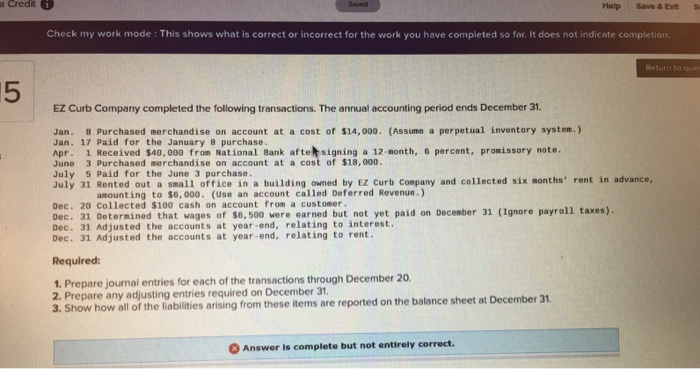

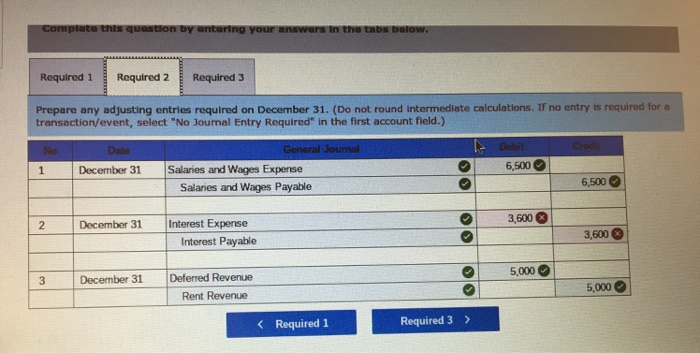

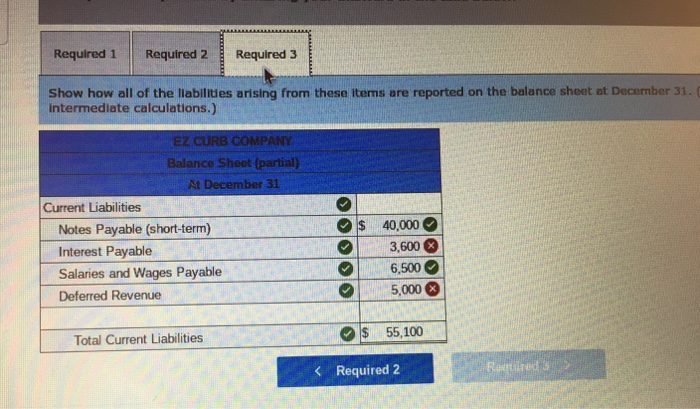

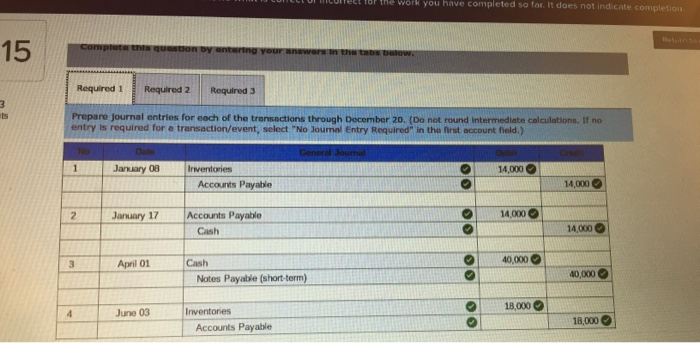

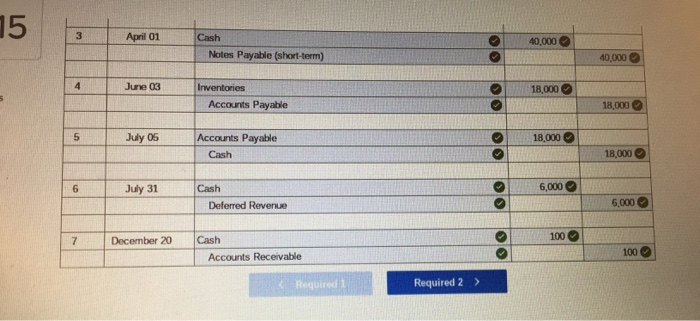

Credit Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion EZ Curb Company completed the following transactions. The annual accounting period ends December 31 Jan. Purchased merchandise on account at a cost of $14,000. (Assume a perpetual inventory system.) Jan. 17 Paid for the January 8 purchase. Apr. 1 Received $40,000 from National Bank aftesigning a 12 month, 6 percent, promissory note. June 3 Purchased merchandise on account at a cost of $18,000. July 5 Paid for the June 3 purchase. July 31 Rented out a small office in a building owned by EZ Curb Company and collected six months' rent in advance, amounting to $6,000. (Use an account called Deferred Revenue.) Dec. 20 Collected $100 cash on account from a customer. Dec. 31 Determined that wages of $6,500 were earned but not yet paid on December 31 (Ignore payroll taxes) Dec. 31 Adjusted the accounts at year-end, relating to interest. Dec. 31 Adjusted the accounts at year-end, relating to rent. Required: 1. Prepare journal entries for each of the transactions through December 20. 2. Prepare any adjusting entries required on December 31 3. Show how all of the liabilities arising from these items are reported on the balance sheet at December 31, Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs balow. Required 1 Required 2 Required 3 Prepare any adjusting entries required on December 31. (Do not round Intermediate calculations. If no entry is required for transaction/event, select "No Journal Entry Required" in the first account field.) Credit Date December 31 General Journal Salaries and Wages Expense Salaries and Wages Payable Debit 6,500 1 6,500 3,600 X December 31 Interest Expense Interest Payable 3,600 5,000 December 31 Deferred Revenue Rent Revenue 5,000 Required 1 Required 2 Required 3 Show how all of the liabilities arising from these items are reported on the balance sheet at December 31. intermediate calculations.) EZ CURB COMPANY Balance Sheet (partial) At December 31 Current Liabilities Notes Payable (short-term) Interest Payable Salaries and Wages Payable Deferred Revenue 40,000 3,600 6,500 5,000 Total Current Liabilities $ 55,100