Answered step by step

Verified Expert Solution

Question

1 Approved Answer

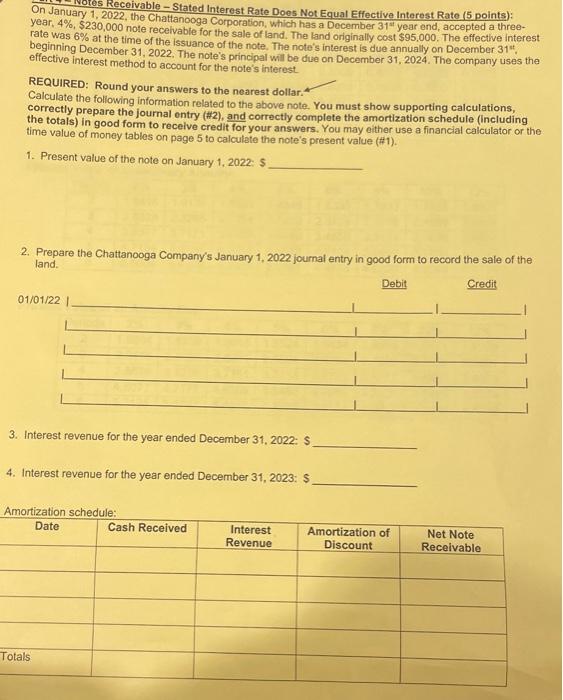

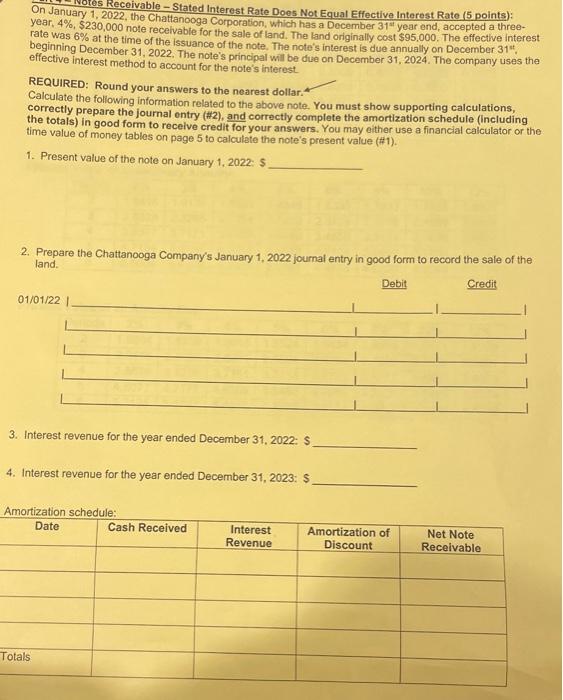

help! tos Receivable --Stated Interest Rate Does Not Equal Effective Interest Rate (5 points) On January 1, 2022, the Chattanooga Corporation, which has a December

help!

tos Receivable --Stated Interest Rate Does Not Equal Effective Interest Rate (5 points) On January 1, 2022, the Chattanooga Corporation, which has a December 31" year end, accepted a three- year. 4%, $230,000 note receivable for the sale of land. The land originally cost $95,000. The effective interest rate was 6% at the time of the issuance of the note. The noto's interest is due annually on December 31 beginning December 31, 2022. The note's principal will be due on December 31, 2024. The company uses the effective interest method to account for the note's interest REQUIRED: Round your answers to the nearest dollar. Calculate the following information related to the above note. You must show supporting calculations, correctly prepare the journal entry (#2), and correctly complete the amortization schedule (including the totals) in good form to receive credit for your answers. You may either use a financial calculator or the time value of money tables on page 5 to calculate the note's present value (#1). 1. Present value of the note on January 1, 2022: $ 2. Prepare the Chattanooga Company's January 1, 2022 journal entry in good form to record the sale of the land. Debit Credit 01/01/22 3. Interest revenue for the year ended December 31, 2022: $ 4. Interest revenue for the year ended December 31, 2023: $ Amortization schedule: Date Cash Received Interest Revenue Amortization of Discount Net Note Receivable Totals

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started