Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The returns on assets in an economy depend on the realization of two risk factors, denoted by I and 1. Three well-diversified portfolios (denoted

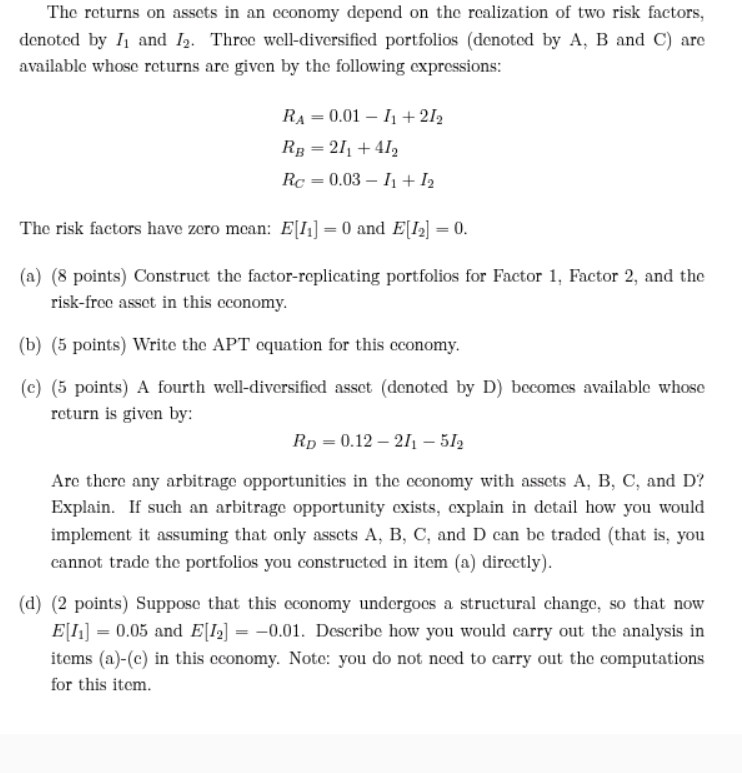

The returns on assets in an economy depend on the realization of two risk factors, denoted by I and 1. Three well-diversified portfolios (denoted by A, B and C) are available whose returns are given by the following expressions: RA= 0.01 I +21 RB = 21 + 4/ Rc = 0.03I+I The risk factors have zero mean: E[] = 0 and E[1] = 0. (a) (8 points) Construct the factor-replicating portfolios for Factor 1, Factor 2, and the risk-free asset in this economy. (b) (5 points) Write the APT equation for this economy. (c) (5 points) A fourth well-diversified asset (denoted by D) becomes available whose return is given by: Rp = 0.12 - 21-51 Are there any arbitrage opportunities in the economy with assets A, B, C, and D? Explain. If such an arbitrage opportunity exists, explain in detail how you would implement it assuming that only assets A, B, C, and D can be traded (that is, you cannot trade the portfolios you constructed in item (a) directly). (d) (2 points) Suppose that this economy undergoes a structural change, so that now E[1] = 0.05 and E[1] = -0.01. Describe how you would carry out the analysis in items (a)-(e) in this economy. Note: you do not need to carry out the computations for this item.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a To construct the factorreplicating portfolios we need to find the weights for each asset that perfectly replicate the returns of the respective fact...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started