Answered step by step

Verified Expert Solution

Question

1 Approved Answer

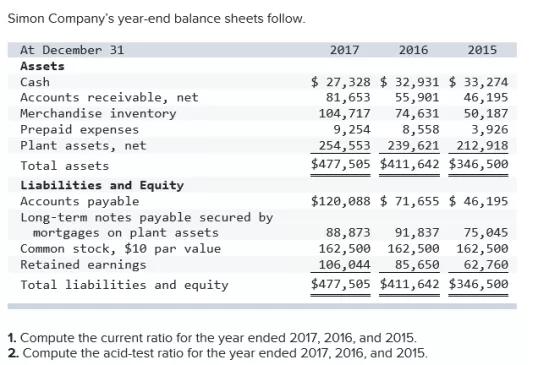

Simon Company's year-end balance sheets follow. At December 31 2017 2016 2015 Assets $ 27,328 $ 32,931 $ 33,274 55,901 74,631 8,558 Cash Accounts

Simon Company's year-end balance sheets follow. At December 31 2017 2016 2015 Assets $ 27,328 $ 32,931 $ 33,274 55,901 74,631 8,558 Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net 81,653 104,717 9,254 46,195 50,187 3,926 254,553 239,621 212,918 $477,505 $411,642 $346,500 Total assets Liabilities and Equity $120,088 $ 71,655 $ 46,195 Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings 91,837 162,500 162, 500 162,500 88,873 75,045 85,650 $477,505 $411,642 $346,500 106,044 62,760 Total liabilities and equity 1. Compute the current ratio for the year ended 2017, 2016, and 2015. 2. Compute the acid-test ratio for the year ended 2017, 2016, and 2015.

Step by Step Solution

★★★★★

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Requirement 1 Current ratio calculation Current assets 201700 201600 201500 Cash 2732...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started