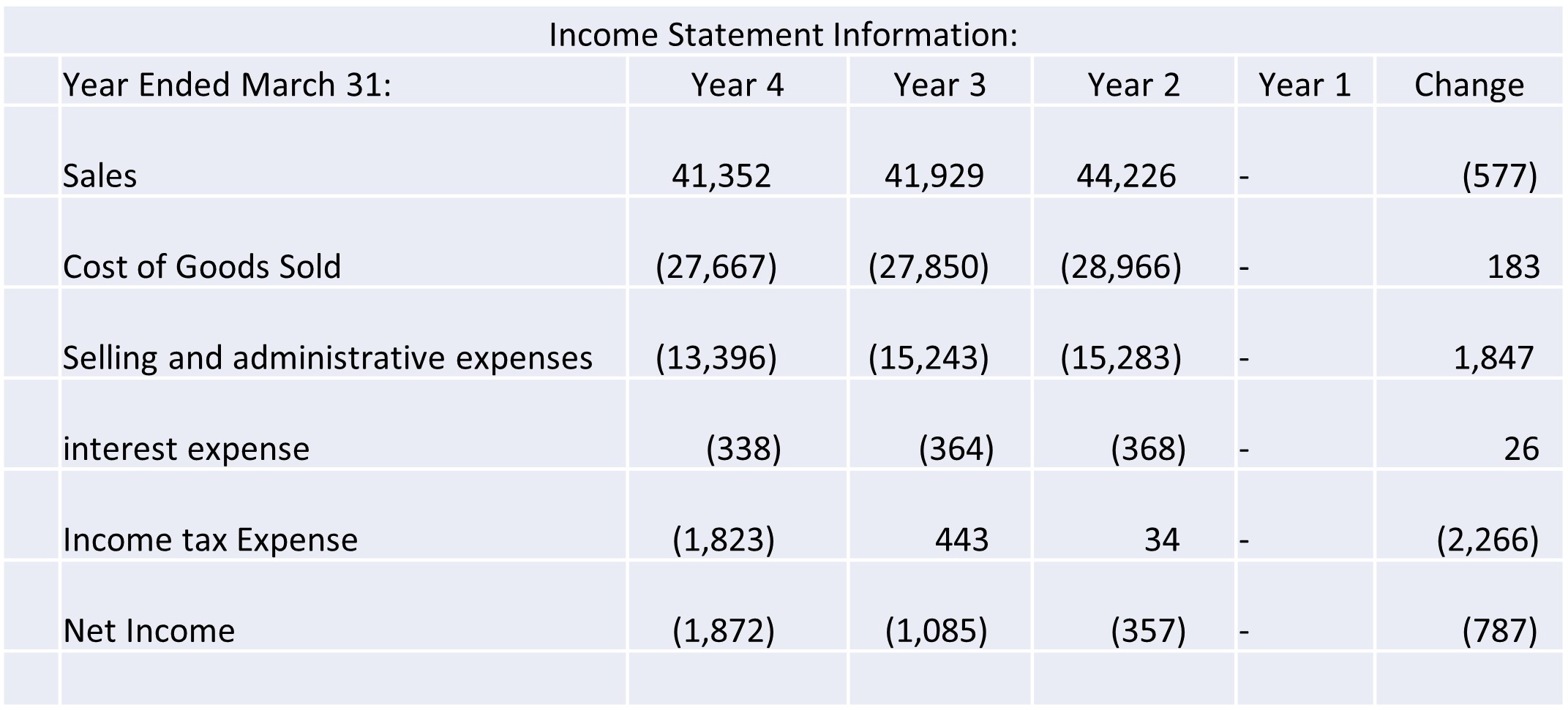

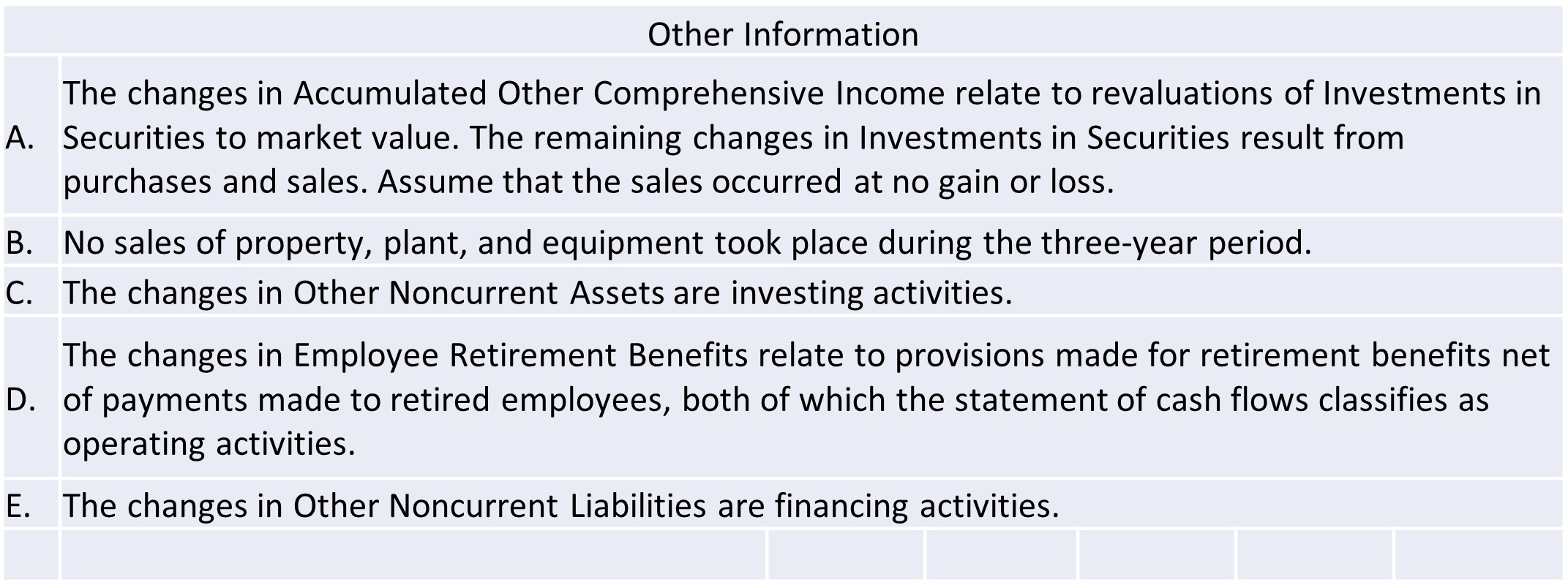

Create an indirect cash flow statement. The balance sheet, income statement, and other items are listed. ASSETS Cash Accounts Receivable Inventories Deferred Income Taxes Prepayments

Create an indirect cash flow statement. The balance sheet, income statement, and other items are listed.

ASSETS Cash Accounts Receivable Inventories Deferred Income Taxes Prepayments Total Current Assets Investments Property, plant, equipment at cost Less Accumulated Depreciation Deferred Income taxes Other Assets Total Assets LIABILITIES ANS SHAREHOLDERS' EQUITY Accounts & Notes Payable - Trade Notes payable to banks Current portion of long term debt Other current Liabilities Total Current Liabilities Long-term Debt Deferred Income taxes Employee retirement benefits Other noncurrent liabilities Total Liabilities Common Stock Additional paid-in capital Retained Earnings Accumulated other Comprehensive income Treasury Stock Total Shareholders' Equity Total Liabilities & Shareholders' Equity Year 4 Balance Sheet Information: Year 3 Year 2 $ 6,233 19,003 7,693 1,355 432 34,716 3,309 71,792 236 4,551 73,915 (40,689) (38,912) 809 175 40,232 10,758 15,012 $ 10,087 $ 9,629 10,360 10,328 100 200 7,200 6,170 27,747 26,327 8,140 7,889 3,361 9,179 $ 4,569 17,828 7,948 1,192 325 (342) 31,862 2,356 71,510 (924) 1,608 3,904 72,328 905 174 35,295 10,758 15,012 11,838 (490) (85) 33,683 37,033 73,915 72,328 $ 4,513 19,703 8,706 948 640 34,510 3,204 71,326 (36,854) 1,481 3,312 76,979 $ 10,851 9,779 9,779 30,409 6,487 1,087 200 38,183 10,758 15,012 13,697 (659) (12) 38,796 76,979 Year 1 $ 5,008 19,457 8,607 824 634 34,530 4,997 71,018 (35,797) 494 3,463 78,705 $ 10,804 10,023 7,565 28,392 8,147 1,166 216 37,921 10,758 15,012 15,014 40,784 78,705 1,664 1,175 (255) 163 107 2,854 953 282 (1,777) (1,372) 647 1,587 458 32 (100) 1,030 1,420 251 3,361 (96) 1 4,937 (2,659) 148 (839) (3,350) 1,587 Change

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To create an indirect cash flow statement we need to analyze the changes in different balance sheet accounts and consider the provided information abo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started