Answered step by step

Verified Expert Solution

Question

1 Approved Answer

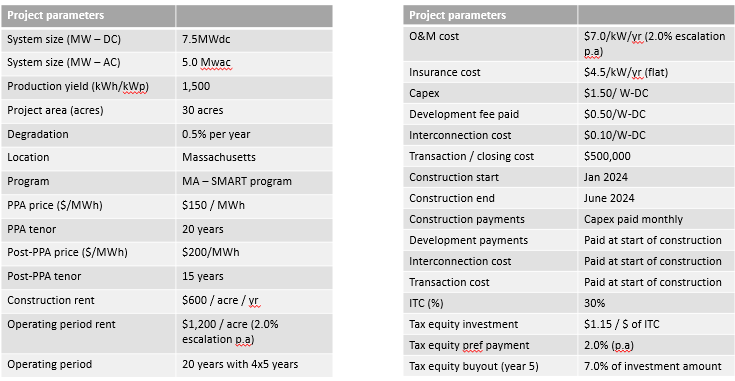

create simple financial model that would calculate the unlevered project IRR (after tax-equity) for the project based on the parameters listed in the image summarize

create simple financial model that would calculate the unlevered project IRR (after tax-equity) for the project based on the parameters listed in the image

summarize the financial model output and S&U the presentation

Project parameters System size (MW-DC) System size (MW-AC) Production yield (kWh/kWp) Project area (acres) Degradation Location Program PPA price ($/MWh) PPA tenor Post-PPA price (S/MWh) Post-PPA tenor Construction rent Operating period rent Operating period 7.5MWdc 5.0 Mwac 1,500 30 acres 0.5% per year Massachusetts MA-SMART program $150/MWh 20 years $200/MWh 15 years $600/acre / yr $1,200/acre (2.0% escalation p.a) 20 years with 4x5 years Project parameters O&M cost Insurance cost Capex Development fee paid Interconnection cost Transaction / closing cost Construction start Construction end Construction payments Development payments Interconnection cost Transaction cost ITC (%) Tax equity investment Tax equity pref payment Tax equity buyout (year 5) $7.0/kW/yr (2.0% escalation p.a) $4.5/kW/yr (flat) $1.50/W-DC $0.50/W-DC $0.10/W-DC $500,000 Jan 2024 June 2024 Capex paid monthly Paid at start of construction Paid at start of construction Paid at start of construction 30% $1.15/S of ITC 2.0% (p.a) 7.0% of investment amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started