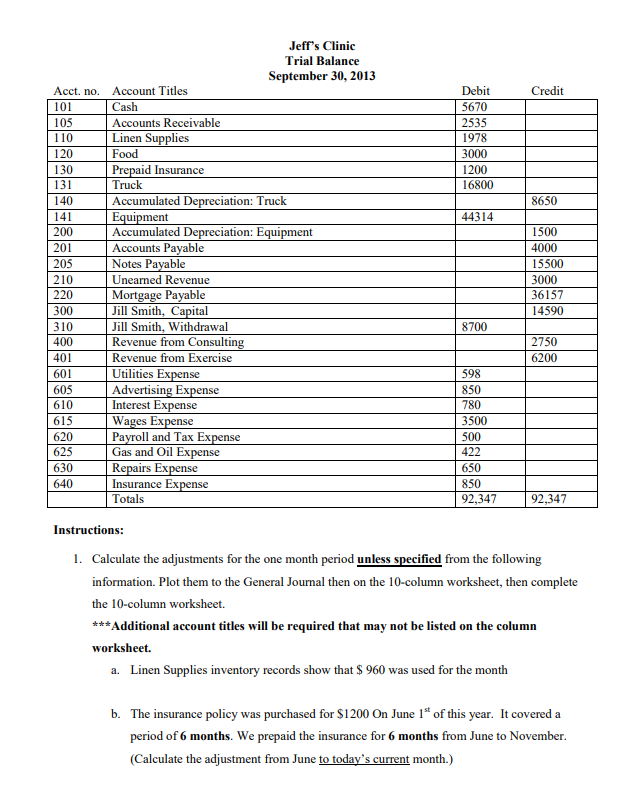

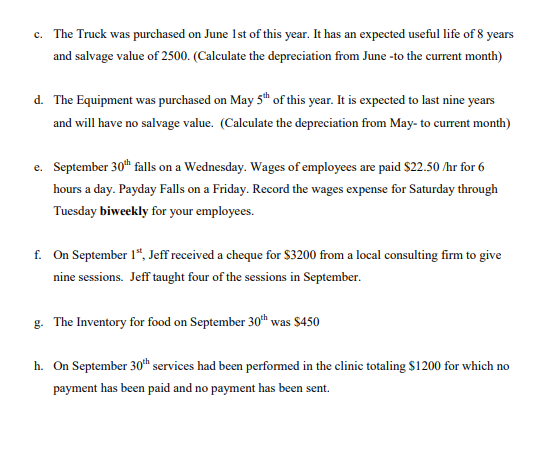

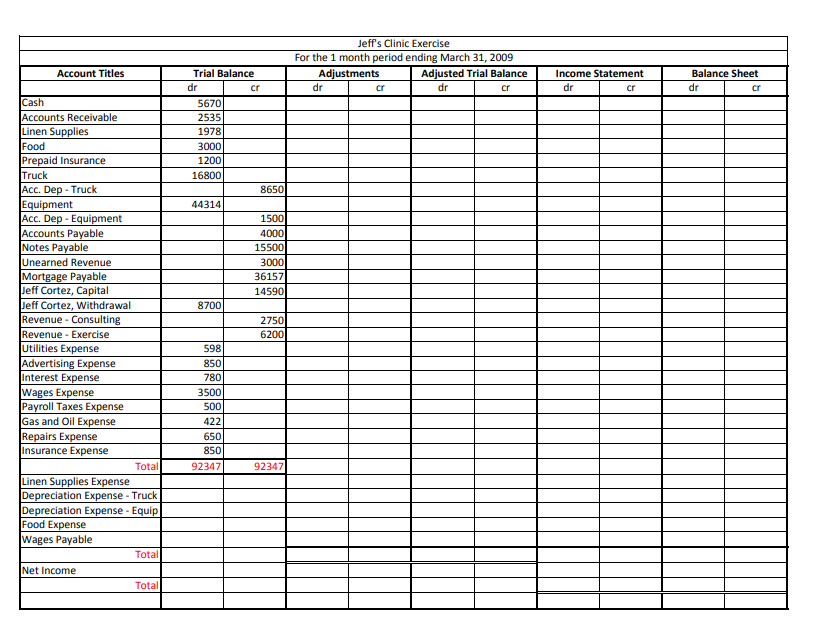

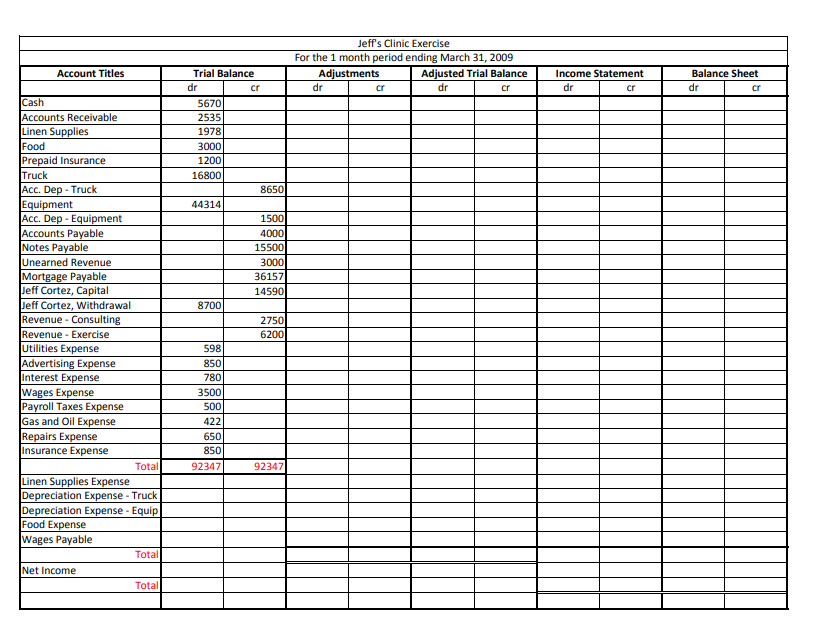

Credit Debit 5670 2535 1978 3000 1200 16800 8650 44314 Jeff's Clinic Trial Balance September 30, 2013 Acct. no. Account Titles 101 Cash 105 Accounts Receivable 110 Linen Supplies 120 Food 130 Prepaid Insurance 131 Truck 140 Accumulated Depreciation: Truck 141 Equipment 200 Accumulated Depreciation: Equipment 201 Accounts Payable 205 Notes Payable 210 Unearned Revenue 220 Mortgage Payable 300 Jill Smith, Capital 310 Jill Smith, Withdrawal 400 Revenue from Consulting 401 Revenue from Exercise 601 Utilities Expense 605 Advertising Expense 610 Interest Expense 615 Wages Expense 620 Payroll and Tax Expense 625 Gas and Oil Expense 630 Repairs Expense 640 Insurance Expense Totals 1500 4000 15500 3000 36157 14590 8700 2750 6200 598 850 780 3500 500 422 650 850 92,347 92,347 Instructions: 1. Calculate the adjustments for the one month period unless specified from the following information. Plot them to the General Journal then on the 10-column worksheet, then complete the 10-column worksheet. ***Additional account titles will be required that may not be listed on the column worksheet. a. Linen Supplies inventory records show that $ 960 was used for the month b. The insurance policy was purchased for $1200 On June 1* of this year. It covered a period of 6 months. We prepaid the insurance for 6 months from June to November. (Calculate the adjustment from June to today's current month.) c. The Truck was purchased on June 1st of this year. It has an expected useful life of 8 years and salvage value of 2500. (Calculate the depreciation from June -to the current month) d. The Equipment was purchased on May 5 of this year. It is expected to last nine years and will have no salvage value. (Calculate the depreciation from May- to current month) e. September 30" falls on a Wednesday. Wages of employees are paid $22.50 /hr for 6 hours a day. Payday Falls on a Friday. Record the wages expense for Saturday through Tuesday biweekly for your employees. f. On September 1", Jeff received a cheque for $3200 from a local consulting firm to give nine sessions. Jeff taught four of the sessions in September. g. The Inventory for food on September 30" was $450 h. On September 30h services had been performed in the clinic totaling $1200 for which no payment has been paid and no payment has been sent. Jeff's Clinic Exercise For the 1 month period ending March 31, 2009 Adjustments Adjusted Trial Balance dr dr cr Account Titles Income Statement dr cr Balance Sheet dr cr Cash Accounts Receivable Linen Supplies Food Prepaid Insurance Truck Acc. Dep. Truck Equipment Acc. Dep - Equipment Accounts Payable Notes Payable Unearned Revenue Mortgage Payable Jeff Cortez, Capital Jeff Cortez, Withdrawal Revenue - Consulting Revenue - Exercise Utilities Expense Advertising Expense Interest Expense Wages Expense Payroll Taxes Expense Gas and Oil Expense Repairs Expense Insurance Expense Total Linen Supplies Expense Depreciation Expense - Truck Depreciation Expense - Equip Food Expense Wages Payable Total Net Income Total Trial Balance dr cr 5670 2535 1978 3000 1200 16800 8650 44314 1500 4000 15500 3000 36157 14590 8700 2750 6200 598 850 780 3500 500 422 650 850 92347 92347