Question

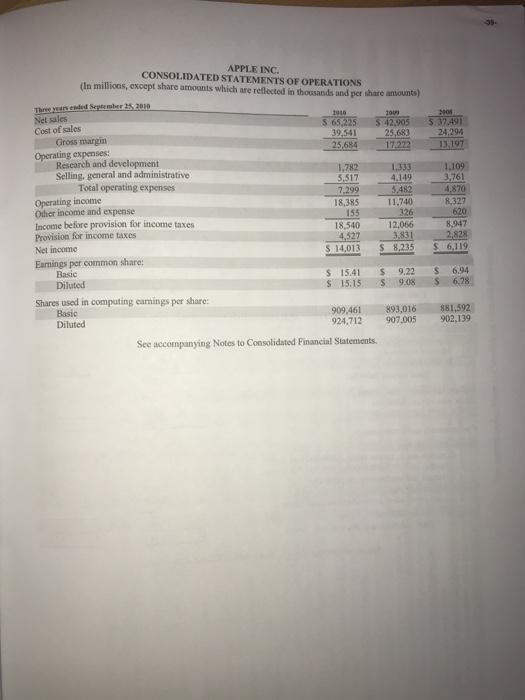

Create T-accounts for the following accounts: accounts receivable, deferred revenue (combine the current and non-current deferred revenue accounts into one T-account), and net sales. Enter

Create T-accounts for the following accounts: accounts receivable, deferred revenue (combine the current and non-current deferred revenue accounts into one T-account), and net sales. Enter the opening balance (as at September 26, 2009) and closing balance (as at September 25, 2010) for the two balance sheet T-accounts and enter the ending balance for the Net sales T-account.

i) Assume that the current portion of deferred revenue is recognized in the next fiscal year. Prepare the fiscal 2010 journal entry to record Net sales for previously deferred revenue. Post the transaction to the T-accounts.

ii) Assume that fiscal 2010 sales transactions included $44,000 of sales on account (in millions) with all other sales conducted in cash. Prepare the fiscal 2010 journal entry to record the 2010 sales transactions, including any portion deferred to a future period. Post the transaction to the T-accounts.

iii) Prepare the journal entry to record cash collections during 2010 for sales made on account

APPLE INC. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except share amouants which are reflected in thousands and per share amounts) Three years endled September 2s, 2010 Net sales Cost of sales Gross margin 2010 S 65,225 39,541 25,684 20 $ 42,905 25,683 17.222 2008 $ 37.491 24,294 13,197 Operating expenses: Research and development Selling, general and administrative Total operating expenses 1,782 5,517 7,299 18,385 155 18,540 4,527 %2414,013 1,333 4.149 5,482 1,109 3,761 4,870 Operating income Other income and expense Income before provision for income taxes Provision for income taxes Net income 11,740 326 12,066 3.831 $ 8,235 8,327 620 8,947 2,828 $ 6,119 Earnings per common share: Basic Diluted $ 15.41 S 15.15 $ 9.22 S 9.08 %24 6.94 6.78 Shares used in computing eamings per share: Basic Diluted 909,461 924,712 893,016 907,005 881,592 902,139 See accompanying Notes to Consolidated Financial Statements.

Step by Step Solution

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Taccounts Accounts Receivable Deferred Revenue 26Sep09 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started