Answered step by step

Verified Expert Solution

Question

1 Approved Answer

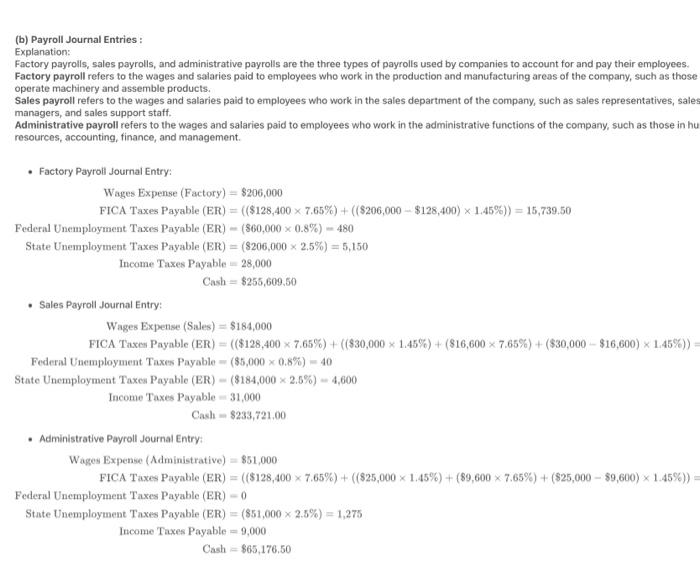

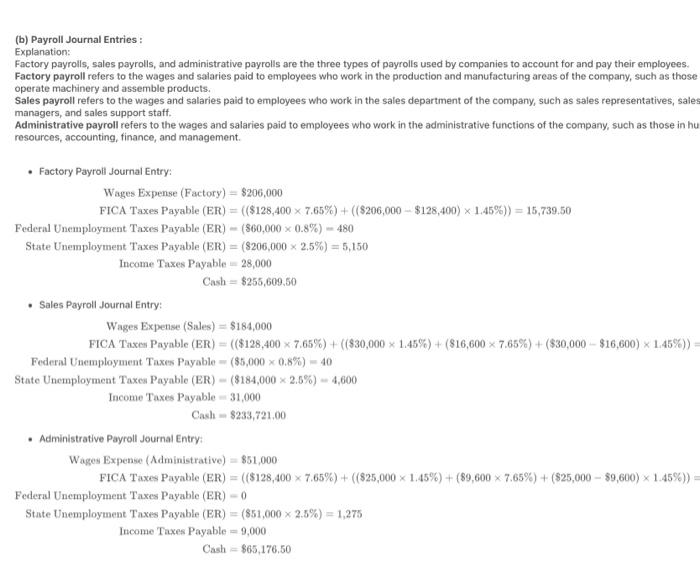

create journal entries for the following. Thanks! (b) Payroll Journal Entries: Explanation: Factory payrolls, sales payrolls, and administrative payrolls are the three types of payrolls

create journal entries for the following. Thanks!

(b) Payroll Journal Entries: Explanation: Factory payrolls, sales payrolls, and administrative payrolls are the three types of payrolls used by companies to account for and pay their employees. Factory payroll refers to the wages and salaries paid to employees who work in the production and manufacturing areas of the company, such as those operate machinery and assemble products. Sales payroll refers to the wages and salaries paid to employees who work in the sales department of the company, such as sales representatives, sale managers, and sales support staff. Administrative payroll refers to the wages and salaries paid to employees who work in the administrative functions of the company, such as those in hu resources, accounting, finance, and management. - Factory Payroll Journal Entry: Wages Expense (Factory) =$206,000 FICA Taxes Payable ( ER )=(($128,4007,65%)+(($206,000$128,400)1.45%))=15,739.50 Federal Unemployment Taxes Payable (ER)=($60,0000.8%)=480 State Unemployment Taxes Payable (ER)=($206,0002,5%)=5,150 Income Taxes Payable =28,000 Cash =$255,609,50 - Sales Payroll Journal Entry: Wages Expense ( Sales )=$184,000 FICA Taxen Payable ( ER )=(($128,4007.65%)+(($30,0001.45%)+($16,6007.65%)+($30,000$16,600)1,45%))= Federal Unemployment Taxes Payable =($5,0000.8%)=40 State Unemployment Taxes Payable (ER)=(8184,0002.5%)=4,600 Income Taxes Payable =31,000 Cash =$233,721,00 - Administrative Payroll Journal Entry: Wages Expense (Administrative) =851,000 FICA Taxes Payable ( ER )=(($128,4007.65%)+(($25,0001.45%)+(89,6007.65%)+($25,000$9,600)1.45%))= Federal Unemployment 'Taxes Payable (ER) =0 State Unemployment Taxes Payable (ER)=(851,0002.5%)=1,275 Income Taxes Payable =9,000 Cash =865,176,50

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started