- CREATE general journal

- Journalize the entries for the month of January in the General Journal. When using the Work in Process account, be sure to post to the appropriate Job Cost Record.

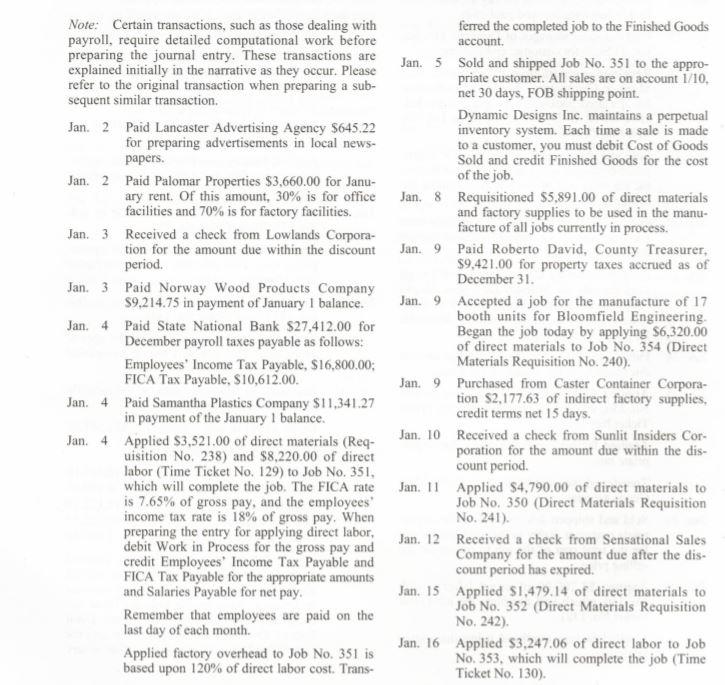

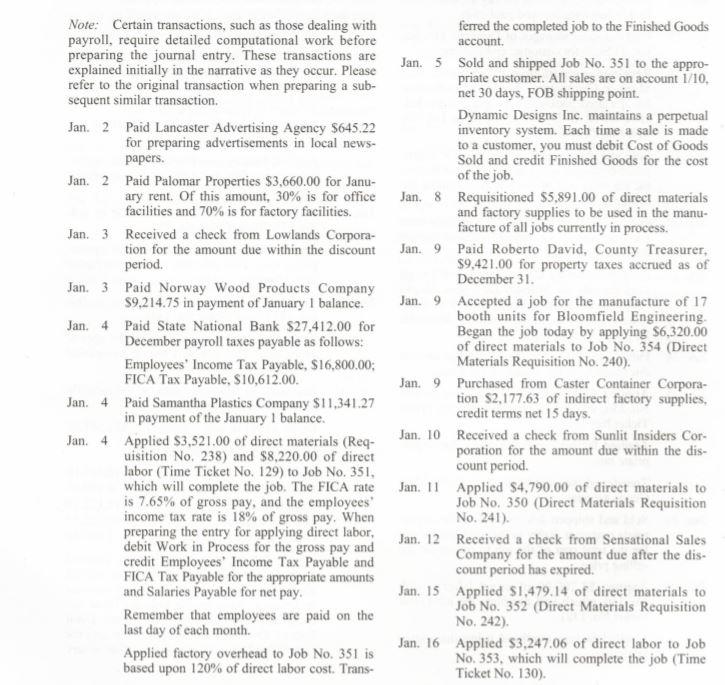

Note: Certain transactions, such as those dealing with payroll, require detailed computational work before preparing the journal entry. These transactions are explained initially in the narrative as they occur. Please refer to the original transaction when preparing a sub- sequent similar transaction. Jan. 2 Paid Lancaster Advertising Agency $645.22 for preparing advertisements in local news- papers Jan. 2 Paid Palomar Properties $3,660.00 for Janu- ary rent. Of this amount, 30% is for office facilities and 70% is for factory facilities. Jan. 3 Received a check from Lowlands Corpora- tion for the amount due within the discount period. Jan. 3 Paid Norway Wood Products Company 9.214.75 in payment of January 1 balance. Jan. 4 Paid State National Bank $27,412.00 for December payroll taxes payable as follows: Employees' Income Tax Payable, $16,800.00; FICA Tax Payable, $10,612.00. Jan. 4. Paid Samantha Plastics Company $11,341.27 in payment of the January 1 balance. Jan. 4 Applied $3,521.00 of direct materials (Req- uisition No. 238) and $8,220.00 of direct labor (Time Ticket No. 129) to Job No. 351, which will complete the job. The FICA rate is 7.65% of gross pay, and the employees income tax rate is 18% of gross pay, When preparing the entry for applying direct labor, debit Work in Process for the gross pay and credit Employees Income Tax Payable and FICA Tax Payable for the appropriate amounts and Salaries Payable for net pay, Remember that employees are paid on the last day of each month. Applied factory overhead to Job No. 351 is based upon 120% of direct labor cost. Trans- ferred the completed job to the Finished Goods account Jan. 5 Sold and shipped Job No. 351 to the appro- priate customer. All sales are on account 1/10, net 30 days, FOB shipping point. Dynamic Designs Inc. maintains a perpetual inventory system. Each time a sale is made to a customer, you must debit Cost of Goods Sold and credit Finished Goods for the cost of the job. Jan. 8 Requisitioned $5,891.00 of direct materials and factory supplies to be used in the manu- facture of all jobs currently in process. Jan. 9 Paid Roberto David, County Treasurer, $9,421.00 for property taxes accrued as of December 31. Jan. 9 Accepted a job for the manufacture of 17 booth units for Bloomfield Engineering, Began the job today by applying $6,320.00 of direct materials to Job No. 354 (Direct Materials Requisition No. 240). Jan. 9 Purchased from Caster Container Corpora- tion $2.177.63 of indirect factory supplies. credit terms net 15 days. Jan. 10 Received a check from Sunlit Insiders Cor: poration for the amount due within the dis- count period. Jan. 11 Applied $4.790.00 of direct materials to Job No. 350 (Direct Materials Requisition No. 241). Jan. 12 Received a check from Sensational Sales Company for the amount due after the dis- count period has expired. Jan. 15 Applied $1,479.14 of direct materials to Job No. 352 (Direct Materials Requisition No. 242). Jan. 16 Applied $3,247.06 of direct labor to Job No. 353, which will complete the job (Time Ticket No. 130)